Calamos Convertible Opportunities and Income Fund (the "Fund")

Supplement dated June 1, 2022 to the Fund's Prospectus dated March 1, 2021, as supplemented from time

to time and to the Fund's Statement of Information ("SAI") dated March 1, 2021, as supplemented from

time to time

I. Recent Developments — Mandatory Redeemable Preferred Shares

The delayed funding date for Series E mandatory redeemable preferred shares ("MRP Shares") occurred on May 24, 2022. The issuance includes 1,330,000 Series E MRP Shares, with an aggregate liquidation preference of $33,250,000 and a mandatory redemption date of May 24, 2027. The Series E MRP Shares are to pay monthly cash dividends initially at the rate of 2.68%, subject to adjustment under certain circumstances.

Additional updated information regarding the Fund's Series E MRP Shares is included in the restated disclosures set forth below.

Revised Disclosure Related to Series E MRP Shares

In accordance with the above, the Fund's Prospectus, SAI and Prospectus Supplement are hereby amended as follows:

The section titled "Capitalization" beginning on page SUP-3 of the Prospectus Supplement is deleted in its entirety and replaced with the following:

CAPITALIZATION

The Fund may offer and sell up to 7,098,784 of our common shares, no par value per share, from time to time through the Sub-Placement Agent as sub-placement agent under this prospectus supplement and the accompanying prospectus. There is no guarantee that there will be any sales of our common shares pursuant to this prospectus supplement and the accompanying prospectus. The table below assumes that we will sell 7,098,784 common shares (the number of common shares remaining to be sold under the current sales agreement as of May 24, 2022) at a price of $11.36 per share (the last reported sale price per share of our common shares on Nasdaq on May 24, 2022). The table below shows our historical capitalization as of April 30, 2022 and the estimated capitalization of the Fund assuming the sale of all 7,098,784 common shares that are subject to the sales agreement at a price of $11.36 per share, the last reported sales price per share of our common shares, on a pro forma, as adjusted basis as of May 24, 2022. Actual sales, if any, of the Fund's common shares under this prospectus supplement and accompanying prospectus may be different than as set forth in the table below. In addition, the price per share of any such sale may be greater or less than $11.36 per share, depending on the market price of the Fund's common shares at the time of any such sale and/or the Fund's net asset value ("NAV") for purposes of calculating the Minimum Price. The Fund and the Distributor will determine whether any sales of the Fund's common shares will be authorized on a particular day; the Fund and the Distributor, however, will not authorize sales of the Fund's common shares if the per share price of the shares is less than the Minimum Price. The Fund and the Distributor may elect not to authorize sales of the Fund's common shares on a particular day even if the per share price of the shares is equal to or greater than the Minimum Price, or may only authorize a fixed number of shares to be sold on any particular day. The Fund and the Distributor will have full discretion regarding whether sales of Fund common shares will be authorized on a particular day and, if so, in what amounts.

The following table sets forth our capitalization:

• on an actual basis as of April 30, 2022

• on a pro forma as further adjusted basis to reflect (1) the assumed sale of 7,098,784 of our common shares at $11.36 per share (the last reported sale price of our common shares on NASDAQ on May 24, 2022) in an offering under this prospectus supplement and the issuance 7,098,784 of our common shares through

SUP-1

the Fund's dividend reinvestment plan, (2) the investment of net proceeds assumed from such offerings in accordance with our investment objections and policies, after deducting assumed aggregate commission of $74,771 (representing an estimated commission of 1% the gross sales price in connection with sale of common shares), and (3) the issuance of $33,250,000 of Mandatory Redeemable Preferred Shares on May 24, 2022.

|

|

|

Actual |

|

As Adjusted |

|

|

Loans(1) |

|

$ |

156,000,000 |

|

|

$ |

201,000,000 |

|

|

|

Preferred Shares |

|

|

133,00,000 |

|

|

|

166,250,000 |

|

|

Common shares, no par value per share, unlimited shares

authorized, 157,874,945 outstanding (actual) and 186,956,985

shares outstanding (as further adjusted) |

|

|

811,822,608 |

|

|

|

900,921,223 |

|

|

|

Accumulated distributable earnings (loss) |

|

|

60,827,255 |

|

|

|

60,827,255 |

|

|

|

Net assets applicable to common shareholders |

|

|

872,649,863 |

|

|

|

961,748,478 |

|

|

|

Total Capitalization |

|

$ |

1,005,649,863 |

|

|

$ |

1,328,998,478 |

|

|

(1) Figures do not reflect additional structural leverage related to certain securities lending programs, which were $243 million and $165 million as of April 30, 2022 and May 24, 2022, respectively.

The section titled "Summary of Fund Expenses" beginning on page SUP-4 of the Prospectus Supplement is deleted in its entirety and replaced with the following:

SUMMARY OF FUND EXPENSES

The following table and example contain information about the costs and expenses that common shareholders will bear directly or indirectly. In accordance with Commission requirements, the table below shows our expenses, including interest payments on borrowed funds, as a percentage of our average net assets as of May 24, 2022, and not as a percentage of gross assets or managed assets.

By showing expenses as a percentage of average net assets, expenses are not expressed as a percentage of all of the assets we invest. The table and example are based on our capital structure as of May 24, 2022. As of May 24, 2022, we had $201 million in borrowings outstanding, $166 million in outstanding preferred shares and additional structural leverage of $165 million, collectively representing 40.2% of managed assets as of that date.

|

Shareholder Transaction Expenses |

|

|

Sales Load (as a percentage of offering price) |

|

|

1.00 |

%(1) |

|

|

Offering Expenses Borne by the Fund (as a percentage of offering price) |

|

|

— |

%(2) |

|

|

Dividend Reinvestment Plan Fees (per sales transaction fee)(3) |

|

|

$15.00 |

|

|

|

Annual Expenses |

|

Percentage of Average Net

Assets Attributable to

Common Shareholders |

|

|

Management Fee(4) |

|

|

1.23 |

% |

|

|

Interest Payments on Borrowed Funds(5) |

|

|

0.22 |

% |

|

|

Preferred Stock Dividend Payments(6) |

|

|

0.42 |

% |

|

|

Other Expenses(7) |

|

|

0.17 |

% |

|

|

Total Annual Expenses |

|

|

2.04 |

% |

|

SUP-2

Example:

The following example illustrates the expenses that common shareholders would pay on a $1,000 investment in common shares, assuming (1) net annual expenses of 2.04% of net assets attributable to common shareholders; (2) a 5% annual gross return; and (3) all distributions are reinvested at net asset value:

|

|

|

1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

|

|

Total Expenses Paid by Common Shareholders(8) |

|

$ |

31 |

|

|

$ |

74 |

|

|

$ |

119 |

|

|

$ |

245 |

|

|

The example should not be considered a representation of future expenses. Actual expenses may be greater or less than those assumed. Moreover, our actual rate of return may be greater or less than the hypothetical 5% return shown in the example.

(1) Represents the estimated commission with respect to the Fund's common shares being sold in this offering. There is no guarantee that there will be any sales of the Fund's common shares pursuant to this prospectus supplement and the accompanying prospectus. Actual sales of the Fund's common shares under this prospectus supplement and the accompanying prospectus, if any, may be less than as set forth under "Capitalization" above. In addition, the price per share of any such sale may be greater or less than the price set forth under "Capitalization" above, depending on the market price of the Fund's common shares at the time of any such sale.

(2) Calamos will pay the expenses of the offering (other than the applicable commissions). However, Calamos may recapture from the Fund previously paid offering expenses in an amount up to $200,000 per each 12-month period of the three-year duration of the offering beginning March 1, 2019, provided that the Fund has made sales resulting in net proceeds of $5 million from the offering during that 12-month period. In the event that the Fund does not achieve sales resulting in net proceeds of $5 million from the offering in that 12-month period, the $200,000 recapture amount will carry forward and be added to the total amount that Calamos can recapture from the Fund in the next 12-month period. The maximum amount that Calamos can recapture from the Fund during the duration of the offering is $600,000. The arrangement is hereinafter referred to as the "recapture provision." As of the date of this prospectus supplement and the accompanying prospectus, Calamos will pay all of the expenses associated with the offering (other than the applicable commissions). If the recapture provision is triggered in the future, such expenses that will be borne by Fund shareholders will be set forth in the "Shareholder Transaction Expenses" table above.

(3) Shareholders will pay a $15.00 transaction fee plus a $0.02 per share brokerage charge if they direct Computershare Shareowner Services LLC (the "Plan Agent") to sell common shares held in an account of the Fund's Automatic Dividend Reinvestment Plan (the "Plan"). In addition, each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent's open-market purchases in connection with the reinvestment of dividends or distributions. If a participant elects to have the Plan Agent sell part or all of his or her common shares and remit the proceeds, such participant will be charged his or her pro rata share of brokerage commissions on the shares sold. See "Dividends and Distributions on Common Shares; Automatic Dividend Reinvestment Plan" on page 78 of the accompanying prospectus.

(4) The Fund pays Calamos an annual management fee, payable monthly in arrears, for its investment management services in an amount equal to 0.80% of the Fund's average weekly managed assets. In accordance with the requirements of the Commission, the table above shows the Fund's management fee as a percentage of average net assets attributable to common shareholders. By showing the management fee as a percentage of net assets, the management fee is not expressed as a percentage of all of the assets the Fund intends to invest. For purposes of the table, the management fee has been converted to 1.23% of the Fund's average weekly net assets as of May 24, 2022 by dividing the total dollar amount of the management fee by the Fund's average weekly net assets (managed assets less outstanding leverage).

(5) Reflects interest expense paid on $169 million in average borrowings under the Fund's Amended and Restated Liquidity Agreement with State Street Bank and Trust Company, plus $230 million in additional average structural leverage related to certain securities lending programs, as described in the accompanying prospectus under "Leverage."

SUP-3

(6) Reflects estimated dividend expense on $133 million aggregate liquidation preference of mandatory redeemable preferred shares ("MRP Shares" or "MRPS") outstanding. See "Prospectus Summary — Use of Leverage by the Fund" and "Leverage" in the accompanying prospectus for additional information.

(7) "Other Expenses" are based on estimated amounts for the Fund's current fiscal year.

(8) The example includes sales load and estimated offering costs.

The third, fourth and fifth sentences of the first paragraph of the section titled "Prospectus Summary — The Fund" beginning on page 1 of the Prospectus are deleted in their entirety and replaced with the following:

As of May 24, 2022, we had $1.3 billion of total managed assets, including $166 million of outstanding mandatory redeemable preferred shares ("MRP Shares" or "MRPS"). As of May 24, 2022, the Fund had utilized $366 million of the $430 million available under the Amended and Restated Liquidity Agreement (the "SSB Agreement") with State Street Bank and Trust Company ("SSB" or "State Street") ($201 million of borrowings outstanding, and $165 million in structural leverage consisting of collateral received from SSB in connection with securities on loan), representing 27.6% of the Fund's managed assets as of that date, and had $ 166 million of MRP Shares outstanding, representing 12.5% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRP Shares represented 40.2% of the Fund's managed assets.

II. Further Revisions to Disclosure

All disclosure in the Fund's Prospectus, SAI and Prospectus Supplement not specifically referenced above is hereby amended to the extent necessary to conform to the information provided in this supplement.

Please retain this supplement for future reference.

SUP-4

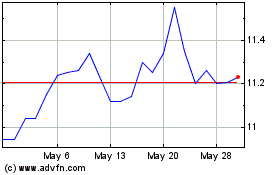

Calamos Convertible Oppo... (NASDAQ:CHI)

Historical Stock Chart

From Jun 2024 to Jul 2024

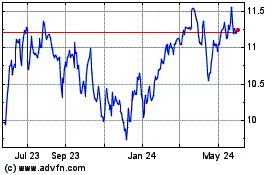

Calamos Convertible Oppo... (NASDAQ:CHI)

Historical Stock Chart

From Jul 2023 to Jul 2024