Cirrus Logic - Momentum

September 03 2012 - 8:00PM

Zacks

Shares of fabless semiconductor company

Cirrus Logic, Inc.

(CRUS) have moved toward its 52-week high since providing a solid

outlook during its first quarter results. This Zacks #1 Rank

(Strong Buy) could improve even further based on its projection for

solid revenue growth in the second quarter of fiscal 2013.

Mixed 1Q, Outlook Upbeat

On July 30, 2012, Cirrus Logic reported first quarter 2013

earnings per share of 16 cents, in line with the Zacks Consensus

Estimate. Net sales increased 7.3% over the comparable prior-year

quarter to $99.0 million, slightly below the Zacks Consensus

Estimate of $101.0 million.

Revenue growth, which was within the company’s guided range, was

affected by lower-than-expected sales of Apple’s iPhone, iMac and

iPod. The company also stated that customers preferred to delay

their purchases to wait for upcoming launches.

Gross margin improved 230 basis points (bps) from the year-ago

quarter to 54.0%. However, operating margin decreased 490 bps to

10.6% due to higher expenses.

Based on upcoming audio and energy products, Cirrus Logic is

upbeat about its growth in the second quarter and in fiscal 2013.

The company expects second quarter revenue in the range of $170.0

million – $190.0 million, which reflects sequential growth of 71.7%

– 91.9%.

Based on the new launches and higher sales of mobile devices and

SSDs (solid state drives), Cirrus Logic forecasts solid growth for

the rest of fiscal 2013.

Following the earnings release, the Zacks Consensus Estimate for

the second quarter nearly doubled (up 91.2%) to 65 cents per share,

while the Zacks Consensus Estimate for fiscal 2013 shot up 53.4% to

$2.27.

Valuation Looks Reasonable

Currently, Cirrus Logic is trading at a premium to most of its

peers based on P/E, P/S and PEG. Since its return on equity (ROE)

of 19.1% is much higher than the 11.2% average for its peers, the

premium is justified. Moreover, its strong growth prospects

indicate room for further expansion.

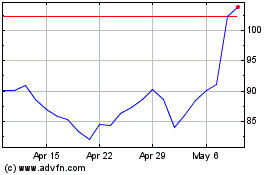

6-Months Chart

Cirrus Logic shares have appreciated 74.9% in the past 6 months

compared to a mere 2.2% increase for the S&P 500.

Shares have traded at a premium to its rivals, Texas Instruments

Inc. (TXN), STMicroelectronics (STM), ON Semiconductor (ONNN) and

Maxim Integrated Products (MXIM) in the past 6 months.

The significant increase in the stock price is on account of

strong demand for its analog and mixed-signal integrated circuits

(IC) for audio products, as well as its close association with

Apple, its largest customer. The stock is currently above its 50

and 200 day moving averages of 34.44 and 27.75, respectively.

Trading volumes are considerably lower than its peers.

Incorporated in 1984 and headquartered in Texas, California,

Cirrus Logic designs ICs for the audio and energy markets. The

major contributor to the company’s revenue is its audio product

portfolio. Audio products generate 85.0% of total revenue, while

only 15.0% comes from Energy products.

Cirrus Logic has a strong customer base but its prime customer

is Apple, with revenue contributions of 62.0% in 2012, 47.0% in

2011 and 35.0% in 2010.

CIRRUS LOGIC (CRUS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

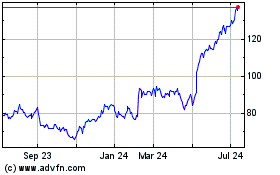

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024