Cheer Holding, Inc. (NASDAQ: CHR) (“Cheer Holding,” “we” or

the “Company”), a leading provider of next-generation mobile

internet infrastructure and platform services, today announced that

it intends to effect a share consolidation of its ordinary shares

at a ratio of 1 post-split ordinary share for every 10 pre-split

ordinary shares (the “Share Consolidation”) so that every ten (10)

shares issued and outstanding will be combined into one (1) share.

Any fractional share of a shareholder resulting from the Share

Consolidation will be rounded up to the nearest whole number of

shares. The Share Consolidation will become effective at 4:05 p.m.

(New York time) on November 24, 2023 (the “Effective Time”).

The Share Consolidation will be effected by

filing a notice to the Registrar of Companies of the Cayman

Islands. The Company’s ordinary shares will continue to be traded

on the Nasdaq Capital Market (“Nasdaq”) under the symbol “CHR” and

will begin trading on a post-consolidation adjusted basis when the

market opens on Monday, November 27, 2023. The CUSIP number for the

Company’s ordinary shares following the Share Consolidation will be

G39973204.

The Share Consolidation is primarily intended to

increase the Company’s per share trading price in order to maintain

its listing on Nasdaq. As previously disclosed, on March 22, 2023,

the Company received notice from the Listing Qualifications

Department of Nasdaq indicating that the Company is not in

compliance with the minimum bid price requirement of US$1.00 per

share under the Nasdaq Listing Rules. We believe that the proposed

Share Consolidation will assist the Company in regaining compliance

under the Nasdaq Listing Rules.

The Share Consolidation will reduce the issued

and outstanding number of ordinary shares of the Company from

100,384,466 shares to approximately 10,038,447 shares. In addition,

the Company will be effecting a share increase immediately upon the

effectiveness of the Share Consolidation, so as to maintain the

same number of authorized ordinary shares before the Share

Consolidation, which will continue to be 200,000,000 ordinary

shares of a par value of US$0.001.

Shareholders holding their shares in book-entry

form or in “street name” (through a broker, bank or other holder of

record) will have their shares automatically adjusted to reflect

the Share Consolidation. Shareholders of record may direct

questions concerning the Share Consolidation to the Company’s

transfer agent, Continental Stock Transfer & Trust Company.

About Cheer Holding,

Inc.

As a preeminent provider of next-generation

mobile internet infrastructure and platform services in China,

Cheer Holding is dedicated to building a digital ecosystem that

integrates “platforms, applications, technology, and industry” into

a cohesive system, thereby creating a new, open business

environment for web3.0 that leverages AI technology. The Company is

developing a 5G+VR+AR+AI shared universe space that builds on

cutting-edge technologies including blockchain, cloud computing,

extended reality, and digital twin.

Cheer Holding’s portfolio includes a wide range

of products and services, such as Polaris Intelligent Cloud, CHEERS

Telepathy, CHEERS Open Platform, CHEERS Video, CHEERS e-Mall,

CheerReal, CheerCar, CheerChat, CHEERS Fresh Group-Buying

E-commerce Platform, Digital Innovation Research Institute, CHEERS

Livestreaming, variety show series, IP short video matrix, and

more. These offerings provide diverse application scenarios that

seamlessly blend “online/offline” and “virtual/reality”

elements.

With “CHEERS+” at the core of Cheer Holding’s

ecosystem, the Company is committed to consolidating and

strengthening its core competitiveness, and achieving long-term

sustainable and scalable growth.

For more information, please visit

http://ir.gsmg.co/.

Safe Harbor Statement

Certain statements made in this release are

“forward looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. When used in this press release, the

words “estimates,” “projected,” “expects,” “anticipates,”

“forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,”

“will,” “should,” “future,” “propose” and variations of these words

or similar expressions (or the negative versions of such words or

expressions) are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the Company’s control, that

could cause actual results or outcomes to differ materially from

those discussed in the forward-looking statements. Important

factors, among others, are: the ability to manage growth; ability

to identify and integrate other future acquisitions; ability to

obtain additional financing in the future to fund capital

expenditures; fluctuations in general economic and business

conditions; costs or other factors adversely affecting our

profitability; litigation involving patents, intellectual property,

and other matters; potential changes in the legislative and

regulatory environment; a pandemic or epidemic; the occurrence of

any event, change or other circumstances that could affect the

Company’s ability to continue successful development and launch of

its metaverse experience centers; the possibility that the Company

may not succeed in developing its new lines of businesses due to,

among other things, changes in the business environment and

technological developments, competition, changes in regulation, or

other economic and policy factors; disruptions or other business

interruptions that may affect the operations of our products and

services, the possibility that the Company’s new lines of business

may be adversely affected by other economic, business, and/or

competitive factors; other factors, risks and uncertainties set

forth in documents filed by the Company with the Securities and

Exchange Commission from time to time, including the Company’s

latest Annual Report on Form 20-F filed with the SEC on March 22,

2023, as amended. The Company undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

applicable law. Such information speaks only as of the date of this

release.

For investor and media inquiries, please contact:

Wealth Financial Services LLCConnie Kang, PartnerEmail:

ckang@wealthfsllc.comTel: +86 1381 185 7742 (CN)

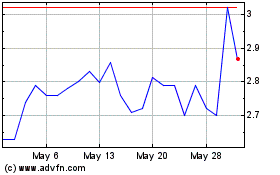

Cheer (NASDAQ:CHR)

Historical Stock Chart

From Oct 2024 to Nov 2024

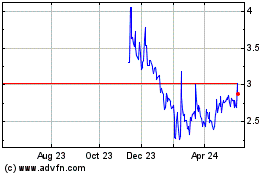

Cheer (NASDAQ:CHR)

Historical Stock Chart

From Nov 2023 to Nov 2024