0000913277

false

0000913277

2023-07-19

2023-07-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 19, 2023

CLARUS CORPORATION

(Exact name of registrant as specified in

its charter)

|

Delaware

(State or other jurisdiction

of incorporation) |

001-34767

(Commission File Number) |

58-1972600

(IRS Employer

Identification Number) |

|

2084 East 3900 South, Salt Lake City, Utah

(Address of principal executive offices) |

84124

(Zip Code) |

Registrant’s telephone number, including

area code: (801) 278-5552

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

¨ |

Emerging growth company |

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which

registered |

| Common Stock, par value $.0001 per share |

|

CLAR |

|

NASDAQ Global Select Market |

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: July 20, 2023

| |

CLARUS CORPORATION |

| |

|

| |

|

| |

By: |

/s/ Michael J. Yates |

| |

Name: Michael J. Yates |

| |

Title: Chief Financial Officer |

Exhibit 5.1

|

|

KANE KESSLER, P.C.

600 THIRD AVENUE

NEW YORK, NEW YORK 10016-1901

TEL 212.541.6222

FAX 212.245.3009

WWW.KANEKESSLER.COM |

| |

|

|

| |

|

|

| |

|

WRITER’S DIRECT NUMBER |

| |

|

|

| |

|

|

| |

|

WRITER’S EMAIL |

| |

|

|

| |

|

|

Clarus Corporation

2084 East 3900 South

Salt Lake City, UT 84124

Ladies and Gentlemen:

Clarus Corporation, a Delaware

corporation (the “Company”), has filed with the Securities and Exchange Commission (the “Commission”) a Registration

Statement on Form S-4 (File No. 333-254107) as amended, which was declared effective by the Commission as of April 8, 2021 (the “Registration

Statement”) for the purpose of registering under the Securities Act of 1933, as amended (the “Securities Act”), certain

securities, including 249,683 shares (the “Shares”) of its common stock, par value $0.0001 per share (the “Common Stock”)

to be issued by the Company as deferred consideration pursuant to the terms of the Share and Unit Purchase Agreement, dated as of November

26, 2021, by and among the Company, Simpson Aluminium Pty Ltd, Brad McCarthy as trustee for the McCarthy Family Trust (the “Seller”),

and Brad McCarthy (“Purchase Agreement”).

In our capacity as special

counsel to the Company in connection with the matters referred to above, we have examined copies of the following: (i) the Amended and

Restated Certificate of Incorporation of the Company, as amended to date and currently in effect (the “Amended and Restated Certificate”),

(ii) the Amended and Restated By-laws of the Company currently in effect, (iii) certain records of the Company’s corporate proceedings

as reflected in its minute books; (iv) the Registration Statement, as amended, in the form it was filed with the Commission, as amended;

and (v) the form of the prospectus supplement, dated July 19, 2023, and the accompanying prospectus, included as a part of the Registration

Statement with respect to the shares of Common Stock issued pursuant to the Purchase Agreement. We have also examined such other documents,

papers, authorities and statutes as we have deemed necessary to form the basis of the opinions hereinafter set forth.

Each share of Common Stock

is accompanied by a right (each, a “Right” and collectively, the “Rights”) to purchase under certain circumstances,

from the Company, one one-hundredth of a share of the Company’s Series A junior participating preferred stock, par value $0.0001

per share (the “Series A Junior Participating Preferred Stock”), pursuant to a Rights Agreement, dated as of February 12,

2008 (the “Plan”), between the Company and American Stock Transfer & Trust Company, LLC, as Rights Agent (the “Rights

Agent”) for which no separate consideration has been received. The Rights associated with the shares of Common Stock initially will

trade together with the shares of Common Stock.

Clarus Corporation

Re: Registration Statement on Form S-4

Page 2

In our examination, we have

assumed the legal capacity of all natural persons, the genuineness of all signatures, the authenticity of all documents submitted to us

as originals, the conformity to original documents of all documents submitted to us as certified or photostatic copies, and the authenticity

of the originals of such documents. As to certain facts material to this opinion, we have relied upon oral or written statements and representations

of officers and other representatives of the Company including that the number of shares of Common Stock and Rights, as the case may be,

which the Company is authorized to issue in its Amended and Restated Certificate exceeds (i) the number of shares of Common Stock or Rights

outstanding, as the case may be, (ii) the number of shares of Common Stock or Rights, as the case may be, held as treasury shares, (iii)

the number of shares of Common Stock or Rights, as the case may be, the Company has otherwise reserved for issuance for any purpose, and

(iv) the number of shares of Common Stock which the Company has issued and is obligated to issue pursuant to the Purchase Agreement, including

the Shares, and we have assumed for purposes of our opinion herein that such condition will remain true at all future times relevant to

this opinion. We have also assumed that the shares of Common Stock have been issued and delivered against adequate consideration therefor

(not less than par value for the offered shares of Common Stock) and that an appropriate prospectus supplement with respect to the shares

of Common Stock and Rights included therein to be offered pursuant to the Purchase Agreement has been prepared, and has been delivered

and filed in compliance with the Securities Act. We have also relied on certificates of public officials, and such other documents and

information as we have deemed necessary or appropriate to enable us to render the opinions expressed below. We have not undertaken any

independent investigation to determine the accuracy of any such facts.

We have also assumed that

(i) at the time of issuance and delivery of the Rights, the Plan is the valid and legally binding obligation of the Rights Agent, (ii)

the Rights Agent is validly existing under the law of the jurisdiction in which it is organized, (iii) at the time of issuance and

delivery of the Rights, there are a sufficient number of Rights and shares of Series A Junior Preferred Stock authorized under the Plan

and the Amended and Restated Certificate, as the case may be, and are not otherwise reserved for issuance, (iv) the Rights Agent is duly qualified to engage in

the activities contemplated by the Plan, and (v) the Rights Agent has the requisite organizational and legal power and authority

to perform its obligations under the Plan.

Based upon the foregoing,

and subject to the additional assumptions and qualifications set forth herein, we advise you that in our opinion:

| (i) | the Shares are validly issued, fully paid and non-assessable,

and |

| (ii) | if

and when separated from the Shares, the Rights have been duly executed, countersigned or authenticated by the Rights Agent, registered

and delivered, the Rights attached to the Shares in accordance with the Plan will constitute the valid and legally binding obligations

of the Company, enforceable against the Company in accordance with their terms, except to the extent that enforcement thereof may be

limited by (w) bankruptcy, insolvency, reorganization, fraudulent conveyance, moratorium or other similar laws now or hereafter

in effect relating creditors’ rights generally, (x) general principles of equity (regardless of whether enforceability is

considered in a proceeding at law or in equity), (y) an implied covenant of good faith and fair dealing, and (z) public policy

considerations which may limit the rights of parties to obtain remedies. |

Furthermore, in our opinion with respect to the Rights

and the Plan, (i) we express no opinion as to any determination a court of competent jurisdiction may make regarding whether the

Board of Directors would be required to redeem or terminate, or take other action with respect to, the Rights at some future time based

on the facts and circumstances existing at that time, (ii) we have assumed that the members of the Board of Directors acted in a

manner consistent with their fiduciary duties as required under applicable law in adopting the Plan, (iii) we address the Rights

and the Plan in their entirety, and it is not settled whether the invalidity of any particular provision of the Plan or of the Rights

issued thereunder would result in invalidating such Plan or Rights in their entirety, and (iv) we express no opinion as to the validity,

legally binding effect or enforceability of provisions of the Plan relating to severability.

We hereby consent to the filing of this opinion as an exhibit to a

current report on Form 8-K to be filed by the Company and its incorporation by reference into the Registration Statement and further consent

to the reference to our name under the caption “Legal Matters” in the prospectus, which is a part of the Registration Statement.

In giving this consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities

Act.

Clarus Corporation

Re: Registration Statement on Form S-4

Page 3

We are qualified to practice

law in the State of New York and do not purport to be experts on any law other than the laws of the State of New York, the General Corporation

Law of the State of Delaware and the Federal law of the United States. We are not admitted or qualified to practice in the State of Delaware;

however, we are generally familiar with the Delaware General Corporation Law as currently in effect and have made such inquiries as we

deem necessary to render the opinions contemplated herein. We express no opinion regarding the Securities Act, or any other federal or

state securities laws or regulations.

This opinion is being furnished

in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act. This opinion letter is limited to the

specific legal matters expressly set forth herein and is limited to present statutes, regulations and administrative and judicial interpretations.

We assume no obligation to revise or supplement this opinion in the event of future changes in such laws or regulations.

| |

Very truly yours, |

| |

|

| |

KANE KESSLER, P.C. |

| |

|

| |

|

| |

/s/ Kane Kessler, P.C. |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

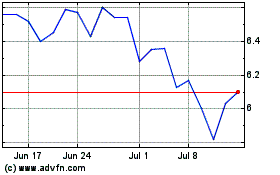

Clarus (NASDAQ:CLAR)

Historical Stock Chart

From Apr 2024 to May 2024

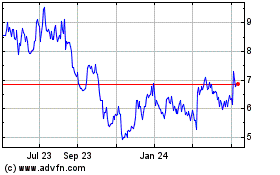

Clarus (NASDAQ:CLAR)

Historical Stock Chart

From May 2023 to May 2024