Sempra Beats EPS, Gives Guidance - Analyst Blog

February 26 2013 - 8:11AM

Zacks

Sempra Energy’s (SRE) fourth-quarter 2012

earnings per share of $1.08 beat the Zacks Consensus Estimate of 97

cents by 11.3% but was lower than the year-ago figure by 10

cents.

The company reported GAAP earnings per share of $1.18, flat

year over year. The variance of 10 cents between GAAP and pro forma

earnings per share was due to a one-time receipt of 10 cents.

In 2012, Sempra Energy posted earnings of $4.35 per share, 5.8%

higher than the Zacks Consensus Estimate but lagged the 2011

results by a penny.

GAAP earnings for 2012 were $3.48 per share versus $5.51 per share

in 2011. The difference between operating and GAAP numbers was due

to non-cash charges of $239 million and after-tax cash receipts of

$25 million.

Total Revenue

Total revenue of Sempra Energy in the fourth quarter of 2012 was

$2,668 million, surpassing the year-ago number by $64 million and

the Zacks Consensus Estimate by $40 million.

Full-year 2012 revenues came in at $9.6 billion, lagging the

year-ago figure by 3.9% and the Zacks Consensus Estimate by 2%. The

year-over-year decline in revenue was primarily due to a 29.6%

decline in revenue from energy-related businesses.

Segment Update

San Diego Gas & Electric: Quarterly earnings

for San Diego Gas & Electric (SDG&E) were $110 million

compared with $158 million in the year-ago quarter, primarily due

to higher expenses and lower revenue for wildfire insurance

premiums compared with the previous year.

Southern California Gas Company (SoCalGas): The

segment generated earnings of $99 million, up $20 million year over

year.

Sempra South American Utilities: The segment

recorded earnings of $46 million, up from $39 million in the fourth

quarter of 2011.

Sempra Mexico: The segment recorded earnings of

$35 million compared with $80 million last year. A change in an

intercompany agreement resulted in lower earnings at Sempra Mexico

and higher earnings at Sempra Natural Gas.

Sempra Renewables: The segment recorded earnings

of $14 million, up from a loss of $2 million in the fourth quarter

of 2011. The uptrend was primarily due to an increase in solar and

wind assets.

Sempra Natural Gas: The segment recorded earnings

of $19 million versus a loss of $36 million in fourth-quarter 2011.

The turn to profit was driven by cash receipts due to sale of its

ownership interest in the Rockies Express Pipeline and the change

in the intercompany agreement with Sempra Mexico, partially offset

by lower earnings from LNG marketing operations.

Financial Update

As of Dec 31, 2012, cash and cash equivalents were $475 million

increasing from $252 million at the end of Dec 31, 2011.

Long-term debt increased to $11.6 billion from $10.1 billion at

2011 end.

In 2012 cash flow from operating activities was $2.02 billion, up

from $1.87 billion in 2011.

Guidance

Sempra Energy expects 2013 pro forma earnings in the range of $4.30

to $4.80 per share. This earnings guidance takes into consideration

the anticipated 2012 impact of the final decision in SDG&E's

and SoCalGas' General Rate Cases and 30 cents per share in

higher tax expense from repatriation of dividends from

international operations.

Other Company Releases

The Laclede Group Inc. (LG) reported earnings per

share of $1.25 in the first quarter of fiscal 2013, which surpassed

the Zacks Consensus Estimate by 14.68%.

Vectren Corporation (VVC) reported fourth quarter

2012 earnings of 52 cents per share, up 23.81% from the Zacks

Consensus Estimate.

Our View

Sempra Energy ends 2012 on a strong note and remains on track to

achieve compound annual earnings growth of 6% to 8%. The company

has doubled its renewable energy generation portfolio and its

success to win a bid to construct and own a $1 billion of natural

gas pipeline in Mexico will surely help its cause.

The board of directors approved a 4.8% increase in the quarterly

dividend rate to 63 cents. The increase reflects the underlying

strength of the business and management’s inclination to improve

shareholder value. Sempra Energy currently has a Zacks Rank #2

(Buy). Another Zacks Rank # 2 (Buy) stock Clean Energy

Fuels Corp. (CLNE) is yet to release its fourth quarter

2012 results.

Based in San Diego, California, Sempra Energy, along with its

subsidiaries, engages in the development of energy infrastructure,

operation of utilities, and provision of energy-related products

and services to its consumers. With a market cap of $18.30 billion,

the company has 17,483 employees.

CLEAN EGY FUELS (CLNE): Free Stock Analysis Report

LACLEDE GRP INC (LG): Free Stock Analysis Report

SEMPRA ENERGY (SRE): Free Stock Analysis Report

VECTREN CORP (VVC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

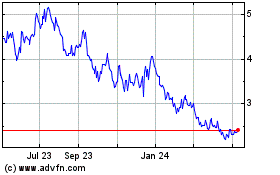

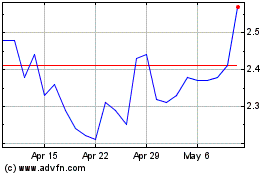

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jul 2023 to Jul 2024