Filed pursuant to Rule 424(b)(5)

Registration No. 333-281668

Prospectus Supplement

(To Prospectus dated August 28, 2024)

COLOR STAR TECHNOLOGY CO., LTD.

$7,675,680

Senior Secured Convertible Notes

Class A Ordinary Shares Issuable Upon

Conversion of the Senior Secured Convertible Notes

Pursuant to this prospectus supplement and the

accompanying prospectus, we are offering approximately $7,675,680 in principal amount of our Senior Secured Convertible Notes (the “New

Notes”) to purchase up to approximately 7,241,208 Class A Ordinary Shares, par value $0.0001 per share (the “Ordinary Shares”).

The New Notes will have a maturity of twelve months from the date of issuance, bear an interest rate of 6.0% per annum and are convertible

immediately upon issuance, subject to certain exceptions, into Ordinary Shares at an initial conversion price equal to the lower of (i)

$6.68, or (ii) a price equal to the greater of (x) the floor price of $1.06, or the Alternate Conversion Price (as herein after defined).

This prospectus supplement also relates to the offering of the Ordinary Shares issuable upon conversion of the New Notes. The issuance

of the New Notes is referred to as the “Second Closing.”

In addition, subject to the conditions set forth

in certain securities purchase agreements we entered into with the investors, as amended, we also agreed to sell the investors, from time

to time, up to $40,000,000 in aggregate principal amount of the Company’s Senior Secured Convertible Notes, (the “Additional

Notes”) and accompanying Ordinary Share purchase warrants (the “Additional Warrants”) with substantially the same terms

as the New Notes and Initial Warrants.

Such Additional Notes, the Ordinary Shares issuable

from time to time upon conversion of such Additional Notes, the Additional Warrants and the Ordinary Shares issuable from time to time

upon exercise of the Additional Warrants, all of which have not yet been sold, are not being registered herein and, if sold, will either

be sold pursuant to an effective registration statement or pursuant to an exemption from registration under the Securities Act.

For a more detailed description of the New Notes,

see the section entitled “Description of Securities We Are Offering” beginning on page S-13. There is no established public

trading market for the New Notes, and we do not expect such markets to develop. We do not intend to apply to list the New Notes on any

securities exchange.

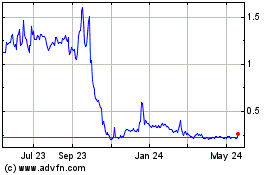

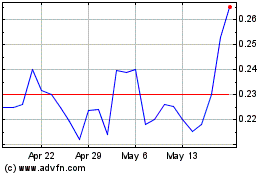

Our Ordinary Shares trade on the NASDAQ Capital

Market under the symbol “ADD.” On November 22, 2024, the closing sale price of our Ordinary Shares was $5.30 per share.

As of November 26, 2024, the aggregate market

value of our outstanding Ordinary Shares held by non-affiliates was approximately $95.2 million based on 842,853 outstanding Ordinary

Shares held by non-affiliates, and a per share price of $113, which was the reported price on the NASDAQ Capital Market of our Ordinary

Shares on September 27, 2024.

We have retained Maxim Group LLC to act as the

exclusive placement agent to use its best efforts to solicit offers from investors to purchase the securities in this offering. The placement

agent has no obligation to buy any securities from us or to arrange for the purchase or sale of any specific number or dollar amount of

securities. The placement agent is not purchasing or selling any securities in this offering. We will pay the placement agent a fee equal

to the sum of 6.5% of the aggregate purchase price paid by investors in this offering.

We are not required to sell any specific number or dollar amount of

the securities offered in this offering. After deducting fees due to the placement agent and our estimated offering expenses, we expect

the net proceeds to us from this offering will be approximately $7.6 million. We expect to deliver the New Notes to the purchasers on

or about November 27, 2024, subject to the satisfaction of customary closing conditions.

| | |

Total | |

| Public offering price | |

$ | 7,675,680 | |

| Placement agent fees(1) | |

$ | 50,000 | |

| Offering proceeds to us, before expenses | |

$ | 7,625,680 | |

| (1) | See

“Plan of Distribution” for additional information regarding total compensation payable to the placement agent, including

expenses for which we have agreed to reimburse the placement agent. |

Our business and holding our Ordinary Shares

involve a high degree of risk. See “Risk Factors” beginning on page S-7 of this prospectus supplement, on page 6 of the

accompanying base prospectus and the risk factors described in the documents incorporated by reference into this prospectus supplement

and the accompanying base prospectus for more information.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the

accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Maxim Group LLC

The date of this prospectus supplement is November 25, 2024

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You should rely only on the information contained

in this prospectus supplement and the accompanying prospectus. We have not authorized anyone else to provide you with additional or different

information. We are offering to sell, and seeking offers to buy, Notes and Warrants only in jurisdictions where offers and sales are permitted.

You should not assume that the information in this prospectus supplement or the accompanying prospectus is accurate as of any date other

than the date on the front of those documents or that any document incorporated by reference is accurate as of any date other than its

filing date.

No action is being taken in any jurisdiction

outside the United States to permit a public offering of the Notes or Warrants or possession or distribution of this prospectus supplement

or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement or the accompanying

prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this

offering and the distribution of this prospectus supplement and the accompanying prospectus applicable to that jurisdiction.

ABOUT THIS PROSPECTUS SUPPLEMENT

On August 20, 2024, we filed with the SEC a registration statement

on Form F-3 (File No. 333-281668) utilizing a shelf registration process relating to the securities described in this prospectus supplement,

which registration statement was declared effective on August 28, 2024. Under this shelf registration process, we may, from time to time,

sell up to $100,000,000 in the aggregate of Ordinary Shares, debt securities, warrants, units and rights, of which approximately $79.87

million will remain available for sale following the offering and as of the date of this prospectus supplement, excluding the shares issuable

upon conversion of the New Notes issued in this offering.

The two parts of this document include: (1) this

prospectus supplement, which describes the specific details regarding this offering; and (2) the accompanying base prospectus, which provides

a general description of the securities that we may offer, some of which may not apply to this offering. Generally, when we refer to this

“prospectus,” we are referring to both documents combined. If information in this prospectus supplement is inconsistent with

the accompanying base prospectus, you should rely on this prospectus supplement. You should read this prospectus supplement together with

the additional information described below under the heading “Where You Can Find More Information” and “Incorporation

of Documents by Reference.”

Any statement made in this prospectus supplement

or in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will be deemed to be modified

or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus supplement or in

any other subsequently filed document that is also incorporated by reference into this prospectus supplement modifies or supersedes that

statement. Any statements so modified or superseded will be deemed not to constitute a part of this prospectus supplement except as so

modified or superseded. In addition, to the extent of any inconsistencies between the statements in this prospectus supplement and similar

statements in any previously filed report incorporated by reference into this prospectus supplement, the statements in this prospectus

supplement will be deemed to modify and supersede such prior statements.

The registration statement that contains this

prospectus supplement, including the exhibits to the registration statement and the information incorporated by reference, contains additional

information about the securities offered under this prospectus supplement. That registration statement can be read on the SEC’s

website or at the SEC’s offices mentioned below under the heading “Where You Can Find More Information.”

We are responsible for the information contained

and incorporated by reference in this prospectus supplement, the accompanying base prospectus and any related free writing prospectus

that we prepare or authorize. We have not authorized anyone to provide you with different or additional information, and we take no responsibility

for any other information that others may give you. If you receive any other information, you should not rely on it.

This prospectus supplement and the accompanying

base prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities

to which this prospectus supplement relates, nor do this prospectus supplement and the accompanying base prospectus constitute an offer

to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer

or solicitation in such jurisdiction.

You should not assume that the information in

this prospectus supplement and the accompanying base prospectus is accurate at any date other than the date indicated on the cover page

of this prospectus supplement or that any information that we have incorporated by reference is correct on any date subsequent to the

date of the document incorporated by reference. Our business, financial condition, results of operations or prospects may have changed

since that date.

You should not rely on or assume the accuracy

of any representation or warranty in any agreement that we have filed in connection with this offering or that we may otherwise publicly

file in the future because any such representation or warranty may be subject to exceptions and qualifications contained in separate disclosure

schedules, may represent the applicable parties’ risk allocation in the particular transaction, may be qualified by materiality

standards that differ from what may be viewed as material for securities law purposes or may no longer continue to be true as of any given

date.

Unless stated otherwise or the context otherwise

requires, references in this prospectus supplement and the accompanying base prospectus to the “Company,” “Color Star,”

“we,” “us” or “our” refer to Color Star Technology Co., Ltd.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained or incorporated by

reference in this prospectus, including the documents referred to or incorporated by reference in this prospectus or statements of our

management referring to our summarizing the contents of this prospectus, include “forward-looking statements”. We have based

these forward-looking statements on our current expectations and projections about future events. Our actual results may differ materially

or perhaps significantly from those discussed herein, or implied by, these forward-looking statements. Forward-looking statements are

identified by words such as “believe,” “expect,” “anticipate,” “intend,” “estimate,”

“plan,” “project” and other similar expressions. In addition, any statements that refer to expectations or other

characterizations of future events or circumstances are forward-looking statements. Forward-looking statements included or incorporated

by reference in this prospectus or our other filings with the Securities and Exchange Commission, or the SEC include, but are not necessarily

limited to, those relating to:

| ● | risks

and uncertainties associated with the integration of the assets and operations we have acquired and may acquire in the future; |

| ● | our

possible inability to raise or generate additional funds that will be necessary to continue and expand our operations; |

| ● | our

potential lack of revenue growth; |

| ● | our

potential inability to add new products and services that will be necessary to generate increased sales; |

| ● | our

potential lack of cash flows; |

| ● | our

potential loss of key personnel; |

| ● | the

availability of qualified personnel; |

| ● | international,

national regional and local economic political changes; |

| ● | general

economic and market conditions; |

| ● | increases

in operating expenses associated with the growth of our operations; |

| ● | the

potential for increased competition; and |

| ● | other

unanticipated factors. |

The foregoing does not represent an exhaustive

list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with that may

cause our actual results to differ from those anticipate in our forward-looking statements. Please see “Risk Factors” in our

reports filed with the SEC or in a prospectus supplement related to this prospectus for additional risks which could adversely impact

our business and financial performance.

Moreover, new risks regularly emerge and it is

not possible for our management to predict or articulate all risks we face, nor can we assess the impact of all risks on our business

or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking

statements. All forward-looking statements included in this prospectus are based on information available to us on the date of this prospectus.

Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements

attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above

and throughout (or incorporated by reference in) this prospectus.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights selected information

contained or incorporated by reference in this prospectus. This summary does not contain all of the information you should consider before

investing in the securities. Before making an investment decision, you should read the entire prospectus and any supplement hereto carefully,

including the risk factors section as well as the financial statements and the notes to the financial statements incorporated herein by

reference.

In this prospectus and any amendment or supplement

hereto, unless otherwise indicated, the terms “Color Star Technology Co., Ltd.”, “Color Star”, “we”,

“us”, and “our” refer and relate to Color Star Technology Co., Ltd. and its consolidated subsidiaries.

Our Company

History and Development of the Company

We are an entertainment technology

company with a global network that focuses on the application of technology and artificial intelligence in the entertainment industry,

and primarily provide services via our wholly-owned subsidiaries, Color Metaverse and CACM Group NY, Inc.

Color Star Technology Co.,

Ltd. (formerly known as Huitao Technology Co., Ltd.) was founded as an unincorporated business on September 1, 2005, under the name TJS

Wood Flooring, Inc., and became a C-corporation in the State of Delaware on February 15, 2007. On April 29, 2008, we changed our name

to China Advanced Construction Materials Group, Inc.

On August 20, 2018, CACM was

incorporated in the State of New York and is wholly owned by us. The establishment of CACM was to expand our business in the U.S. CACM

has not commenced operations.

On December 27, 2018, we consummated

a redomicile merger pursuant to which we merged with and into China Advanced Construction Materials Group, Inc., a newly formed Cayman

Islands exempted company and the surviving entity in the merger, pursuant to the terms and conditions of an Agreement and Plan of Merger

adopted in July 2018. As a result of the merger, we are now governed by the laws of the Cayman Islands.

By special resolution of shareholders

dated 28 June 2019, our name was changed from China Advanced Construction Materials Group, Inc. to Huitao Technology Co., Ltd. On July

12, 2019, our Amended and Restated Memorandum and Articles of Association (“2019 Amended and Restated Memorandum and Articles”)

was filed with the Registrar of Companies (Cayman Islands) and a Certificate of Incorporation on Change of Name for Huitao Technology

Co. Ltd. was issued.

On December 31, 2019, we entered

into a share exchange agreement with Sunway Kids International Education Group Ltd. (“Sunway Kids”) and its shareholders.

On February 14, 2020, we consummated the acquisition of Sunway Kids whereby we issued 1,989,262 ordinary shares and $2 million of cash

to be paid in exchange for all of the issued and outstanding share capital of Sunway Kids. The $2 million cash consideration is payable

in five installments over five years according to an earn-out schedule. Sunway Kids thereby became our wholly-owned subsidiary. Sunway

Kids was established on February 29, 2012, under the laws of the British Virgin Islands as an offshore holding company. On August 23,

2018, Sunway Kids established its wholly-owned subsidiary, Brave Millenium Limited (“Brave Millenium”) under the laws of Hong

Kong. On December 4, 2019, Brave Millenium established Chengdu Hengshanghui Intelligent Technology Co., Ltd. (“Chengdu Hengshanghui”)

in China as a wholly foreign owned limited liability company (the “WFOE”). On December 9, 2019, Chengdu Hengshanghui entered

into a series of variable interest entity agreements with Chengdu Hengshanghui Education Consulting Co., Ltd. (“Hengshanghui Education”).

Through Sunway Kids and its variable interest entity Hengshanghui Education, we were engaged in providing education and health services

to day-care and preschools in China.

On March 10, 2020, CACM entered

into a certain joint venture agreement (the “JV Agreement”) with Baydolphin, Inc., a company organized under the laws of New

York (“Baydolphin”). Pursuant to the JV Agreement, CACM and Baydolphin established a limited liability company under the laws

of New York, Baytao LLC (“Baytao”), which intended to be the 100% owner of one or more operating entities in the U.S. to engage

in the business of online and offline after-school education.

Prior to acquisition of Sunway

Kids in February 2020, our core business has been the concrete business in China. Our concrete business was negatively affected by the

economic cycle and government policies. The concrete industry was influenced by the decline in the macro economy in recent years. The

entire concrete industry in the PRC’s Beijing area experienced a slowdown in industry production and economic growth in the last

few years as the Beijing government continues to enforce concrete production reformation and tightened environmental laws from late 2017

to date. The reformation causes great uncertainties for local enterprises in the construction market. Since 2017, the pressure on small

concrete companies has further increased and many have been shut down. Also, the Beijing government ordered the suspension of construction

jobsites during winters to reduce air pollution since 2017. The operations of Xin Ao were also severely affected. As a result of our deteriorating

cash position, we defaulted on bank loans and experienced a substantial increase in contingent liabilities. As of December 31, 2019, there

was a default on a bank loan of $24,345,129. As of December 31, 2019, Xin Ao was subject to several civil lawsuits for which we estimated

that it is more than likely to pay judgments in the amount of approximately $6.8 million (including interest and penalties of $1.6 million).

During the six months ended December 31, 2019 and 2018, there were additional estimated claims of approximately $0.3 million and $1.1

million, respectively. We believed it would be very difficult, if not impossible, to turn around the concrete business. As such, we had

decided to dispose of the concrete business after the acquisition of Sunway Kids.

On May 6, 2020, we completed

the disposition (the “Xin Ao Disposition”) of Xin Ao Construction Materials, Inc. (“BVI-ACM”), after obtaining

our shareholders’ approval on April 27, 2020 and satisfaction or waiver of all other closing conditions. Upon the closing of the

Xin Ao Disposition, Mr. Xianfu Han and Mr. Weili He became the sole shareholders of BVI-ACM and assumed all assets and liabilities of

all the subsidiaries and variable interest entities owned or controlled by BVI-ACM. The proceeds of $600,000 from the Xin Ao Disposition

have been used for our working capital and general corporate purposes.

By special resolution of shareholders

dated April 27, 2020, our name was changed from Huitao Technology Co., Ltd. to Color Star Technology Co., Ltd. On May 1, 2020, our Amended

and Restated Memorandum and Articles of Association (“2020 Amended and Restated Memorandum and Articles”) was filed with the

Registrar of Companies (Cayman Islands) and a Certificate of Incorporation on Change of Name to “Color Star Technology Co., Ltd.

was issued,

On May 7, 2020, we entered

into a Share Exchange Agreement (“2020 Exchange Agreement”) with Color China Entertainment Limited (“Color China”),

a Hong Kong limited company, and shareholders of Color China (the “Sellers”), pursuant to which, among other things and subject

to the terms and conditions contained therein, we shall acquire all of the outstanding issued shares and other equity interests in Color

China from the Sellers (the “Acquisition”). On June 3, 2020, the transaction contemplated by the 2020 Exchange Agreement was

consummated when we issued 4,633,333 ordinary shares to the Sellers and the Sellers transferred all of Color China’s issued and

outstanding shares to us. Immediately after the Acquisition, we owned 100% of Color China. The Company planned to make Color China an

emerging online performance and online education provider with a significant collection of performance specific assets.

On June 25, 2020, we and the

former shareholders of Sunway Kids entered into an Amendment No. 2 (“Amendment”) to the Share Exchange Agreement dated December

31, 2019, as amended. Pursuant to the Amendment, we should not make any Earn-out Payment to the former shareholders of Sunway Kids since

Sunway Kids had been unable to conduct its normal operations due to the COVID-19 pandemic and management of Sunway Kids believed it would

be very difficult to achieve its projected financial results. On the same day, Sunway Kids and Yanliang Han, an unrelated third party,

entered into certain share purchase agreement (the “Disposition SPA”). Pursuant to the Disposition SPA, the Purchaser agreed

to purchase Sunway Kids for cash consideration of $2.4 million consisting of $400,000 which should be paid within a month of closing,

and $2,000,000 to be paid in monthly installments of $200,000 over 10 months. Upon the closing of the transaction contemplated by the

Disposition SPA on June 25, 2020, Yanliang Han became the sole shareholder of Sunway Kids and as a result, assumed all assets and liabilities

of all the subsidiaries and variable interest entities owned or controlled by Sunway Kids. By disposing Sunway Kids, we exited the business

of preschool children online education service.

Effective October 1, 2020,

we changed the ticker symbol of our ordinary shares traded on the Nasdaq Capital Market from “HHT” to “CSCW”,

representing the abbreviation of “Color Star Color World.” Our online platform “Color World” was the new focus

of our business.

On June 18, 2021, Modern Pleasure

International Limited, a limited liability company, was incorporated in Hong Kong and is wholly owned by us. As of the date hereof, Modern

Pleasure International Limited has not commenced operations.

On June 29, 2021, CACM entered

into a share purchase agreement with Baydolphin. Pursuant to the agreement, CACM agreed to sell, and Baydolphin agreed to purchase, 80%

of the outstanding equity interest of Baytao for a consideration of $100. Prior to the sale, Baytao LLC had no operation or asset. Upon

completion of the sale, Baytao ceased to be our subsidiary.

On April 11, 2022, as approved

by our shareholders, we amended the 2021 Amended and Restated Memorandum and Articles, which was duly filed with the Cayman Registrar

on 29 August 2022 as the Fourth Amended and Restated Memorandum and Articles of Association (the “2022 Amended and Restated Memorandum

and Articles”). Our authorized capital was $32,000,000 divided into 800,000,000 ordinary shares with a par value of $0.04 per share.

On September 3, 2022, Color

Metaverse Pte. Ltd., our Singapore subsidiary, entered into a phone purchase agreement with Ziaul Haq for a quantity of 10,000 units of

smart phones which shall be paid by the following methods: (i) $2,800,000 by cash and (ii) $2,200,000 to be paid with ordinary shares

issued by us. The Share Consideration would be paid to Ziaul Haq at the trading price of the trading day immediately prior to the signing

date. As of the date of this annual report, such shares have not been issued yet.

On September 26, 2022, we

completed a 40-for-1 reverse share split of our ordinary shares, which was approved by our shareholders on April 11, 2022. As a result

of the reverse share split, the number of ordinary shares outstanding was reduced from approximately 261,757,531 to approximately 6,543,938

ordinary shares, subject to rounding up of all fractional shares to the nearest whole share in lieu of such fractional shares. No preference

shares were issued and outstanding then and there.

Effective November 1, 2022,

we changed the ticker symbol of our ordinary shares traded on the Nasdaq Capital Market from “CSCW” to “ADD”,

representing our hope that more and more will people join “Color World” and that our business will keep increasing.

On January 11, 2023, the Company,

Color Sky Entertainment Limited, a Hong Kong corporation and the Company’s wholly owned subsidiary, and Tian Jie (the “Purchaser”),

entered into a certain share purchase agreement (the “Disposition SPA”). Pursuant to the Disposition SPA, the Purchaser agreed

to purchase Color Sky in exchange for no consideration. Upon the closing of the transaction contemplated by the Disposition SPA, the Purchaser

became the sole shareholder of Color Sky and as a result, assumed all assets and liabilities of Color Sky.

On March 24, 2023, we held

our annual meeting of shareholders, pursuant to which the shareholders of the Company approved the proposal to amend the authorized share

capital of the Company from US$32,000,000 divided into 800,000,000 Ordinary Shares with a par value of US$0.04 each; to 700,000,000 Class

A Ordinary Shares with a par value of $0.04 each and 100,000,000 Class B Ordinary Shares with a par value of US$0.04 each, in each case

having the rights and subject to the restrictions set out in the Fifth Amended and Restated Memorandum of Association and Articles of

Association of the Company (the “2023 Amended and Restated Memorandum and Articles”).

On May 19, 2023, the Company

entered into a certain concert cooperation agreement (“Agreement”) dated, by and among Rich America Inc., an Ohio corporation,

(“Rich America”), Color Star DMCC, a United Arab Emirates corporation (“Color Star”) and the Company. Pursuant

to the Agreement, Rich America agreed to have certain music artists represented by Rich America perform at nine concert events organized

by Color Star to be held between May 2023 and March 2024 (the “Concerts’) for an aggregate consideration of US$8,000,000,

to be paid in 6,400,000 restricted Class A Ordinary Shares, par value $0.04 per share, of the Company.

On December 17, 2023, the Company

entered into certain copyright acquisition agreement, by and among Nine Star Parties and Entertainment LLC., an Ohio limited liability

company, (“Nine Star”), the Company, and Color Star DMCC, a United Arab Emirates corporation (“Color Star DMCC”)

and wholly owned subsidiary of the Company. Pursuant to the Agreement, Nine Star agreed to sell to Color Star DMCC all of Nine Star’s

right, title and interests in and to 24 pieces of music works created by Nine Star (the “Works”), for an aggregate consideration

of US$7,200,000, to be paid in 24,000,000 restricted Class A Ordinary Shares, par value $0.04 per share, of the Company. The 24,000,000

restricted Class A Ordinary Shares to be issued as consideration to Nine Star are exempt from registration pursuant to Regulation S of

the Securities and Exchange Act of 1934. The transaction contemplated by the Copyright Agreement closed on December 19, 2023 when all

of the closing conditions in the copyright acquisition agreement were satisfied.

On September 29, 2024, we held our annual meeting of shareholders,

pursuant to which the shareholders of the Company approved the proposal to effect a reverse share split at a ratio of up to one-for-two

hundred fifty (“Reverse Split”), and immediately after the approval of the Reverse Split, the subdivision of the Company’s

authorized share capital to US$32,000,000, divided into: (i) 280,000,000,000 Class A Ordinary Shares of US$0.0001 par value each; and

(ii) 40,000,000,000 Class B Ordinary Shares of US$0.0001 par value each.

Recent Developments

Note Financing

On September 27, 2024, the Company entered into

certain securities purchase agreements dated September 27, 2024 (the “SPA”) by and among the Company and the purchasers signatory

thereto (the “Purchasers”). Pursuant to the SPA, the Company sold to the Purchasers an initial tranche of senior secured convertible

notes in the aggregate principal amount of approximately $7.6 million (the “Initial Notes”), having a maturity date twelve

months from the date of issuance, bearing an interest rate of 6% per annum, and convertible into Ordinary Shares of the Company, and accompanying

Series A Warrants to purchase up to an aggregate of 2,853,118 Ordinary Shares, with an exercise price of $1.60 per Ordinary Share (the

“Initial Warrants”). The Initial Notes are convertible into the Company’s Ordinary Shares at the holder’s option,

after 45 days from the date of issuance, in whole or in part, until the Initial Note is fully converted, at the lower of (i) $1.60 (“Conversion

Price”), or (ii) a price equal to 90% of the lowest VWAP of the Ordinary Shares during the ten (10)-trading day period immediately

preceding the applicable conversion date (the “Alternate Conversion Price”).

First Note Exchange

On October 8, 2024, the Company and the Purchasers

entered into a certain note exchange agreement (the “October Exchange Agreement”), pursuant to which the Purchasers delivered

to the Company for cancellation and termination the Initial Notes previously issued by the Company to the Purchasers pursuant to the SPA.

In exchange, the Company issued to the Purchasers new convertible notes (the “October Notes”) with substantially all of the

same terms of the Initial Notes, except that the October Notes shall become convertible into the Company’s Ordinary Shares at the

holder’s option, immediately from the date of issuance, in whole or in part, until the October Notes are fully converted.

100-for-1 Reverse Split and Increase in Authorized

Share Capital

Effective November 15, 2024, the Company effected

a 100-for-1 reverse share split of its Class A and Class B ordinary shares, and increased the authorized share capital of the Company

to US$32 million divided into 280 billion Class A ordinary shares with a par value of US$0.0001 per share and 40 billion Class B ordinary

shares with a par value of US$0.0001 per share.

Second Note Exchange

On November 25, 2024, the Company and the Purchasers

entered into a second note exchange agreement (the “November Exchange Agreement”), pursuant to which the Purchasers agreed

to deliver to the Company for cancellation and termination the October Notes previously issued by the Company to the Purchasers pursuant

to the October Exchange Agreement. In exchange, the Company will issue to the Purchasers new convertible notes (the “New Notes”)

with substantially all of the same terms of the October Notes, except that a floor price of $25.40, equal to 20% of the closing price

of the Company’s Ordinary Shares on the trading day immediately prior to the execution of the SPA (the “Floor Price”),

was added to the New Notes. The New Notes are convertible into the Company’s Ordinary Shares at the holder’s option, in whole

or in part, until the New Notes are fully converted, at the lower of (i) the Conversion Price, or (ii) a price equal to the greater of

(x) the Floor Price and (y) the Alternate Conversion Price.

Amendment to the SPA

On November 25, 2024, the Company and each of

the Purchasers entered into an amendment to the SPA (the “SPA Amendment”) to increase the maximum aggregate Subscription Amounts

(as defined in the SPA) from US$33,000,000 to US$40,000,000. Except as expressly set forth above, the SPA shall remain unchanged and in

full force and effect.

Business Overview

We are an entertainment technology

company with a global network that focuses on the application of technology and artificial intelligence in the entertainment industry,

and primarily provide services via our wholly-owned subsidiaries, CACM Group NY and Color Star DMCC, Inc. We strive to deliver world-class

entertainment experiences and promoting entertainment exchange with our strong resources and deep connections in the industry.

We launched our online cultural

entertainment platform, Color World, globally on September 10, 2020. We used to operate Color World by Color Sky Entertainment Limited,

our subsidiary in Hong Kong, which was formerly known as Color China Entertainment Limited. After our internal reallocation of resources,

since September 2022, we have operated Color World through Color Metaverse, our Singapore subsidiary. It used to be a platform primarily

providing celebrity-led education services. The curriculum development created by us includes music, sports, animation, painting and calligraphy,

film and television, life skills, etc., covering plenty of aspects of entertainment, sports and culture. At present, Color World is operated

by Color Star DMCC. We have signed contracts with well-known international artists and more than 50 celebrity teachers have been retained

to launch online lectures. In January 2022, Color World was transformed into the current version, a metaverse with “artificial intelligence

+ celebrity entertainment” as its core features. Since transforming into a metaverse platform, Color World has been inviting many

global superstar celebrities to join the platform to expand on the celebrity content by creating more celebrity masterclasses, online

virtual performances, celebrity merchandise, games and so on. We are keep adding new modules to Color World to enrich the metaverse community.

In the future, we plan to add more virtual locations as well as digital products. As of the date of this report, we do not have any operations

in the PRC.

We are committed to the development

of entertainment technology and artificial intelligent technology. We strive to create a parallel world of entertainment, allowing more

people to realize their dreams in the virtual entertainment world.

The following diagram illustrates

our current corporate structure:

All subsidiaries are 100%

wholly owned by the parent, unless otherwise indicated by the percentage on the chart.

Corporate Information

Our principal executive office

is located at 80 Broad Street, 5th Floor, New York, NY 10005. Our telephone number is (929) 317-2699. We maintain a website at http://www.colorstarinternational.com/

that contains information about our Company, though no information contained on our website is part of this prospectus. We do not incorporate

by reference into this prospectus the information on, or accessible through, our website, and you should not consider it as part of this

prospectus. Our annual reports on Form 20-F and reports on Form 6-K filed with the SEC are available, as soon as practicable after filing,

at the investors’ page on our corporate website, or by a direct link to its filings on the SEC’s free website.

THE OFFERING

| Notes |

|

$7,675,680 in principal amount of Senior Secured

Convertible Notes.

This prospectus supplement also relates to the

offering of our Ordinary Shares issuable upon conversion or repayment of the New Notes.

|

| |

|

|

| Additional Closings |

|

Upon our filing of an additional prospectus supplement and upon mutual consent of us and the investors and the satisfaction of certain other closing conditions, we may elect to consummate additional closings of up to an aggregate amount of $40 million. However, we are not registering pursuant to this prospectus supplement the issuance of any such Additional Notes or Additional Warrants (or Ordinary Shares issuable upon conversion and/or exercise of the Additional Notes and Additional Warrants) that may be issued, from time to time, at such additional closings. |

| |

|

|

| Maturity of Notes |

|

November 25, 2025, unless earlier converted. |

| |

|

|

| Interest |

|

The New Notes will accrue interest at a rate of 6.0% per annum or 10% per annum in the event of default. Interest will accrue beginning on the issue date of the New Notes and will be due and payable on each conversion date for the principal amount being converted and on the maturity date in our Ordinary Shares. |

| |

|

|

| Conversion Rights |

|

Holders may convert all or any portion of their

New Notes at their option at any time after the issuance of the New Notes and prior to such holder’s New Note being paid in full,

provided, however, that the conversion price of the New Notes shall be equal to or greater than US$3.50 during the initial fifteen (15)

Trading Days following the issuance of the New Notes.

Upon conversion, we will deliver our Ordinary

Shares, as described in this prospectus supplement. |

| |

|

|

| Floor Price |

|

The floor price is $1.06, which is 20% of our closing share price on November 22, 2024 (“Floor Price”). |

| Conversion Price |

|

The initial conversion price is equal to the lower of (i) $6.68 (“Conversion Price”), or (ii) a price equal to the greater of (x) the Floor Price and (y) 90% of the lowest VWAP of the Ordinary Shares during the ten (10)-trading day period immediately preceding the applicable conversion date (the “Alternate Conversion Price”). The conversion price is subject to adjustment if certain events occur. For more information, see “Description of Notes.” |

| |

|

|

| Use of proceeds |

|

We intend to allocate the net proceeds of this offering for working capital and other general corporate purposes. See “Use of Proceeds” on page S-10 of this prospectus supplement. |

| |

|

|

| Risk factors |

|

Investing in our securities involves a high degree of risk. For a discussion of factors you should consider carefully before deciding to invest in our securities, see the information contained in or incorporated by reference under the heading “Risk Factors” beginning on page S-7 of this prospectus supplement, on page 6 of the accompanying prospectus, in our Annual Report on Form 20-F for the fiscal year ended June 30, 2024 and in the other documents incorporated by reference into this prospectus supplement. |

| |

|

|

| Market for the Ordinary Shares and Notes |

|

Our Ordinary Shares are quoted and traded on the NASDAQ Capital Market under the symbol “ADD.” |

| |

|

|

| |

|

However, there is no established public trading market for the New Notes, and we do not expect such markets to develop. In addition, we do not intend to apply to list the New Notes on any securities exchange. |

RISK FACTORS

Before you make a decision to invest in our

securities, you should consider carefully the risks described below, together with other information in this prospectus supplement, the

accompanying prospectus and the information incorporated by reference herein and therein. If any of the following events actually occur,

our business, operating results, prospects or financial condition could be materially and adversely affected. This could cause the trading

price of our Ordinary Shares to decline and you may lose all or part of your investment. The risks described below are not the only ones

that we face. Additional risks not presently known to us or that we currently deem immaterial may also significantly impair our business

operations and could result in a complete loss of your investment.

RISKS RELATED TO THIS OFFERING

Since we have some discretion in how we use the proceeds from this

offering, we may use the proceeds in ways with which you disagree.

We have not allocated specific amounts of the

net proceeds from this offering for any specific purpose. Accordingly, subject to any agreed upon contractual restrictions under the terms

of the securities purchase agreement, our management will have some flexibility in applying the net proceeds of this offering. You will

be relying on the judgment of our management with regard to the use of these net proceeds, and subject to any agreed upon contractual

restrictions under the terms of the purchase agreement, you will not have the opportunity, as part of your investment decision, to assess

whether the proceeds are being used appropriately. It is possible that the net proceeds will be invested in a way that does not yield

a favorable, or any, return for us. The failure of our management to use such funds effectively could have a material adverse effect on

our business, financial condition, operating results and cash flow.

There is no minimum offering amount required to consummate this

offering.

There is no minimum offering amount which must

be raised in order for us to consummate this offering. Accordingly, the amount of money raised may not be sufficient for us to meet our

business objectives. Moreover, if only a small amount of money is raised, all or substantially all of the offering proceeds may be applied

to cover the offering expenses and we will not otherwise benefit from the offering. In addition, because there is no minimum offering

amount required, investors will not be entitled to a return of their investment if we are unable to raise sufficient proceeds to meet

our business objectives.

A large number of shares may be sold in the market following this

offering, which may significantly depress the market price of our Ordinary Shares.

The Ordinary Shares underlying the New Notes sold

in the offering will be freely tradable without restriction or further registration under the Securities Act. As a result, a substantial

number of our Ordinary Shares may be sold in the public market following this offering. If there are significantly more Ordinary Shares

offered for sale than buyers are willing to purchase, then the market price of our Ordinary Shares may decline to a market price at which

buyers are willing to purchase the offered Ordinary Shares and sellers remain willing to sell our Ordinary Shares.

The New Notes may be dilutive to holders of our Ordinary Shares.

The Conversion Price of the New Notes exceeds

the net tangible book value per share of our Ordinary Shares outstanding prior to this offering. Assuming that an aggregate of 7,241,208

Ordinary Shares are issued upon conversion of the New Notes at the Conversion Price of $1.06 per share, holders of our Ordinary Shares

will experience immediate dilution of $4.26 per share, representing the difference between our as adjusted net tangible book value per

share as of June 30, 2024, after giving effect to this offering and the conversion of the New Notes. See the section entitled “Dilution”

on page S-12 of this prospectus supplement for a more detailed illustration of the dilution you would incur if the New Notes are converted.

There is no public market for the New Notes to purchase our ordinary

shares in this offering.

There is no established public trading market

for the New Notes being offered in this offering, and we do not expect such markets to develop. In addition, we do not intend to apply

to list the New Notes on any securities exchange. Without an active market, the liquidity of the New Notes will be limited.

Upon mutual consent of us and the investors

in this offering and the satisfaction of certain other closing conditions, we may elect to consummate additional closings of up to an

aggregate amount of $40 million, which could result in additional dilution of the percentage ownership of our shareholders upon the issuance

of Ordinary Shares upon conversion and/or exercise of the Additional Notes and Additional Warrants and could cause our share price to

fall.

Upon our filing of an additional prospectus supplement

and upon mutual consent of us and the investors in this offering and the satisfaction of certain other closing conditions, we may elect

to consummate additional closings of up to an aggregate of $40 million of Additional Notes and Additional Warrants with substantially

the same terms as the Initial Notes and Initial Warrants. To the extent that we raise additional capital by issuing equity securities,

our stockholders may experience substantial dilution. We may also sell Ordinary Shares, convertible securities or other equity securities

in one or more other transactions at prices and in a manner we determine from time to time, which may result in further dilution to our

existing shareholders.

RISK RELATED TO OUR ORDINARY SHARES

There can be no assurance that our Class A

ordinary shares will continue to be listed on NASDAQ, which could limit investors’ ability to make transactions in our securities

and subject us to additional trading restrictions.

To continue listing our Class A ordinary shares

on NASDAQ, we are required to demonstrate compliance with NASDAQ’s continued listing requirements, particularly the requirement

to maintain a minimum $1.00 bid price per share. Historically, we received several notification letters from the Nasdaq Listing Qualifications

Staff notifying us that we are no longer in compliance with the minimum stockholders’ equity requirement for continued listing on

the NASDAQ Capital Market set forth in the Nasdaq Listing Rule 5550(a)(2) and 5810(c)(3)(A).

On November 14, 2024, we received a letter from

the Listings Qualifications Department of the NASDAQ Capital Market “Nasdaq”) notifying us that the minimum closing bid price

per share for our Class A ordinary shares was below $1.00 for a period of 30 consecutive business days and that we did not meet the minimum

bid price requirement set forth in the Nasdaq Listing Rule 5550(a)(2). The notification received has no immediate effect on the listing

of our Class A ordinary shares on Nasdaq. Under the Nasdaq Listing Rules, we have until May 13, 2025 to regain compliance.

However, we cannot assure you that we will continue

to be able to meet NASDAQ’s other continued listing standards. If our Class A ordinary shares are delisted by NASDAQ, and we are

not able to list our securities on another national securities exchange, we expect our securities could be quoted on an over-the-counter

market. If this were to occur, we could face significant material adverse consequences, including:

| ● | less

liquid trading market for our securities; |

| ● | more

limited market quotations for our securities; |

| ● | determination

that our ordinary shares and/or warrants are a “penny stock” that requires brokers to adhere to more stringent rules and

possibly resulting in a reduced level of trading activity in the secondary trading market for our securities; |

| ● | more

limited research coverage by stock analysts; |

| ● | more

difficult and more expensive equity financings in the future. |

USE OF PROCEEDS

We estimate that the net proceeds from the sale

of the securities offered by this prospectus supplement, after deducting the placement agent fees and other estimated expenses of this

offering payable by us, will be approximately $7.6 million.

We intend to allocate the net proceeds of this

offering for working capital and general corporate purposes. Except for the foregoing, we have not yet determined with certainty the manner

in which we will allocate the net proceeds of this offering. The precise amount and timing of the application of these proceeds will depend

on our funding requirements and the availability and costs of other funds. Accordingly, we will retain broad discretion over the use of

such proceeds.

DIVIDEND POLICY

We have never declared or paid any cash dividends

on our Ordinary Shares. We anticipate that we will retain any earnings to support operations and to finance the growth and development

of our business. Therefore, we do not expect to pay cash dividends in the foreseeable future. Any future determination relating to our

dividend policy will be made at the discretion of our Board of Directors and will depend on a number of factors, including future earnings,

capital requirements, financial conditions and future prospects and other factors the Board of Directors may deem relevant. Payments of

dividends to our company are subject to restrictions including primarily the restriction that foreign invested enterprises may only buy,

sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents.

CAPITALIZATION

The following table sets forth our capitalization as of June 30, 2024:

| |

● |

on an actual basis; |

| |

|

|

| |

● |

on an actual basis to the effect a 100-for-1 reverse share split of its Class A and Class B ordinary shares on November 15, 2024 with the issuance of 181,451 Class A Ordinary Shares resulted from the round up of fractional shares; |

| |

● |

on a pro forma basis, as adjusted basis to give effect to the net proceeds from the sale and issuance of 23,500 Class A Ordinary Shares in August 2024 at a price per share of $40.00, after deducting expenses payable by us, if any; |

| |

● |

on a pro forma basis, as adjusted basis to give effect to the issuance of 6,735 Class A Ordinary Shares in September 2024 in connection with the cashless exercise of warrants; |

| |

● |

on a pro forma basis, as adjusted basis to give effect to the issuance of 70,040 Class A Ordinary Shares in July, August, September, and October 2024 in connection with the conversion of convertible notes; |

| |

|

|

| |

● |

on a pro forma basis, as adjusted basis to give effect to the issuance of 83,700 Class A Ordinary Shares in October 2024 to the Company’s officers and employees; and |

| |

● |

on a pro forma as adjusted basis, as adjusted basis to reflect the issuance of 7,241,208 Class A Ordinary Shares underlying $7,675,680 in principal amount of the New Notes in this offering, after deducting placement agent fees and expenses and estimated offering expenses payable by us, assuming a conversion price of $1.06. |

| | |

June 30, 2024 | |

| | |

Actual | | |

Pro forma as Adjusted | |

| | |

US$ | | |

US$ | |

| Equity | |

| | |

| |

| Class A Ordinary shares, par value $0.0001 per share: 280,000,000,000 shares authorized, 512,124 shares issued and outstanding, actual; 7,937,708 shares issued and outstanding, pro forma as adjusted (unaudited) | |

| 52 | | |

| 794 | |

| Class B Ordinary shares, par value $0.0001 per share: 40,000,000,000 shares authorized, 12,000 shares issued and outstanding, actual and as adjusted (unaudited) | |

| 1 | | |

| 1 | |

| Additional paid-in capital | |

| 230,619,837 | | |

| 241,947,756 | |

| Deferred share compensation | |

| (9,778 | ) | |

| (9,778 | ) |

| Deficit | |

| (212,084,368 | ) | |

| (212,084,368 | ) |

| Total equity | |

| 18,525,744 | | |

| 29,854,406 | |

| Total capitalization | |

| 18,525,744 | | |

| 29,854,406 | |

The above discussion and table exclude: (i) 2,707

Ordinary Shares issuable upon exercise of certain warrants issued in a registered direct offering pursuant to a certain securities purchase

agreement dated February 21, 2022; (ii) 12,750 Ordinary Shares issuable upon exercise of certain warrants issued in a registered direct

offering pursuant to a certain securities purchase agreement dated September 14, 2022, and (iii) 28,532 Ordinary Shares issuable upon

exercise of the Initial Warrants offered in a registered direct offering pursuant to a certain securities purchase agreement dated September

27, 2024.

DILUTION

Our net tangible book value as of June 30, 2024

was $1,411,035, or $2.76 per Ordinary Share. Net tangible book value per share represents the amount of our total tangible assets, less

our total liabilities, divided by the number of Ordinary Shares outstanding as of June 30, 2024. Net tangible book value dilution per

Ordinary Share to new investors represents the difference between the amount per Ordinary Share paid by purchasers in this offering and

the net tangible book value per Ordinary Share immediately after completion of this offering.

After giving effect to (i) the effect a 100-for-1

reverse share split of its Class A and Class B ordinary shares on November 15, 2024 with the issuance of 181,451 Class A Ordinary Shares

resulted from the round up of fractional shares (ii) the net proceeds from the sale and issuance of 235,000 Ordinary Shares in August

2024 at a price per share of $40.00, after deducting expenses payable by us, if any; (iii) the issuance of 6,735 Class A Ordinary Shares

in September 2024 in connection with the cashless exercise of warrants; (iv) the issuance of 70,040 Class A Ordinary Shares in July, August,

September, and October 2024 in connection with the conversion of convertible notes; and (v) the issuance of 83,700 Class A Ordinary Shares

in October 2024 to the Company’s officers and employees; our pro forma net tangible book value as of June 30, 2024 would have been

US$5,114,017, or US$5.83 per share

After giving effect to the entire conversion of

the New Notes, assuming a conversion price of $1.06 per Class A Ordinary Share and that 7,241,208 shares are issued upon conversion of

the New Notes, and after deducting estimated offering expenses, our pro forma as adjusted net tangible book value as of June 30, 2024

would have been $12,739,697or $1.57 per share. This represents an immediate dilution in net tangible book value of $4.26 per share to

our existing stockholders and an immediate increase in net tangible book value of $0.51 per share to purchasers in this offering, as illustrated

in the following table:

| Assuming conversion price per share | |

$ | 1.06 | |

| Net tangible book value per share as of June 30, 2024 | |

$ | 2.76 | |

| Increase in net tangible book value per share attributable to the pro forma adjustments described above | |

$ | 3.07 | |

| Pro forma net tangible book value per share as of June 30, 2024 | |

$ | 5.83 | |

| Dilution per share attributable to pro forma existing holders of ordinary shares | |

$ | (4.26 | ) |

| Pro forma as adjusted net tangible book value per share after this offering | |

$ | 1.57 | |

| Increase per share to new investors | |

$ | 0.51 | |

The above discussion and table exclude: (i) 2,707

Ordinary Shares issuable upon exercise of certain warrants issued in a registered direct offering pursuant to a certain securities purchase

agreement dated February 21, 2022; (ii) 12,750 Ordinary Shares issuable upon exercise of certain warrants issued in a registered direct

offering pursuant to a certain securities purchase agreement dated September 14, 2022, and (iii) 28,532 Ordinary Shares issuable upon

exercise of the Initial Warrants offered in a registered direct offering pursuant to a certain securities purchase agreement dated September

27, 2024.

DESCRIPTION OF SECURITIES WE ARE OFFERING

Senior Secured Convertible Notes

The material terms and provisions of the New

Notes being offered pursuant to this prospectus supplement and being issued to the investors (with some exceptions noted below) are summarized

below. The form of New Note will be provided in this offering and will be filed as an exhibit to a Report of Foreign Issuer on Form 6-K

with the SEC in connection with this offering.

The New Notes will have a maturity of twelve months

from the date of issuance, bear an interest rate of 6.0% per annum and will be convertible immediately after the date of issuance, provided,

however, the Conversion Price shall be equal to or greater than US$3.50 during the initial fifteen (15) Trading Days following the issuance

of the New Notes.

Interest accrues at 6% per annum on the outstanding

principal amount. In the case of an Event of Default (e.g., failure to make payments, breach of covenants, etc.), the interest rate increases

to 10% per annum until the default is cured. Interest can be paid either in ordinary shares or cash. If the Company cannot issue shares

due to the unavailability of an effective registration statement, the Company must pay the interest in cash.

Immediately after issuance, the New Notes (plus

accrued interest) are convertible into the Company’s Ordinary Shares at the holder’s option, in whole or in part, until the

New Note is fully converted, at the lower of (i) the fixed conversion price of $6.68, or (ii) a price equal to the greater of (x) the

floor price of $1.06 (the “Floor Price”) and (y) a price equal to 90% of the lowest VWAP of the Ordinary Shares during the

ten (10)-trading day period immediately preceding the applicable conversion date (the “Alternate Conversion Price”). Upon

delivering a Notice of Conversion, the holder receives Ordinary Shares based on the applicable conversion price. The Company must deliver

these shares within 1 trading day or by the standard settlement period for its exchange. The holder may not convert the Initial Note if

the conversion would result in the holder owning more than 4.99% (or 9.99% at the election of the holder) of the Company’s outstanding

shares. This threshold can be increased to 9.99% with 61 days’ written notice from the holder to the Company.

If the Company raises funds through subsequent

financings, the holder can require the Company to use up to 30% of the proceeds to redeem the Note at 105% of the principal amount, plus

accrued interest. In the event of a change of control (e.g., sale of the company or merger), the holder can demand redemption of the Note

for cash at the same 105% redemption price. The Company must also redeem the New Note if certain conditions (e.g., failure to maintain

an effective registration statement or if share volume falls below a set threshold) are not met within a specified time frame, as set

forth in the New Notes.

If the Company issues dividends, splits, or combines

its Ordinary Shares, the conversion price will be adjusted proportionately. If the Company offers purchase rights to existing shareholders,

the holder is entitled to participate in the same proportion as if the Initial Note had been fully converted. If the Company undergoes

a merger, asset sale, reclassification, or similar fundamental transaction, the holder has the right to convert the Initial Note into

shares of the successor entity or receive “Alternate Consideration” equivalent to what the Company’s shareholders receive.

Events that constitute default include failure

to pay principal or interest, breach of covenants, failure to maintain listing of shares on the stock exchange, and insolvency or bankruptcy.

Upon an event of default, the holder can demand immediate repayment of the New Note at a “Mandatory Default Amount,” which is

calculated as the greater of (a) 130% of the outstanding principal plus accrued interest, or (b) a discounted value based on share price.

This New Note is secured by all assets of the

Company and its subsidiaries under a Security Agreement and Subsidiary Guarantee, and the New Note ranks senior to all other Company debts

and liabilities.

The above summaries of certain terms and provisions of the New Notes

are not complete and are subject to, and qualified in its entirety by, the provisions of the forms of such documents, which will be filed

as exhibits to a Report of Foreign Issuer on Form 6-K with the SEC. You should review the copies of such documents before you invest in

our securities.

In addition, subject to the conditions set forth in certain securities

purchase agreements we entered into with the investors, we also agreed to sell the investors, from time to time, up to $40,000,000 in

aggregate principal amount of Additional Notes and Additional Warrants with substantially the same terms as the Initial Notes and Initial

Warrants.

Such Additional Notes, the Ordinary Shares issuable

from time to time upon conversion of such Additional Notes, the Additional Warrants and the Ordinary Shares issuable from time to time

upon exercise of the Additional Warrants, all of which have not yet been sold and may never be sold, are not being registered herein and,

if sold, will either be sold pursuant to an effective registration statement or pursuant to an exemption from registration under the Securities

Act.

No Market for Notes

There is no established public trading market for the New Notes, and

we do not expect a market to develop. We do not intend to apply to list the New Notes on any securities exchange. Without an active market,

the liquidity of the New Notes will be limited.

Transfer Agent and Registrar

The transfer agent and registrar for the Ordinary

Shares is Transhare Corporation, 17755 North US Highway 19, Suite 140, Clearwater, FL 33764.

Listing

Our Ordinary Shares are listed on the NASDAQ Capital

Market under the symbol “ADD”.

PLAN OF DISTRIBUTION

Maxim Group LLC, which we refer to as the placement agent, has agreed

to act as the exclusive placement agent in connection with this offering subject to the terms and conditions of a placement agency agreement

dated as of September 27, 2024. The placement agent is not purchasing or selling any securities offered by this prospectus supplement,

nor is it required to arrange the purchase or sale of any specific number or dollar amount of securities, but it has agreed to use its

reasonable efforts to arrange for the sale of all of the securities offered hereby.

We entered into securities purchase agreements

with the investors on September 27, 2024, as amended, pursuant to which we agreed to issue to the investors up to an aggregate of $40,000,000

of Notes and Warrants.

We agreed to sell to the investors approximately

$7,675,680 of New Notes that are offered and sold pursuant this prospectus supplement.

We expect delivery of our New Notes issued and

sold in this Second Closing to occur on or before November 27, 2024, subject to the satisfaction of customary closing conditions.

We have agreed to reimburse the placement agent

upon the Second Closing for the actual and reasonable expenses incurred by it in connection with the offering, not to exceed $50,000.

After deducting fees due to the placement agent and our estimated offering

expenses, we expect the net proceeds from this offering to be approximately $7.6 million.

We have agreed to indemnify the placement agent

and certain other persons against certain liabilities, including liabilities under the Securities Act of 1933, as amended.

For a period of two (2) months from the closing of the offering, we

have granted the placement agent the right of first refusal to act as to act as sole managing underwriter and sole book runner, sole placement

agent, or sole sales agent, for any and all such future public or private equity, equity-linked or debt (excluding commercial bank debt)

offerings for which the Company retains the service of an underwriter, agent, advisor, finder or other person or entity in connection

with such offering during such two (2) month period.

Our executive officers, directors and affiliates

who are the holders of our Ordinary Shares, as of the pricing date of the offering, have agreed, subject to certain conditions and exceptions,

not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any securities of the

Company for a period of ninety days from the First Closing. We, and any successor, agree, subject to certain exceptions, not to for a

period of forty-five days from the First Closing (1) offer, sell or otherwise transfer or dispose of, directly or indirectly, any shares

of capital stock of the Company or (2) file or caused to be filed any registration statement with the SEC relating to the offering of

any shares of our capital stock or any securities convertible into or exercisable or exchangeable for shares of our capital stock.

In addition, we also agreed with the purchasers

that so long as any of the Notes and/or Warrants remain outstanding, we will not effect or enter into an agreement to effect a “Variable

Rate Transaction,” as defined in the securities purchase agreements.

The placement agent may be deemed to be an underwriter

within the meaning of Section 2(a)(11) of the Securities Act, and any fees or commissions received by it and any profit realized on the

resale of securities sold by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities

Act. As an underwriter, the placement agent is required to comply with the requirements of the Securities Act and the Exchange Act, including,

without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations

may limit the timing of purchases and sales of Ordinary Shares and warrants by the placement agent. Under these rules and regulations,

the placement agent:

| ● | may

not engage in any stabilization activity in connection with our securities; and |

| ● | may

not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted

under the Exchange Act, until it has completed its participation in the distribution. |

From time to time in the common course of their

respective businesses, the placement agent or its affiliates have in the past or may in the future engage in investment banking and/or

other services with us and our affiliates for which it has or may in the future receive customary fees and expenses.

LEGAL MATTERS

Certain legal matters relating to the offering

of Ordinary Shares under this prospectus supplement will be passed upon for us by Conyers Dill & Pearman LLP with respect to matters

of Cayman Islands law and by Hunter Taubman Fischer & Li LLC with respect to matters of U.S. law. The placement agent is being represented

in connection with this offering by Ellenoff Grossman & Schole LLP.

EXPERTS

The consolidated financial statements of our Company for the year ended

June 30, 2024, June 30, 2023 and June 30, 2022 appearing in our annual report on Form 20-F for the fiscal year ended June 30, 2024 have

been audited by Audit Alliance LLP, an independent registered public accounting firm, as set forth in the report thereon included therein

and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such

reports given on the authority of such firm as an expert in accounting and auditing.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

All documents filed by the registrant after the

date of filing the initial registration statement on Form F-3 of which this prospectus forms a part and prior to the effectiveness of

such registration statement pursuant to Section 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934 shall be deemed to be

incorporated by reference into this prospectus and to be part hereof from the date of filing of such documents. In addition, the documents

we are incorporating by reference as of the date hereof are as follows:

We hereby incorporate by reference into this prospectus

the following documents that we have filed with the SEC under the Exchange Act:

| (1) | our Annual Report on Form 20-F for the fiscal year

ended June 30, 2024, filed with the SEC on October 17, 2024; |

| (2) | our Report on Form 6-K, filed with the SEC on November 26,

2024; and |

| (3) | the description of our

Ordinary Shares incorporated by reference in our registration statement on Form 8-A, as amended

(File No. 001-34515) filed with the Commission on October 30, 2009, including any amendment and report subsequently filed for the

purpose of updating that description. |

All documents that we file with the SEC pursuant to Section 13(a),

13(c), 14 or 15(d) of the Exchange Act (and in the case of a Report on Form 6-K, so long as they state that they are incorporated by reference

into this prospectus, and other than Reports on Form 6-K, or portions thereof, furnished under Form 6-K) (i) after the initial filing

date of the registration statement of which this prospectus forms a part and prior to the effectiveness of such registration statement

and (ii) after the date of this prospectus and prior to the termination of the offering shall be deemed to be incorporated by reference

in this prospectus from the date of filing of the documents, unless we specifically provide otherwise. Information that we file with the

SEC will automatically update and may replace information previously filed with the SEC. To the extent that any information contained

in any Report on Form 6-K or any exhibit thereto, was or is furnished to, rather than filed with the SEC, such information or exhibit

is specifically not incorporated by reference.

Upon request, we will provide, without charge,

to each person who receives this prospectus, a copy of any or all of the documents incorporated by reference (other than exhibits to the

documents that are not specifically incorporated by reference in the documents). Please direct written or oral requests for copies to

us at 80 Broad Street, 5th Floor, New York, NY 10005, Attention: Louis Luo, (929) 317-2699.

You should rely only on the information incorporated

by reference or provided in this prospectus or any prospectus supplement. We have not authorized anyone else to provide you with different

information. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other

than the date on the front page of those documents.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement with the

Securities and Exchange Commission under the Securities Act of 1933, as amended, with respect to the Ordinary Shares offered by this prospectus.

This prospectus is part of that registration statement and does not contain all the information included in the registration statement.

For further information with respect to our Ordinary Shares and us,

you should refer to the registration statement, its exhibits and the material incorporated by reference therein. Portions of the exhibits

have been omitted as permitted by the rules and regulations of the Securities and Exchange Commission. Statements made in this prospectus

as to the contents of any contract, agreement or other document referred to are not necessarily complete. In each instance, we refer you

to the copy of the contracts or other documents filed as an exhibit to the registration statement, and these statements are hereby qualified

in their entirety by reference to the contract or document.

We file periodic reports, proxy statements and

other information with the SEC. Our filings are available to the public over the Internet at the SEC’s web site at http://www.sec.gov.

Upon request, we will provide, without charge, to each person who receives this prospectus, a copy of any or all of the documents incorporated

by reference (other than exhibits to the documents that are not specifically incorporated by reference in the documents). Please direct

written or oral requests for copies to us at 80 Broad Street, 5th Floor, New York, NY 10005, Attention: Louis Luo, (929) 317-2699.

We maintain a corporate website at http://www.colorstarinternational.com/.

Information contained on, or that can be accessed through, our website does not constitute a part of this prospectus.

ENFORCEABILITY OF CIVIL LIABILITIES

We are incorporated under

the laws of the Cayman Islands as an exempted company with limited liability. We incorporated in the Cayman Islands because of certain

benefits associated with being a Cayman Islands exempted company, such as political and economic stability, an effective judicial system,

a favorable tax system, the absence of foreign exchange control or currency restrictions and the availability of professional and support

services. However, the Cayman Islands have a less developed body of securities laws that provide significantly less protection to investors

as compared to the securities laws of the United States. In addition, Cayman Islands companies may not have standing to sue before the

federal courts of the United States.

All of our assets are located

outside of the United States. In addition, some of our directors and officers are residents of jurisdictions other than the United States

and all or a substantial portion of their assets are located outside the United States. As a result, it may be difficult for investors

to effect service of process within the United States upon us or our directors and officers, or to enforce against us or them judgments

obtained in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United

States or any state in the United States.

According to Conyers Dill

& Pearman LLP, our local Cayman Islands’ counsel, there is uncertainty with regard to Cayman Islands law relating to whether

a judgment obtained from the United States or Hong Kong courts under civil liability provisions of the securities laws will be determined

by the courts of the Cayman Islands as penal or punitive in nature. If such a determination is made, the courts of the Cayman Islands