Clean Energy Fuels Corp. (NASDAQ:CLNE) today announced financial

results for the first quarter ended March 31, 2008. Financial

Results Revenue for the first quarter of 2008 increased to $29.9

million, up from $28.2 million in the first quarter of the prior

year. Net loss for the first quarter of 2008 was $5.4 million, or

$0.12 per share, compared with a net loss of $0.9 million, or $0.03

per share, in the first quarter of 2007. Non-GAAP loss per share

for the first quarter of 2008, which excludes employee-related

stock based compensation charges, was $0.07. This compares with a

non-GAAP loss per share of $0.03 in the first quarter of 2007. The

Company reports earnings (loss) per share on a GAAP and non-GAAP

basis, as well as a non-GAAP measure it calls Adjusted Margin. For

more information on these non-GAAP financial measures, please see

below. The non-GAAP measures are also reconciled to their

corresponding GAAP measures in the accompanying tables below.

Adjusted Margin was $8.6 million for the first quarter of 2008,

compared with $7.7 million for the same quarter last year. Adjusted

margin is a financial measure intended to approximate the margin

results that would have been reported in a particular period had

the Company�s underlying futures contracts related to its fixed

price and price cap contracts qualified for hedge accounting under

SFAS No. 133 and been held to maturity. Adjusted Margin is

discussed in more detail below. For the first quarter of 2008, the

Company�s combined volume of CNG and LNG delivered was 17.6 million

gasoline gallon equivalents (Gallons), compared with 17.8 million

Gallons in the same period a year ago. �Increasing diesel and gas

prices, heightened emissions concerns and increased awareness that

natural gas is a domestically produced fuel have led to a

substantial increase in the interest for natural gas fueling

solutions,� said Andrew J. Littlefair, President and Chief

Executive Officer. �We have grown our sales force, are building

more stations than at any point in our history and are exploring

opportunities worldwide. We are laying the groundwork to take

advantage of this opportunity.� Mr. Littlefair continued, �We have

recently signed several new contracts that we anticipate will

contribute to volume growth in the future. We are also making

headway with our existing ventures at the Ports of Los Angeles and

Long Beach. The authorities at the Ports continue to take the

necessary steps leading up to a clean truck roll out, and our Boron

LNG plant construction is on schedule to be operational this fall,

in time to fuel the Ports' LNG vehicles.� Non-GAAP Financial

Measures To supplement the Company�s consolidated financial

statements, which statements are prepared and presented in

accordance with GAAP, the Company uses the following non-GAAP

financial measures: Adjusted Margin and non-GAAP earnings per share

(Non-GAAP EPS). The presentation of this financial information is

not intended to be considered in isolation from, or as a substitute

for, or superior to, the financial information prepared and

presented in accordance with GAAP. The Company uses these non-GAAP

financial measures for financial and operational decision making

and as a means to evaluate period-to-period comparisons. Management

believes that these non-GAAP financial measures provide meaningful

supplemental information regarding the Company�s performance by

excluding certain expenses that may not be indicative of its

recurring core business operating results and may help in comparing

its current-period results with those of prior periods. Management

believes that they and investors benefit from referring to these

non-GAAP financial measures in assessing Company performance and

when planning, forecasting and analyzing future periods. Management

believes these non-GAAP financial measures are useful to investors

because (1) they allow for greater transparency with respect to key

metrics used by management in its financial and operational

decision making and (2) they are used by institutional investors

and the analyst community to help them analyze the results of Clean

Energy�s business. The material limitations of Adjusted Margin and

Non-GAAP EPS are as follows: Adjusted Margin and Non-GAAP EPS are

not recognized terms under GAAP and do not purport to be an

alternative to gross margin or earnings per share as an indicator

of operating performance or any other GAAP measure. Moreover,

because not all companies use identical measures and calculations,

the presentation of Adjusted Margin and Non-GAAP EPS may not be

comparable to other similarly-titled measures of other companies.

These limitations are compensated for by using Adjusted Margin and

Non-GAAP EPS in conjunction with traditional GAAP operating

performance and cash flow measures, and therefore, management does

not recommend placing undue reliance on these measures. Adjusted

Margin Approximately 25-30% of Clean Energy�s current natural gas

fuel sales are covered by contracts under which the Company is

obligated to sell fuel to customers at a fixed price or a variable

price subject to a cap. The Company�s policy is to purchase natural

gas futures contracts to cover its estimated fuel sales under these

sales contracts to mitigate the risk that natural gas prices may

rise above the natural gas component of the price at which the

Company is obligated to sell gas to its customers. From time to

time in the past, Clean Energy has sold these underlying futures

contracts when it believed natural gas prices were going to fall.

At December 31, 2006, the Company had sold all such futures

contracts associated with fixed-price and price cap sales contracts

and did not purchase any futures contracts during 2007 or the first

three months of 2008. Management uses a measure called Adjusted

Margin to measure operating performance and manage its business.

Adjusted Margin is defined as operating income (loss), plus (1)

depreciation and amortization, (2) selling, general and

administrative expenses, (3) loss on extinguishment of derivative

liability, and (4) derivative (gains) losses, the sum of which is

adjusted by a non-GAAP measure which management calls �futures

contract adjustment,� which is described below. Management believes

Adjusted Margin provides helpful information for investors about

the underlying profitability of the Company�s fuel sales

activities. Adjusted Margin attempts to approximate the results

that would have been reported if the underlying futures contracts

related to its fixed price and price cap contracts would have

qualified for hedge accounting under SFAS No. 133 and were held

until they matured. Futures contract adjustment reflects the gain

or loss that would have been experienced in a respective period on

the underlying futures contracts associated with the Company�s

fixed price and price cap contracts had those underlying futures

contracts been held and allowed to mature according to their

contract terms. The table below shows Adjusted Margin and also

reconciles these figures to the GAAP measure operating income

(loss): � � Three Months Ended March 31, � � 2007 � � � 2008 � �

Operating Income (Loss) $ (1,030,050 ) $ (6,117,458 ) Futures

Contract Adjustment 868,567 1,076,210 Derivative (Gains) Losses � �

Selling, General, and Administrative 6,299,878 11,587,718

Depreciation and Amortization � 1,576,057 � � 2,063,421 � �

Adjusted Margin $ 7,714,452 � $ 8,609,891 � Non-GAAP EPS Non-GAAP

EPS is defined as net income (loss) plus employee-related stock

based compensation, net of related tax benefits, divided by the

Company�s weighted average shares outstanding on a diluted basis.

The table below shows Non-GAAP EPS and also reconciles these

figures to the GAAP measure net income (loss): � � � Three Months

Ended March 31, � � 2007 � � � 2008 � � Net Income (Loss) $

(870,179 ) $ (5,428,699 ) Employee Stock Based Compensation, Net of

Tax Benefits � � � � 2,498,436 � Adjusted Net Income (Loss)

(870,179 ) (2,930,263 ) Diluted Weighted Average Common Shares

Outstanding 34,192,786 44,282,492 Non-GAAP Earnings (Loss) per

Share: $ (0.03 ) $ (0.07 ) Conference Call The Company will host an

investor conference call today at 4:30 p.m. Eastern (1:30 p.m.

Pacific). The live call can be accessed from the US by dialing

(800) 762-8795, or by dialing (480) 629-1990 from outside the U.S.

A telephone replay will be available approximately two hours after

the call concludes and will be available through Thursday, May 29,

2008, by dialing (800) 406-7325 from the U.S., or (303) 590-3030

from international locations, and entering confirmation code

3868622. There also will be a simultaneous webcast available on the

Investor Relations section of the Company's web site at

www.cleanenergyfuels.com, which will be archived on the Company�s

web site for 30 days. About Clean Energy Clean Energy, based in

Seal Beach, Calif., is the leading provider of natural gas for

transportation in North America. It has a broad customer base in

the refuse, transit, shuttle, taxi, intrastate and interstate

trucking, airport and municipal fleet markets, fueling more than

14,000 vehicles daily at strategic locations across the United

States and Canada. Additional information about the Company can be

found at: www.cleanenergyfuels.com. Safe Harbor Statement This

press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934 that involve risks,

uncertainties and assumptions, such as statements regarding the

demand for our products and services, primarily being the sale of

CNG and LNG, the impact of new projects on our future results and

our ability to continue to grow our business. Actual results and

the timing of events could differ materially from those anticipated

in these forward-looking statements as a result of several factors

including, but not limited to, changes in the prices of natural gas

relative to gasoline and diesel, the acceptance of natural gas

vehicles in fleet markets, the availability of natural gas

vehicles, difficulties expanding operations outside the United

States and Canada, unanticipated delays or cost overruns related to

the construction of our LNG plant, the progress of the clean truck

program at the Ports of Los Angeles and Long Beach, our competitive

position, and the development of competing technologies that are

perceived to be cleaner and more cost-effective than natural gas.

The forward-looking statements made herein speak only as of the

date of this press release and the Company undertakes no obligation

to update publicly such forward-looking statements to reflect

subsequent events or circumstances. Additionally, the Company�s

Form 10-K filed with the SEC (www.sec.gov) on March 19, 2008

contains risk factors which you should consider before investing.

Clean Energy Fuels Corp. and Subsidiaries Condensed Consolidated

Balance Sheets December 31, 2007 and March 31, 2008 (Unaudited) � �

December 31,2007 March 31,2008 � Assets Current assets: Cash and

cash equivalents $ 67,937,602 $ 17,476,431 Short-term investments

12,479,684 42,580,469 Accounts receivable, net of allowance for

doubtful accounts of $501,751 and $669,621 as of December 31, 2007

and March 31, 2008, respectively 11,026,890 10,037,671 Other

receivables 23,153,904 27,925,169 Inventory, net 2,403,890

2,580,848 Deposits on LNG trucks 15,515,927 17,355,927 Prepaid

expenses and other current assets 3,633,318 3,353,015 Total current

assets 136,151,215 121,309,530 � Land, property and equipment, net

88,676,318 99,392,400 Capital lease receivables 763,500 663,750

Notes receivable and other long-term assets 2,511,813 2,953,852

Goodwill and other intangible assets 20,922,098 20,913,226 Total

assets $ 249,024,944 $ 245,232,758 � Liabilities and Stockholders�

Equity Current liabilities: Current portion of capital lease

obligation $ 63,520 $ 65,121 Accounts payable 10,547,451 8,342,694

Accrued liabilities 5,381,541 6,850,244 Deferred revenue 677,826

717,466 Total current liabilities 16,670,338 15,975,525 � Capital

lease obligation, less current portion 161,377 144,484 Other

long-term liabilities 1,260,755 1,187,743 Total liabilities

18,092,470 17,307,752 � Commitments and contingencies �

Stockholders� equity: Preferred stock, $0.0001 par value.

Authorized 1,000,000 shares; issued and outstanding no shares � �

Common stock, $0.0001 par value. Authorized 99,000,000 shares;

issued and outstanding 44,274,375 shares and 44,293,768 shares at

December 31, 2007 and March 31, 2008, respectively 4,428 4,430

Additional paid-in capital 297,866,745 300,449,498 Accumulated

deficit (69,086,583 ) (74,515,282 ) Accumulated other comprehensive

income 2,147,884 1,986,360 Total stockholders� equity 230,932,474

227,925,006 Total liabilities and stockholders� equity $

249,024,944 $ 245,232,758 Clean Energy Fuels Corp. and Subsidiaries

Condensed Consolidated Statements of Operations For the Three

Months Ended March 31, 2007 and 2008 (Unaudited) � � Three Months

EndedMarch 31, 2007 2008 � Revenue $ 28,167,044 $ 29,947,357

Operating expenses: Cost of sales 21,321,159 22,413,676 Selling,

general and administrative 6,299,878 11,587,718 Depreciation and

amortization 1,576,057 2,063,421 � Total operating expenses

29,197,094 36,064,815 � Operating loss (1,030,050 ) (6,117,458 ) �

Interest income, net 292,212 839,216 Other income (expense), net

(123,372 ) 38,356 Equity in losses of equity method investee �

(145,046 ) � Loss before income taxes (861,210 ) (5,384,932 ) �

Income tax expense 8,969 43,767 � Net loss $ (870,179 ) $

(5,428,699 ) � Loss per share Basic $ (0.03 ) $ (0.12 ) Diluted $

(0.03 ) $ (0.12 ) � Weighted average common shares outstanding

Basic 34,192,786 44,282,492 Diluted 34,192,786 44,282,492 �

Included in net loss are the following amounts (in millions): � � �

� Three Months Ended March 31, 2007 � 2008 Construction Revenues

1.8 ? Construction Cost of Sales (1.8 ) ? Fuel Tax Credits 3.8 4.7

Employee Stock Option Expense, Net of Tax Benefits ? (2.5 )

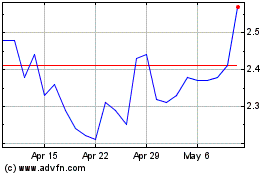

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

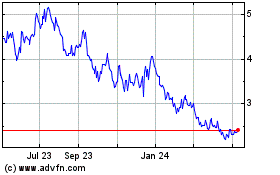

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jul 2023 to Jul 2024