Clearside Biomedical Announces First Quarter 2024 Financial Results and Provides Corporate Update

May 09 2024 - 4:05PM

Clearside Biomedical, Inc. (Nasdaq: CLSD), a biopharmaceutical

company revolutionizing the delivery of therapies to the back of

the eye through the suprachoroidal space (SCS®), today reported

financial results for the first quarter ended March 31, 2024, and

provided a corporate update.

“As we near the midpoint of 2024, I am excited

to highlight key aspects of our program and the steps we have taken

to position Clearside for an important year,” said George Lasezkay,

Pharm.D., J.D., Clearside’s President and Chief Executive Officer.

“Our lead clinical program, CLS-AX (axitinib injectable

suspension), is focused on the multi-billion-dollar market for wet

AMD. Our target profile for CLS-AX is to maintain visual acuity

without the need for retreatment for potentially up to 6 months.

The data readout from our Phase 2b ODYSSEY clinical trial remains

on track for the end of the third quarter of this year.

Importantly, ODYSSEY is a 36-week study designed to re-dose

patients with CLS-AX at 6 months, or earlier if needed. This will

provide valuable data in a chronic disease for patients treated

with more than one dose of CLS-AX as we begin planning our CLS-AX

Phase 3 clinical development program.”

Dr. Lasezkay continued, “We have an outstanding

team at Clearside that has been strategically expanded over the

past several months. We added Dr. Victor Chong, a well-respected,

board-certified retinal specialist, as our Chief Medical Officer.

Victor’s extensive major pharmaceutical company experience, most

recently at Johnson & Johnson, is extremely valuable as he

spearheads our product development activities led by the upcoming

ODYSSEY data analysis and the planning for our Phase 3 program. In

addition, we appointed Tony Gibney, a seasoned biotechnology

executive, to our Board of Directors. Tony has broad expertise in

business strategy, collaborations, finance, and M&A, including

recent and relevant ophthalmology experience at Iveric Bio. We look

forward to their contributions as we advance our pipeline and

continue our efforts to increase the adoption of suprachoroidal

delivery.”

Key Highlights

- Topline data expected in the third

quarter of 2024 from Phase 2b ODYSSEY clinical trial of CLS-AX

using suprachoroidal delivery in neovascular age-related macular

degeneration (wet AMD).

- Victor Chong, M.D., MBA joined

Clearside in March 2024 as Chief Medical Officer. Dr. Chong has

more than 25 years of experience advancing drug candidates through

all stages of development, including serving as Vice President,

Global Head of Retina DAS at Johnson & Johnson, and Global Head

of Medicine, Retinal Health at Boehringer Ingelheim.

- Appointed Tony Gibney to

Clearside’s Board of Directors in April 2024. Mr. Gibney is an

experienced biotechnology executive and former investment banker

who brings over 25 years of experience dedicated to advising

biotechnology companies on business strategy, collaborations,

financings, and mergers and acquisitions.

- Completed a registered direct

offering in February 2024, which generated $15.0 million in gross

proceeds to Clearside.

- On January 1, 2024, a new permanent

Category 1 Current Procedural Terminology (CPT) code

for XIPERE® (triamcinolone acetonide injectable suspension)

for suprachoroidal use became available for physician use.

- Multiple data presentations on the

use of Clearside’s suprachoroidal delivery platform were featured

at prominent medical meetings, including the Association for

Research in Vision and Ophthalmology (ARVO), the Macula Society and

Hawaiian Eye and Retina.

- Presentations included positive

data on the extended treatment duration of XIPERE utilizing

suprachoroidal delivery. Real-world data showed excellent

durability in which more than 75% of eyes did not require

retreatment for 6 months after a single dose of XIPERE, supporting

Clearside’s approach to extended drug release and reduced treatment

burden for patients by delivering drug directly to the back of the

eye via the SCS Microinjector.

First Quarter 2024 Financial

Results

- License and other revenue for the

first quarter of 2024 was $230,000, compared to $4,000 for the

first quarter of 2023.

- Research and development expenses

for the first quarter of 2024 were $5.6 million, compared to $4.5

million for the first quarter of 2023. The increase was primarily

due to ODYSSEY clinical trial expenses.

- General and administrative expenses

for the first quarter of 2024 were $2.8 million, compared to $3.2

million for the first quarter of 2023.

- Other expense for the first quarter

of 2024 was $1.5 million, compared to $0 for the first quarter of

2023. Other expense was comprised of issuance costs for the

warrants and shares of common stock issued in the February 2024

registered direct offering and the change in fair value related to

warrant liabilities.

- Non-cash interest expense for the

first quarter of 2024 was $2.4 million, compared to $2.2 million in

the first quarter of 2023. Non-cash interest expense was comprised

of imputed interest on the liability related to the sales of future

royalties and the amortization of the associated issuance

costs.

- Net loss for the first quarter of

2024 was $11.8 million, or $0.17 per share of common stock,

compared to net loss of $9.3 million, or $0.15 per share of common

stock, for the first quarter of 2023.

- As of March 31, 2024, Clearside’s

cash and cash equivalents totaled $35.4 million. The Company

believes it will have sufficient resources to fund its planned

operations into the third quarter of 2025.

Conference Call & Webcast

Details

Clearside’s management will host a webcast and

conference call today at 4:30 p.m. Eastern Time to discuss the

financial results and provide a corporate update. The live and

archived webcast may be accessed on the Clearside website under the

Investors section: Events and Presentations. The live call can be

accessed by dialing 888-645-4404 (U.S.) or 862-298-0702

(international) and requesting the Clearside call. The Company

suggests participants join 15 minutes in advance of the event.

About Clearside Biomedical,

Inc.

Clearside Biomedical, Inc. is a

biopharmaceutical company revolutionizing the delivery of therapies

to the back of the eye through the suprachoroidal space (SCS®).

Clearside’s SCS injection platform, utilizing the Company’s

patented SCS Microinjector®, enables an in-office, repeatable,

non-surgical procedure for the targeted and compartmentalized

delivery of a wide variety of therapies to the macula, retina, or

choroid to potentially preserve and improve vision in patients with

sight-threatening eye diseases. Clearside is developing its own

pipeline of small molecule product candidates for administration

via its SCS Microinjector. The Company’s lead program, CLS-AX

(axitinib injectable suspension), for the treatment of neovascular

age-related macular degeneration (wet AMD), is in Phase 2b clinical

testing. Clearside developed and gained approval for its first

product, XIPERE® (triamcinolone acetonide injectable suspension)

for suprachoroidal use, which is available in the U.S. through a

commercial partner. Clearside also strategically partners its SCS

injection platform with companies utilizing other ophthalmic

therapeutic innovations. For more information, please visit

clearsidebio.com and follow us on LinkedIn and X.

Cautionary Note Regarding

Forward-Looking Statements

Any statements contained in this press release

that do not describe historical facts may constitute

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. These statements may be

identified by words such as “believe”, “expect”, “may”, “plan”,

“potential”, “will”, and similar expressions, and are based on

Clearside’s current beliefs and expectations. These forward-looking

statements include statements regarding the clinical development of

CLS-AX, the expected timing of topline results from the ODYSSEY

clinical trial, the potential benefits of CLS-AX, Clearside’s

suprachoroidal delivery technology and Clearside’s SCS

Microinjector® and Clearside’s ability to fund its operations into

the third quarter of 2025. These statements involve risks and

uncertainties that could cause actual results to differ materially

from those reflected in such statements. Risks and uncertainties

that may cause actual results to differ materially include

uncertainties inherent in the conduct of clinical trials,

Clearside’s reliance on third parties over which it may not always

have full control and other risks and uncertainties that are

described in Clearside’s Annual Report on Form 10-K for the year

ended December 31, 2023, filed with the U.S. Securities and

Exchange Commission (SEC) on March 12, 2024 and Clearside’s other

Periodic Reports filed with the SEC. Any forward-looking statements

speak only as of the date of this press release and are based on

information available to Clearside as of the date of this release,

and Clearside assumes no obligation to, and does not intend to,

update any forward-looking statements, whether as a result of new

information, future events or otherwise.

Investor and Media

Contacts:

Jenny Kobin Remy Bernarda

ir@clearsidebio.com(678) 430-8206

-Financial Tables Follow-

| |

|

|

| CLEARSIDE

BIOMEDICAL, INC.Selected Financial Data

(in thousands, except share and per share data)(unaudited) |

| |

|

|

| Statements of

Operations Data |

Three Months EndedMarch 31, |

|

| |

2024 |

|

|

2023 |

|

|

License and other revenue |

$ |

230 |

|

|

$ |

4 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

5,615 |

|

|

|

4,451 |

|

|

General and administrative |

|

2,824 |

|

|

|

3,158 |

|

|

Total operating expenses |

|

8,439 |

|

|

|

7,609 |

|

| Loss from operations |

|

(8,209 |

) |

|

|

(7,605 |

) |

| Interest income |

|

348 |

|

|

|

492 |

|

| Other expense |

|

(1,499 |

) |

|

|

— |

|

| Non-cash interest expense on

liability related to the sales of future royalties |

|

(2,403 |

) |

|

|

(2,167 |

) |

| Net loss |

$ |

(11,763 |

) |

|

$ |

(9,280 |

) |

| Net loss per share of common

stock — basic and diluted |

$ |

(0.17 |

) |

|

$ |

(0.15 |

) |

| Weighted average shares

outstanding — basic and diluted |

|

69,853,227 |

|

|

|

61,169,486 |

|

|

|

|

|

|

|

|

|

|

| Balance Sheet

Data |

March 31, |

|

|

December 31, |

|

| |

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

35,355 |

|

|

$ |

28,920 |

|

| Total assets |

|

40,142 |

|

|

|

34,018 |

|

| Liabilities related to the sales

of future royalties, net |

|

44,391 |

|

|

|

41,988 |

|

| Warrant liabilities |

|

11,039 |

|

|

|

— |

|

| Total liabilities |

|

61,952 |

|

|

|

49,930 |

|

| Total stockholders’ deficit |

|

(21,810 |

) |

|

|

(15,912 |

) |

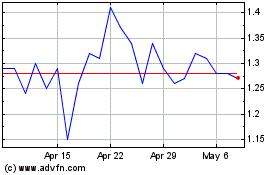

Clearside Biomedical (NASDAQ:CLSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Clearside Biomedical (NASDAQ:CLSD)

Historical Stock Chart

From Nov 2023 to Nov 2024