Current Report Filing (8-k)

January 09 2023 - 8:41AM

Edgar (US Regulatory)

0000928340false00009283402023-01-042023-01-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

January 4, 2023

(Date of earliest event reported)

CONSOLIDATED WATER CO. LTD.

(Exact Name of Registrant as Specified in Charter)

| | | | |

Cayman Islands, B.W.I. | | 0-25248 | | 98-0619652 |

(State or Other Jurisdiction of | | (Commission File No.) | | (IRS Employer Identification No.) |

Incorporation) | | | | |

Regatta Office Park

Windward Three, 4th Floor

West Bay Road, P.O. Box 1114

Grand Cayman, KY1-1102

Cayman Islands

(Address of Principal Executive Offices)

(345) 945-4277

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A common stock, $0.60 par value | | CWCO | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01Entry into a Material Definitive Agreement.

As previously reported, in October 2022, Consolidated Water Co. Ltd. (the “Company”), through its wholly-owned subsidiary, Consolidated Water U.S. Holdings, Inc. (“CW-Holdings”), exercised its option to purchase shares constituting the remaining 39% interest (the “Remaining Interest”) in PERC Water Corporation (“PERC”) not owned by CW-Holdings at a price to be determined by an independent valuation.

On January 4, 2023, CW-Holdings entered into a stock purchase agreement (the “Purchase Agreement”) with Johan Perslow, Nathan Owen, Steven Owen and Colton Schmidt (collectively, the “Sellers”), pursuant to which CW-Holdings acquired the Remaining Interest in exchange for approximately $2.44 million in cash and 368,383 shares of the Company’s common stock, having a value of approximately $5.36 million based upon the opening trading price of the Company’s common stock on The Nasdaq Global Market on the date of the transaction. After giving effect to the transactions contemplated by the Purchase Agreement, CW-Holdings owns 100% of the outstanding capital stock of PERC.

PERC designs, builds, sells, operates and manages water, wastewater and water reuse infrastructure. PERC generated approximately $17.8 million and $13.4 million in revenues over the nine months ended September 30, 2022 and the twelve months ended December 31, 2021, respectively.

The Purchase Agreement is provided to give investors information regarding the agreement terms. It is not provided to give investors factual information about the Company, CW-Holdings or any other parties thereto. In addition, the representations, warranties and covenants contained in the Purchase Agreement were made only for purposes of those agreements and as of specific dates, were solely for the benefit of the parties to the Purchase Agreement, and may be subject to limitations agreed by the contracting parties, including being qualified by disclosures exchanged between the parties in connection with the execution of the Purchase Agreement. The representations and warranties may have been made for the purposes of allocating contractual risk between the parties to the agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors are not third-party beneficiaries under the Purchase Agreement and should not view the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or conditions of the Company.

Item 2.01Completion of Acquisition or Disposition of Assets.

To the extent required by Item 2.01 of Form 8-K, the information relating to the consummation of the transaction contained or incorporated elsewhere in this Current Report on Form 8-K is incorporated by reference herein.

Item 3.02 Unregistered Sales of Equity Securities.

To the extent required by Item 3.02 of Form 8-K, the information relating to the consummation of the transaction contained or incorporated elsewhere in this Current Report on Form 8-K is incorporated by reference herein. The issuance of the common stock was exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended. The Sellers are knowledgeable, sophisticated and experienced in making investment decisions of this kind and received adequate information about the Company or had adequate access, including through the their business relationship with the Company, to information about the Company.

Item 7.01Regulation FD Disclosure.

On January 9, 2023, the Company issued a press release announcing the consummation of the transaction described in Item 1.01, a copy of which is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended, regardless of any general incorporation language in those filings.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | |

| CONSOLIDATED WATER CO. LTD. |

| | |

| | |

| By: | /s/ David W. Sasnett | |

|

| Name: | David W. Sasnett |

| Title: | Executive Vice President & Chief Financial Officer |

| | | |

Date: January 9, 2023

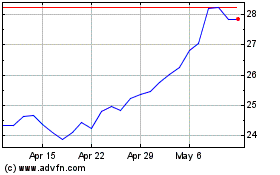

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

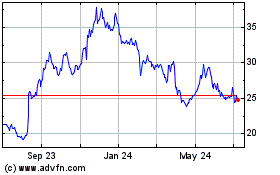

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Jul 2023 to Jul 2024