falseUSD0001546417iso4217:USDxbrli:shares00015464172025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) February 26, 2025

BLOOMIN’ BRANDS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35625 | 20-8023465 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

2202 North West Shore Boulevard, Suite 500, Tampa, FL 33607

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (813) 282-1225

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | $0.01 par value

| | BLMN | | The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 26, 2025, Bloomin’ Brands, Inc. issued a press release reporting its financial results for the thirteen weeks ended December 29, 2024. A copy of the release is attached as Exhibit 99.1.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | | | | |

| | Exhibit Number | | Description |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | BLOOMIN’ BRANDS, INC. |

| | | (Registrant) |

| | | |

| Date: | February 26, 2025 | By: | /s/ W. Michael Healy |

| | | W. Michael Healy |

| | | Executive Vice President and Chief Financial Officer

(Principal Financial Officer) |

| | | | | | | | | | | | | | |

| | NEWS |

| Exhibit 99.1 |

| | | |

| Tara Kurian | | |

| VP, Corporate Finance and Investor Relations | | |

| (813) 830-5311 | | |

Bloomin’ Brands Announces 2024 Q4 Financial Results

Q4 Diluted EPS of $(0.93) and Q4 Adjusted Diluted EPS of $0.38

Provides Full Year 2025 Financial Outlook

TAMPA, Fla., February 26, 2025 - Bloomin’ Brands, Inc. (Nasdaq: BLMN) today reported results for the fourth quarter 2024 (“Q4 2024”) and fiscal year ended December 29, 2024 (“Fiscal Year 2024”) compared to the fourth quarter 2023 (“Q4 2023”) and the fiscal year ended December 31, 2023 (“Fiscal Year 2023”). In 2023, the fourth quarter and fiscal year included an additional operating week (“53rd week”) compared to Fiscal Year 2024.

CEO Comments

“In my first six months, I have become even more confident that we have iconic brands with a strong right to succeed in on-trend, large scale categories,” said Mike Spanos, CEO. “I am also aware that our current results are not what we expect and are not representative of our potential. We are making changes to address our near-term execution as well as drive sustainable sales and profit growth. Our guidance for the first quarter and full year is reflective of where we are and our go-forward short term performance.”

Sale of Majority Ownership of our Brazil Operations

On December 30, 2024, we completed the sale of 67% of our Brazil operations to a fund managed by an affiliate of Vinci Partners and retained a 33% interest. Following the closing of the sale, our subsidiary entered into amended and restated franchise agreements with all existing restaurants in Brazil, and these Brazil restaurants began operating as unconsolidated franchises.

Diluted EPS and Adjusted Diluted EPS

The following tables reconcile Diluted (loss) earnings per share to Adjusted diluted earnings per share consolidated and from continuing operations for the periods indicated (unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4 | | | | | | FISCAL YEAR | | | | |

| Consolidated: | 2024 | | 2023 | | CHANGE | | | | 2024 | | 2023 | | CHANGE | | |

| Diluted (loss) earnings per share | $ | (0.93) | | | $ | 0.45 | | | $ | (1.38) | | | | | $ | (1.49) | | | $ | 2.56 | | | $ | (4.05) | | | |

| Adjustments (1) | 1.31 | | | 0.26 | | | 1.05 | | | | | 3.28 | | | 0.22 | | | 3.06 | | | |

| Adjusted diluted earnings per share (1) | 0.38 | | | 0.71 | | | (0.33) | | | | | 1.79 | | | 2.78 | | | (0.99) | | | |

| Remove Fiscal 2023 53rd Week Impact (2) | — | | | (0.15) | | | 0.15 | | | | | — | | | (0.15) | | | 0.15 | | | |

| Adjusted diluted earnings per share on a comparable period basis (2) | $ | 0.38 | | | $ | 0.56 | | | $ | (0.18) | | | | | $ | 1.79 | | | $ | 2.63 | | | $ | (0.84) | | | |

| | | | | | | | | | | | | | | |

| Continuing operations: | | | | | | | | | | | | | | | |

| Diluted earnings (loss) per share | $ | 0.12 | | | $ | 0.37 | | | $ | (0.25) | | | | | $ | (0.61) | | | $ | 2.13 | | | $ | (2.74) | | | |

| Adjustments | 0.10 | | | 0.26 | | | (0.16) | | | | | 2.06 | | | 0.25 | | | 1.81 | | | |

| Adjusted diluted earnings per share | $ | 0.22 | | | $ | 0.63 | | | $ | (0.41) | | | | | $ | 1.45 | | | $ | 2.38 | | | $ | (0.93) | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

___________________

(1)Adjusted diluted earnings per share for Q4 and fiscal year 2023 have been recast to remove the previously included non-GAAP adjustment of 5.1 million diluted weighted average common shares outstanding related to the convertible note hedge contracts entered into at the issuance of the 2025 Notes. See non-GAAP Measures later in this release. Also see Tables Four, Five and Six for details regarding the nature of diluted earnings per share adjustments for the periods presented.

(2)The 53rd week of 2023 was estimated to have positively impacted both GAAP and adjusted diluted earnings per share by approximately $0.15 for both the Q4 2023 and Fiscal Year 2023. For comparability, we have presented adjusted diluted earnings per share excluding the impact of the 53rd week of December 25, 2023 to December 31, 2023.

Fourth Quarter Financial Results

The financial results presented below include both continuing operations and consolidated operations, inclusive of our Brazil operations which were classified as discontinued operations during Q4 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONTINUING OPERATIONS | | CONSOLIDATED | | | | |

| (dollars in millions, unaudited) | Q4 2024 | | Q4 2023 | | CHANGE | | Q4 2024 | | Q4 2023 | | CHANGE | | | | |

| Total revenues (1) | $ | 972.0 | | | $ | 1,071.7 | | | (9.3) | % | | $ | 1,096.8 | | | $ | 1,194.2 | | | (8.2) | % | | | | |

| | | | | | | | | | | | | | | |

| GAAP operating income margin | 1.7 | % | | 4.6 | % | | (2.9) | % | | (3.6) | % | | 4.8 | % | | (8.4) | % | | | | |

| Adjusted operating income margin (2) | 3.5 | % | | 7.7 | % | | (4.2) | % | | 4.4 | % | | 7.5 | % | | (3.1) | % | | | | |

| | | | | | | | | | | | | | | |

| Restaurant-level operating margin (2) | 12.4 | % | | 15.9 | % | | (3.5) | % | | 13.8 | % | | 16.4 | % | | (2.6) | % | | | | |

| Adjusted restaurant-level operating margin (2) | 12.4 | % | | 15.3 | % | | (2.9) | % | | 13.8 | % | | 15.9 | % | | (2.1) | % | | | | |

___________________(1)Q4 2023 includes $83.5 million from the 53rd week.

(2)See non-GAAP Measures later in this release. Also see Tables Four and Five for details regarding the nature of restaurant-level operating margin and operating income margin adjustments, respectively.

•The decrease in Total revenues from continuing operations was primarily due to the 53rd week included in 2023 and the net impact of restaurant closures and openings.

•GAAP operating income margin from continuing operations decreased from Q4 2023 primarily due to a decrease in restaurant-level operating margin, as detailed below, higher depreciation and amortization expense and impairment and closure costs. These decreases are partially offset by gains on foreign currency forward contracts within general and administrative expense.

•Restaurant-level operating margin from continuing operations decreased from Q4 2023 primarily due to: (i) lower revenues, as discussed above, (ii) higher labor, operating and commodity costs, primarily due to inflation, (iii) higher insurance and legal expense, primarily from lapping favorable 2023 settlements and (iv) higher advertising expense. These decreases were partially offset by an increase in average check per person and the impact of certain cost-saving and productivity initiatives.

•Adjusted income from operations from continuing operations primarily excludes certain net impairment and closure costs for Q4 2024 and Q4 2023, and gains on foreign currency forward contracts for Q4 2024.

Fourth Quarter Comparable Restaurant Sales

| | | | | | | | | | | |

| THIRTEEN WEEKS ENDED DECEMBER 29, 2024 | | COMPANY-OWNED |

| Comparable restaurant sales (stores open 18 months or more): | | | | | |

U.S. (1) | | | | | |

| Outback Steakhouse | | (1.8) | % | | | |

| Carrabba’s Italian Grill | | (0.9) | % | | | |

| Bonefish Grill | | (1.5) | % | | | |

| Fleming’s Prime Steakhouse & Wine Bar | | 3.0 | % | | | |

| Combined U.S. | | (1.1) | % | | | |

| | | | | |

| | | | | |

| | | | | |

___________________

(1)For Q4 2024, comparable restaurant sales compare the thirteen weeks from September 30, 2024 through December 29, 2024 to the thirteen weeks from October 2, 2023 through December 31, 2023. See Table Nine for details regarding our fiscal and comparable basis calendars.

Dividend Declaration and Share Repurchases

On February 12, 2025, our Board of Directors declared a quarterly cash dividend of $0.15 per share, payable on March 26, 2025 to stockholders of record at the close of business on March 11, 2025.

We repurchased 10.1 million shares for a total of $265.7 million during 2024 and have $96.8 million of share repurchase authorization remaining under the 2024 Share Repurchase Program.

Fiscal 2025 Financial Outlook

The tables below present our expectations for selected 2025 financial and operating results from continuing operations.

| | | | | | | | | | |

| Financial Results: | | 2025 Guidance | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| U.S. comparable restaurant sales | | (2.0%) to Flat | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Diluted earnings per share (1) | | $1.08 to $1.28 | | |

| | | | |

Adjusted diluted earnings per share (1)(2) | | $1.20 to $1.40 | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Effective income tax rate | | Close to 0% | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other Selected Financial Data: | | 2025 Guidance | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Commodity inflation | | 2.5% to 3.5% | | |

| | | | |

Labor Inflation | | 4% to 5% | | |

| | | | |

| Capital expenditures | | $190M to $210M | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Number of new company-owned restaurants | | 18 to 20 | | |

| | | | |

| Number of new franchised restaurants | | Approximately 30 | | |

___________________

(1)Assumes diluted weighted average shares of 85 to 86 million.

(2)Includes estimated adjustments related to the workforce reduction announced on February 20, 2025 and the cost of executing the foreign currency forward contracts entered into as part of the Brazil transaction.

Q1 2025 Financial Outlook

The table below presents our expectations for selected fiscal Q1 2025 financial operating results from continuing operations.

| | | | | | | | | | | | | |

| Financial Results: | | | | | | Q1 2025 Outlook | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| U.S. comparable restaurant sales | | | | | | (1.5%) to (0.5%) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Diluted earnings per share (1) | | | | | | $0.48 to $0.53 | |

| | | | | | | |

Adjusted diluted earnings per share (1)(2) | | | | | | $0.55 to $0.60 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

___________________

(1)Assumes diluted weighted average shares of approximately 85 million.

(2)Includes estimated adjustments related to the workforce reduction announced on February 20, 2025 and the cost of executing the foreign currency forward contracts entered into as part of the Brazil transaction.

Conference Call

The Company will host a conference call today, February 26, 2025 at 8:30 AM EST. The conference call will be webcast live from the Company’s website at http://www.bloominbrands.com under the Investors section. A replay of this webcast will be available on the Company’s website after the call.

About Bloomin’ Brands, Inc.

Bloomin’ Brands, Inc. is one of the largest casual dining restaurant companies in the world with a portfolio of leading, differentiated restaurant concepts. The Company’s restaurant portfolio includes Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill and Fleming’s Prime Steakhouse & Wine Bar. The Company owns, operates and franchises more than 1,450 restaurants in 46 states, Guam and 12 countries. For more information, please visit www.bloominbrands.com.

Non-GAAP Measures

In addition to the results provided in accordance with GAAP, this press release and related tables include certain non-GAAP measures, which present operating results on an adjusted basis. These are supplemental measures of performance that are not required by or presented in accordance with GAAP and include: (i) Restaurant-level operating income, adjusted restaurant-level operating income and their corresponding margins, (ii) Adjusted income from operations and the corresponding margin, (iii) Adjusted segment income from operations and the corresponding margin, (iv) Adjusted net income and (v) Adjusted diluted earnings per share.

Restaurant-level operating margin is a non-GAAP financial measure widely regarded in the industry as a useful metric to evaluate restaurant-level operating efficiency and performance of ongoing restaurant-level operations, and we use it for these purposes.

We believe that our use of non-GAAP financial measures permits investors to assess the operating performance of our business relative to our performance based on GAAP results and relative to other companies within the restaurant industry by isolating the effects of certain items that may vary from period to period without correlation to core operating performance or that vary widely among similar companies. However, our inclusion of these adjusted measures should not be construed as an indication that our future results will be unaffected by unusual or infrequent items or that the items for which we have made adjustments are unusual or infrequent or will not recur. We believe that the disclosure of these non-GAAP measures is useful to investors as they form part of the basis for how our management team and Board of Directors evaluate our operating performance, allocate resources and administer employee incentive plans.

These non-GAAP financial measures are not intended to replace GAAP financial measures, and they are not necessarily standardized or comparable to similarly titled measures used by other companies. We maintain internal guidelines with respect to the types of adjustments we include in our non-GAAP measures. These guidelines endeavor to differentiate between types of gains and expenses that are reflective of our core operations in a period, and those that may vary from period to period without correlation to our core performance in that period. However, implementation of these guidelines necessarily involves the application of judgment, and the treatment of any items not directly addressed by, or changes to, our guidelines will be considered by our disclosure committee. You should refer to the reconciliations of non-GAAP measures in Tables Four, Five and Six included later in this release for descriptions of the actual adjustments made in the current period and the corresponding prior period.

Forward-Looking Statements

Certain statements contained herein, including statements under the headings “CEO Comments”, “Fiscal 2025 Financial Outlook” and “Q1 2025 Financial Outlook” are not based on historical fact and are “forward-looking statements” within the meaning of applicable securities laws. Generally, these statements can be identified by the use of words such as “guidance,” “believes,” “estimates,” “anticipates,” “expects,” “on track,” “feels,” “forecasts,” “seeks,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “could,” “would” and similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from the Company’s forward-looking statements. These risks and uncertainties include, but are not limited to: consumer reaction to public health and food safety issues; increases in labor costs and fluctuations in the availability of employees; increases in unemployment rates and taxes; competition; interruption or breach of our systems or loss of consumer or employee information; price and availability of commodities and other impacts of inflation; our dependence on a limited number of suppliers and distributors; political, social and legal conditions in international markets and their effects on foreign operations and foreign currency exchange rates; the impacts of our operations in Brazil as a minority investor and franchisor following our recent sale transaction on our results; our ability to address corporate citizenship and sustainability matters and investor expectations; local, regional, national and international economic conditions; changes in patterns of consumer traffic, consumer tastes and dietary habits; the effects of changes in tax laws; costs, diversion of management attention and reputational damage from any claims or litigation; government actions and policies; challenges associated with our remodeling, relocation and expansion plans; our ability to preserve the value of and grow our brands; consumer confidence and spending patterns; the effects of a health

pandemic, weather, acts of God and other disasters and the ability or success in executing related business continuity plans; the Company’s ability to make debt payments and planned investments and the Company’s compliance with debt covenants; the cost and availability of credit; interest rate changes; and any impairments in the carrying value of goodwill and other assets. Further information on potential factors that could affect the financial results of the Company and its forward-looking statements is included in its most recent Form 10-K and subsequent filings with the Securities and Exchange Commission. The Company assumes no obligation to update any forward-looking statement, except as may be required by law. These forward-looking statements speak only as of the date of this release. All forward-looking statements are qualified in their entirety by this cautionary statement.

Note: Numerical figures included in this release have been subject to rounding adjustments.

| | | | | | | | | | | | | | | | | | | | | | | |

| TABLE ONE |

| BLOOMIN’ BRANDS, INC. |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

|

|

| THIRTEEN WEEKS ENDED | | FOURTEEN WEEKS ENDED | | FISCAL YEAR |

| DECEMBER 29, 2024 | | DECEMBER 31, 2023 | | 2024 | | 2023 |

| (in thousands, except per share data) | (UNAUDITED) | | (UNAUDITED) | | (UNAUDITED) | | |

| Revenues | | | | | | | |

| Restaurant sales | $ | 952,091 | | | $ | 1,048,590 | | | $ | 3,866,344 | | | $ | 4,077,789 | |

| Franchise and other revenues | 19,929 | | | 23,124 | | | 84,131 | | | 90,371 | |

| Total revenues | 972,020 | | | 1,071,714 | | | 3,950,475 | | | 4,168,160 | |

| Costs and expenses | | | | | | | |

| Food and beverage | 276,239 | | | 310,822 | | | 1,147,859 | | | 1,240,485 | |

| Labor and other related | 301,170 | | | 316,323 | | | 1,202,520 | | | 1,219,839 | |

| Other restaurant operating | 256,408 | | | 254,818 | | | 1,001,034 | | | 988,668 | |

| Depreciation and amortization | 45,146 | | | 42,936 | | | 175,580 | | | 169,266 | |

| General and administrative | 43,723 | | | 62,784 | | | 219,383 | | | 233,559 | |

| Provision for impaired assets and restaurant closings | 33,137 | | | 34,431 | | | 64,291 | | | 33,574 | |

| | | | | | | |

| Total costs and expenses | 955,823 | | | 1,022,114 | | | 3,810,667 | | | 3,885,391 | |

| Income from operations | 16,197 | | | 49,600 | | | 139,808 | | | 282,769 | |

| Loss on extinguishment of debt | — | | | — | | | (136,022) | | | — | |

| | | | | | | |

| | | | | | | |

| Interest expense, net | (17,138) | | | (13,928) | | | (62,593) | | | (51,582) | |

| (Loss) income before (benefit) provision for income taxes | (941) | | | 35,672 | | | (58,807) | | | 231,187 | |

| (Benefit) provision for income taxes | (13,526) | | | (2,352) | | | (12,134) | | | 18,402 | |

| Net income (loss) from continuing operations | 12,585 | | | 38,024 | | | (46,673) | | | 212,785 | |

| Net (loss) income from discontinued operations, net of tax | (90,122) | | | 7,529 | | | (75,982) | | | 41,629 | |

| Net (loss) income | (77,537) | | | 45,553 | | | (122,655) | | | 254,414 | |

| Less: net income attributable to noncontrolling interests | 1,924 | | | 2,283 | | | 5,363 | | | 7,028 | |

Net (loss) income attributable to Bloomin’ Brands | $ | (79,461) | | | $ | 43,270 | | | $ | (128,018) | | | $ | 247,386 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Basic earnings (loss) per share: | | | | | | | |

| Continuing operations | $ | 0.13 | | | $ | 0.41 | | | $ | (0.61) | | | $ | 2.36 | |

| Discontinued operations | (1.06) | | | 0.09 | | | (0.88) | | | 0.48 | |

| Net basic (loss) earnings per share | $ | (0.94) | | | $ | 0.50 | | | $ | (1.49) | | | $ | 2.84 | |

| | | | | | | |

Diluted earnings (loss) per share: | | | | | | | |

| Continuing operations | $ | 0.12 | | | $ | 0.37 | | | $ | (0.61) | | | $ | 2.13 | |

| Discontinued operations | (1.05) | | | 0.08 | | | (0.88) | | | 0.43 | |

| Net diluted (loss) earnings per share | $ | (0.93) | | | $ | 0.45 | | | $ | (1.49) | | | $ | 2.56 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 84,845 | | | 86,918 | | | 85,905 | | | 87,230 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted | 85,428 | | | 96,226 | | | 85,905 | | | 96,453 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| TABLE TWO |

| BLOOMIN’ BRANDS, INC. |

| SEGMENT RESULTS |

|

|

| THIRTEEN WEEKS ENDED | | FOURTEEN WEEKS ENDED | | FISCAL YEAR |

(dollars in thousands) | DECEMBER 29, 2024 | | DECEMBER 31, 2023 | | 2024 | | 2023 |

| U.S. Segment | (UNAUDITED) | | (UNAUDITED) | | (UNAUDITED) | | |

| Revenues | | | | | | | |

| Restaurant sales | $ | 942,568 | | | $ | 1,029,908 | | | $ | 3,812,604 | | | $ | 4,005,053 | |

| Franchise and other revenues | 9,940 | | | 12,494 | | | 44,530 | | | 48,546 | |

Total U.S. segment revenues | 952,508 | | | 1,042,402 | | | 3,857,134 | | | 4,053,599 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| International Franchise Segment | | | | | | | |

| | | | | | | |

| | | | | | | |

Franchise revenues | 9,988 | | | 10,554 | | | 39,490 | | | 41,524 | |

| | | | | | | |

| | | | | | | |

| Reconciliation | | | | | | | |

| All other revenues (1) | 9,524 | | | 18,758 | | | 53,851 | | | 73,036 | |

| Revenues from discontinued operations | 131,286 | | | 128,854 | | | 525,268 | | | 529,671 | |

| Intercompany royalties (2) | (6,460) | | | (6,371) | | | (25,932) | | | (26,360) | |

| Total revenues | $ | 1,096,846 | | | $ | 1,194,197 | | | $ | 4,449,811 | | | $ | 4,671,470 | |

| | | | | | | |

| Reconciliation of Segment Operating Income to Consolidated Operating Income | | | | | | | |

| Segment income from operations | | | | | | | |

| U.S. | $ | 34,036 | | | $ | 73,269 | | | $ | 250,050 | | | $ | 377,534 | |

| International Franchise | 9,668 | | | 10,040 | | | 37,961 | | | 39,207 | |

| Total segment income from operations | 43,704 | | | 83,309 | | | 288,011 | | | 416,741 | |

| Unallocated corporate operating expense | (27,102) | | | (32,834) | | | (130,769) | | | (134,057) | |

| Other (loss) income from operations (1) | (405) | | | (875) | | | (17,434) | | | 85 | |

| Total income from operations | 16,197 | | | 49,600 | | | 139,808 | | | 282,769 | |

| Total (loss) income from discontinued operations | (55,425) | | | 7,249 | | | (38,601) | | | 42,375 | |

| Total (loss) income from operations | $ | (39,228) | | | $ | 56,849 | | | $ | 101,207 | | | $ | 325,144 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

_________________

(1)Includes revenues related to our Hong Kong and China subsidiaries.

(2)To remove intercompany royalty revenues already included in total revenues from continuing operations within the international franchise segment. These royalties were eliminated in consolidation prior to discontinued operations reporting.

| | | | | | | | | | | |

| TABLE THREE |

| BLOOMIN’ BRANDS, INC. |

| SUPPLEMENTAL BALANCE SHEET INFORMATION |

| DECEMBER 29, 2024 | | DECEMBER 31, 2023 |

| (dollars in thousands) | (UNAUDITED) | |

| Cash and cash equivalents | $ | 70,056 | | | $ | 111,519 | |

| Net working capital (deficit) (1) | $ | (631,817) | | | $ | (659,021) | |

| Total assets | $ | 3,384,805 | | | $ | 3,424,081 | |

| Total debt | $ | 1,027,398 | | | $ | 780,719 | |

| Total stockholders’ equity | $ | 139,446 | | | $ | 412,003 | |

| | | |

_________________

(1)We have, and in the future may continue to have, negative working capital balances (as is common for many restaurant companies). We operate successfully with negative working capital because cash collected on restaurant sales is typically received before payment is due on our current liabilities, and our inventory turnover rates require relatively low investment in inventories. Additionally, ongoing cash flows from restaurant operations and gift card sales are typically used to service debt obligations and to make capital expenditures.

| | | | | | | | | | | | | | | | | | | | | | | |

| TABLE FOUR |

| BLOOMIN’ BRANDS, INC. |

| RESTAURANT-LEVEL AND ADJUSTED RESTAURANT-LEVEL OPERATING INCOME AND MARGINS NON-GAAP RECONCILIATIONS |

| (UNAUDITED) |

| Consolidated | THIRTEEN WEEKS ENDED | | FOURTEEN WEEKS ENDED | | FISCAL YEAR |

| (dollars in thousands) | DECEMBER 29, 2024 | | DECEMBER 31, 2023 | | 2024 | | 2023 |

| Income from continuing operations | $ | 16,197 | | | $ | 49,600 | | | $ | 139,808 | | | $ | 282,769 | |

| Operating income margin, continuing operations | 1.7 | % | | 4.6 | % | | 3.5 | % | | 6.8 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Less: | | | | | | | |

| Franchise and other revenues | 19,929 | | | 23,124 | | | 84,131 | | | 90,371 | |

| Plus: | | | | | | | |

| Depreciation and amortization | 45,146 | | | 42,936 | | | 175,580 | | | 169,266 | |

| General and administrative | 43,723 | | | 62,784 | | | 219,383 | | | 233,559 | |

| Provision for impaired assets and restaurant closings | 33,137 | | | 34,431 | | | 64,291 | | | 33,574 | |

| Restaurant-level operating income (1) | $ | 118,274 | | | $ | 166,627 | | | $ | 514,931 | | | $ | 628,797 | |

| Restaurant-level operating margin | 12.4 | % | | 15.9 | % | | 13.3 | % | | 15.4 | % |

| Adjustments: | | | | | | | |

| | | | | | | |

| Legal and other matters (2) | — | | | (3,650) | | | — | | | (3,650) | |

| Asset impairments and closure-related charges (3) | — | | | (2,450) | | | 434 | | | (2,450) | |

| Partner compensation (4) | — | | | — | | | — | | | 1,894 | |

| Total restaurant-level operating income adjustments | — | | | (6,100) | | | 434 | | | (4,206) | |

| Adjusted restaurant-level operating income from continuing operations | $ | 118,274 | | | $ | 160,527 | | | $ | 515,365 | | | $ | 624,591 | |

| Adjusted restaurant-level operating margin, continuing operations | 12.4 | % | | 15.3 | % | | 13.3 | % | | 15.3 | % |

| Restaurant-level operating income from discontinued operations (5) | 30,948 | | | 26,255 | | | 108,062 | | | 117,500 | |

| Adjusted restaurant-level operating income | $ | 149,222 | | | $ | 186,782 | | | $ | 623,427 | | | $ | 742,091 | |

| Adjusted restaurant-level operating margin | 13.8 | % | | 15.9 | % | | 14.2 | % | | 16.1 | % |

_________________(1)The following categories of revenue and operating expenses are not included in restaurant-level operating income and the corresponding margin because we do not consider them reflective of operating performance at the restaurant-level within a period:

(a)Franchise and other revenues, which are earned primarily from franchise royalties and other non-food and beverage revenue streams, such as rental and sublease income.

(b)Depreciation and amortization, which, although substantially all of which is related to restaurant-level assets, represent historical sunk costs rather than cash outlays for the restaurants.

(c)General and administrative expense, which includes primarily non-restaurant-level costs associated with support of the restaurants and other activities at our corporate offices.

(d)Asset impairment charges and restaurant closing costs, which are not reflective of ongoing restaurant performance in a period.

(2)Reflects changes in legal reserves in connection with certain collective action wage and hour lawsuits.

(3)Lease remeasurement gain within the U.S. segment in connection with closure of three U.S. and two Hong Kong Aussie Grill restaurants and the decision to close 36 predominantly older, underperforming U.S. restaurants (the “2023 Restaurant Closures”).

(4)Costs incurred in connection with the transition to a new partner compensation program, within the U.S. segment.

(5)No adjustments for the periods presented. Excludes intercompany royalty expense of $6.5 million, $6.4 million, $25.9 million and $26.4 million for the thirteen weeks ended December 29, 2024 and fourteen weeks ended December 31, 2023 and fiscal years 2024 and 2023, respectively, since the corresponding intercompany royalty revenue is included within Franchise and other revenues from continuing operations and is therefore already excluded from the calculation of restaurant-level operating income.

| | | | | | | | | | | | | | | | | | | | | | | |

| TABLE FIVE |

| BLOOMIN’ BRANDS, INC. |

| ADJUSTED INCOME FROM OPERATIONS AND MARGIN NON-GAAP RECONCILIATIONS |

| (UNAUDITED) |

| (dollars in thousands) | THIRTEEN WEEKS ENDED | | FOURTEEN WEEKS ENDED | | FISCAL YEAR |

| Consolidated | DECEMBER 29, 2024 | | DECEMBER 31, 2023 | | 2024 | | 2023 |

| Income from continuing operations | $ | 16,197 | | | $ | 49,600 | | | $ | 139,808 | | | $ | 282,769 | |

| Operating income margin, continuing operations | 1.7 | % | | 4.6 | % | | 3.5 | % | | 6.8 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjustments: | | | | | | | |

| Total restaurant-level operating income adjustments (1) | — | | | (6,100) | | | 434 | | | (4,206) | |

| Asset impairments and closure-related charges (2) | 30,602 | | | 34,822 | | | 63,009 | | | 28,236 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Executive transition costs (3) | — | | | — | | | 4,121 | | | — | |

| Strategic initiative fees (4) | 2,500 | | | — | | | 6,500 | | | — | |

| Foreign currency hedge gains (5) | (15,728) | | | — | | | (15,728) | | | — | |

| Other (6) | — | | | 4,110 | | | — | | | 7,546 | |

| Total income from operations adjustments | 17,374 | | | 32,832 | | | 58,336 | | | 31,576 | |

| Adjusted income from operations, continuing operations | $ | 33,571 | | | $ | 82,432 | | | $ | 198,144 | | | $ | 314,345 | |

| Adjusted operating income margin, continuing operations | 3.5 | % | | 7.7 | % | | 5.0 | % | | 7.5 | % |

| Adjusted income from operations, discontinued operations (7) | 14,667 | | | 7,249 | | | 34,446 | | | 42,375 | |

| Adjusted income from operations | $ | 48,238 | | | $ | 89,681 | | | $ | 232,590 | | | $ | 356,720 | |

| Adjusted operating income margin | 4.4 | % | | 7.5 | % | | 5.2 | % | | 7.6 | % |

| | | | | | | |

| U.S. Segment | | | | | | | |

| Income from continuing operations | $ | 34,036 | | | $ | 73,269 | | | $ | 250,050 | | | $ | 377,534 | |

| Operating income margin | 3.6 | % | | 7.0 | % | | 6.5 | % | | 9.3 | % |

| Adjustments: | | | | | | | |

| Total restaurant-level operating income adjustments (1) | — | | | (2,450) | | | 434 | | | (556) | |

| Strategic initiative fees (4) | 2,500 | | | — | | | 6,500 | | | — | |

| Asset impairments and closure-related charges (2) | 30,071 | | | 33,360 | | | 43,929 | | | 26,774 | |

| Other (6) | — | | | — | | | — | | | 1,147 | |

| | | | | | | |

| Total income from operations adjustments | 32,571 | | | 30,910 | | | 50,863 | | | 27,365 | |

| Adjusted income from continuing operations | $ | 66,607 | | | $ | 104,179 | | | $ | 300,913 | | | $ | 404,899 | |

| Adjusted operating income margin | 7.0 | % | | 10.0 | % | | 7.8 | % | | 10.0 | % |

| | | | | | | |

| International Franchise Segment | | | | | | | |

| Income from continuing operations | $ | 9,668 | | | $ | 10,040 | | | $ | 37,961 | | | $ | 39,207 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

_________________ (1)See Table Four Restaurant-level and Adjusted Restaurant-Level Operating Income and Margins Non-GAAP Reconciliations for details regarding restaurant-level operating income adjustments.

(2)The thirteen weeks and fiscal year ended December 29, 2024, include asset impairment related to 41 older, underperforming restaurants, within the U.S. segment. Fiscal year 2024, includes asset impairment, closure costs and severance primarily related to the 2023 Restaurant Closures, within the U.S. segment and the closure of nine restaurants in Hong Kong. The fourteen weeks and fiscal year ended December 31, 2023, include asset impairment, closure costs and severance primarily related to the 2023 Restaurant Closures, primarily within the U.S. segment.

(3)Compensation costs and professional fees related to our CEO transition and severance related to other executive level changes.

(4)Represents fees incurred in connection with a project-based strategic initiative. The costs incurred represent third-party consulting fees related to a strategic initiative to develop revenue growth management capabilities for Outback Steakhouse and are included in General and administrative expense. Given the magnitude and scope of this initiative and that it is not expected to recur in the foreseeable future after 2024, we consider these incremental expenses to be distinct from other consulting fees that we incur in the ordinary course of business and not reflective of the ongoing costs to operate our business or operating performance in the period.

(5)Gains in connection with the foreign currency forward contracts to partially offset the risk associated with the payments from the sale of our Brazil operations.

(6)Primarily includes professional fees, severance and other costs not correlated to our core operating performance during the period.

(7)Includes operating income from our Brazil operations for the periods presented, including intercompany royalty expense. For 2024, includes non-GAAP adjustments of $68.3 million for impairment of assets held for sale, $3.3 million of transaction related professional fees and $1.5 million of other impairment.

| | | | | | | | | | | | | | | | | | | | | | | |

| TABLE SIX |

| BLOOMIN’ BRANDS, INC. |

| ADJUSTED NET INCOME AND ADJUSTED DILUTED EARNINGS PER SHARE NON-GAAP RECONCILIATIONS |

| (UNAUDITED) |

| | | | | | | |

| THIRTEEN WEEKS ENDED | | FOURTEEN WEEKS ENDED | | FISCAL YEAR |

| (in thousands, except per share data) | DECEMBER 29, 2024 | | DECEMBER 31, 2023 | | 2024 | | 2023 |

Net (loss) income attributable to Bloomin’ Brands | $ | (79,461) | | | $ | 43,270 | | | $ | (128,018) | | | $ | 247,386 | |

| | | | | | | |

| | | | | | | |

| Net (loss) income from discontinued operations, net of tax | (90,122) | | | 7,529 | | | (75,982) | | | 41,629 | |

Net income (loss) attributable to Bloomin' Brands from continuing operations (1) | 10,661 | | | 35,741 | | | (52,036) | | | 205,757 | |

| Adjustments: | | | | | | | |

| Income from operations adjustments (2) | 17,374 | | | 32,832 | | | 58,336 | | | 31,576 | |

| Loss on extinguishment of debt (3) | — | | | — | | | 135,797 | | | — | |

| | | | | | | |

| Total adjustments, before income taxes | 17,374 | | | 32,832 | | | 194,133 | | | 31,576 | |

| Adjustment to provision for income taxes (4) | (9,107) | | | (8,151) | | | (13,001) | | | (7,872) | |

| Net adjustments, continuing operations | 8,267 | | | 24,681 | | | 181,132 | | | 23,704 | |

| Adjusted net income, continuing operations | 18,928 | | | 60,422 | | | 129,096 | | | 229,461 | |

| Adjusted net income, discontinued operations (5) | 13,723 | | | 7,529 | | | 30,246 | | | 38,700 | |

| Adjusted net income | $ | 32,651 | | | $ | 67,951 | | | $ | 159,342 | | | $ | 268,161 | |

| | | | | | | |

Diluted earnings (loss) per share | | | | | | | |

| Continuing operations | $ | 0.12 | | | $ | 0.37 | | | $ | (0.61) | | | $ | 2.13 | |

| Discontinued operations | (1.05) | | | 0.08 | | | (0.88) | | | 0.43 | |

| Diluted (loss) earnings per share | $ | (0.93) | | | $ | 0.45 | | | $ | (1.49) | | | $ | 2.56 | |

| | | | | | | |

| Adjusted diluted earnings per share | | | | | | | |

| Continuing operations | $ | 0.22 | | | $ | 0.63 | | | $ | 1.45 | | | $ | 2.38 | |

| Discontinued operations | 0.16 | | | 0.08 | | | 0.34 | | | 0.40 | |

| Adjusted diluted earnings per share (6)(7) | $ | 0.38 | | | $ | 0.71 | | | $ | 1.79 | | | $ | 2.78 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted weighted average common shares outstanding (7) | 85,428 | | | 96,226 | | | 85,905 | | | 96,453 | |

| Adjusted diluted weighted average common shares outstanding (6)(7) | 85,428 | | | 96,226 | | | 88,900 | | | 96,453 | |

________________(1)Represents net (loss) income from continuing operations less net income attributable to noncontrolling interests.

(2)See Table Five Adjusted Income from Operations and Margin Non-GAAP Reconciliations above for details regarding Income from operations adjustments.

(3)Includes losses in connection with the partial repurchase of the 2025 Notes, including settlements of the related convertible senior note hedges and warrants.

(4)Includes the tax effects of non-GAAP adjustments determined based on the nature of the underlying non-GAAP adjustments and their relevant jurisdictional tax rates for all periods presented. For fiscal year 2024, the difference between GAAP and adjusted effective income tax rates primarily relates to nondeductible losses and other tax costs associated with the partial repurchase of the 2025 Notes.

(5)Includes net (loss) income from our Brazil operations for the periods presented and Income from operations adjustments described in footnote 7 of the Adjusted Income from Operations Non-GAAP Reconciliations table above. For 2024, also includes adjustments for $33.8 million of deferred income tax expense resulting from the sale of our Brazil operations and the tax effects of non-GAAP adjustments. For fiscal year 2023, includes a $2.9 million adjustment related to a Brazil federal income tax exemption on certain state value added tax benefits.

(6)Adjusted diluted weighted average common shares outstanding for the thirteen weeks ended December 29, 2024 and the fourteen weeks ended December 31, 2023 and the fiscal years 2024 and 2023 were calculated including the effect of 0.5 million, 5.1 million, 1.6 million and 5.1 million dilutive securities, respectively, for outstanding 2025 Notes and the effect of zero, 3.3 million, 1.0 million and 3.4 million dilutive securities, respectively, for the Warrant Transactions, as defined below. In connection with the offering of the 2025 Notes, we entered into convertible note hedge transactions (the “Convertible Note Hedge Transactions”) and concurrently entered into warrant transactions relating to the same number of shares of our common stock (the “Warrant Transactions”). If our stock price is in excess of the conversion price of the 2025 Notes ($10.60 and $11.14 as of December 29, 2024 and December 31, 2023, respectively), the Convertible Note Hedge Transactions deliver shares to offset dilution from the

2025 Notes, which, in combination with the Warrant Transactions, effectively offset dilution from the 2025 Notes up to the strike price of the Warrant Transactions ($14.84 and $15.60 as of December 29, 2024 and December 31, 2023, respectively). Adjusted diluted earnings per share and adjusted diluted weighted average common shares outstanding for both the fourteen weeks ended December 31, 2023 and fiscal year 2023 have been recast to remove the 5.1 million share benefit of the Convertible Note Hedge Transactions which was previously included as a non-GAAP share adjustment.

(7)Due to a GAAP net loss from continuing operations, antidilutive securities are excluded from diluted weighted average common shares outstanding for the fiscal year 2024. However, considering the adjusted net income position, adjusted diluted weighted average common shares outstanding incorporates securities that would have been dilutive for GAAP.

Following is a summary of the financial statement line item classification of the net income (loss) adjustments from continuing operations:

| | | | | | | | | | | | | | | | | | | | | | | |

| THIRTEEN WEEKS ENDED | | FOURTEEN WEEKS ENDED | | FISCAL YEAR |

| (dollars in thousands) | DECEMBER 29, 2024 | | DECEMBER 31, 2023 | | 2024 | | 2023 |

| | | | | | | |

| | | | | | | |

| Labor and other related | $ | — | | | $ | — | | | $ | 434 | | | $ | 1,894 | |

| Other restaurant operating | — | | | (6,100) | | | — | | | (6,100) | |

| | | | | | | |

| General and administrative | (11,742) | | | 4,732 | | | 748 | | | 8,266 | |

| Provision for impaired assets and restaurant closings | 29,116 | | | 34,200 | | | 57,154 | | | 27,516 | |

| Loss on extinguishment of debt | — | | | — | | | 135,797 | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Provision for income taxes | (9,107) | | | (8,151) | | | (13,001) | | | (7,872) | |

| Net adjustments | $ | 8,267 | | | $ | 24,681 | | | $ | 181,132 | | | $ | 23,704 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TABLE SEVEN | | |

| BLOOMIN’ BRANDS, INC. | | |

| COMPARATIVE RESTAURANT INFORMATION | | |

| (UNAUDITED) | | |

| Number of restaurants: | SEPTEMBER 29, 2024 | | OPENINGS | | CLOSURES | | | | DECEMBER 29, 2024 | | |

| | | | | | | | | | | |

| U.S. | | | | | | | | | | | |

| Outback Steakhouse | | | | | | | | | | | |

| Company-owned | 550 | | | 3 | | | — | | | | | 553 | | | |

| Franchised | 123 | | | — | | | (1) | | | | | 122 | | | |

| Total | 673 | | | 3 | | | (1) | | | | | 675 | | | |

| Carrabba’s Italian Grill | | | | | | | | | | | |

| Company-owned | 192 | | | — | | | — | | | | | 192 | | | |

| Franchised | 18 | | | — | | | — | | | | | 18 | | | |

| Total | 210 | | | — | | | — | | | | | 210 | | | |

| Bonefish Grill | | | | | | | | | | | |

| Company-owned | 162 | | | — | | | — | | | | | 162 | | | |

| Franchised | 4 | | | — | | | — | | | | | 4 | | | |

| Total | 166 | | | — | | | — | | | | | 166 | | | |

| Fleming’s Prime Steakhouse & Wine Bar | | | | | | | | | | | |

| Company-owned | 63 | | | — | | | — | | | | | 63 | | | |

| Aussie Grill | | | | | | | | | | | |

| Company-owned | 4 | | | — | | | (4) | | | | | — | | | |

| Franchised | 2 | | | — | | | — | | | | | 2 | | | |

| Total | 6 | | | — | | | (4) | | | | | 2 | | | |

| U.S. total | 1,118 | | | 3 | | | (5) | | | | | 1,116 | | | |

| International Franchise | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Outback Steakhouse - South Korea | 94 | | | 2 | | | — | | | | | 96 | | | |

| Other | 49 | | | — | | | — | | | | | 49 | | | |

| International Franchise total | 143 | | | 2 | | | — | | | | | 145 | | | |

| Other - Company-owned | | | | | | | | | | | |

| Outback Steakhouse - Hong Kong/China | 11 | | | — | | | (1) | | | | | 10 | | | |

| Discontinued operations - Company-owned | | | | | | | | | | | |

| Outback Steakhouse - Brazil (1) | 172 | | | 1 | | | — | | | | | 173 | | | |

| Other - Brazil (1) | 19 | | | — | | | — | | | | | 19 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| System-wide total | 1,463 | | | 6 | | | (6) | | | | | 1,463 | | | |

| System-wide total - Company-owned | 1,173 | | | 4 | | | (5) | | | | | 1,172 | | | |

| System-wide total - Franchised | 290 | | | 2 | | | (1) | | | | | 291 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

____________________

(1)The restaurant counts for Brazil, including Abbraccio and Aussie Grill restaurants within International Company-owned Other - Brazil, are reported as of August 31, 2024 and November 30, 2024, respectively, to correspond with the balance sheet dates of this subsidiary. Following the close of the Brazil sale on December 30, 2024, all restaurants in this market are operated as unconsolidated franchisees.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TABLE EIGHT |

| BLOOMIN’ BRANDS, INC. |

| COMPARABLE RESTAURANT SALES INFORMATION |

| (UNAUDITED) |

| | THIRTEEN WEEKS ENDED | | | FOURTEEN WEEKS ENDED | | | FISCAL YEAR |

| | | | | | | |

| | | | | | | |

| | DECEMBER 29, 2024 (1) | | | DECEMBER 31, 2023 (1) | | | 2024 (1) | | | | 2023 (1) |

| Year over year percentage change: | | | | | | | | | | | | |

| Comparable restaurant sales (restaurants open 18 months or more): | | | | | | | | | | | | |

| U.S. - continuing operations (2) | | | | | | | | | | | | |

| Outback Steakhouse | | (1.8) | % | | | (0.3) | % | | | (1.2) | % | | | | 1.1 | % |

| Carrabba’s Italian Grill | | (0.9) | % | | | 2.5 | % | | | — | % | | | | 3.9 | % |

| Bonefish Grill | | (1.5) | % | | | (3.0) | % | | | (3.2) | % | | | | 0.8 | % |

| Fleming’s Prime Steakhouse & Wine Bar | | 3.0 | % | | | (0.3) | % | | | 0.2 | % | | | | (0.7) | % |

| Combined U.S. | | (1.1) | % | | | (0.2) | % | | | (1.1) | % | | | | 1.4 | % |

| Discontinued operations | | | | | | | | | | | | |

| Outback Steakhouse - Brazil (3)(4) | | 0.3 | % | | | 0.6 | % | | | (1.4) | % | | | | 5.5 | % |

| | | | | | | | | | | | |

| Traffic: | | | | | | | | | | | | |

| U.S. - continuing operations | | | | | | | | | | | | |

| Outback Steakhouse | | (4.7) | % | | | (4.3) | % | | | (4.2) | % | | | | (4.3) | % |

| Carrabba’s Italian Grill | | (4.5) | % | | | 0.4 | % | | | (3.2) | % | | | | 0.3 | % |

| Bonefish Grill | | (8.7) | % | | | (4.0) | % | | | (7.1) | % | | | | (3.3) | % |

| Fleming’s Prime Steakhouse & Wine Bar | | (3.5) | % | | | (1.9) | % | | | (5.8) | % | | | | (2.0) | % |

| Combined U.S. | | (5.1) | % | | | (3.1) | % | | | (4.4) | % | | | | (3.1) | % |

| Discontinued operations | | | | | | | | | | | | |

| Outback Steakhouse - Brazil (3) | | (2.9) | % | | | (0.9) | % | | | (4.4) | % | | | | (1.1) | % |

| | | | | | | | | | | | |

| Average check per person (5): | | | | | | | | | | | | |

| U.S. - continuing operations | | | | | | | | | | | | |

| Outback Steakhouse | | 2.9 | % | | | 4.0 | % | | | 3.0 | % | | | | 5.4 | % |

| Carrabba’s Italian Grill | | 3.6 | % | | | 2.1 | % | | | 3.2 | % | | | | 3.6 | % |

| Bonefish Grill | | 7.2 | % | | | 1.0 | % | | | 3.9 | % | | | | 4.1 | % |

| Fleming’s Prime Steakhouse & Wine Bar | | 6.5 | % | | | 1.6 | % | | | 6.0 | % | | | | 1.3 | % |

| Combined U.S. | | 4.0 | % | | | 2.9 | % | | | 3.3 | % | | | | 4.5 | % |

| Discontinued operations | | | | | | | | | | | | |

| Outback Steakhouse - Brazil (3) | | 2.9 | % | | | 1.2 | % | | | 2.6 | % | | | | 6.5 | % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

____________________

(1)For 2024, U.S. comparable restaurant sales, traffic and average check per person compare the thirteen weeks from September 30, 2024 through December 29, 2024 to the thirteen weeks from October 2, 2023 through December 31, 2023, and for the fifty-two weeks from January 1, 2024 through December 29, 2024 to the fifty-two weeks from January 2, 2023 through December 31, 2023. For 2023, U.S. comparable restaurant sales, traffic and average check per person compare the fourteen weeks from September 25, 2023 through December 31, 2023 to the fourteen weeks from September 26, 2022 through January 1, 2023, and for the fifty-three weeks from December 26, 2022 through December 31, 2023 to the fifty-three weeks from December 27, 2021 through January 1, 2023. See Table Nine for details regarding our fiscal and comparable basis calendars.

(2)Relocated restaurants closed more than 60 days are excluded from comparable restaurant sales until at least 18 months after reopening.

(3)Excludes the effect of fluctuations in foreign currency rates and the benefit of the Brazil value added tax exemptions.

(4)Includes trading day impact from calendar period reporting.

(5)Includes the impact of menu pricing changes, product mix and discounts.

| | | | | | | | | | | | |

| TABLE NINE | |

| BLOOMIN’ BRANDS, INC. | |

| FISCAL AND COMPARABLE CALENDAR CALCULATION DATES | |

| (UNAUDITED) | |

| FISCAL CALENDAR BASIS | | | COMPARABLE CALENDAR BASIS | |

| |

| | | | |

| | | | |

| | | | |

| |

| | | | |

| | | | |

| | | | |

| |

| | | | |

| | | | |

| | | | |

| Q4 | |

| September 30, 2024 - December 29, 2024 | | | September 30, 2024 - December 29, 2024 | |

| vs. | | | vs. | |

| September 25, 2023 - December 31, 2023 | | | October 2, 2023 - December 31, 2023 | |

| Total Year | |

| January 1, 2024 - December 29, 2024 | | | January 1, 2024 - December 29, 2024 | |

| vs. | | | vs. | |

| December 26, 2022 - December 31, 2023 | | | January 2, 2023 - December 31, 2023 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

____________________

Note: Financial statements for 2024 are reported on a Fiscal Calendar Basis. Due to the 53rd week in Fiscal Year 2023, our financial statement comparisons are one week different year over year. Comparable restaurant sales are reported on a Comparable Calendar Basis. We believe this provides the most accurate assessment of comparable sales.

SOURCE: Bloomin’ Brands, Inc.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe par value per share of security quoted in same currency as Trading currency. Example: '0.01'.

| Name: |

dei_EntityListingParValuePerShare |

| Namespace Prefix: |

dei_ |

| Data Type: |

dtr-types:perShareItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe three character ISO 4217 code for the currency in which the security is quoted. Example: 'USD'

| Name: |

dei_EntityListingSecurityTradingCurrency |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

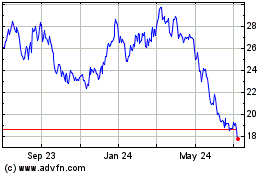

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Feb 2025 to Mar 2025

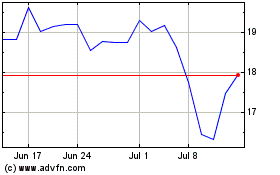

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Mar 2024 to Mar 2025