Cirrus Logic - Momentum

June 18 2012 - 8:00PM

Zacks

Shares of

Cirrus Logic, Inc. (CRUS) are on a great run,

buoyed by strong fourth quarter results announced on April 25,

2012. This fabless semiconductor company has a Zacks #1 Rank

(Strong Buy).

Currently, the stock is trading around its 52-week high.

However, there are chances of further upside based on Cirrus’

projection of solid growth during the second half of fiscal

2013.

Earnings Beat, Outlook Upbeat

Cirrus Logic reported fiscal fourth quarter 2012 earnings per

share of 41 cents, beating the Zacks Consensus Estimate by more

than 36%. Net sales jumped 21.0% over the comparable prior-year

quarter to $110.6 million, inching past the Zacks Consensus

Estimate of $110.0 million. Audio Products were the high point,

growing 35.2% from the year-ago quarter.

The gross margin improved 610 bps from the year-ago quarter to

56.4%. The operating margin increased 400 bps year over year to

18.9%.

Cirrus remains upbeat about its growth in fiscal 2013, which

should benefit from new audio and energy products.

The fiscal first quarter revenue guidance of $96.0 million to

$106.0 million represents management’s conservatism. Since the

company will launch some new products later in the year, customers

are likely to delay purchases, leading to a temporary softening in

demand. Therefore, any pullback in the shares on account of this

softness represents an excellent buying opportunity.

Following the earnings release, the Zacks Consensus Estimate for

the fiscal first quarter has dropped 44.8% to 16 cents, but the

estimate for fiscal 2013 shot up 8.9% to $1.50.

Valuation Looks Reasonable

Currently, Cirrus is trading at a premium to most of its peers

based on P/E, P/S and PEG. Its strong growth prospects indicate

room for further expansion.

Cirrus shares are up 79.8% year to date, compared to a mere 5.2%

increase for the S&P 500.

Cirrus shares have traded at a premium to rivals Texas

Instruments Inc. (TXN), STMicroelectronics (STM), ON Semiconductor

(ONNN) and Maxim Integrated Products (MXIM) year to date.

The significant increase in the stock price in recent months is

on account of strong demand for its analog and mixed-signal

integrated circuits (IC) for audio products and its rumored win

with Apple TV. The stock is currently above its 50 and 200 day

moving averages of 27.09 and 22.35, respectively.

Trading volumes are considerably lower than its peers.

Cirrus Logic designs ICs for the audio and energy markets. The

major contributor to the company’s revenue is its audio product

portfolio. Audio products generate 85.0% of total revenue, while

only 15.0% comes from Energy products.

Cirrus has a strong customer base, but the prime customer is

Apple with 62.0%, 47.0% and 35.0% revenue contributions in 2012,

2011 and 2010, respectively. The company employs 676 full time

employees.

CIRRUS LOGIC (CRUS): Free Stock Analysis Report

To read this article on Zacks.com click here.

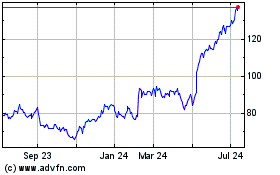

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

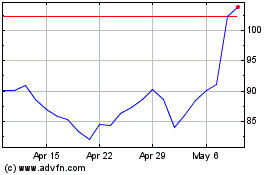

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024