GONZALES, La., Feb. 13 /PRNewswire-FirstCall/ -- Crown Crafts, Inc.

(the "Company") (NASDAQ:CRWS) today reported net income for the

third quarter of fiscal year 2008 of $1.2 million, or $0.12 per

diluted share, on net sales of $18.4 million compared to net income

for the third quarter of fiscal year 2007 of $0.6 million, or $0.06

per diluted share, on net sales of $15.4 million. Net income for

the third quarter of fiscal year 2007 included a $0.4 million

charge related to the closure of Churchill Weavers, a wholly-owned

subsidiary of the Company. "We are very pleased with our net sales

increase of 19.9% quarter over quarter. We are also very pleased

that our pre-tax net income from continuing operations increased

34.4% from $1.4 million in the third quarter of the prior year to

$1.9 million in the same period of the current year. Our gross

profit increased $0.7 million quarter over quarter, but gross

profit would have increased by an additional $0.2 million or 1.2%

as a percentage of net sales without the effect of the deferred

overhead burden. Our earnings before interest, taxes, depreciation

and amortization (EBITDA) was $2.5 million as compared to $1.1

million in the same quarter last year," commented E. Randall

Chestnut, Chairman, President and Chief Executive Officer of the

Company. "We completed the acquisition of the Springs Baby products

line on November 5, 2007 and shipped Springs products for only half

of November and the month of December. The Company is off to a very

strong start with the integration of Springs Baby and anticipates

being out of the warehouse facility leased by Springs by the end of

March, which will further reduce our operating costs. We are happy

to have purchased Springs Baby for 2.5 times the anticipated

incremental EBITDA contribution. The Company paid $11 million for

the baby products line and anticipates $4.4 million of annual

EBITDA to be generated after the six-month shared services

arrangement with Springs is over. We hired none of the employees

from Springs, and to date we have added seven people to our staff

to service the new business. After the consolidation of the

warehouse, we anticipate that the number of new personnel hired

will increase to eighteen," Mr. Chestnut concluded. During the

third quarter of fiscal year 2008, the Company repurchased 140,353

shares of common stock for approximately $519,000 including broker

fees at an average price per share, excluding fees, of $3.67.

Year-to-date the Company has repurchased 225,208 shares, or 2.2% of

its outstanding common stock, for approximately $854,000 including

broker fees at an average price per share, excluding fees, of

$3.76. The Company will host a teleconference today at 1:00 p.m.

Central Standard Time to discuss the Company's results and answer

appropriate questions. Interested individuals may join the

teleconference by dialing (888) 400-7916. Please refer to

confirmation number 909011. The teleconference can also be accessed

in listen-only mode by visiting the Company's website at

http://www.crowncrafts.com/. The financial information to be

discussed during the teleconference may be accessed prior to the

call on the investor relations portion of the Company's website. A

telephone replay of the teleconference will be available from 2:30

p.m. Central Standard Time on February 13, 2008 through 11:59 p.m.

Central Standard Time on February 20, 2008. To access the replay,

dial (800) 475-6701 in the United States or (320) 365-3844 from

international locations. The access code for the replay is 909011.

Crown Crafts, Inc. designs, markets and distributes infant, toddler

and juvenile consumer products, including bedding, blankets, bibs,

bath items and accessories. Its operating subsidiaries include

Hamco, Inc. in Louisiana and Crown Crafts Infant Products, Inc. in

California. Crown Crafts is America's largest distributor of infant

bedding, bibs and bath items. The Company's products include

licensed and branded collections as well as exclusive private label

programs for certain of its customers. This release contains

forward-looking statements within the meaning of the Securities Act

of 1933, the Securities Exchange Act of 1934 and the Private

Securities Litigation Reform Act of 1995. Such statements are based

upon management's current expectations, projections, estimates and

assumptions. Words such as "expects," "believes," "anticipates" and

variations of such words and similar expressions identify such

forward-looking statements. Forward-looking statements involve

known and unknown risks and uncertainties that may cause future

results to differ materially from those suggested by the

forward-looking statements. These risks include, among others,

general economic conditions, including changes in interest rates,

in the overall level of consumer spending and in the price of oil,

cotton and other raw materials used in the Company's products,

changing competition, changes in the retail environment, the level

and pricing of future orders from the Company's customers, the

Company's dependence upon third-party suppliers, including some

located in foreign countries, customer acceptance of both new

designs and newly-introduced product lines, actions of competitors

that may impact the Company's business, disruptions to

transportation systems or shipping lanes used by the Company or its

suppliers, and the Company's dependence upon licenses from third

parties. Reference is also made to the Company's periodic filings

with the Securities and Exchange Commission for additional factors

that may impact the Company's results of operations and financial

condition. The Company does not undertake to update the

forward-looking statements contained herein to conform to actual

results or changes in our expectations, whether as a result of new

information, future events or otherwise. CROWN CRAFTS, INC AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME SELECTED FINANCIAL

DATA In thousands, except per share data Three Months Ended Nine

Months Ended December 30, December 31, December 30, December 31,

2007 2006 2007 2006 Net sales $18,431 $15,368 $50,902 $52,041 Gross

profit 4,578 3,864 12,847 14,010 Gross margin 24.8% 25.1% 25.2%

26.9% Income from operations 1,994 1,628 4,887 7,123 Gain on debt

refinancing - - - 4,069 Income before income taxes 1,928 1,435

4,566 10,150 Income tax expense 692 451 1,705 2,758 Income from

continuing operations after income taxes 1,236 984 2,861 7,392 Loss

from discontinued operations - net of income taxes (12) (370) (110)

(513) Net income 1,224 614 2,751 6,879 Basic income per share .12

.06 .28 .71 Diluted income per share .12 .06 .27 .69 Weighted

Average Shares Outstanding: Basic 9,903 9,953 9,966 9,716 Diluted

10,176 10,269 10,248 9,973 CONSOLIDATED BALANCE SHEETS SELECTED

FINANCIAL DATA In thousands December 30, April 1, 2007 2007 Cash

and cash equivalents $1 $33 Accounts receivable, net of allowances

14,838 12,885 Inventories 16,473 7,145 Total current assets 35,028

23,784 Goodwill 22,884 22,884 Intangible assets, net 7,712 617

Total assets 66,456 48,916 Current maturities of long-term debt

2,508 19 Total current liabilities 13,753 5,615 Long-term debt

12,813 5,780 Total non-current liabilities 13,511 6,478

Shareholders' equity 39,192 36,823 Total liabilities and

shareholders' equity 66,456 48,916 Crown Crafts, Inc. and

Subsidiaries Non-GAAP Reconciliation - EBITDA (In thousands)

Unaudited Three Months Ended December 30, December 31, 2007 2006

Net Income $1,224 $614 Interest expense 244 195 Interest income (9)

0 Taxes 687 194 Depreciation 88 111 Amortization 303 6 EBITDA

$2,537 $1,120 Earnings before interest, income taxes, depreciation

and amortization (EBITDA) is a measure that management uses to

monitor the Company's operating and cash flow performance. In

calculating EBITDA, the Company excludes interest, taxes,

depreciation and amortization. This non-GAAP financial measure is

provided as supplemental information and should not be considered

as a substitute for net income, as an indicator of the Company's

operating performance, or for cash flow, as a measure of the

Company's liquidity. Springs Baby Products Line Non-GAAP

Reconciliation - EBITDA (In thousands) Unaudited Annual Incremental

Pre-tax net income $3,500 Interest expense 900 Depreciation 0

Amortization 0 EBITDA $4,400 The above reconciliation reflects the

annual incremental EBITDA anticipated to be contributed by the

Springs Baby products line after the six-month shared services

arrangement between the Company and Springs has terminated.

DATASOURCE: Crown Crafts, Inc. CONTACT: Crown Crafts, Inc. Investor

Relations Department, +1-225-647-9146; or Halliburton Investor

Relations, +1-972-458-8000, for Crown Crafts, Inc. Web site:

http://www.crowncrafts.com/

Copyright

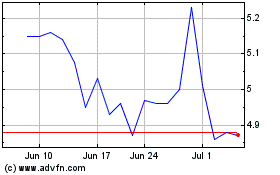

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Sep 2024 to Oct 2024

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Oct 2023 to Oct 2024