AGL Resources Cut to Underperform - Analyst Blog

February 13 2013 - 11:40AM

Zacks

On Feb 7, 2013, we downgraded

energy services holding company AGL Resources Inc.

(GAS) to Underperform from Neutral, considering its weak

fundamentals and tepid outlook. The disappointing fourth quarter

results and a number of other challenges have added to this

bearishness, which is supported by a Zacks Rank #5 (Strong

Sell).

Why the Downgrade?

AGL Resources recently reported lower-than-expected EPS for the

December quarter – 91 cents versus the Zacks Consensus Estimate of

$1.01 – affected by higher operating expenses.

We expect shareholder sentiment toward the company to remain

lukewarm, considering its investment in higher-risk unregulated

operations and the uncertain economic environment.

Causes for Concern

The outlook for AGL Resources’ wholesale segment continues to be

less than favorable. We believe that margins in this unit will be

under pressure, based on narrow spreads for transportation and

storage.

During the next few quarters, AGL Resources’ shipping segment

results may also remain weak. The absence of a strong economic

recovery in the U.S. continues to have a negative impact on tourism

and the economies in Tropical Shipping’s service territories

(particularly in the Bahamas and the Caribbean).

Natural gas distribution is usually a temperature-sensitive

business with about half of all deliveries used for space heating.

Usually, almost 75% of the deliveries and sales occur during the

six-month period of October through March. Consequently,

milder-than-normal weather conditions in the future could adversely

effect AGL Resources’ operating results, cash flow and financial

condition.

Stocks That Warrant a Look

While we expect AGL Resources to perform below its peers and

industry levels in the coming months and see little reason for

investors to own the stock, one can look at Atmos Energy

Corp. (ATO), Centrica plc (CPYYY) and

Clean Energy Fuels Corp. (CLNE) as good buying

opportunities. These natural gas distributors – sporting a Zacks

Rank #2 (Buy) – have solid secular growth stories with potential to

rise from current levels.

ATMOS ENERGY CP (ATO): Free Stock Analysis Report

CLEAN EGY FUELS (CLNE): Free Stock Analysis Report

(CPYYY): ETF Research Reports

AGL RESOURCES (GAS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

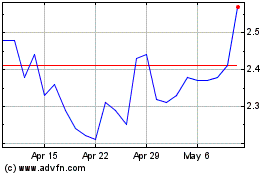

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

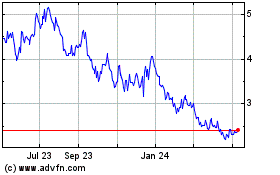

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jul 2023 to Jul 2024