Empowering customers with AI-driven solutions

to confront evolving threats, driving follow-on orders and new

customer acquisition

Raises fiscal 2025 guidance once again

Cognyte Software Ltd. (NASDAQ: CGNT) (the “Company,” “Cognyte,”

“we,” “us” and “our”), a global leader in investigative analytics

software, today announced results for the three and six months

ended July 31, 2024 (“Q2 FYE25” and “H1 FYE25”).

Q2 FYE25 Financial

Highlights

Three Months Ended

July 31, 2024

Three Months Ended

July 31, 2023

(in thousands, except per share data)

GAAP

Non-GAAP

GAAP

Non-GAAP

Revenue

$84,413

$84,413

$77,053

$77,053

Gross Margin

70.6%

71.3%

68.7%

69.2%

Basic and diluted earnings (loss) per

share (“EPS”)*

$(0.03)

$0.05

$(0.13)

$(0.03)

H1 FYE25 Financial

Highlights

Six Months Ended

July 31, 2024

Six Months Ended

July 31, 2023

(in thousands, except per share data)

GAAP

Non-GAAP

GAAP

Non-GAAP

Revenue

$167,127

$167,127

$150,319

$150,431

Gross Margin

70.6%

71.2%

68.3%

68.8%

Basic and diluted EPS*

$(0.10)

$0.02

$(0.26)

$(0.14)

*Our non-GAAP income taxes for prior

period were adjusted as detailed further under footnote 3.

“We delivered strong second quarter results as we continued to

execute on our growth strategy and business plan,” said Elad

Sharon, Cognyte’s chief executive officer. “A healthy market and

the tangible operational outcomes our solutions generate for

customers are resulting in follow-on orders and driving new

customer acquisitions.”

He added, “At the core of our work is our mission to make the

world a safer place. Our leading AI-driven solutions empower

customers to confront significant, evolving threats, accelerate

investigations, enable faster decision-making and mitigate a wide

range of security challenges.”

“Cognyte has grown revenue by more than 11% in the first six

months of fiscal 2025,” said David Abadi, Cognyte’s chief financial

officer. “We delivered $13.3 million in Adjusted EBITDA, marking a

meaningful improvement compared to almost breakeven results in the

first half of the prior fiscal year. Our advanced solutions deliver

significant value to our customers, driving demand. As a result of

market conditions and our strong execution, we are once again

raising our full year outlook.”

FYE25 Outlook

Our non-GAAP outlook for the year ending January 31, 2025

(“FYE25” and “Fiscal 2025”) is as follows:

- Revenue: $347 million at the midpoint with a range of

+/-2%, representing approximately 11% growth from previous year

revenue.

- Adjusted EBITDA: Approximately $25 million at the

midpoint of our revenue outlook.

- Diluted EPS: Loss of $0.03 at the midpoint of our

revenue outlook.

Our non-GAAP outlook for FYE25 excludes the following GAAP

measures which we are able to quantify with reasonable certainty,

as described further below under “Supplemental Information About

non-GAAP Financial Measures and Operating Metrics”:

- Amortization of intangible assets of approximately $0.3

million.

Our non-GAAP outlook for FYE25 excludes the following GAAP

measures for which we are able to provide a range of probable

significance:

- Stock-based compensation is expected to be between

approximately $17.0 and $19.0 million, assuming market prices for

our ordinary shares are generally consistent with current

levels.

For additional information about our expectations for FYE25,

please refer to the Q2 FYE25 conference call we will conduct on

September 10, 2024.

Our non-GAAP outlook does not include the potential impact of

any business acquisitions that may close after the date hereof,

and, unless otherwise specified, reflects foreign currency exchange

rates approximately consistent with current rates.

We are unable, without unreasonable effort, to provide a

reconciliation for other GAAP measures which are excluded from our

non-GAAP outlook, including the impact of future business

acquisitions or acquisition expenses, future restructuring

expenses, and non-GAAP income tax adjustments due to the level of

unpredictability and uncertainty associated with these items. For

these same reasons, we are unable to assess the probable

significance of these excluded items. While historical results may

not be indicative of future results, actual amounts for the three

and six months ended July 31, 2024, and 2023, respectively, for the

GAAP measures excluded from our non-GAAP outlook appear in Table 4

of this press release.

Conference Call Information

We will conduct a conference call today at 8:30 a.m. ET to discuss

our results for the three months ended July 31, 2024. A real-time

webcast of the conference call with presentation slides will be

available in the Investor Relations section of Cognyte’s website.

Those interested in participating in the question-and-answer

session need to register here to receive the dial-in numbers and

unique PIN to access the call seamlessly. It is recommended that

you join 10 minutes prior to the event start (although you may

register and dial in at any time during the call). An archived

webcast of the conference call will also be available in the

“Investors” section of the company’s website.

About Non-GAAP Financial Measures This press release and

the accompanying tables include non-GAAP financial measures. For a

description of these non-GAAP financial measures, including the

reasons management uses each measure, and reconciliations of

non-GAAP financial measures presented for completed periods to the

most directly comparable financial measures prepared in accordance

with GAAP, please see the tables below as well as “Supplemental

Information About Non-GAAP Financial Measures” at the end of this

press release.

About Cognyte Software Ltd. Cognyte Software Ltd. is a

global leader in investigative analytics software that empowers a

variety of government and other organizations with Actionable

Intelligence for a Safer World™. Our open interface software is

designed to help customers accelerate and improve the effectiveness

of investigations and decision-making. Hundreds of customers rely

on our solutions to accelerate and conduct investigations and

derive insights, with which they identify, neutralize and tackle

threats to national security and address different forms of

criminal and terror activities. Learn more at www.cognyte.com.

Caution About Forward-Looking Statements This press

release contains “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995 and Section

21E of the United States Securities Exchange Act of 1934.

Forward-looking statements include statements regarding

expectations, predictions, views, opportunities, plans, strategies,

beliefs, and statements of similar effect relating to Cognyte. All

statements contained in this press release that do not relate to

matters of historical fact should be considered forward-looking

statements. These forward-looking statements do not guarantee

future performance and are based on management's expectations that

involve a number of known and unknown risks, uncertainties,

assumptions and other important factors, any of which could cause

our actual results or conditions to differ materially from those

expressed in or implied by the forward-looking statements. Some of

the factors that could cause our actual results or conditions to

differ materially from current expectations include, among others:

uncertainties regarding the impact of changes in macroeconomic

and/or global conditions; risks related to government contract

dependency, including procurement risks, risks associated with

operational challenges amid the Hamas and other terrorist

organizations’ attack on Israel on October 7, 2023 and Israel’s war

against them; risks related to geopolitical changes and investor

visibility constraints; risks related to the impact of inflation

and related volatility on our financial performance; risks relating

to adverse changes to the regulatory constraints to which we are

subject; risks related to the impact of disruptions to the global

supply chain; risks resulting from health epidemics or pandemics or

actions taken in response to such pandemics; risks associated with

customer concentration and challenges associated with our ability

to accurately forecast revenue and expenses; risks associated with

political and reputational factors related to our business or

operations; risks associated with our ability to keep pace with

technological advances and challenges and evolving industry

standards; risks relating to proprietary rights infringement

claims; risks relating to defects, operational problems, or

vulnerability to cyber-attacks of our products or any of the

components used in our products; risks related to the strengths of

our intellectual property rights protection; risks that we may be

unable to establish and maintain relationships with key resellers,

partners, and system integrators and risks associated with our

reliance on third-party suppliers for certain components, products

or services; risks due to the aggressive competition in all of our

markets; challenges associated with our long sales cycles and with

the sophisticated nature of our solutions; risks associated with

our ability or costs to retain, recruit and train qualified

personnel; risks relating to our ability to properly manage

investments in our business and operations, execute on growth or

strategic initiatives; risks associated with acquisitions,

strategic investments, partnerships or alliances; risk of security

vulnerabilities or lapses, including cyber-attacks, information

technology system breaches, failures or disruptions; risks

associated with the mishandling or perceived mishandling of

sensitive, confidential or classified information; risks associated

with our failure to comply with laws; risks associated with our

credit facilities or that we may experience liquidity or working

capital issues and related risks that financing sources may be

unavailable to us on reasonable terms; risks associated with

changing tax laws and regulations, tax rates, and the continuing

availability of expected tax benefits in the countries in which we

operate; risks associated with our significant international

operations, including due to our Israeli operations, fluctuations

in foreign exchange rates, and exposure to regions subject to

political or economic instability; risks associated with complex

and changing regulatory environments relating to our operations and

the markets we operate in; risks relating to the adequacy of our

existing infrastructure, systems, processes, policies, procedures,

internal controls and personnel for our current and future

operations and reporting needs; risks associated with our limited

operating history as an independent public company; risks related

to the tax treatment of our spin-off from Verint; and risks

associated with different corporate governance requirements

applicable to Israeli companies and risks associated with being a

foreign private issuer. ; and other risks set forth and in Section

3.D - “Risk Factors” in our latest annual report on Form 20-F for

the fiscal year ended January 31, 2024, filed with the Securities

and Exchange Commission (the "SEC") on April 9, 2024, and in our

subsequent filings with the SEC. In addition, we operate in a very

competitive and rapidly changing environment. New risks and

uncertainties emerge from time to time. It is not possible for our

management to predict all risks and uncertainties, nor can we

assess the impact of all factors on its business or the extent to

which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any

forward-looking statements that we may make. In light of these

risks, uncertainties and assumptions, the forward-looking events

and circumstances discussed in this release are inherently

uncertain and may not occur, and actual results could differ

materially and adversely from those anticipated or implied in the

forward-looking statements. Accordingly, you should not rely upon

forward-looking statements as predictions of future events. Any

forward-looking statement made in this press release speaks only as

of the date hereof. Except as otherwise required by law, the

Company undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events, changed circumstances, or any other reason.

Table 1

COGNYTE SOFTWARE LTD.

Condensed Consolidated

Statements of Operations

(Unaudited)

Six Months Ended

July 31,

Three Months Ended

July 31,

(in thousands except per share data)

2024

2023

2024

2023

Revenue:

Software

$

58,377

$

51,892

$

26,932

$

26,520

Software service

89,693

81,313

45,338

40,220

Professional service and other

19,057

17,114

12,143

10,313

Total revenue

167,127

150,319

84,413

77,053

Cost of revenue:

Software

10,036

7,217

4,186

3,880

Software service

21,888

22,641

11,253

11,569

Professional service and other

17,197

17,745

9,350

8,657

Total cost of revenue

49,121

47,603

24,789

24,106

Gross profit

118,006

102,716

59,624

52,947

Operating expenses:

Research and development, net

53,005

54,850

26,180

27,103

Selling, general and administrative

68,528

60,110

34,762

31,310

Amortization of other acquired intangible

assets

145

181

72

91

Total operating expenses

121,678

115,141

61,014

58,504

Operating loss

(3,672

)

(12,425

)

(1,390

)

(5,557

)

Other income, net:

Interest income

1,100

763

532

394

Interest expense

(39

)

(10

)

(29

)

(7

)

Other income (loss), net:

284

836

86

(108

)

Total other income, net

1,345

1,589

589

279

Loss before provision for income

taxes

(2,327

)

(10,836

)

(801

)

(5,278

)

Provision for income taxes

2,129

5,105

54

3,236

Net loss

(4,456

)

(15,941

)

(855

)

(8,514

)

Net income attributable to noncontrolling

interest

2,595

2,238

1,079

912

Net loss attributable to Cognyte

Software Ltd.

$

(7,051

)

$

(18,179

)

$

(1,934

)

$

(9,426

)

Net loss per share attributable to

Cognyte Software Ltd.

Basic and diluted

$

(0.10

)

$

(0.26

)

$

(0.03

)

$

(0.13

)

Weighted-average shares

outstanding:

Basic and diluted

71,425

69,528

71,800

70,134

Table 2

COGNYTE SOFTWARE LTD.

Condensed Consolidated Balance

Sheets

July 31,

January 31,

2024

2024

(in thousands)

(Unaudited)

(Audited)

Assets

Current assets:

Cash and cash equivalents

$

91,741

$

74,477

Restricted cash and cash equivalents and

restricted bank time deposits

7,811

8,666

Accounts receivable, net of allowance for

credit losses of $3 million and $2.7 million, respectively

91,563

113,260

Contract assets, net of allowance for

credit losses of $1.4 million

8,885

8,859

Inventories

23,151

24,584

Prepaid expenses and other current

assets

33,488

35,135

Total current assets

256,639

264,981

Property and equipment, net

27,013

24,384

Operating lease right-of-use assets

34,803

33,833

Goodwill

126,242

126,563

Intangible assets, net

113

258

Deferred income taxes

2,688

2,928

Other assets

19,520

19,135

Total assets

$

467,018

$

472,082

Liabilities and stockholders'

equity

Current liabilities:

Accounts payable

$

25,916

$

20,863

Accrued expenses and other current

liabilities

75,113

75,826

Contract liabilities

91,410

93,778

Total current liabilities

192,439

190,467

Long-term contract liabilities

19,995

29,362

Deferred income taxes

2,006

1,964

Operating lease liabilities

29,499

27,950

Other liabilities

6,824

7,606

Total liabilities

250,763

257,349

Commitments and Contingencies

Stockholders' equity:

Common stock - $0 par value; Authorized

300,000,000 shares. Issued and outstanding 71,894,969 and

70,996,535 at July 31, 2024 and January 31, 2024, respectively

—

—

Additional paid-in capital

364,052

355,097

Accumulated deficit

(151,643

)

(144,592

)

Accumulated other comprehensive loss

(15,627

)

(12,630

)

Total Cognyte Software Ltd.

stockholders' equity

196,782

197,875

Noncontrolling interest

19,473

16,858

Total stockholders’ equity

216,255

214,733

Total liabilities and stockholders’

equity

$

467,018

$

472,082

Table 3

COGNYTE SOFTWARE LTD.

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

Six months ended July

31,

(in thousands)

2024

2023

Cash flows from operating

activities:

Net loss

$

(4,456

)

$

(15,941

)

Adjustments to reconcile net loss to

net cash provided by operating activities:

Depreciation and amortization

7,179

6,855

Allowance for credit losses

1,456

769

Gain from business divestiture

—

23

Stock-based compensation, excluding

cash-settled awards

8,955

4,628

Provision from deferred income taxes

105

124

Non-cash gains on derivative financial

instruments, net

(113

)

(291

)

Other non-cash items, net

1,061

646

Changes in operating assets and

liabilities:

Accounts receivable

25,958

23,300

Contract assets

(5,940

)

(3,826

)

Inventories

(475

)

(2,463

)

Prepaid expenses and other assets

(6,182

)

6,545

Accounts payable and accrued expenses

464

1,683

Contract liabilities

(11,134

)

2,666

Other liabilities

(982

)

785

Other, net

(100

)

(258

)

Net cash provided by operating

activities

15,796

25,245

Cash flows from investing

activities:

Purchases of property and equipment

(2,861

)

(3,618

)

Purchases of short-term investments

—

(38,904

)

Maturities and sales of short-term

investments

—

32,156

Settlements of derivative financial

instruments not designated as hedges

141

(359

)

Cash paid for capitalized software

development costs

(1,385

)

(1,108

)

Proceeds from Business divestiture, net of

cost

4,943

386

Change in restricted bank time deposits,

including long-term portion

1,389

(105

)

Net cash provided by (used in)

investing activities

2,227

(11,552

)

Foreign currency effects on cash, cash

equivalents, restricted cash, and restricted cash equivalents

(289

)

35

Net increase in cash, cash equivalents,

restricted cash and restricted cash equivalents

17,734

13,728

Cash, cash equivalents, restricted

cash, and restricted cash equivalents, beginning of period

80,396

39,044

Cash, cash equivalents, restricted

cash, and restricted cash equivalents, end of period

$

98,130

$

52,772

Reconciliation of cash, cash

equivalents, restricted cash and restricted cash equivalents at end

of period:

Cash and cash equivalents

$

91,741

$

48,472

Restricted cash and cash equivalents

included in restricted cash and cash equivalents and restricted

bank time deposits

6,382

4,200

Restricted cash and cash equivalents

included in other assets

7

100

Total cash, cash equivalents,

restricted cash, and restricted cash equivalents

$

98,130

$

52,772

Table 4

COGNYTE SOFTWARE LTD.

Reconciliation of GAAP to

Non-GAAP Measures

(Unaudited)

Six Months Ended July

31,

Three Months Ended

July 31,

(in thousands, except per share data)

2024

2023

2024

2023

Revenue

Total GAAP revenue

$

167,127

$

150,319

$

84,413

$

77,053

Revenue adjustments

—

112

—

—

Total non-GAAP revenue

$

167,127

$

150,431

$

84,413

$

77,053

Gross profit and gross margin

GAAP gross profit

118,006

102,716

59,624

52,947

GAAP gross margin

70.6

%

68.3

%

70.6

%

68.7

%

Revenue adjustments

—

112

—

—

Stock-based compensation expenses

976

585

562

272

Restructuring expenses, net

—

106

—

106

Non-GAAP gross profit

$

118,982

$

103,519

$

60,186

$

53,325

Non-GAAP gross margin

71.2

%

68.8

%

71.3

%

69.2

%

Research and development, net

GAAP research and development,

net

53,005

54,850

26,180

27,103

As a percentage of GAAP revenue

31.7

%

36.5

%

31.0

%

35.2

%

Stock-based compensation expenses

(880

)

(1,098

)

(439

)

(626

)

Restructuring expenses, net

(123

)

(143

)

(79

)

(64

)

Non-GAAP research and development,

net

$

52,002

$

53,609

$

25,662

$

26,413

As a percentage of non-GAAP

revenue

31.1

%

35.6

%

30.4

%

34.3

%

Selling, general and administrative

expenses

GAAP selling, general and

administrative expenses

68,528

60,110

34,762

31,310

As a percentage of GAAP revenue

41.0

%

40.0

%

41.2

%

40.6

%

Stock-based compensation expenses

(7,099

)

(2,945

)

(4,062

)

(1,815

)

Restructuring expenses, net

(85

)

(1,483

)

(33

)

(1,364

)

Separation (expenses) income

(92

)

921

(87

)

(103

)

Other adjustments

(544

)

(241

)

(499

)

(188

)

Non-GAAP selling, general and

administrative expenses

$

60,708

$

56,362

$

30,081

$

27,840

As a percentage of non-GAAP

revenue

36.3

%

37.5

%

35.6

%

36.1

%

Operating income (loss), operating

margin and adjusted EBITDA

GAAP Operating loss

(3,672

)

(12,425

)

(1,390

)

(5,557

)

GAAP operating margin

(2.2

)%

(8.3

)%

(1.6

)%

(7.2

)%

Revenue adjustments

—

112

—

—

Amortization of other acquired intangible

assets

145

181

73

91

Stock-based compensation expenses

8,955

4,628

5,063

2,713

Restructuring expenses

208

1,732

112

1,534

Separation expenses (income), net

92

(921

)

87

103

Other adjustments

544

241

499

188

Non-GAAP operating income

(loss)

$

6,272

$

(6,452

)

$

4,444

$

(928

)

Depreciation and amortization

7,022

6,502

3,828

3,255

Six Months Ended July

31,

Three Months Ended

July 31,

(in thousands, except per share data)

2024

2023

2024

2023

Adjusted EBITDA

$

13,294

$

50

$

8,272

$

2,327

Non-GAAP operating margin

3.8

%

(4.3

)%

5.3

%

(1.2

)%

Adjusted EBITDA margin

8.0

%

0.0

%

9.8

%

3.0

%

Other income reconciliation:

GAAP other income, net

1,345

1,589

589

279

Business divestiture

12

165

—

4

Non-GAAP other income , net

$

1,357

$

1,754

$

589

$

283

Tax provision reconciliation

GAAP provision

2,129

5,105

54

3,236

Effective income tax rate

(91.5

)%

(47.1

)%

(6.7

)%

(61.3

)%

Non-GAAP tax adjustments (footnote 3)

1,544

(2,268

)

45

(2,592

)

Non-GAAP provision (footnote 3)

$

3,673

$

2,837

$

99

$

644

Non-GAAP effective income tax rate

(footnote 3)

48.1

%

(60.4

)%

2.0

%

(99.8

)%

Net income (loss) attributable to

Cognyte Software Ltd. reconciliation

GAAP Net loss attributable to Cognyte

Software Ltd.

$

(7,051

)

$

(18,179

)

$

(1,934

)

$

(9,426

)

Revenue adjustments

—

112

—

—

Stock-based compensation expenses

8,955

4,628

5,063

2,713

Restructuring expenses, net

208

1,732

112

1,534

Separation expenses (income), net

92

(921

)

87

103

Non-GAAP tax adjustments (footnote 3)

(1,544

)

2,268

(45

)

2,592

Other Non-GAAP adjustments

701

587

572

283

Total adjustments (footnote 3)

8,412

8,406

5,789

7,225

Non-GAAP net income (loss) attributable

to Cognyte Software Ltd. (footnote 3)

1,361

(9,773

)

3,855

(2,201

)

Table comparing GAAP diluted net loss

per share attributable to Cognyte Software Ltd. and Non-GAAP

diluted net income (loss) per share attributable to Cognyte

Software Ltd.

GAAP diluted net loss per share

attributable to Cognyte Software Ltd.

$

(0.10

)

$

(0.26

)

$

(0.03

)

$

(0.13

)

Non-GAAP diluted net income (loss) per

share attributable to Cognyte Software Ltd. (footnote 3)

$

0.02

$

(0.14

)

$

0.05

$

(0.03

)

GAAP weighted-average shares used in

computing diluted net income (loss) per share attributable to

Cognyte Software Ltd.

71,425

69,528

71,800

70,134

Additional weighted-average shares

applicable to non-GAAP diluted net income per share attributable to

Cognyte Software Ltd.

1,388

—

1,391

—

Non-GAAP diluted weighted-average

shares used in computing net income (loss) per share attributable

to Cognyte Software Ltd.

72,813

69,528

73,191

70,134

Table of reconciliation from GAAP Net

loss attributable to Cognyte Software Ltd. to adjusted

EBITDA

GAAP Net loss attributable to Cognyte

Software Ltd.

$

(7,051

)

$

(18,179

)

$

(1,934

)

$

(9,426

)

As a percentage of GAAP revenue

(4.2

)%

(12.1

)%

(2.3

)%

(12.2

)%

Six Months Ended July

31,

Three Months Ended

July 31,

(in thousands, except per share data)

2024

2023

2024

2023

Net income attributable to noncontrolling

interest

2,595

2,238

1,079

912

GAAP provision

2,129

5,105

54

3,236

GAAP other income, net

(1,345

)

(1,589

)

(589

)

(279

)

Depreciation and amortization

7,022

6,502

3,828

3,255

Stock-based compensation expenses

8,955

4,628

5,063

2,713

Restructuring expenses

208

1,732

112

1,534

Separation expenses (income), net

92

(921

)

87

103

Other adjustments

689

534

572

279

Adjusted EBITDA

$

13,294

$

50

$

8,272

$

2,327

As a percentage of non-GAAP

revenue

8.0

%

0.0

%

9.8

%

3.0

%

Table 5

COGNYTE SOFTWARE LTD.

Calculation of Change in

Revenue on a Constant Currency Basis

(Unaudited)

GAAP Revenue

Non-GAAP Revenue

(in thousands)

Six Months Ended

Three Months Ended

Six Months Ended

Three Months Ended

Revenue for the three months ended July

31, 2023

$

150,319

$

77,053

$

150,431

$

77,053

Revenue for the three months ended July

31, 2024

$

167,127

$

84,413

$

167,127

$

84,413

Revenue for the three months ended July

31, 2024 at constant currency (2)

$

167,956

$

85,011

$

167,956

$

85,011

Reported period-over-period revenue

change

11.2

%

9.6

%

11.1

%

9.6

%

% impact from change in foreign currency

exchange rates

0.6

%

0.8

%

0.6

%

0.8

%

Constant currency period-over-period

revenue change

11.7

%

10.3

%

11.6

%

10.3

%

For more information see “Supplemental Information About

Constant Currency” at the end of this press release.

Footnotes

(1) The actual cash tax paid, net of refunds, was $1.6 million

and $4.0 million for the three and six months ended July 31, 2024,

respectively and $2.1 million and $3.1 million for the three and

six months ended July 31, 2023, respectively.

(2) Revenue for the three and six months ended July 31, 2024, at

constant currency is calculated by translating current-period GAAP

or non-GAAP foreign currency revenue (as applicable) into U.S.

dollars using average foreign currency exchange rates for the three

and six months ended July 31, 2024, rather than actual

current-period foreign currency exchange rates.

(3) The non-GAAP income tax adjustments for the quarter reflects

a change in calculating our non-GAAP income taxes from a cash basis

(income taxes we expect to pay in the current year) to an accrual

basis, as detailed further under “supplemental information about

Non-GAAP financial measures” – “non-GAAP income tax adjustments”.

Prior period comparative numbers were adjusted accordingly. The

non-GAAP income tax provision, non-GAAP net loss attributable to

Cognyte Software Ltd. and non-GAAP diluted net loss per share

attributable to Cognyte Software Ltd. under the previous method of

calculation, which was presented in last year’s press release

filing on September 12, 2023, were $15.4 million, $22.3 million and

$(0.32) for the six months ended July 31, 2023 and $4.8 million,

$6.4 million and $(0.09) for the three months ended July 31, 2023,

respectively.

Cognyte Software Ltd. and

Subsidiaries Supplemental Information About Non-GAAP

Financial Measures

The press release includes reconciliations of certain financial

measures not prepared in accordance with GAAP, consisting of

non-GAAP revenue, non-GAAP gross profit and gross margins, non-GAAP

research and development expenses, net, non-GAAP selling, general

and administrative expenses, non-GAAP operating (loss) income and

operating margins, non-GAAP other income (expense), net, non-GAAP

provision for income taxes and non-GAAP effective income tax rate,

non-GAAP net (loss) income attributable to Cognyte, adjusted EBITDA

and adjusted EBITDA margin, non-GAAP diluted net (loss) income per

share attributable to Cognyte and non-GAAP diluted weighted-average

shares used in computing such measure. The tables above include a

reconciliation of each non-GAAP financial measure for completed

periods presented in this press release to the most directly

comparable GAAP financial measure.

We believe these non-GAAP financial measures, used in

conjunction with the corresponding GAAP measures, provide investors

with useful supplemental information about the financial

performance of our business by:

- facilitating the comparison of our financial results and

business trends between periods, by excluding certain items that

either can vary significantly in amount and frequency, are based

upon subjective assumptions, or in certain cases are unplanned for

or difficult to forecast,

- facilitating the comparison of our financial results and

business trends with other software companies who publish similar

non-GAAP measures, and

- allowing investors to see and understand key supplementary

metrics used by our management to run our business, including for

budgeting and forecasting, resource allocation, and compensation

matters.

We also make these non-GAAP financial measures available because

our management believes they provide meaningful information about

the financial performance of our business and are useful to

investors for informational and comparative purposes.

Non-GAAP financial measures should not be considered in

isolation as substitutes for, or superior to, comparable GAAP

financial measures. The non-GAAP financial measures we present have

limitations in that they do not reflect all of the amounts

associated with our results of operations as determined in

accordance with GAAP, and these non-GAAP financial measures should

only be used to evaluate our results of operations in conjunction

with the corresponding GAAP financial measures. These non-GAAP

financial measures do not represent discretionary cash available to

us to invest in the growth of our business, and we may in the

future incur expenses similar to or in addition to the adjustments

made in these non-GAAP financial measures. Other companies may

calculate similar non-GAAP financial measures differently than we

do, limiting their usefulness as comparative measures.

Our non-GAAP financial measures are calculated by making the

following adjustments to our GAAP financial measures:

Revenue adjustments. We exclude from our non-GAAP revenue the

impact of fair value adjustments required under GAAP relating to

software and software service revenue and professional service and

other revenue acquired in a business acquisition, which would have

otherwise been recognized on a stand-alone basis. We believe that

it is useful for investors to understand the total amount of

revenue that we and the acquired company would have recognized on a

stand-alone basis under GAAP, absent the accounting adjustment

associated with the business acquisition. We believe that our

non-GAAP revenue measure helps management and investors understand

our revenue trends and serves as a useful measure of ongoing

business performance.

Amortization of acquired technology and other acquired

intangible assets. When we acquire an entity, we are required under

GAAP to record the fair values of the intangible assets of the

acquired entity and amortize those assets over their useful lives.

We exclude the amortization of acquired intangible assets,

including acquired technology, from our non-GAAP financial measures

because they are inconsistent in amount and frequency and are

significantly impacted by the timing and size of acquisitions. We

also exclude these amounts to provide easier comparability of pre

and post-acquisition operating results.

Stock-based compensation expenses. We exclude stock-based

compensation expenses related to restricted stock awards, stock

bonus programs, bonus share programs, and other stock-based awards

from our non-GAAP financial measures. We evaluate our performance

both with and without these measures because stock-based

compensation is typically a non-cash expense and can vary

significantly over time based on the timing, size and nature of

awards granted, and is influenced in part by certain factors which

are generally beyond our control, such as the volatility of the

price of our ordinary shares. In addition, measurement of

stock-based compensation is subject to varying valuation

methodologies and subjective assumptions, and therefore we believe

that excluding stock-based compensation from our non-GAAP financial

measures allows for meaningful comparisons of our current operating

results to our historical operating results and to other companies

in our industry.

Acquisition expenses (benefit), net. In connection with

acquisition activity (including with respect to acquisitions that

are not consummated), we incur expenses, including legal,

accounting, and other professional fees, integration costs, changes

in the fair value of contingent consideration obligations, and

other costs. Integration costs may consist of information

technology expenses as systems are integrated across the combined

entity, consulting expenses, marketing expenses, and professional

fees, as well as non-cash charges to write-off or impair the value

of redundant assets. We exclude these expenses from our non-GAAP

financial measures because they are unpredictable, can vary based

on the size and complexity of each transaction, and are unrelated

to our continuing operations or to the continuing operations of the

acquired businesses.

Restructuring expenses. We exclude restructuring expenses from

our non-GAAP financial measures, which include employee termination

costs, facility exit costs, certain professional fees, asset

impairment charges, and other costs directly associated with

resource realignments incurred in reaction to changing strategies

or business conditions. All of these costs can vary significantly

in amount and frequency based on the nature of the actions as well

as the changing needs of our business and we believe that excluding

them provides easier comparability of pre- and post-restructuring

operating results.

Separation expenses. On December 4, 2019, Verint announced its

intention to separate into two independent publicly traded

companies: Cognyte Software Ltd., which consists of Verint’s Cyber

Intelligence Solutions business, and Verint Systems Inc., which

consists of its Customer Engagement Business. We incurred

significant expenses to separate the aforesaid businesses,

including third-party advisory, accounting, legal, consulting, and

other similar services related to the separation as well as costs

associated with accelerated depreciation and amortization of assets

which became obsolete following the separation from Verint,

including those related to human resources, brand management, real

estate, and information technology to the extent not capitalized.

These costs are incremental to our normal operating expenses and

incurred solely as a result of the separation transaction.

Accordingly, we are excluding these separation expenses from our

non-GAAP financial measures in order to evaluate our performance on

a comparable basis.

Business Divestiture gains/losses. In certain cases, we may

divest a portion of our business, which may result in a gain or

loss on divestiture. These gains or losses may result from the sale

of a business unit or the termination of a product line or service.

We exclude these gains or losses from our non-GAAP financial

measures in order to provide a more meaningful comparisons of our

ongoing business performance between periods and to other companies

in our industry. On December 1, 2022, as part of our ongoing

strategic plan to simplify and focus the Company on fewer agendas,

we sold our Situational Intelligence Solutions (SIS) business.

Provision for legal claim. We exclude from our non-GAAP

financial measures accrual recorded for the settlement of certain

legal claims related to our business acquisitions.

Other adjustments. We exclude from our non-GAAP financial

measures rent expense for redundant facilities, gains on change in

fair value of equity investment, gains or losses on sales of

property and certain professional fees unrelated to our ongoing

operations.

Non-GAAP income tax adjustments. We exclude our GAAP provision

(benefit) for income taxes from our non-GAAP measures of net income

attributable to Cognyte Software Ltd., and instead include a

non-GAAP provision for income taxes. Cognyte uses a full-year

non-GAAP tax rate to compute the non-GAAP tax provision. This

full-year non-GAAP tax rate is based on Cognyte’s annual GAAP

income, adjusted to exclude non-GAAP items, as well as the effects

of significant non-recurring and period-specific tax items which

vary in size and frequency. This annual non-GAAP tax rate is based

on an evaluation of our historical and projected profit before tax,

taking into account the impact of non-GAAP adjustments, tax law

changes, as well as other factors such as our current tax

structure, existing tax positions and expected recurring tax

incentives. Our GAAP effective income tax rate can vary

significantly from year to year as a result of tax law changes,

settlements with tax authorities, changes in the geographic mix of

earnings including acquisition activity, changes in the projected

realizability of deferred tax assets, and other unusual or

period-specific events, all of which can vary in size and

frequency. We believe that our non-GAAP effective income tax rate

removes much of this variability and facilitates meaningful

comparisons of operating results across periods. We evaluate our

non-GAAP effective income tax rate on an ongoing basis, and it can

change from time to time. Our non-GAAP income tax rate can differ

materially from our GAAP effective income tax rate.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP measure defined as net income

(loss) attributable to non-controlling interest before interest

expense, interest income, income taxes, depreciation expense,

amortization expense, revenue adjustments, restructuring expenses,

acquisition expenses, and other expenses excluded from our non-GAAP

financial measures as described above. We believe that adjusted

EBITDA is also commonly used by investors to evaluate operating

performance between companies because it helps reduce variability

caused by differences in capital structures, income taxes,

stock-based compensation accounting policies, and depreciation and

amortization policies. Adjusted EBITDA is also used by credit

rating agencies, lenders, and other parties to evaluate our

creditworthiness.

Supplemental Information About Constant Currency

Because we operate on a global basis and transact business in

many currencies, fluctuations in foreign currency exchange rates

can affect our consolidated U.S. dollar operating results. To

facilitate the assessment of our performance excluding the effect

of foreign currency exchange rate fluctuations, we calculate our

GAAP and non-GAAP revenue, cost of revenue, and operating expenses

on both an as-reported basis and a constant currency basis,

allowing for comparison of results between periods as if foreign

currency exchange rates had remained constant. We perform our

constant currency calculations by translating current-period

foreign currency results into U.S. dollars using prior-period

average foreign currency exchange rates or hedge rates, as

applicable, rather than current period exchange rates. We believe

that constant currency measures, which exclude the impact of

changes in foreign currency exchange rates, facilitate the

assessment of underlying business trends.

Unless otherwise indicated, our financial outlook for each of

revenue, operating margin, and diluted earnings per share, which is

provided on a non-GAAP basis, reflects foreign currency exchange

rates approximately consistent with rates in effect when the

outlook is provided.

We also incur foreign exchange gains and losses resulting from

the revaluation and settlement of monetary assets and liabilities

that are denominated in currencies other than the entity’s

functional currency. Our financial outlook for diluted earnings per

share includes net foreign exchange gains or losses incurred to

date, if any, but does not include potential future gains or

losses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240910079172/en/

Investor Relations Dean

Ridlon Cognyte Software Ltd. IR@cognyte.com

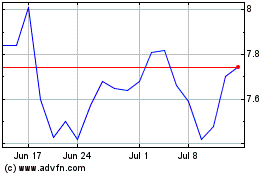

Cognyte Software (NASDAQ:CGNT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cognyte Software (NASDAQ:CGNT)

Historical Stock Chart

From Jan 2024 to Jan 2025