Additional Proxy Soliciting Materials (definitive) (defa14a)

June 05 2023 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☑ Definitive Additional Materials

☐ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

CONSENSUS CLOUD SOLUTIONS, INC.

_______________________________________________________________________________

(Name of Registrant as Specified in Its Charter)

_______________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ No Fee Required

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1)

☐ Fee paid previously with preliminary materials

_____________________________________

SUPPLEMENT NO. 1 TO PROXY STATEMENT

For

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 15, 2023

_____________________________________

Dear Stockholders:

This Supplement provides updated and amended information with respect the Annual Meeting of Stockholders of Consensus Cloud Solutions, Inc. (“we” or the “Company”), to be held on June 15, 2023 (the “Annual Meeting”).

The information contained in this Supplement should be read in conjunction with the Notice of Annual Meeting of Stockholders and the accompanying Proxy Statement (the “Proxy Statement”), each dated April 28, 2023, furnished in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting. There is no change to the record date to determine stockholders entitled to notice of and to vote at the Annual Meeting and at all adjournments of the annual meeting, and as such only holders at the close of business on April 18, 2023 are entitled to notice of, and to vote at, the Annual Meeting and at all adjournments of the annual meeting.

Change in Company’s Certifying Accountant

On June 5, 2023, the Company filed a Current Report on Form 8-K (the “Form 8-K”) announcing that the Audit Committee of the Company’s board of directors had dismissed BDO USA, LLC (“BDO”) as the Company’s independent registered public accounting firm and appointed Deloitte & Touche LLP (“Deloitte”) as its new independent registered public accounting firm, effective May 31, 2023.

As disclosed in the Form 8-K, BDO’s audit reports on the Company’s consolidated financial statements as of and for the fiscal years ended December 31, 2021 and December 31, 2022 did not contain any adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the fiscal years ended December 31, 2021 and December 31, 2022, and in the subsequent interim periods through May 30, 2023, there were no (1) disagreements (within the meaning of Item 304(a)(1)(iv) of Regulation S-K (“Regulation S-K”) of the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”)) with BDO on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which if not resolved to BDO’s satisfaction, would have caused BDO to make reference to the subject matter of such disagreement in connection with its report, or (2) reportable events (within the meaning of Item 304(a)(1)(v) of Regulation S-K of the rules and regulations of the SEC), except for the material weaknesses disclosed in Item 9A of the Company’s Annual Reports on Form 10-K for the fiscal years ended December 31, 2022 and 2021 relating the Company’s internal control over financial reporting. For the fiscal year ended December 31, 2022, these material weaknesses related to (1) entity-level controls impacting the control environment and monitoring of controls; (2) accounting for revenue recognition and related controls; (3) accounting for significant unusual transactions; (4) balance sheet account reconciliations; and (5) user access and segregation of duties related to systems that track employee related costs. For the fiscal year ended December 31, 2021, the material weakness related to accounting for certain elements of the spin-off transaction.

In accordance with Item 304(a)(3) of Regulation S-K, the Company provided BDO with a copy of the foregoing disclosures and requested that BDO provide a letter addressed to the SEC stating whether it agrees with such disclosures. A copy of BDO’s letter dated June 1, 2023 is filed as Exhibit 16.1 to the Form 8-K.

During the Company’s two most recent fiscal years ended December 31, 2021 and December 31, 2022, and for the subsequent interim periods through May 31, 2023, neither the Company nor anyone on its behalf consulted Deloitte regarding (i) the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements, and neither a written report nor oral advice was provided to the Company that Deloitte concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue; (ii) any matter that was the subject of a disagreement within the meaning of Item 304(a)(1)(iv) of Regulation S-K and the related instructions; or (iii) any reportable event within the meaning of Item 304(a)(1)(v) of Regulation S-K.

As a result of the dismissal of BDO, the Company is withdrawing Proposal 2 from the meeting agenda of the Annual Meeting, which requests the stockholders of the Company ratify the appointment of BDO as the Company’s independent registered public accounting firm for the year ending December 31, 2023. The Company does not intend to submit any other proposal for ratification with respect to the appointment of an independent registered public accounting firm at the Annual Meeting.

You should note the following:

■The Company will not make available or distribute, and you do not need to sign, new proxy cards or submit new voting instructions solely as a result of the withdrawal of Proposal 2.

■Proxy cards or voting instructions already received with direction on Proposal 2 will not be voted on Proposal 2.

■Proxy cards or voting instructions received and providing direction on the remaining proposals to be considered at the Annual Meeting (Proposal 1 and Proposal 3) will remain valid and in effect, and will be voted as directed.

■If you have already submitted a proxy card or voting instructions, you do not need to resubmit proxies or voting instructions with different directions, unless you wish to change your previously cast votes on the remaining proposal.

This Supplement does not revise or update any other information set forth in the Proxy Statement and should be read in conjunction with the Proxy Statement. From and after the date of this Supplement, any references to the “Proxy Statement” are to the Proxy Statement as supplemented hereby.

_____________________________________

The date of this Supplement is June 5, 2023.

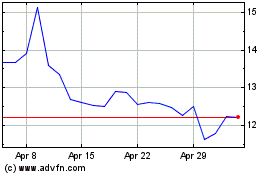

Concensus Cloud Solutions (NASDAQ:CCSI)

Historical Stock Chart

From Jun 2024 to Jul 2024

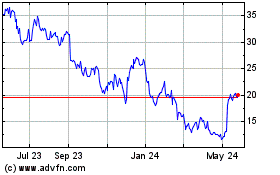

Concensus Cloud Solutions (NASDAQ:CCSI)

Historical Stock Chart

From Jul 2023 to Jul 2024