0000726958false00007269582024-06-052024-06-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 5, 2024

CASEY'S GENERAL STORES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Iowa |

| (State or other jurisdiction of incorporation) |

| | |

| 001-34700 | | 42-0935283 |

| (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | |

One SE Convenience Blvd., Ankeny, Iowa

(Address of principal executive offices)

50021

(Zip Code)

515/965-6100

(Registrant's telephone number, including area code)

NONE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, no par value per share | CASY | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 2.02. Results of Operations and Financial Condition

On June 11, 2024, the Company issued a press release announcing its financial results for the fourth quarter and year ended April 30, 2024. A copy of the Company's press release is attached as Exhibit 99.1 and is incorporated herein by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

2024 Fiscal Year Annual Incentive Payouts

On June 5, 2024, the Compensation Committee (the “Committee”) of the Company’s Board of Directors (the “Board”) authorized payment to the Company’s NEOs under the 2024 fiscal year Annual Incentive Plan. Based on the Company's performance in its 2024 fiscal year, the payouts equal 157% of the “target” for each NEO (which “target” is represented by a percentage of their 2024 fiscal year base salary), resulting in the following payments: (i) Darren M. Rebelez, President/CEO, $2,826,000; (ii) Stephen P. Bramlage, Jr., CFO, $1,177,500; (iii) Ena Williams, COO, $1,177,500; (iv) Thomas P. Brennan, CMO, $671,175; and (v) Chad M. Frazell, CHRO, $641,738.

2025 Fiscal Year Long-Term Equity Incentive Awards

On June 5, 2024, the Committee (and June 6, 2024, the Board, acting on a recommendation of the Committee for Mr. Rebelez) approved annual long-term equity incentive awards to the NEOs. The awards, made under the terms of the Company’s 2018 Stock Incentive Plan, are based on a percentage of 2025 fiscal year base salary (or for Mr. Rebelez, a target amount) (Mr. Rebelez, $7,500,000; Mr. Bramlage, 250%; Ms. Williams, 275%; Mr. Brennan, 200%; and Mr. Frazell, 175%) and consist of (i) time-based restricted stock units (“RSUs”), comprising 25% of the award amount, (ii) performance-based restricted stock units (“PSUs”) subject to return on invested capital (“ROIC”) performance goals, comprising 37.5% of the award amount, and (iii) PSUs subject to EBITDA performance goals, comprising 37.5% of the award amount. The PSUs granted represent a “target” amount, with the number of shares awarded based on the Company’s achievement of threshold (50% awarded), target (100% awarded) and maximum (200% awarded) performance goals over a three-year performance period (fiscal years 2025, 2026 and 2027) (the “Performance Period”).

Additionally, following the determination of the Company’s achievement of the ROIC and EBITDA goals for the Performance Period, the PSUs actually awarded will be subject to a positive or negative adjustment based upon a comparison of the Company's total shareholder return (“TSR”) relative to a comparator group for the Performance Period (the “TSR Modifier”). If the Company ranks in the bottom quartile of the group, the number of PSUs actually awarded will be reduced by 25%; if the Company ranks in the top quartile of the group, the number of PSUs actually awarded will be increased by 25% (which, based on maximum performance goals achieved, could result in a payment of up to 250% of “target” for the PSUs).

The RSUs will vest in equal installments on June 15, 2025, June 15, 2026, and June 15, 2027, and the PSUs will vest in full on June 15, 2027, subject to satisfaction of the applicable performance goals and application of the TSR Modifier, with each generally subject to continued employment through the vesting date, except as otherwise set forth in the applicable award agreement.

2025 Fiscal Year Annual Incentive Plan Awards

On June 5, 2024, the Committee (and June 6, 2024, the Board, acting on a recommendation of the Committee for Mr. Rebelez), approved the Annual Incentive Plan for the 2025 fiscal year (the “2025 Annual Plan”) for the NEOs. The 2025 Annual Plan will be based on EBITDA (60%) and same-store sales growth in the inside sales category (40%). The payout at “target” is based on a percentage of 2025 fiscal year base salary (Mr. Rebelez, 150%; Mr. Bramlage, 100%; Ms. Williams, 100%; Mr. Brennan, 75%; and Mr. Frazell, 75%), with an overall payout range from 0% to 200% of “target” depending on performance. All bonuses earned under the 2025 Annual Plan will be paid in cash.

2025 Fiscal Year NEO Base Salaries

On June 5, 2024, the Committee (and June 6, 2024, the Board, acting on a recommendation of the Committee for Mr. Rebelez), approved base salaries for the NEOs for the 2025 fiscal year: (i) Mr. Rebelez, $1,200,000; (ii) Mr. Bramlage, $780,000; (iii) Ms. Williams, $780,000; (iv) Mr. Brennan, $595,000; and (v) Mr. Frazell, $560,000.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | CASEY'S GENERAL STORES, INC. |

| | |

| Dated: June 11, 2024 | By: | /s/ Stephen P. Bramlage Jr. |

| | Stephen P. Bramlage Jr. |

| | Chief Financial Officer |

Exhibit 99.1

| | |

| FOR IMMEDIATE RELEASE |

| Casey’s General Stores, Inc. |

| One SE Convenience Blvd |

| Ankeny, IA 50021 |

Casey's Announces Fourth Quarter and Fiscal Year Results

Ankeny, IA, June 11, 2024 - Casey’s General Stores, Inc., ("Casey's" or the "Company") (Nasdaq symbol CASY) one of the leading convenience store chains in the United States, today announced financial results for the three months and year ended April 30, 2024.

Fourth Quarter 2024 Key Highlights1

•Diluted EPS of $2.34, up 57% from the same period a year ago. Net income was $87 million, up 55%, and EBITDA2 was $219 million, up 32%, from the same period a year ago.

•Inside same-store sales up 5.6% compared to the prior year, and 12.4% on a two-year stack basis, with an inside margin of 41.2%. Total inside gross profit increased 16.2% to $517.6 million compared to the prior year.

•Fuel same-store gallons were up 0.9% compared to the prior year with a fuel margin of 36.5 cents per gallon. Total fuel gross profit increased 15.4% to $253.6 million compared to the prior year.

•In June, Casey's increased the quarterly dividend 16% to $0.50 per share, marking the 25th consecutive annual increase.

Fiscal Year 2024 Key Highlights

•Diluted EPS of $13.43 up 13% over the prior year. Net income was $502 million, up 12%, and EBITDA was $1.06 billion, up 11%, from the prior year.

•Casey's Rewards members grew to 7.9 million by year-end.

•The Company built or acquired 154 stores in the fiscal year, ending at 2,658 stores and entered Texas, its 17th state.

•Casey's recorded strong prepared food and dispensed beverage growth driven by innovation including thin crust pizza and a refreshed lunch sandwich menu.

“Casey's started its three-year strategic plan with a record fiscal year, exceeding $1 billion in EBITDA for the first time in the company's history," said Darren Rebelez, President and CEO. “Inside same-store sales were outstanding, up 4.4%, or 11.2% on a two-year stack basis, led by strong performance in pizza and bakery as well as alcoholic and non-alcoholic beverages. Strong sales growth was accomplished while improving inside margin. Our fuel team achieved market share gains while striking the right balance between fuel gallon growth and gross profit margin throughout the year to drive fuel gross profit up 3.9% from the prior year. The operations team did a tremendous job driving sales growth, while integrating new stores and reducing same-store labor hours for the eighth consecutive quarter.”

Earnings

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended April 30, | | Twelve Months Ended April 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income (in thousands) | $ | 87,020 | | | $ | 56,092 | | | $ | 501,972 | | | $ | 446,691 | |

| Diluted earnings per share | $ | 2.34 | | | $ | 1.49 | | | $ | 13.43 | | | $ | 11.91 | |

| EBITDA (in thousands) | $ | 219,026 | | | $ | 166,023 | | | $ | 1,059,398 | | | $ | 952,464 | |

Fourth quarter net income, diluted EPS, and EBITDA were up versus the same period the prior year primarily due to higher inside and higher fuel gross profit partially offset by higher operating expense due to operating 137 additional stores.

1 During the quarter Casey's had one additional operating day due to the leap year. This impacted same-store and total results for the quarter by approximately 100 basis points. The impact for the full year was approximately 25 basis points.

2 EBITDA is reconciled to net income below.

Inside

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended April 30, | Twelve Months Ended April 30, |

| 2024 | | 2023 | 2024 | | 2023 |

| Inside sales (in thousands) | $ | 1,257,375 | | | $ | 1,124,060 | | $ | 5,188,994 | | | $ | 4,768,337 | |

| Inside same-store sales | 5.6 | % | | 6.5 | % | 4.4 | % | | 6.5 | % |

| Grocery and general merchandise same-store sales | 4.3 | % | | 7.1 | % | 3.5 | % | | 6.3 | % |

| Prepared food and dispensed beverage same-store sales | 8.8 | % | | 4.9 | % | 6.8 | % | | 7.1 | % |

| Inside gross profit (in thousands) | $ | 517,613 | | | $ | 445,549 | | $ | 2,128,822 | | | $ | 1,904,856 | |

| Inside margin | 41.2 | % | | 39.6 | % | 41.0 | % | | 39.9 | % |

| Grocery and general merchandise margin | 34.4 | % | | 33.0 | % | 34.1 | % | | 33.6 | % |

| Prepared food and dispensed beverage margin | 58.1 | % | | 56.8 | % | 58.7 | % | | 56.6 | % |

For the quarter, total inside sales were up 11.9% for the quarter and total inside gross profit was up 16.2%. Inside same-store sales were up 5.6%, or 12.4% on a two-year stack basis, driven by strong performance in hot sandwiches and dispensed beverage in the prepared food and dispensed beverage category as well as non-alcoholic and alcoholic beverages in the grocery and general merchandise category. Inside margin was up 160 basis points for the quarter primarily due to mix shift, modest retail price adjustments and strong cost of goods management.

Fuel3

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended April 30, | | Twelve Months Ended April 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Fuel gallons sold (in thousands) | 694,989 | | | 635,916 | | | 2,828,669 | | | 2,672,366 | |

| Same-store gallons sold | 0.9 | % | | 0.0 | % | | 0.1 | % | | (0.8) | % |

| Fuel gross profit (in thousands) | $ | 253,612 | | | $ | 219,746 | | | $ | 1,116,671 | | | $ | 1,074,913 | |

| Fuel margin (cents per gallon, excluding credit card fees) | 36.5 | ¢ | | 34.6 | ¢ | | 39.5 | ¢ | | 40.2 | ¢ |

For the quarter, total fuel gallons sold increased 9.3% compared to the prior year primarily due to operating more stores, while same-store gallons sold were up 0.9% versus the prior year. Fuel gross profit was up 15.4% versus the prior year. The Company sold $1.0 million in renewable fuel credits (RINs) in the fourth quarter, while the company did not sell any RINs in the same period last year.

Operating Expenses

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended April 30, | Twelve Months Ended April 30, | | | |

| 2024 | | 2023 | 2024 | | 2023 | | | |

| Operating expenses (in thousands) | $ | 579,047 | | | $ | 521,729 | | $ | 2,288,513 | | | $ | 2,119,942 | | | | |

| Credit card fees (in thousands) | $ | 53,539 | | | $ | 51,287 | | $ | 229,418 | | | $ | 233,014 | | | | |

| Same-store operating expense excluding credit card fees | 2.6 | % | | 2.7 | % | 2.7 | % | | 2.8 | % | | | |

Total operating expenses increased 11% for the fourth quarter. Approximately 6% of the increase is due to operating 137 more stores than a year ago. Approximately 2% of the increase was due to same-store employee expense. Approximately 1% of the change is related to an increase in accrued costs for incentive compensation due to strong financial performance. Finally, approximately 1% of the increase was due to discretionary charitable giving and a special team member bonus.

3 Fuel category does not include wholesale fuel activity, which is included in Other.

Expansion | | | | | |

| Store Count |

| April 30, 2023 | 2,521 | |

| New store construction | 42 | |

| Acquisitions | 112 |

| Acquisitions not opened | (1) | |

| Prior acquisitions opened | 6 | |

| Closed | (22) | |

| April 30, 2024 | 2,658 | |

Liquidity

At April 30, 2024, the Company had approximately $1.1 billion in available liquidity, consisting of approximately $206 million in cash and cash equivalents on hand and $900 million in undrawn borrowing capacity on existing lines of credit.

Share Repurchase

During the fourth quarter, the Company repurchased approximately $15 million of shares bringing the total for the year to $105 million. The Company has approximately $295 million remaining under its existing share repurchase authorization.

Dividend

At its June meeting, the Board of Directors voted to increase the quarterly dividend by 16% to $0.50 per share, which is the 25th consecutive year increasing the dividend. The dividend is payable August 15, 2024, to shareholders of record on August 1, 2024.

Fiscal 2025 Outlook

Casey's expects the following performance during fiscal 2025. The Company expects EBITDA to increase at least 8%. The Company expects inside same-store sales to increase 3% to 5% and inside margin comparable to fiscal 2024. The Company expects same-store fuel gallons sold to be between negative 1% to positive 1%. Total operating expenses are expected to increase approximately 6% to 8%. The Company expects to add at least 100 stores in fiscal 2025 through a mix of M&A and new store construction. Net interest expense is expected to be approximately $56 million. Depreciation and amortization is expected to be approximately $390 million and the purchase of property and equipment is expected to be approximately $575 million. The tax rate is expected to be approximately 24% to 26% for the year.

Casey’s General Stores, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(Amounts in thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended April 30, | Twelve Months Ended April 30, | | |

| | 2024 | | 2023 | 2024 | | 2023 | | | | |

| Total revenue | $ | 3,600,015 | | | $ | 3,328,701 | | $ | 14,862,913 | | | $ | 15,094,475 | | | | | |

| Cost of goods sold (exclusive of depreciation and amortization, shown separately below) | 2,801,942 | | | 2,640,949 | | 11,515,002 | | | 12,022,069 | | | | | |

| | | | | | | | | | |

| Operating expenses | 579,047 | | | 521,729 | | 2,288,513 | | | 2,119,942 | | | | | |

| Depreciation and amortization | 92,344 | | | 80,631 | | 349,797 | | | 313,131 | | | | | |

| Interest, net | 14,494 | | | 12,800 | | 53,441 | | | 51,815 | | | | | |

| Income before income taxes | 112,188 | | | 72,592 | | 656,160 | | | 587,518 | | | | | |

| Federal and state income taxes | 25,168 | | | 16,500 | | 154,188 | | | 140,827 | | | | | |

| Net income | $ | 87,020 | | | $ | 56,092 | | $ | 501,972 | | | $ | 446,691 | | | | | |

| Net income per common share | | | | | | | | | | |

| Basic | $ | 2.35 | | | $ | 1.50 | | $ | 13.51 | | | $ | 11.99 | | | | | |

| Diluted | $ | 2.34 | | | $ | 1.49 | | $ | 13.43 | | | $ | 11.91 | | | | | |

| Basic weighted average shares | 37,025,986 | | | 37,283,677 | | 37,164,022 | | | 37,266,851 | | | | | |

| Plus effect of stock compensation | 233,993 | | | 290,000 | | 206,284 | | | 252,844 | | | | | |

| Diluted weighted average shares | 37,259,979 | | | 37,573,677 | | 37,370,306 | | | 37,519,695 | | | | | |

Casey’s General Stores, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Dollars in thousands)

(Unaudited)

| | | | | | | | | | | |

| April 30, 2024 | | April 30, 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 206,482 | | | $ | 378,869 | |

| Receivables | 151,793 | | | 120,547 | |

| Inventories | 428,722 | | | 376,085 | |

| Prepaid expenses | 25,791 | | | 22,107 | |

| | | |

| Income taxes receivable | 17,066 | | | 23,347 | |

| Total current assets | 829,854 | | | 920,955 | |

| Other assets, net of amortization | 195,559 | | | 192,153 | |

| Goodwill | 652,663 | | | 615,342 | |

Property and equipment, net of accumulated depreciation of $2,883,925 at April 30, 2024 and $2,620,149 at April 30, 2023 | 4,669,357 | | | 4,214,820 | |

| Total assets | $ | 6,347,433 | | | $ | 5,943,270 | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities | | | |

| | | |

| Current maturities of long-term debt and finance lease obligations | $ | 53,181 | | | $ | 52,861 | |

| Accounts payable | 569,527 | | | 560,546 | |

| | | |

| Accrued expenses | 330,758 | | | 313,718 | |

| Total current liabilities | 953,466 | | | 927,125 | |

| Long-term debt and finance lease obligations, net of current maturities | 1,582,758 | | | 1,620,513 | |

| Deferred income taxes | 596,850 | | | 543,598 | |

| | | |

| Insurance accruals, net of current portion | 30,046 | | | 32,312 | |

| Other long-term liabilities | 168,932 | | | 159,056 | |

| Total liabilities | 3,332,052 | | | 3,282,604 | |

| Total shareholders’ equity | 3,015,381 | | | 2,660,666 | |

| Total liabilities and shareholders’ equity | $ | 6,347,433 | | | $ | 5,943,270 | |

Casey’s General Stores, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Dollars in thousands)

(Unaudited)

| | | | | | | | | | | |

| | Twelve months ended April 30, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 501,972 | | | $ | 446,691 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 349,797 | | | 313,131 | |

| Amortization of debt issuance costs | 1,111 | | | 1,789 | |

| Change in excess replacement cost over LIFO inventory valuation | 12,499 | | | 24,231 | |

| Share-based compensation | 41,379 | | | 47,024 | |

| Loss on disposal of assets and impairment charges | 6,414 | | | 6,871 | |

| Deferred income taxes | 53,252 | | | 23,126 | |

| | | |

| Changes in assets and liabilities: | | | |

| Receivables | (31,246) | | | (12,519) | |

| Inventories | (51,785) | | | (141) | |

| Prepaid expenses | (3,684) | | | (4,248) | |

| Accounts payable | (8,731) | | | (9,483) | |

| Accrued expenses | 14,387 | | | 20,292 | |

| Income taxes | 5,112 | | | 20,652 | |

| Other, net | 2,476 | | | 4,535 | |

| Net cash provided by operating activities | 892,953 | | | 881,951 | |

| Cash flows from investing activities: | | | |

| Purchase of property and equipment | (522,004) | | | (476,568) | |

| Payments for acquisitions of businesses, net of cash acquired | (330,032) | | | (85,569) | |

| Proceeds from sales of property and equipment | 26,680 | | | 17,103 | |

| Net cash used in investing activities | (825,356) | | | (545,034) | |

| Cash flows from financing activities: | | | |

| | | |

| Repayments of long-term debt | (53,656) | | | (40,970) | |

| Payments of debt issuance costs | — | | | (3,940) | |

| | | |

| | | |

| Payments of cash dividends | (62,918) | | | (55,617) | |

| | | |

| Repurchase of common stock | (104,898) | | | — | |

| Tax withholdings on employee share-based awards | (18,512) | | | (16,399) | |

| | | |

| Net cash used in financing activities | (239,984) | | | (116,926) | |

| | | |

| | | | | | | | | | | |

| |

| | | |

| Net (decrease) increase in cash and cash equivalents | (172,387) | | | 219,991 | |

| Cash and cash equivalents at beginning of the period | 378,869 | | | 158,878 | |

| Cash and cash equivalents at end of the period | $ | 206,482 | | | $ | 378,869 | |

SUPPLEMENTAL DISCLOSURES OF CASH FLOWS INFORMATION | | | | | | | | | | | |

| | Twelve months ended April 30, |

| | 2024 | | 2023 |

| Cash paid during the period for: | | | |

| Interest, net of amount capitalized | $ | 63,449 | | | $ | 56,799 | |

| Income taxes, net | 105,000 | | | 90,398 | |

| Noncash investing and financing activities: | | | |

| Purchased property and equipment in accounts payable | 45,617 | | | 27,905 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Summary by Category (Amounts in thousands) |

| Three months ended April 30, 2024 | Prepared Food

& Dispensed Beverage | | Grocery & General

Merchandise | | Fuel | | Other | | Total |

| Revenue | $ | 356,895 | | | $ | 900,480 | | | $ | 2,276,586 | | | $ | 66,054 | | | $ | 3,600,015 | |

| Gross profit | $ | 207,443 | | | $ | 310,170 | | | $ | 253,612 | | | $ | 26,848 | | | $ | 798,073 | |

| 58.1 | % | | 34.4 | % | | 11.1 | % | | 40.6 | % | | 22.2 | % |

| Fuel gallons sold | | | | | 694,989 | | | | | |

| Three months ended April 30, 2023 | | | | | | | | | |

| Revenue | $ | 314,222 | | | $ | 809,838 | | | $ | 2,137,815 | | | $ | 66,826 | | | $ | 3,328,701 | |

| Gross profit | $ | 178,580 | | | $ | 266,969 | | | $ | 219,746 | | | $ | 22,457 | | | $ | 687,752 | |

| 56.8 | % | | 33.0 | % | | 10.3 | % | | 33.6 | % | | 20.7 | % |

| Fuel gallons sold | | | | | 635,916 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Summary by Category (Amounts in thousands) |

| Twelve months ended April 30, 2024 | Prepared Food

& Dispensed Beverage | Grocery & General

Merchandise | | | Fuel | | Other | | Total |

| Revenue | $ | 1,461,600 | | $ | 3,727,394 | | | | $ | 9,402,071 | | | $ | 271,848 | | | $ | 14,862,913 | |

| Gross profit | $ | 858,295 | | $ | 1,270,527 | | | | $ | 1,116,671 | | | $ | 102,418 | | | $ | 3,347,911 | |

| 58.7 | % | 34.1 | % | | | 11.9 | % | | 37.7 | % | | 22.5 | % |

| Fuel gallons sold | | | | | 2,828,669 | | | | | |

| Twelve months ended April 30, 2023 | | | | | | | | | |

| Revenue | $ | 1,322,560 | | $ | 3,445,777 | | | | $ | 10,027,310 | | | $ | 298,828 | | | $ | 15,094,475 | |

| Gross profit | $ | 748,405 | | $ | 1,156,451 | | | | $ | 1,074,913 | | | $ | 92,637 | | | $ | 3,072,406 | |

| 56.6 | % | 33.6 | % | | | 10.7 | % | | 31.0 | % | | 20.4 | % |

| Fuel gallons sold | | | | | 2,672,366 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Prepared Food & Dispensed Beverage | | Prepared Food & Dispensed Beverage |

| Same-store Sales | Margin |

| | Q1 | | Q2 | | Q3 | | Q4 | | Fiscal

Year | | Q1 | | Q2 | | Q3 | | Q4 | | Fiscal

Year |

| F2024 | 5.9 | % | | 6.1 | % | | 7.5 | % | | 8.8 | % | | 6.8 | % | F2024 | 58.2 | % | | 59.0 | % | | 59.6 | % | | 58.1 | % | | 58.7 | % |

| F2023 | 8.4 | | | 10.5 | | | 5.0 | | | 4.9 | | | 7.1 | | F2023 | 55.6 | | | 56.7 | | | 57.3 | | | 56.8 | | | 56.6 | |

| F2022 | 10.8 | | | 4.1 | | | 7.4 | | | 7.6 | | | 7.4 | | F2022 | 61.0 | | | 60.6 | | | 58.0 | | | 56.9 | | | 59.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Grocery & General Merchandise | | Grocery & General Merchandise |

| Same-store Sales | Margin |

| | Q1 | | Q2 | | Q3 | | Q4 | | Fiscal

Year | | Q1 | | Q2 | | Q3 | | Q4 | | Fiscal

Year |

| F2024 | 5.2 | % | | 1.7 | % | | 2.8 | % | | 4.3 | % | | 3.5 | % | F2024 | 34.1 | % | | 34.0 | % | | 33.9 | % | | 34.4 | % | | 34.1 | % |

| F2023 | 5.5 | | | 6.9 | | | 5.8 | | | 7.1 | | | 6.3 | | F2023 | 33.9 | | | 33.3 | | | 34.0 | | | 33.0 | | | 33.6 | |

| F2022 | 7.0 | | | 6.8 | | | 7.7 | | | 4.3 | | | 6.3 | | F2022 | 33.0 | | | 33.3 | | | 32.0 | | | 32.5 | | | 32.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fuel Gallons | | Fuel Margin |

| Same-store Sales | (Cents per gallon, excluding credit card fees) |

| | Q1 | | Q2 | | Q3 | | Q4 | | Fiscal

Year | | Q1 | | Q2 | | Q3 | | Q4 | | Fiscal

Year |

| F2024 | 0.4 | % | | — | % | | (0.4) | % | | 0.9 | % | | 0.1 | % | F2024 | 41.6 | ¢ | | 42.3 | ¢ | | 37.3 | ¢ | | 36.5 | ¢ | | 39.5 | ¢ |

| F2023 | (2.3) | | | 0.3 | | | (0.5) | | | — | | | (0.8) | | F2023 | 44.7 | | | 40.5 | | | 40.7 | | | 34.6 | | | 40.2 | |

| F2022 | 9.0 | | | 2.5 | | | 5.7 | | | 1.5 | | | 4.4 | | F2022 | 35.1 | | | 34.7 | | | 38.3 | | | 36.2 | | | 36.0 | |

RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA

We define EBITDA as net income before net interest expense, income taxes, depreciation and amortization. Adjusted EBITDA further adjusts EBITDA by excluding the gain or loss on disposal of assets as well as impairment charges. Neither EBITDA nor Adjusted EBITDA are considered GAAP measures, and should not be considered as a substitute for net income, cash flows from operating activities or other income or cash flow statement data. These measures have limitations as analytical tools, and should not be considered in isolation or as substitutes for analysis of our results as reported under GAAP. We strongly encourage investors to review our financial statements and publicly filed reports in their entirety and not to rely on any single financial measure.

We believe EBITDA and Adjusted EBITDA are useful to investors in evaluating our operating performance because securities analysts and other interested parties use such calculations as a measure of financial performance and debt service capabilities, and they are regularly used by the Company for internal purposes including our capital budgeting process, evaluating acquisition targets, assessing performance, and awarding incentive compensation.

Because non-GAAP financial measures are not standardized, EBITDA and Adjusted EBITDA, as defined by us, may not be comparable to similarly titled measures reported by other companies. It therefore may not be possible to compare our use of these non-GAAP financial measures with those used by other companies.

The following table contains a reconciliation of net income to EBITDA and Adjusted EBITDA for the three and twelve months ended April 30, 2024 and 2023: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Three Months Ended April 30, | | Twelve Months Ended April 30, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Net income | $ | 87,020 | | | $ | 56,092 | | | $ | 501,972 | | | $ | 446,691 | | | | | |

| Interest, net | 14,494 | | | 12,800 | | | 53,441 | | | 51,815 | | | | | |

| Depreciation and amortization | 92,344 | | | 80,631 | | | 349,797 | | | 313,131 | | | | | |

| Federal and state income taxes | 25,168 | | | 16,500 | | | 154,188 | | | 140,827 | | | | | |

| EBITDA | $ | 219,026 | | | $ | 166,023 | | | $ | 1,059,398 | | | $ | 952,464 | | | | | |

| Loss on disposal of assets and impairment charges | 5,522 | | | 894 | | | 6,414 | | | 6,871 | | | | | |

| Adjusted EBITDA | $ | 224,548 | | | $ | 166,917 | | | $ | 1,065,812 | | | $ | 959,335 | | | | | |

NOTES:

•Gross Profit is defined as revenue less cost of goods sold (exclusive of depreciation and amortization)

•Inside is defined as the combination of Grocery and General Merchandise and Prepared Food and Dispensed Beverage

This release contains statements that may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including those related to expectations for future periods, possible or assumed future results of operations, financial conditions, liquidity and related sources or needs, business and/or integration strategies, plans and synergies, supply chain, growth opportunities, performance at our stores. There are a number of known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from any results expressed or implied by these forward-looking statements, including but not limited to the execution of our strategic plan, the integration and financial performance of acquired stores, wholesale fuel, inventory and ingredient costs, distribution challenges and disruptions, the impact and duration of the conflict in Ukraine or other geopolitical disruptions, as well as other risks, uncertainties and factors which are described in the Company’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q, as filed with the Securities and Exchange Commission and available on our website. Any forward-looking statements contained in this release represent our current views as of the date of this release with respect to future events, and Casey’s disclaims any intention or obligation to update or revise any forward-looking statements in the release whether as a result of new information, future events, or otherwise.

Corporate information is available at this website: https://www.caseys.com. Earnings will be reported during a conference call on June 12, 2024. The call will be broadcast live over the Internet at 7:30 a.m. CDT. To access the call, go to the Events and Presentations section of our website at https://investor.caseys.com/events-and-presentations/default.aspx. No access code is required. A webcast replay of the call will remain available in an archived format on the Events and Presentations section of our website at https://investor.caseys.com/events-and-presentations/default.aspx for one year after the call.

| | | | | |

| Investor Relations Contact: | Media Relations Contact: |

| Brian Johnson (515) 446-6587 | Katie Petru (515) 446-6772 |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

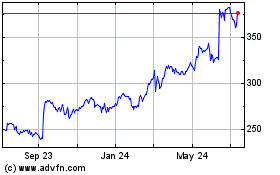

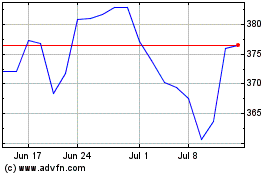

Caseys General Stores (NASDAQ:CASY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Caseys General Stores (NASDAQ:CASY)

Historical Stock Chart

From Nov 2023 to Nov 2024