SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

______________

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): July

23, 2014

|

|

CIRRUS

LOGIC, INC.

|

|

|

(Exact

name of Registrant as specified in its charter)

|

|

Delaware

|

|

0-17795

|

|

77-0024818

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

800 West 6th Street, Austin, TX

|

|

|

78701

|

|

|

(Address

of Principal Executive Offices)

|

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (512)

851-4000

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

⃞

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

⃞

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

⃞

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On July 23, 2014, the Company issued a press release announcing its

results for its first quarter fiscal year 2015. The full text of the

press release is furnished as Exhibit No. 99.1 to this Current Report on

Form 8-K.

Item 7.01 Regulation FD.

On July 23, 2014, in addition to issuing a press release, the Company

posted on its website a shareholder letter to investors summarizing the

financial results for its first quarter of fiscal year 2015. The full

text of the shareholder letter is furnished as Exhibit No. 99.2 to this

Current Report on Form 8-K.

Use of Non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a GAAP

basis, Cirrus has provided certain non-GAAP financial information,

including operating expenses, net income, income from operations,

operating margin and diluted earnings per share. A reconciliation of the

adjustments to GAAP results is included in the tables to the press

release furnished as Exhibit No. 99.1 to this Current Report on Form

8-K. Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and comparative

purposes. In addition, certain non-GAAP financial information is used

internally by management to evaluate and manage the company. As a note,

the non-GAAP financial information used by Cirrus Logic may differ from

that used by other companies. These non-GAAP measures should be

considered in addition to, and not as a substitute for, the results

prepared in accordance with GAAP.

The information contained in Items 2.02, 7.01, and 9.01 in this Current

Report on Form 8-K and the exhibits furnished hereto contain

forward-looking statements regarding the Company and cautionary

statements identifying important factors that could cause actual results

to differ materially from those anticipated. In addition, this

information shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise subject to the liabilities of that section, nor shall they be

deemed incorporated by reference in any filing under the Securities Act

of 1933, as amended, or the Exchange Act, except as expressly set forth

by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Description

Exhibit

99.1 Cirrus Logic, Inc. press release dated July 23, 2014

Exhibit

99.2 Cirrus Logic, Inc. shareholder letter dated July 23,

2014

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, Registrant has

duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

|

|

CIRRUS LOGIC, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

July 23, 2014

|

By:

|

/s/ Thurman K. Case

|

|

|

|

|

|

Name: Thurman K. Case

|

|

|

|

|

|

Title: Chief Financial Officer

|

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

|

|

|

|

|

99.1

|

Registrant's press release dated July 23, 2014

|

|

|

99.2

|

Cirrus Logic, Inc. shareholder letter dated July 23, 2014

|

|

|

|

|

|

|

|

|

|

|

Exhibit 99.1

|

|

|

Exhibit 99.2

|

|

Exhibit 99.1

Cirrus

Logic Reports Q1 Revenue of $152.6 Million

Expects

to Close Wolfson Microelectronics Acquisition in September Quarter

AUSTIN, Texas--(BUSINESS WIRE)--July 23, 2014--Cirrus Logic, Inc.

(Nasdaq: CRUS), a leader in high-precision analog and digital

signal processing components, today posted on its investor relations

website at http://investor.cirrus.com the quarterly Shareholder

Letter that contains the complete financial results for the first

quarter fiscal year 2015, which ended June 28, 2014, as well as the

company’s current business outlook.

“We are pleased with our Q1 financial results as we experienced strong

demand for our custom and general market portable audio products across

our customer base,” said Jason Rhode, president and chief executive

officer. “With a robust pipeline of innovative products and the pending

acquisition of Wolfson, we are strengthening the company’s position as a

market leader in audio with a comprehensive product portfolio,

differentiated software capabilities and a top-tier customer base.”

Reported Financial Results – First Quarter FY15

-

Revenue of $152.6 million;

-

Gross margin of 49 percent;

-

GAAP operating expenses of $59.5 million and non-GAAP operating

expenses of $51.6 million; and

-

GAAP diluted earnings per share of $0.16 and non-GAAP diluted earnings

per share of $0.37.

A reconciliation of the non-GAAP charges is included in the tables

accompanying this press release.

Business Outlook – Second Quarter FY15

Guidance for the September quarter excludes any potential financial

contributions or expenses associated with the Wolfson acquisition.

-

Revenue is expected to range between $175 million and $195 million;

-

Gross margin is expected to be between 47 percent and 49 percent; and

-

Combined R&D and SG&A expenses are expected to range between $58

million and $62 million, which includes approximately $7 million in

share-based compensation and amortization of acquired intangibles.

Cirrus Logic will host a live Q&A session at 5 p.m. EDT today to answer

questions related to its financial results and business outlook.

Participants may listen to the conference call on the Cirrus Logic

website. Participants who would like to submit a question to be

addressed during the call are requested to email investor.relations@cirrus.com.

A replay of the webcast can be accessed on the Cirrus Logic website

approximately two hours following its completion, or by calling (404)

537-3406, or toll-free at (855) 859-2056 (Access Code: 66089509).

Cirrus Logic, Inc.

Cirrus Logic develops high-precision, analog and mixed-signal integrated

circuits for a broad range of innovative customers. Building on its

diverse analog and signal-processing patent portfolio, Cirrus Logic

delivers highly optimized products for a variety of audio and

energy-related applications. The company operates from headquarters in

Austin, Texas, with offices in Phoenix, Ariz., Europe, Japan and Asia.

More information about Cirrus Logic is available at www.cirrus.com.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a GAAP

basis, Cirrus has provided non-GAAP financial information, including

operating expenses, net income, operating profit and diluted earnings

per share. A reconciliation of the adjustments to GAAP results is

included in the tables below. Non-GAAP financial information is not

meant as a substitute for GAAP results, but is included because

management believes such information is useful to our investors for

informational and comparative purposes. In addition, certain non-GAAP

financial information is used internally by management to evaluate and

manage the company. The non-GAAP financial information used by Cirrus

Logic may differ from that used by other companies. These

non-GAAP measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters set

forth in this news release contain forward-looking statements, including

our estimates of second quarter fiscal year 2015 revenue, gross margin,

combined research and development and selling, general and

administrative expense levels, share-based compensation expense and

amortization of acquired intangibles. In some cases, forward-looking

statements are identified by words such as “expect,” “anticipate,”

“target,” “project,” “believe,” “goals,” “opportunity,” “estimates,”

“intend,” and variations of these types of words and similar expressions.

In addition, any statements that refer to our plans, expectations,

strategies or other characterizations of future events or circumstances

are forward-looking statements. These forward-looking statements

are based on our current expectations, estimates and assumptions and are

subject to certain risks and uncertainties that could cause actual

results to differ materially. These risks and uncertainties include, but

are not limited to, the following: the level of orders and shipments

during the second quarter of fiscal year 2015, as well as customer

cancellations of orders, or the failure to place orders consistent with

forecasts; and the risk factors listed in our Form 10-K for the year

ended March 29, 2014, and in our other filings with the Securities and

Exchange Commission, which are available at www.sec.gov. The

foregoing information concerning our business outlook represents our

outlook as of the date of this news release, and we undertake no

obligation to update or revise any forward-looking statements, whether

as a result of new developments or otherwise.

Cirrus Logic, Cirrus and SoundClear are registered trademarks of Cirrus

Logic, Inc.

Summary financial data follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIRRUS LOGIC, INC.

|

|

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS

|

|

(unaudited)

|

|

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

Jun. 28,

|

|

Mar. 29,

|

|

Jun. 29,

|

|

|

|

|

2014

|

|

2014

|

|

2013

|

|

|

|

|

Q1'15

|

|

Q4'14

|

|

Q1'14

|

|

Audio products

|

|

|

$

|

141,161

|

|

|

$

|

137,773

|

|

|

$

|

143,666

|

|

|

Energy products

|

|

|

|

11,404

|

|

|

|

11,886

|

|

|

|

11,459

|

|

|

Net revenue

|

|

|

|

152,565

|

|

|

|

149,659

|

|

|

|

155,125

|

|

|

Cost of sales

|

|

|

|

77,190

|

|

|

|

76,291

|

|

|

|

75,627

|

|

|

Gross Profit

|

|

|

|

75,375

|

|

|

|

73,368

|

|

|

|

79,498

|

|

|

Gross Margin

|

|

|

|

49.4

|

%

|

|

|

49.0

|

%

|

|

|

51.2

|

%

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

|

39,777

|

|

|

|

35,511

|

|

|

|

28,530

|

|

|

Selling, general and administrative

|

|

|

|

19,683

|

|

|

|

17,823

|

|

|

|

19,198

|

|

|

Restructuring and other costs

|

|

|

|

-

|

|

|

|

(26

|

)

|

|

|

(430

|

)

|

|

Patent infringement settlements, net

|

|

|

|

-

|

|

|

|

-

|

|

|

|

695

|

|

|

Total operating expenses

|

|

|

|

59,460

|

|

|

|

53,308

|

|

|

|

47,993

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

|

15,915

|

|

|

|

20,060

|

|

|

|

31,505

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net

|

|

|

|

(467

|

)

|

|

|

267

|

|

|

|

158

|

|

|

Other income (expense), net

|

|

|

|

501

|

|

|

|

(27

|

)

|

|

|

(17

|

)

|

|

Income before income taxes

|

|

|

|

15,949

|

|

|

|

20,300

|

|

|

|

31,646

|

|

|

Provision (benefit) for income taxes

|

|

|

|

5,701

|

|

|

|

7,698

|

|

|

|

11,004

|

|

|

Net income

|

|

|

$

|

10,248

|

|

|

$

|

12,602

|

|

|

$

|

20,642

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share:

|

|

|

$

|

0.17

|

|

|

$

|

0.20

|

|

|

$

|

0.33

|

|

|

Diluted earnings per share:

|

|

|

$

|

0.16

|

|

|

$

|

0.20

|

|

|

$

|

0.31

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares:

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

62,032

|

|

|

|

62,215

|

|

|

|

63,363

|

|

|

Diluted

|

|

|

|

64,688

|

|

|

|

64,545

|

|

|

|

66,188

|

|

|

|

|

|

|

|

|

|

|

|

Prepared in accordance with Generally Accepted Accounting

Principles

|

|

|

|

|

|

CIRRUS LOGIC, INC.

|

|

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION

|

|

(unaudited, in thousands, except per share data)

|

|

(not prepared in accordance with GAAP)

|

|

|

|

Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage

the company. As a note, the non-GAAP financial information used by

Cirrus Logic may differ from that used by other companies. These

non-GAAP measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

Certain modifications to prior year non-GAAP presentation has been

made and had no material effect on the results of operations.

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

Jun. 28,

|

|

Mar. 29,

|

|

Jun. 29,

|

|

|

|

|

2014

|

|

2014

|

|

2013

|

|

Net Income Reconciliation

|

|

|

Q1'15

|

|

Q4'14

|

|

Q1'14

|

|

GAAP Net Income

|

|

|

$

|

10,248

|

|

|

$

|

12,602

|

|

|

$

|

20,642

|

|

|

Amortization of acquisition intangibles

|

|

|

|

246

|

|

|

|

217

|

|

|

|

-

|

|

|

Stock based compensation expense

|

|

|

|

5,622

|

|

|

|

5,545

|

|

|

|

5,774

|

|

|

Provision for litigation expenses and settlements

|

|

|

|

-

|

|

|

|

-

|

|

|

|

695

|

|

|

Restructuring and other costs, net

|

|

|

|

-

|

|

|

|

(26

|

)

|

|

|

(430

|

)

|

|

Wolfson acquisition items

|

|

|

|

2,304

|

|

|

|

-

|

|

|

|

-

|

|

|

Provision (benefit) for income taxes

|

|

|

|

5,226

|

|

|

|

7,808

|

|

|

|

10,161

|

|

|

Non-GAAP Net Income

|

|

|

$

|

23,646

|

|

|

$

|

26,146

|

|

|

$

|

36,842

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share Reconciliation

|

|

|

|

|

|

|

|

|

GAAP Diluted earnings per share

|

|

|

$

|

0.16

|

|

|

$

|

0.20

|

|

|

$

|

0.31

|

|

|

Effect of Stock based compensation expense

|

|

|

|

0.09

|

|

|

|

0.09

|

|

|

|

0.09

|

|

|

Effect of Provision for litigation expenses and settlements

|

|

|

|

-

|

|

|

|

-

|

|

|

|

0.01

|

|

|

Effect of Wolfson acquisition items

|

|

|

|

0.04

|

|

|

|

-

|

|

|

|

-

|

|

|

Effect of Provision (benefit) for income taxes

|

|

|

|

0.08

|

|

|

|

0.12

|

|

|

|

0.15

|

|

|

Non-GAAP Diluted earnings per share

|

|

|

$

|

0.37

|

|

|

$

|

0.41

|

|

|

$

|

0.56

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income Reconciliation

|

|

|

|

|

|

|

|

|

GAAP Operating Income

|

|

|

$

|

15,915

|

|

|

$

|

20,060

|

|

|

$

|

31,505

|

|

|

GAAP Operating Profit

|

|

|

|

10

|

%

|

|

|

13

|

%

|

|

|

20

|

%

|

|

Amortization of acquisition intangibles

|

|

|

|

246

|

|

|

|

217

|

|

|

|

-

|

|

|

Stock compensation expense - COGS

|

|

|

|

231

|

|

|

|

287

|

|

|

|

6

|

|

|

Stock compensation expense - R&D

|

|

|

|

2,543

|

|

|

|

2,546

|

|

|

|

2,854

|

|

|

Stock compensation expense - SG&A

|

|

|

|

2,848

|

|

|

|

2,712

|

|

|

|

2,914

|

|

|

Provision for litigation expenses and settlements

|

|

|

|

-

|

|

|

|

-

|

|

|

|

695

|

|

|

Restructuring and other costs, net

|

|

|

|

-

|

|

|

|

(26

|

)

|

|

|

(430

|

)

|

|

Wolfson acquisition items

|

|

|

|

2,192

|

|

|

|

-

|

|

|

|

-

|

|

|

Non-GAAP Operating Income

|

|

|

$

|

23,975

|

|

|

$

|

25,796

|

|

|

$

|

37,544

|

|

|

Non-GAAP Operating Profit

|

|

|

|

16

|

%

|

|

|

17

|

%

|

|

|

24

|

%

|

|

|

|

|

|

|

|

|

|

|

Operating Expense Reconciliation

|

|

|

|

|

|

|

|

|

GAAP Operating Expenses

|

|

|

$

|

59,460

|

|

|

$

|

53,308

|

|

|

$

|

47,993

|

|

|

Amortization of acquisition intangibles

|

|

|

|

(246

|

)

|

|

|

(217

|

)

|

|

|

-

|

|

|

Stock compensation expense - R&D

|

|

|

|

(2,543

|

)

|

|

|

(2,546

|

)

|

|

|

(2,854

|

)

|

|

Stock compensation expense - SG&A

|

|

|

|

(2,848

|

)

|

|

|

(2,712

|

)

|

|

|

(2,914

|

)

|

|

Provision for litigation expenses and settlements

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(695

|

)

|

|

Restructuring and other costs, net

|

|

|

|

-

|

|

|

|

26

|

|

|

|

430

|

|

|

Wolfson acquisition items

|

|

|

|

(2,192

|

)

|

|

|

-

|

|

|

|

-

|

|

|

Non-GAAP Operating Expenses

|

|

|

$

|

51,631

|

|

|

$

|

47,859

|

|

|

$

|

41,960

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIRRUS LOGIC, INC.

|

|

CONSOLIDATED CONDENSED BALANCE SHEET

|

|

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jun. 28,

|

|

Mar. 29,

|

|

Jun. 29,

|

|

|

|

|

2014

|

|

2014

|

|

2013

|

|

|

|

|

(unaudited)

|

|

|

|

(unaudited)

|

|

ASSETS

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

$

|

268,544

|

|

|

$

|

31,850

|

|

|

$

|

67,170

|

|

|

Restricted investments

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Marketable securities

|

|

|

|

75,198

|

|

|

|

263,417

|

|

|

|

165,540

|

|

|

Accounts receivable, net

|

|

|

|

77,219

|

|

|

|

63,220

|

|

|

|

63,642

|

|

|

Inventories

|

|

|

|

92,002

|

|

|

|

69,743

|

|

|

|

110,624

|

|

|

Deferred tax asset

|

|

|

|

19,921

|

|

|

|

22,024

|

|

|

|

54,774

|

|

|

Other current assets

|

|

|

|

40,469

|

|

|

|

25,079

|

|

|

|

20,810

|

|

|

Total Current Assets

|

|

|

|

573,353

|

|

|

|

475,333

|

|

|

|

482,560

|

|

|

|

|

|

|

|

|

|

|

|

Long-term marketable securities

|

|

|

|

39,952

|

|

|

|

89,243

|

|

|

|

39,408

|

|

|

Property and equipment, net

|

|

|

|

102,765

|

|

|

|

103,650

|

|

|

|

99,169

|

|

|

Intangibles, net

|

|

|

|

11,341

|

|

|

|

11,999

|

|

|

|

4,714

|

|

|

Goodwill

|

|

|

|

16,367

|

|

|

|

16,367

|

|

|

|

6,027

|

|

|

Deferred tax asset

|

|

|

|

25,034

|

|

|

|

25,065

|

|

|

|

16,732

|

|

|

Other assets

|

|

|

|

1,007

|

|

|

|

3,087

|

|

|

|

11,289

|

|

|

Total Assets

|

|

|

$

|

769,819

|

|

|

$

|

724,744

|

|

|

$

|

659,899

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

$

|

75,695

|

|

|

$

|

51,932

|

|

|

$

|

47,341

|

|

|

Accrued salaries and benefits

|

|

|

|

11,598

|

|

|

|

13,388

|

|

|

|

13,476

|

|

|

Other accrued liabilities

|

|

|

|

14,080

|

|

|

|

11,572

|

|

|

|

9,532

|

|

|

Deferred income on shipments to distributors

|

|

|

|

7,398

|

|

|

|

5,631

|

|

|

|

4,419

|

|

|

Total Current Liabilities

|

|

|

|

108,771

|

|

|

|

82,523

|

|

|

|

74,768

|

|

|

|

|

|

|

|

|

|

|

|

Other long-term obligations

|

|

|

|

4,039

|

|

|

|

4,863

|

|

|

|

9,706

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

Capital stock

|

|

|

|

1,088,493

|

|

|

|

1,078,878

|

|

|

|

1,048,497

|

|

|

Accumulated deficit

|

|

|

|

(430,663

|

)

|

|

|

(440,634

|

)

|

|

|

(472,180

|

)

|

|

Accumulated other comprehensive loss

|

|

|

|

(821

|

)

|

|

|

(886

|

)

|

|

|

(892

|

)

|

|

Total Stockholders' Equity

|

|

|

|

657,009

|

|

|

|

637,358

|

|

|

|

575,425

|

|

|

Total Liabilities and Stockholders' Equity

|

|

|

$

|

769,819

|

|

|

$

|

724,744

|

|

|

$

|

659,899

|

|

|

|

|

|

|

|

|

|

|

|

Prepared in accordance with Generally Accepted Accounting

Principles

|

CONTACT:

Cirrus Logic, Inc.

Thurman K. Case, 512-851-4125

Chief

Financial Officer

Investor.Relations@cirrus.com

Exhibit 99.2

July 23, 2014 Letter to

Shareholders Q1 FY15 CIRRUS LOGIC, INC.

Dear Shareholders, Our

financial results for the June quarter were at the high end of guidance

as we delivered GAAP EPS of $0.16 and non-GAAP EPS of $0.37 on revenue

of $152.6 million. Sales of our portable audio products accelerated in

Q1, as we continued to experience robust demand for higher performance

audio solutions across our customer base. Sales in our energy division

remained relatively unchanged from the prior quarter. In the June

quarter, we began sampling several new audio products in advanced

geometries and are encouraged by the initial feedback from key

customers. Cirrus Logic announced its intention on April 29, 2014 to

acquire Wolfson Microelectronics for an enterprise value of

approximately $467 million. This acquisition augments the company’s core

audio signal processing product portfolio, provides differentiated

software capabilities, particularly in the Android ecosystem, and adds

new product categories such as MEMS microphones. With a diverse customer

base and an end-to-end audio solution consisting of a broad selection of

custom-and general-market products, the combination of the two companies

reinforces Cirrus Logic’s position as a market leader. The additional

resources will enable the company to better address the substantial

opportunities driving future revenue growth in the portable audio

market. During the quarter, we made progress toward meeting the

necessary UK regulatory approvals for the acquisition of Wolfson and

expect to complete the transaction during our second fiscal quarter. As

we do not have an exact close date, please note that all forecasts that

we are providing for the second quarter do not include any potential

contribution or expenses associated with the Wolfson acquisition.

Revenue and Gross Margins

Revenue for the first quarter was $152.6 million, up two percent

sequentially and down two percent from the prior year, as broad based

unit growth in our portable audio business offset a shift in mix to

products with lower average selling prices. Sales in energy were down

slightly sequentially and flat year over year. Our relationship with our

largest customer remains outstanding with ongoing design activity on

various products. While we understand there is intense interest in this

customer, in accordance with our policy, we do not discuss specifics

about our business relationship. Accurately predicting the timing of

revenue between quarters can be challenging as orders may fluctuate,

especially in the September and December quarters when steep product

ramps for the holiday season occur. Taking this into consideration,

revenue in the September quarter is forecast to range from $175 to $195

million, with the midpoint up 21 percent quarter over quarter and down

three percent year over year. Sequentially, the forecasted increase in

revenue is primarily attributable to strength in portable audio driven

by expected new product ramps in the second half of CY14. On a

year-over-year basis, strong demand for our general market portable

audio codecs, amplifiers and converters is offsetting some of the

previously discussed impact from the shift in mix toward products with

lower average selling prices. Figure A: Cirrus Logic Revenue Q1 FY12 to

Q2 FY15 (M) *Midpoint)of)guidance)as)of)July)23,)2014) Q1/FY12' Q2/FY12'

Q3/FY12' Q4/FY12' Q1/FY13' Q2/FY13' Q3/FY13' Q4/FY13' Q1/FY14' Q2/FY14'

Q3/FY14' Q4/FY14' Q1/FY15' Q2/FY15' $92'' $102'' $122'' $111'' $99''

$194'' $310'' $207'' $155'' $191'' $219'' $150'' $153'' $185*''

Gross margins for the June

quarter were 49.4 percent, reflecting increased shipments of certain

higher margin, general-market audio products. In the September quarter,

we expect gross margin to range from 47 percent to 49 percent. Our

long-term gross margin expectations remain in the mid-40 percent

range. Operating Profit and Earnings Operating profit in the June

quarter was 10 percent GAAP and 16 percent non-GAAP. Operating expenses

on a GAAP basis were $59.5 million, including $5.4 million in

share-based compensation. The sequential increase of $6.2 million

includes costs associated with tape outs and product development. The

year-over-year increase in operating expenses of $11.5 million was

largely due to additional headcount, product development expenses and

tape outs. Operating expenses for the September quarter should range

from $58 million to $62 million, including $7 million in share-based

compensation and amortization of acquired intangibles. Our total

headcount in Q1 was 739, down 12 employees from the March quarter.

Cirrus Logic’s business model requires a substantial investment in R&D

for the development of innovative products that are essential for future

growth. Over the past six months the company has taped out numerous

custom-and general-market products in 55, 65, and 180 nanometers

designed for the rapidly growing audio and voice markets. We expect

development activity to accelerate in the September quarter as we

continue to tape out new mixed-signal products in advanced

geometries. Figure B: Cirrus Logic GAAP R&D and SG&A Expenses/Headcount

Q1 FY12 to Q2 FY15 *Midpoint of guidance as of July 23, 2014 ($

millions, except headcount) 594 623 635 667 698 644 637 652 665 678 735

751 739 0 10 20 30 40 50 60 Q1/FY12 Q2/FY12 Q3/FY12 Q4/FY12 Q1/FY13

Q2/FY13 Q3/FY13 Q4/FY13 Q1/FY14 Q2/FY14 Q3/FY14 Q4/FY14 Q1/FY15 Q2/FY15

OpEx*SG&A R&D Headcount $M

The ending cash balance in

the June quarter was $383.7 million, relatively flat from the prior

quarter, due in part to expenditures associated with the Wolfson

acquisition. This transaction will be financed through a combination of

existing cash on the balance sheet and $225 million in debt funding.

Cash from operations in Q1 was $13 million. Taxes and Inventory Our GAAP

tax expense during the quarter was $5.7 million, which included $5.2

million of non-cash expense associated with our deferred tax asset and

other tax credits. We have approximately $48.9 million remaining of

deferred tax assets and other tax credits. We continue to actively

evaluate various long-term operating structures that could result in a

reduction of our overall corporate tax rate, including opportunities

associated with the acquisition of Wolfson. At this time, we expect our

effective quarterly cash tax rate to be less than four percent in Q2 and

we expect it to remain at that rate until we have depleted our remaining

deferred tax assets and other tax credits. Q1 inventory was $92

million, up from $69.7 million from the prior quarter, as we expect

increased product demand in the back half of the calendar year. We also

expect inventory growth in the September quarter to support customer

demand. Company Strategy Recently, we have seen a significant

transformation in the audio market as a wide range of OEMs developing

mobile consumer products have begun to view audio and voice as a way to

deliver highly differentiated consumer experiences, driving a

substantial increase in customers looking for devices with higher

performance, more features and more processing power. There is also

growing consumer demand in emerging markets for smartphones that deliver

high fidelity audio playback experiences that rival high-end consumer

audio/video equipment. Our broad portfolio of high performance audio

converters provide OEMs addressing these markets the ability to deliver

a best in class user experience, thus driving additional demand for

these products.

With a robust long-term

roadmap, Cirrus Logic is focused on strengthening our leadership

position in audio, organically and through the acquisition of Wolfson.

Our engineers are developing an innovative portfolio of custom-and

general-market products targeting audio and voice applications that fuse

our expertise in complex analog and mixed-signal processing with our

SoundClear® embedded software suite. We are excited to be sampling

several of our new, advanced geometry, high-performance products and are

actively engaged with customers on future designs. Further, the desire

for innovation in mobile accessories is expanding as new intelligent

products emerge and OEMs participate in and fuel the development of this

ecosystem. With an extensive range of advanced codecs, DSPs and

amplifiers, coupled with our SoundClear® noise suppression and echo

cancellation software, Cirrus Logic is well positioned to capitalize on

this emerging market. In the June quarter, we gained momentum in our

portable audio business. We are now shipping general market products

into multiple mobile handsets on seven unique customer platforms. During

the quarter, we ramped shipments of our boosted amplifier with speaker

protection and sound quality enhancement software to support the product

launch of a recently added top tier smartphone customer. Reviews of the

smartphone have been positive, contributing to increased interest for

this product. Although the amplifier market is highly competitive, we

are encouraged by our success with these products and expect to see

year-over-year unit growth in FY15. As the portable market evolves we

believe the requirements for advanced processing functionality in

amplifiers will increase considerably, enhancing Cirrus Logic’s

competitive advantage given our expertise in sophisticated analog and

mixed signal processing. Cirrus Logic introduced its first amplifier for

the portable market several years ago, and while we do not expect to win

every socket in the business, we are extremely pleased to have built a

highly profitable and growing business in a few short years.

As we highlighted in the

March quarter, a wide range of opportunities in audio and voice

applications have emerged that we believe will fuel future revenue

growth and diversification. As such, over the past few quarters we have

increased the percentage of company resources dedicated to audio. We

expect this focus to accelerate following the close of the Wolfson

acquisition. While the company is expanding its developments in audio,

we will continue to support retrofit LED lighting with existing products

as our team explores alternative markets where customers are willing to

pay a premium for higher performance products. With a strong

intellectual property portfolio and differentiating technology in the

LED lighting market we are evaluating various options to best capitalize

on our investment. Summary and Guidance For the September quarter,

excluding any potential financial contributions or expenses associated

with the Wolfson acquisition, we expect the following results: Revenue

to range between $175 million and $195 million; Gross margin to be

between 47 percent and 49 percent; and Combined R&D and SG&A expenses to

range between $58 million and $62 million, including approximately $7

million in share-based compensation expense and amortization of acquired

intangibles. In summary, we are pleased with our progress in Q1 as we

delivered strong financial results and gained momentum across our

portable audio products. We believe the portable audio market is in the

initial stages of the next wave of growth, driven by the desire to

differentiate products through the audio and voice experience. With a

strong pipeline of compelling products and the pending acquisition of

Wolfson, we are strengthening the company’s position as a market leader

in audio with a comprehensive custom-and general-market product

portfolio, differentiated software capabilities and a top-tier customer

base.

Sincerely, Jason Rhode

Thurman Case President and Chief Executive Officer Chief Financial

Officer Conference Call Q&A Session Cirrus Logic will host a live Q&A

session at 5 p.m. EDT today to answer questions related to its financial

results and business outlook. Participants may listen to the conference

call on the Cirrus Logic website. Participants who would like to submit

a question to be addressed during the call are requested to email

investor.relations@cirrus.com. A replay of the webcast can be accessed

on the Cirrus Logic website approximately two hours following its

completion, or by calling (404) 537-3406, or toll-free at (855)

859-2056 (Access Code: 66089509). Use of Non-GAAP Financial Information

This shareholder letter and its attachments include references to

non-GAAP financial information, including operating expenses, net

income, operating profit and diluted earnings per share. A

reconciliation of the adjustments to GAAP results is included in the

tables below. Non-GAAP financial information is not meant as a

substitute for GAAP results, but is included because management believes

such information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage the

company. As a note, the non-GAAP financial information used by Cirrus

Logic may differ from that used by other companies. These non-GAAP

measures should be considered in addition to, and not as a substitute

for, the results prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters set

forth in this news release contain forward-looking statements, including

our future growth expectations and our estimates of second quarter

fiscal year 2015 revenue, gross margin, combined research and

development and selling, general and administrative expense levels,

share-based compensation expense and amortization of acquired

intangibles. In some cases, forward-looking statements are identified by

words such as “expect,” “anticipate,” “target,” “project,” “believe,”

“goals,” “opportunity,” “estimates,” “intend,” and variations of these

types of words and similar expressions. In addition, any statements

that refer to our plans, expectations, strategies or other

characterizations of future events or circumstances are forward-looking

statements. These forward-looking statements are based on our current

expectations, estimates and assumptions and are subject to certain risks

and uncertainties that could cause actual results to differ materially.

These risks and uncertainties include, but are not limited to, the level

of orders and shipments during the second quarter fiscal year 2015, as

well as customer cancellations of orders, or the failure to place orders

consistent with forecasts; and the risk factors listed in our Form 10-K

for the year ended March 29, 2014, and in our other filings with the

Securities and Exchange Commission, which are available at www.sec.gov.

The foregoing information concerning our business outlook represents our

outlook as of the date of this news release, and we undertake no

obligation to update or revise any forward-looking statements, whether

as a result of new developments or otherwise. Cirrus Logic, Cirrus and

SoundClear are registered trademarks of Cirrus Logic, Inc. All other

product names noted herein may be trademarks of their respective

holders. Summary financial data follows:

Jun. 28, Mar. 29, Jun. 29,

2014 2014 2013 Q1'15 Q4'14 Q1'14 Audio products 141,161 $ 137,773 $

143,666 $ Energy products 11,404 11,886 11,459 CIRRUS LOGIC, INC.

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS (unaudited) (in

thousands, except per share data) Three Months Ended Net revenue 152,565

149,659 155,125 Cost of sales 77,190 76,291 75,627 Gross Profit 75,375

73,368 79,498 Gross Margin 49.4% 49.0% 51.2% Research and development

39,777 35,511 28,530 Selling, general and administrative 19,683 17,823

19,198 Restructuring and other costs - (26) (430) Patent infringement

settlements, net - - 695 Total operating expenses 59,460 53,308 47,993

Operating income 15,915 20,060 31,505 Interest income, net (467) 267 158

Other income (expense), net 501 (27) (17) Income before income taxes

15,949 20,300 31,646 Provision (benefit) for income taxes 5,701 7,698

11,004 Net income 10,248 $ 12,602 $ 20,642 $ Basic earnings per share:

0.17 $ 0.20 $ 0.33 $ Diluted earnings per share: 0.16 $ 0.20 $ 0.31 $

Weighted average number of shares: Basic 62,032 62,215 63,363 Diluted

64,688 64,545 66,188 See notes to Consolidated Condensed Statement of

Operations Prepared in accordance with Generally Accepted Accounting

Principles

Jun. 28, Mar. 29, Jun. 29,

2014 2014 2013 Net Income Reconciliation Q1'15 Q4'14 Q1'14 GAAP Net

Income 10,248 $ 12,602 $ 20,642 $ Amortization of acquisition

intangibles 246 217 - Stock based compensation expense 5,622 5,545 5,774

Non-GAAP financial information is not meant as a substitute for GAAP

results, but is included because management believes such information is

useful to our investors for informational and comparative purposes. In

addition, certain non-GAAP financial information is used internally by

management to evaluate and manage the company. As a note, the non-GAAP

financial information used by Cirrus Logic may differ from that used by

other companies. These non-GAAP measures should be considered in

addition to, and not as a substitute for, the results prepared in

accordance with GAAP. Certain modifications to prior year non-GAAP

presentation have been made and had no material effect on the results of

operations. Three Months Ended (not prepared in accordance with GAAP)

CIRRUS LOGIC, INC. RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL

INFORMATION (unaudited, in thousands, except per share data) Provision

for litigation expenses and settlements - - 695 Restructuring and other

costs, net - (26) (430) Wolfson acquisition items 2,304 - - Provision

(benefit) for income taxes 5,226 7,808 10,161 Non-GAAP Net Income 23,646

$ 26,146 $ 36,842 $ Earnings Per Share Reconciliation GAAP Diluted

earnings per share 0.16 $ 0.20 $ 0.31 $ Effect of Stock based

compensation expense 0.09 0.09 0.09 Effect of Provision for litigation

expenses and settlements - - 0.01 Effect of Wolfson acquisition items

0.04 - - Effect of Provision (benefit) for income taxes 0.08 0.12 0.15

Non-GAAP Diluted earnings per share 0.37 $ 0.41 $ 0.56 $ Operating

Income Reconciliation GAAP Operating Income 15,915 $ 20,060 $ 31,505 $

GAAP Operating Profit 10% 13% 20% Amortization of acquisition

intangibles 246 217 - Stock compensation expense - COGS 231 287 6 Stock

compensation expense - R&D 2,543 2,546 2,854 Stock compensation expense

- SG&A 2,848 2,712 2,914 Provision for litigation expenses and

settlements - - 695 Restructuring and other costs, net - (26) (430)

Wolfson acquisition items 2,192 - - Non-GAAP Operating Income 23,975 $

25,796 $ 37,544 $ Non-GAAP Operating Profit 16% 17% 24% Operating

Expense Reconciliation GAAP Operating Expenses 59,460 $ 53,308 $ 47,993

$ Amortization of acquisition intangibles (246) (217) - Stock

compensation expense - R&D (2,543) (2,546) (2,854) Stock compensation

expense - SG&A (2,848) (2,712) (2,914) Provision for litigation expenses

and settlements - - (695) Restructuring and other costs, net - 26 430

Wolfson acquisition items (2,192) - -Non-GAAP Operating Expenses 51,631

$ 47,859 $ 41,960 $

CIRRUS LOGIC, INC.

CONSOLIDATED CONDENSED BALANCE SHEET Jun. 28, Mar. 29, Jun. 29, 2014

2014 2013 (unaudited) (unaudited) ASSETS Current assets Cash and cash

equivalents 268,544 $ 31,850 $ 67,170 $ Restricted investments - - -

Marketable securities 75,198 263,417 165,540 Accounts receivable, net

77,219 63,220 63,642 Inventories 92,002 69,743 110,624 Deferred tax

asset 19,921 22,024 54,774 Other current assets 40,469 25,079 20,810

Total Current Assets 573,353 475,333 482,560 Long-term marketable

securities 39,952 89,243 39,408 Property and equipment, net 102,765

103,650 99,169 Intangibles, net 11,341 11,999 4,714 Goodwill 16,367

16,367 6,027 (in thousands) Deferred tax asset 25,034 25,065 16,732

Other assets 1,007 3,087 11,289 Total Assets 769,819 $ 724,744 $ 659,899

$ LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts

payable 75,695 $ 51,932 $ 47,341 $ Accrued salaries and benefits 11,598

13,388 13,476 Other accrued liabilities 14,080 11,572 9,532 Deferred

income on shipments to distributors 7,398 5,631 4,419 Total Current

Liabilities 108,771 82,523 74,768 Other long-term obligations 4,039

4,863 9,706 Stockholders' equity: Capital stock 1,088,493 1,078,878

1,048,497 Accumulated deficit (430,663) (440,634) (472,180) Accumulated

other comprehensive loss (821) (886) (892) Total Stockholders' Equity

657,009 637,358 575,425 Total Liabilities and Stockholders' Equity

769,819 $ 724,744 $ 659,899 $ Prepared in accordance with Generally

Accepted Accounting Principles

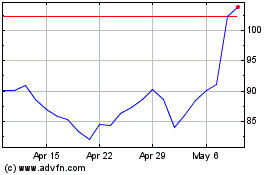

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

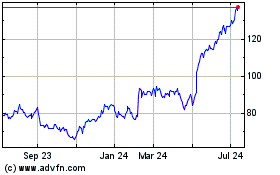

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024