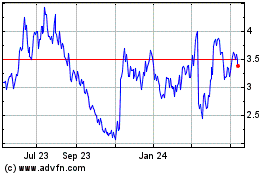

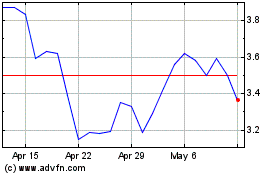

Blade Air Mobility, Inc. (Nasdaq: BLDE, "Blade" or the "Company"),

today announced financial results for the fourth quarter ended

December 31, 2023.

GAAP FINANCIAL RESULTS(in

thousands except percentages, unaudited)

|

|

Three Months Ended December 31, |

|

|

|

Year EndedDecember 31, |

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

% Change |

|

|

2023 |

|

|

|

2022 |

|

|

% Change |

|

Revenue |

$ |

47,478 |

|

|

$ |

38,135 |

|

|

24.5 |

% |

|

$ |

225,180 |

|

|

$ |

146,120 |

|

|

54.1 |

% |

|

Cost of revenue |

|

38,468 |

|

|

|

33,160 |

|

|

16.0 |

% |

|

|

183,058 |

|

|

|

123,845 |

|

|

47.8 |

% |

|

Software development |

|

988 |

|

|

|

1,622 |

|

|

(39.1) |

% |

|

|

4,627 |

|

|

|

5,545 |

|

|

(16.6) |

% |

|

General and administrative |

|

41,242 |

|

|

|

20,576 |

|

|

100.4 |

% |

|

|

95,174 |

|

|

|

62,510 |

|

|

52.3 |

% |

|

Selling and marketing |

|

2,413 |

|

|

|

2,455 |

|

|

(1.7) |

% |

|

|

10,438 |

|

|

|

7,749 |

|

|

34.7 |

% |

|

Total operating expenses |

|

83,111 |

|

|

|

57,813 |

|

|

43.8 |

% |

|

|

293,297 |

|

|

|

199,649 |

|

|

46.9 |

% |

|

Loss from operations |

|

(35,633 |

) |

|

|

(19,678 |

) |

|

81.1 |

% |

|

|

(68,117 |

) |

|

|

(53,529 |

) |

|

27.3 |

% |

|

Net loss |

$ |

(33,941 |

) |

|

$ |

(15,415 |

) |

|

120.2 |

% |

|

$ |

(56,076 |

) |

|

$ |

(27,260 |

) |

|

105.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Passenger loss |

$ |

(25,349 |

) |

|

$ |

(5,771 |

) |

|

339.2 |

% |

|

$ |

(33,503 |

) |

|

$ |

(14,029 |

) |

|

138.8 |

% |

|

Medical loss |

$ |

(2,443 |

) |

|

$ |

(5,145 |

) |

|

(52.5) |

% |

|

$ |

(1,388 |

) |

|

$ |

(2,930 |

) |

|

(52.6) |

% |

|

Unallocated corporate expenses and software development |

$ |

(7,841 |

) |

|

$ |

(8,762 |

) |

|

(10.5) |

% |

|

$ |

(33,226 |

) |

|

$ |

(36,570 |

) |

|

(9.1) |

% |

NON-GAAP(1)

FINANCIAL RESULTS(in thousands except percentages,

unaudited)

|

|

Three Months Ended December 31, |

|

|

|

Year EndedDecember 31, |

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

Change |

|

|

2023 |

|

|

|

2022 |

|

|

% Change |

|

GAAP Revenue |

$ |

47,478 |

|

|

$ |

38,135 |

|

|

24.5% |

|

$ |

225,180 |

|

|

$ |

146,120 |

|

|

54.1% |

|

GAAP Cost of revenue |

|

38,468 |

|

|

|

33,160 |

|

|

16.0% |

|

|

183,058 |

|

|

|

123,845 |

|

|

47.8% |

|

Non-cash timing of ROU asset amortization |

|

— |

|

|

|

464 |

|

|

(100.0%) |

|

|

— |

|

|

|

612 |

|

|

(100.0%) |

|

Flight Profit |

|

9,010 |

|

|

|

5,439 |

|

|

65.7% |

|

|

42,122 |

|

|

|

22,887 |

|

|

84.0% |

|

Flight Margin |

|

19.0 |

% |

|

|

14.3 |

% |

|

471bps |

|

|

18.7 |

% |

|

|

15.7 |

% |

|

304bps |

|

Adjusted Corporate Expense (1) |

|

14,258 |

|

|

|

13,394 |

|

|

6.5% |

|

|

58,755 |

|

|

|

50,338 |

|

|

16.7% |

|

Adjusted Corporate Expense as a percentage of GAAP Revenue |

|

30.0 |

% |

|

|

35.1 |

% |

|

(510)bps |

|

|

26.1 |

% |

|

|

34.4 |

% |

|

(836bps) |

|

Adjusted EBITDA (1) |

$ |

(5,248 |

) |

|

$ |

(7,955 |

) |

|

(34.0%) |

|

$ |

(16,633 |

) |

|

$ |

(27,451 |

) |

|

(39.4%) |

|

Adjusted EBITDA as a percentage of GAAP Revenue |

|

(11.1) |

% |

|

|

(20.9) |

% |

|

980bps |

|

|

(7.4) |

% |

|

|

(18.8) |

% |

|

1,140bps |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Passenger Adjusted EBITDA (1) |

$ |

(2,635 |

) |

|

$ |

(3,769 |

) |

|

(30.1%) |

|

$ |

(4,988 |

) |

|

$ |

(6,367 |

) |

|

(21.7%) |

|

Medical Adjusted EBITDA (1) |

$ |

2,505 |

|

|

$ |

1,587 |

|

|

57.8% |

|

$ |

10,754 |

|

|

$ |

5,116 |

|

|

110.2% |

|

Adjusted unallocated corporate expenses and software development

(1) |

$ |

(5,118 |

) |

|

$ |

(5,773 |

) |

|

(11.3%) |

|

$ |

(22,399 |

) |

|

$ |

(26,200 |

) |

|

(14.5%) |

|

(1) See "Use of Non-GAAP Financial Measures" and "Key Metrics and

Non-GAAP Financial Information" sections attached to this release

for an explanation of Non-GAAP measures used and reconciliations to

the most directly comparable GAAP financial measure. |

| |

"After a rewarding year of strong growth, flight

profit margin expansion and cost structure improvements, we are now

confident to begin providing guidance to our investors for positive

Adjusted EBITDA for the year-ending December 31, 2024 and

double-digit Adjusted EBITDA in 2025(2)," said Rob Wiesenthal,

Blade's Chief Executive Officer. "Though Q4 is a seasonally light

quarter for Blade, we remained focused on continued margin

enhancement and significant additions to our dedicated aircraft

fleet, highlighted by the acquisition of eight jets for our organ

transportation business. These initiatives will further improve our

competitive positioning without compromising the benefits of our

asset-light model, as the vast majority of our Medical flights and

nearly 100% of our Passenger flights will continued to be serviced

by third-party owned and operated aircraft."

"We've made huge progress transitioning more and

more of our Medical flights to dedicated aircraft that provide us

with fixed cost leverage as we grow and are strategically based

near our hospital customers," said Will Heyburn, Blade's Chief

Financial Officer. "This is a win-win that has enabled us to

increase our Flight Profit per trip while reducing costs for our

hospital customers. When paired with our growing fleet of medical

vehicles and new organ placement offering, we believe we’ve built

the most cost-effective and reliable end-to-end organ logistics

platform in the United States. At the same time, we improved our

Passenger flight profit margins by five percentage points in Q4

2023 versus the prior year, demonstrating our path to full-year

profitability in the Passenger segment, which we expect in

2025."

"Our Medical business has more than tripled

since our acquisition of Trinity in 2021, presenting us with an

opportunity to further leverage our scale through the acquisition

of a limited number of jet aircraft. By purchasing aircraft that we

already utilize exclusively and by maintaining the existing

operator and crews, we expect to capture incremental fixed cost

leverage without the risk of building a new medical aircraft

operation from the ground up," said Melissa Tomkiel, Blade's

President. "We remain committed to our asset-light model and expect

the significant majority of our flying to remain with third party

owned and operated aircraft."

|

(2) We have not reconciled the forward-looking Adjusted EBITDA

guidance included above to the most directly comparable GAAP

measure because this cannot be done without unreasonable effort due

to the variability and low visibility with respect to certain

costs, the most significant of which are incentive compensation

(including stock-based compensation), transaction-related expenses,

certain fair value measurements, which are potential adjustments to

future earnings. We expect the variability of these items to have a

potentially unpredictable, and a potentially significant, impact on

our future GAAP financial results. |

|

|

Fourth Quarter Ended December 31, 2023

Financial Highlights

- Total revenue

increased 24.5% to $47.5 million in the current quarter versus

$38.1 million in the prior year period.

- Flight Profit(1)

increased 65.7% to $9.0 million in the current quarter versus

$5.4 million in the prior year period, driven by strong growth in

our MediMobility Organ Transport business and improved

profitability across our U.S. Short Distance business.

- Flight Margin(1)

improved to 19.0% in the current quarter from 14.3% in the prior

year period, driven by increased use of dedicated aircraft and

owned ground vehicles in our MediMobility Organ Transport business

line, which results in lower costs, improved pricing and

utilization in our New York by-the-seat airport transfer product,

and a reduction in spot market jet charter costs, which decreased

more quickly than our jet charter pricing.

- Short Distance

revenue increased 13.6% to $10.7 million in the current quarter

versus $9.4 million in the prior year period. Growth was driven by

an increase in seat volume and improved pricing in our New York

by-the-seat airport transfer product, increased revenue in Europe

and in Canada.

- MediMobility

Organ Transport revenue increased 47.9% to $32.0 million in the

current quarter versus $21.6 million in the prior year period,

driven by the addition of new transplant center customers,

increased average trip distance, growth with existing customers,

and strong overall market growth.

- Jet and Other

revenue decreased (32.4)% to $4.8 million in the current quarter

versus $7.1 million in the prior year period driven primarily by

the discontinuation of our seasonal by-the-seat jet service between

New York and South Florida and softer jet charter demand.

- Net loss increased 120.2% to

$(33.9) million in the current quarter versus $(15.4) million in

the prior year period and increased as a percentage of revenues to

(71.5)% in the current quarter from (40.4)% in the prior year

period, primarily due to a $20.8 million impairment charge on

intangible assets related to the Blade Europe acquisition.

- Adjusted

EBITDA(1) improved to $(5.2) million in the current quarter versus

$(8.0) million in the prior year period, and improved as a

percentage of revenues to (11.1)% in the current quarter from

(20.9)% in the prior year period primarily due to a 57.8% increase

in Medical Segment Adjusted EBITDA to $2.5 million in the current

quarter, a $1.1 million improvement in Passenger Segment

Adjusted EBITDA to $(2.6) million and a $0.7 million improvement in

Adjusted Unallocated Corporate Expenses and Software Development to

$(5.1) million.

- Ended Q4 2023 with

$166.1 million in cash and short term investments.

Business Highlights and Recent

Updates

- Launched Trinity Organ Placement

Services (“TOPS”) in December, a new Medical service helping

transplant centers determine if an organ is a match for a potential

recipient.

- Announced pending acquisition of

eight Hawker 800 aircraft which had previously been 100% dedicated

to Blade’s Medical business. The $21.0 million acquisition cost

will be funded through $11.7 million in cash and $9.3 million in

existing deposits with the operator.

|

(1) See "Use of Non-GAAP Financial Measures" and "Key Metrics and

Non-GAAP Financial Information" sections attached to this release

for an explanation of Non-GAAP measures used and reconciliations to

the most directly comparable GAAP financial measure. |

|

|

Financial Outlook

(1)

For the full year 2024, we expect:

- Revenue of $240 million to $250

million

- Positive Adjusted EBITDA

For the full year 2025, we expect:

- Double-digit year-over-year revenue

growth

- Double-digit Adjusted EBITDA

Conference Call

The Company will conduct a conference call

starting at 8:00 a.m. ET on Wednesday, March 12, 2024 to

discuss the results for the fourth quarter ended December 31,

2023.

A live audio-only webcast of the call may be

accessed from the Investor Relations section of the Company’s

website at https://ir.blade.com/. An archived replay of the call

will be available on the Investor Relations section of the

Company's website for one year.

|

(1) We have not reconciled the forward-looking Adjusted EBITDA

guidance included above to the most directly comparable GAAP

measure because this cannot be done without unreasonable effort due

to the variability and low visibility with respect to certain

costs, the most significant of which are incentive compensation

(including stock-based compensation), transaction-related expenses,

certain fair value measurements, which are potential adjustments to

future earnings. We expect the variability of these items to have a

potentially unpredictable, and a potentially significant, impact on

our future GAAP financial results. |

| |

Use of Non-GAAP Financial

InformationBlade believes that the non-GAAP measures

discussed below, viewed in addition to and not in lieu of our

reported U.S. Generally Accepted Accounting Principles ("GAAP")

results, provide useful information to investors by providing a

more focused measure of operating results, enhance the overall

understanding of past financial performance and future prospects,

and allow for greater transparency with respect to key metrics used

by management in its financial and operational decision making. The

non-GAAP measures presented herein may not be comparable to

similarly titled measures presented by other companies. Adjusted

EBITDA, Segment Adjusted EBITDA, Adjusted Unallocated Corporate

Expenses, Corporate Expenses, Adjusted Corporate Expenses, Flight

Profit, Flight Margin and Free Cash Flow have been reconciled to

the nearest GAAP measure in the tables within this press

release.

Adjusted EBITDA and Segment Adjusted EBITDA -

Blade reports Adjusted EBITDA, which is a non-GAAP financial

measure. This measure excludes non-cash items or certain

transactions that are not indicative of ongoing Company operating

performance and / or items that management does not believe are

reflective of our ongoing core operations (as shown in the table

below). Blade defines Segment Adjusted EBITDA as segment income

(loss) excluding non-cash items or certain transactions that

management does not believe are reflective of our ongoing core

operations.

Adjusted Unallocated Corporate Expenses – Blade

defines Adjusted Unallocated Corporate Expenses as expenses

attributable to our Corporate expenses and software development

operating segment less non-cash items or certain transactions that

are not indicative of ongoing Company operating performance and /

or items that management does not believe are reflective of our

ongoing core operations that cannot be allocated to either of our

reporting segments (Passenger and Medical). Adjusted Unallocated

Corporate Expenses has the same meaning as Segment Adjusted EBITDA

for our Corporate expenses and software development operating

segment and is reconciled in the tables below under the caption

“Reconciliation of Segment Income (loss) to Segment Adjusted

EBITDA.”

Corporate Expenses and Adjusted Corporate

Expenses - Blade defines Corporate Expenses as total operating

expenses excluding cost of revenue. Blade defines Adjusted

Corporate Expenses as Corporate Expenses excluding non-cash items

or certain transactions that are not indicative of ongoing Company

operating performance and / or items that management does not

believe are reflective of our ongoing core operations.

Flight Profit and Flight Margin - Blade defines

Flight Profit as revenue less cost of revenue, and in 2022

excluding non-cash right-of-use (“ROU”) asset amortization. Cost of

revenue consists of flight costs paid to operators of aircraft and

cars, landing fees, ROU asset amortization and internal costs

incurred in generating ground transportation revenue using the

Company’s owned cars. Blade defines Flight Margin for a period as

Flight Profit for the period divided by revenue for the same

period. Blade believes that Flight Profit and Flight Margin provide

a more accurate measure of the profitability of the Company's

flight and ground operations, as they focus solely on the direct

costs associated with those operations. Blade believes the

exclusion of ROU asset amortization from Flight Profit and Flight

Margin is helpful as it better represents the Company's actual

payable charges in exchange for flights served by the operators. We

also believe that excluding this non-cash ROU asset amortization

expense will aid in comparing to prior and future periods as we do

not expect it to re-occur after the fourth quarter of 2022, which

it did not, as shown in the table below.

Free Cash Flow - Blade defines Free Cash Flow as

net cash provided by / (used in) operating activities less capital

expenditures.

Financial Results

BLADE AIR MOBILITY, INC.

CONSOLIDATED BALANCE SHEETS(in thousands, except

share data, unaudited)

| |

December 31,2023 |

|

December 31, 2022 |

|

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents (1) |

$ |

27,873 |

|

|

$ |

41,338 |

|

|

Restricted cash (1) |

|

1,148 |

|

|

|

3,085 |

|

|

Accounts receivable, net of allowance of $98 and $0 at

December 31, 2023 and December 31, 2022 |

|

21,005 |

|

|

|

10,877 |

|

|

Short-term investments |

|

138,264 |

|

|

|

150,740 |

|

|

Prepaid expenses and other current assets |

|

17,971 |

|

|

|

12,086 |

|

|

Total current assets |

|

206,261 |

|

|

|

218,126 |

|

| |

|

|

|

|

Non-current assets: |

|

|

|

|

Property and equipment, net |

|

2,899 |

|

|

|

2,037 |

|

|

Intangible assets, net |

|

20,519 |

|

|

|

46,365 |

|

|

Goodwill |

|

40,373 |

|

|

|

39,445 |

|

|

Operating right-of-use asset |

|

23,484 |

|

|

|

17,692 |

|

|

Other non-current assets (1) |

|

1,402 |

|

|

|

1,360 |

|

|

Total assets |

$ |

294,938 |

|

|

$ |

325,025 |

|

| |

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable and accrued expenses |

$ |

23,859 |

|

|

$ |

16,536 |

|

|

Deferred revenue |

|

6,845 |

|

|

|

6,709 |

|

|

Operating lease liability, current |

|

4,787 |

|

|

|

3,362 |

|

|

Total current liabilities |

|

35,491 |

|

|

|

26,607 |

|

| |

|

|

|

|

Non-current liabilities: |

|

|

|

|

Warrant liability |

|

4,958 |

|

|

|

7,083 |

|

|

Operating lease liability, long-term |

|

19,738 |

|

|

|

14,970 |

|

|

Deferred tax liability |

|

451 |

|

|

|

1,876 |

|

|

Total liabilities |

|

60,638 |

|

|

|

50,536 |

|

| |

|

|

|

|

Stockholders' Equity |

|

|

|

|

Preferred stock, $0.0001 par value, 2,000,000 shares authorized at

December 31, 2023 and December 31, 2022. No shares issued

and outstanding at December 31, 2023 and December 31,

2022. |

|

— |

|

|

|

— |

|

|

Common stock, $0.0001 par value; 400,000,000 authorized; 75,131,425

and 71,660,617 shares issued at December 31, 2023 and

December 31, 2022, respectively. |

|

7 |

|

|

|

7 |

|

|

Additional paid in capital |

|

390,083 |

|

|

|

375,873 |

|

|

Accumulated other comprehensive income |

|

3,964 |

|

|

|

2,287 |

|

|

Accumulated deficit |

|

(159,754 |

) |

|

|

(103,678 |

) |

|

Total stockholders' equity |

|

234,300 |

|

|

|

274,489 |

|

| |

|

|

|

|

Total Liabilities and Stockholders' Equity |

$ |

294,938 |

|

|

$ |

325,025 |

|

|

(1) Prior year amounts have been updated to conform to current

period presentation. |

|

|

BLADE AIR MOBILITY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS(in

thousands, except share and per share data, unaudited)

| |

Three Months Ended December 31, |

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

Revenue |

$ |

47,478 |

|

|

$ |

38,135 |

|

|

$ |

225,180 |

|

|

$ |

146,120 |

|

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

38,468 |

|

|

|

33,160 |

|

|

|

183,058 |

|

|

|

123,845 |

|

|

|

Software development |

|

988 |

|

|

|

1,622 |

|

|

|

4,627 |

|

|

|

5,545 |

|

|

|

General and administrative |

|

41,242 |

|

|

|

20,576 |

|

|

|

95,174 |

|

|

|

62,510 |

|

|

|

Selling and marketing |

|

2,413 |

|

|

|

2,455 |

|

|

|

10,438 |

|

|

|

7,749 |

|

|

|

Total operating expenses |

|

83,111 |

|

|

|

57,813 |

|

|

|

293,297 |

|

|

|

199,649 |

|

|

| |

|

|

|

|

|

|

|

|

|

Loss from operations |

|

(35,633 |

) |

|

|

(19,678 |

) |

|

|

(68,117 |

) |

|

|

(53,529 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Other non-operating income (expense) |

|

|

|

|

|

|

|

|

|

Interest income, net |

|

2,264 |

|

|

|

1,542 |

|

|

|

8,442 |

|

|

|

3,434 |

|

|

|

Change in fair value of warrant liabilities |

|

(1,698 |

) |

|

|

1,984 |

|

|

|

2,125 |

|

|

|

24,225 |

|

|

|

Realized gain (loss) from sales of short-term investments |

|

103 |

|

|

|

(91 |

) |

|

|

8 |

|

|

|

(2,162 |

) |

|

|

Total other non-operating income |

|

669 |

|

|

|

3,435 |

|

|

|

10,575 |

|

|

|

25,497 |

|

|

| |

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

(34,964 |

) |

|

|

(16,243 |

) |

|

|

(57,542 |

) |

|

|

(28,032 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Income tax benefit |

|

(1,023 |

) |

|

|

(828 |

) |

|

|

(1,466 |

) |

|

|

(772 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(33,941 |

) |

|

$ |

(15,415 |

) |

|

$ |

(56,076 |

) |

|

$ |

(27,260 |

) |

|

BLADE AIR MOBILITY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS(in

thousands, unaudited)

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

Cash Flows From Operating Activities: |

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(33,941 |

) |

|

$ |

(15,415 |

) |

|

|

$ |

(56,076 |

) |

|

$ |

(27,260 |

) |

|

Adjustments to reconcile net income (loss) to net cash and

restricted cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

1,806 |

|

|

|

1,984 |

|

|

|

|

7,111 |

|

|

|

5,725 |

|

|

Stock-based compensation |

|

3,153 |

|

|

|

2,650 |

|

|

|

|

12,501 |

|

|

|

8,277 |

|

|

Change in fair value of warrant liabilities |

|

1,698 |

|

|

|

(1,984 |

) |

|

|

|

(2,125 |

) |

|

|

(24,225 |

) |

|

Impairment of intangible assets |

|

20,753 |

|

|

|

— |

|

|

|

|

20,753 |

|

|

|

— |

|

|

Realized (gain) loss from sales of short-term investments |

|

(103 |

) |

|

|

91 |

|

|

|

|

(8 |

) |

|

|

2,162 |

|

|

Realized foreign exchange loss |

|

— |

|

|

|

(1 |

) |

|

|

|

6 |

|

|

|

6 |

|

|

Accretion of interest income on held-to-maturity securities |

|

(1,803 |

) |

|

|

(783 |

) |

|

|

|

(6,519 |

) |

|

|

(1,094 |

) |

|

Deferred tax benefit |

|

(1,023 |

) |

|

|

(772 |

) |

|

|

|

(1,466 |

) |

|

|

(772 |

) |

|

Loss on disposal of property and equipment |

|

48 |

|

|

|

(129 |

) |

|

|

|

48 |

|

|

|

68 |

|

|

Bad debt expense |

|

(8 |

) |

|

|

— |

|

|

|

|

163 |

|

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

(4,928 |

) |

|

|

(1,474 |

) |

|

|

|

(6,032 |

) |

|

|

(5,255 |

) |

|

Accounts receivable |

|

125 |

|

|

|

(886 |

) |

|

|

|

(10,254 |

) |

|

|

(5,347 |

) |

|

Other non-current assets |

|

12 |

|

|

|

396 |

|

|

|

|

4 |

|

|

|

(663 |

) |

|

Operating right-of-use assets/lease liabilities |

|

(42 |

) |

|

|

415 |

|

|

|

|

379 |

|

|

|

611 |

|

|

Accounts payable and accrued expenses |

|

4,963 |

|

|

|

5,645 |

|

|

|

|

9,049 |

|

|

|

9,900 |

|

|

Deferred revenue |

|

(30 |

) |

|

|

1,154 |

|

|

|

|

117 |

|

|

|

737 |

|

|

Other |

|

— |

|

|

|

5 |

|

|

|

|

— |

|

|

|

— |

|

|

Net cash used in operating activities |

|

(9,320 |

) |

|

|

(9,104 |

) |

|

|

|

(32,349 |

) |

|

|

(37,130 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash Flows From Investing Activities: |

|

|

|

|

|

|

|

|

|

Acquisitions, net of cash acquired |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

(48,101 |

) |

|

Investment in joint venture |

|

(39 |

) |

|

|

— |

|

|

|

|

(39 |

) |

|

|

(190 |

) |

|

Purchase of property and equipment |

|

(24 |

) |

|

|

(11 |

) |

|

|

|

(2,109 |

) |

|

|

(730 |

) |

|

Proceeds from disposal of property and equipment |

|

138 |

|

|

|

— |

|

|

|

|

138 |

|

|

|

— |

|

|

Purchase of short-term investments |

|

— |

|

|

|

(151 |

) |

|

|

|

(135 |

) |

|

|

(729 |

) |

|

Proceeds from sales of short-term investments |

|

— |

|

|

|

10,000 |

|

|

|

|

20,532 |

|

|

|

258,377 |

|

|

Purchase of held-to-maturity investments |

|

— |

|

|

|

(87,376 |

) |

|

|

|

(265,835 |

) |

|

|

(227,287 |

) |

|

Proceeds from maturities of held-to-maturity investments |

|

— |

|

|

|

78,000 |

|

|

|

|

264,537 |

|

|

|

98,000 |

|

|

Net cash provided by investing activities |

|

75 |

|

|

|

462 |

|

|

|

|

17,089 |

|

|

|

79,340 |

|

| |

|

|

|

|

|

|

|

|

|

Cash Flows From Financing Activities: |

|

|

|

|

|

|

|

|

|

Proceeds from the exercise of common stock options |

|

7 |

|

|

|

6 |

|

|

|

|

70 |

|

|

|

87 |

|

|

Taxes paid related to net share settlement of equity awards |

|

(30 |

) |

|

|

(6 |

) |

|

|

|

(146 |

) |

|

|

(1,171 |

) |

|

Net cash used in financing activities |

|

(23 |

) |

|

|

— |

|

|

|

|

(76 |

) |

|

|

(1,084 |

) |

| |

|

|

|

|

|

|

|

|

|

Effect of foreign exchange rate changes on cash balances |

|

15 |

|

|

|

81 |

|

|

|

|

(66 |

) |

|

|

72 |

|

|

Net (decrease) increase in cash and cash equivalents and

restricted cash |

|

(9,253 |

) |

|

|

(8,561 |

) |

|

|

|

(15,402 |

) |

|

|

41,198 |

|

|

Cash and cash equivalents and restricted cash -

beginning |

|

38,274 |

|

|

|

52,984 |

|

|

|

|

44,423 |

|

|

|

3,225 |

|

|

Cash and cash equivalents and restricted cash -

ending |

$ |

29,021 |

|

|

$ |

44,423 |

|

|

|

$ |

29,021 |

|

|

$ |

44,423 |

|

| |

|

|

|

|

|

|

|

|

|

Reconciliation to consolidated balance sheets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

27,873 |

|

|

$ |

41,338 |

|

|

|

$ |

27,873 |

|

|

$ |

41,338 |

|

|

Restricted cash |

|

1,148 |

|

|

|

3,085 |

|

|

|

|

1,148 |

|

|

|

3,085 |

|

|

Total |

$ |

29,021 |

|

|

$ |

44,423 |

|

|

|

$ |

29,021 |

|

|

$ |

44,423 |

|

Key Metrics and Non-GAAP Financial

Information

DISAGGREGATED REVENUE BY PRODUCT

LINE(in thousands, unaudited)

| |

Three Months Ended December 31, |

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Passenger segment |

|

|

|

|

|

|

|

|

Short Distance |

$ |

10,703 |

|

$ |

9,418 |

|

$ |

70,700 |

|

$ |

44,986 |

|

Jet and Other |

|

4,784 |

|

|

7,081 |

|

|

27,876 |

|

|

29,355 |

|

Total |

$ |

15,487 |

|

$ |

16,499 |

|

$ |

98,576 |

|

$ |

74,341 |

| |

|

|

|

|

|

|

|

|

Medical segment |

|

|

|

|

|

|

|

|

MediMobility Organ Transport |

$ |

31,991 |

|

$ |

21,636 |

|

|

126,604 |

|

|

71,779 |

|

Total |

$ |

31,991 |

|

$ |

21,636 |

|

$ |

126,604 |

|

$ |

71,779 |

| |

|

|

|

|

|

|

|

|

Total Revenue |

$ |

47,478 |

|

$ |

38,135 |

|

$ |

225,180 |

|

$ |

146,120 |

SEGMENT INFORMATION: REVENUE, FLIGHT

PROFIT, FLIGHT MARGIN, ADJUSTED EBITDA WITH RECONCILIATION TO TOTAL

ADJUSTED EBITDA(in thousands except percentages,

unaudited)

| |

Three Months Ended December 31, |

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Passenger |

$ |

15,487 |

|

|

$ |

16,499 |

|

|

$ |

98,576 |

|

|

$ |

74,341 |

|

|

Medical |

|

31,991 |

|

|

|

21,636 |

|

|

|

126,604 |

|

|

|

71,779 |

|

|

Total Revenue |

$ |

47,478 |

|

|

$ |

38,135 |

|

|

$ |

225,180 |

|

|

$ |

146,120 |

|

| |

|

|

|

|

|

|

|

|

Passenger |

$ |

2,580 |

|

|

$ |

1,886 |

|

|

$ |

19,444 |

|

|

$ |

11,295 |

|

|

Medical |

|

6,430 |

|

|

|

3,553 |

|

|

|

22,678 |

|

|

|

11,592 |

|

|

Total Flight Profit |

$ |

9,010 |

|

|

$ |

5,439 |

|

|

$ |

42,122 |

|

|

$ |

22,887 |

|

| |

|

|

|

|

|

|

|

|

Passenger |

|

16.7 |

% |

|

|

11.4 |

% |

|

|

19.7 |

% |

|

|

15.2 |

% |

|

Medical |

|

20.1 |

% |

|

|

16.4 |

% |

|

|

17.9 |

% |

|

|

16.1 |

% |

|

Total Flight Margin |

|

19.0 |

% |

|

|

14.3 |

% |

|

|

18.7 |

% |

|

|

15.7 |

% |

| |

|

|

|

|

|

|

|

|

Passenger |

$ |

(2,635 |

) |

|

$ |

(3,769 |

) |

|

$ |

(4,988 |

) |

|

$ |

(6,367 |

) |

|

Medical |

|

2,505 |

|

|

|

1,587 |

|

|

|

10,754 |

|

|

|

5,116 |

|

|

Total Segment Adjusted EBITDA |

|

(130 |

) |

|

|

(2,182 |

) |

|

|

5,766 |

|

|

|

(1,251 |

) |

|

Adjusted unallocated corporate expenses and software

development |

|

(5,118 |

) |

|

|

(5,773 |

) |

|

|

(22,399 |

) |

|

|

(26,200 |

) |

|

Total Adjusted EBITDA |

$ |

(5,248 |

) |

|

$ |

(7,955 |

) |

|

$ |

(16,633 |

) |

|

$ |

(27,451 |

) |

SEATS FLOWN - ALL PASSENGER

FLIGHTS(unaudited)

|

|

Three Months Ended December 31, |

Year Ended December 31, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Seats flown – all passenger flights |

33,600 |

|

31,193 |

|

154,608 |

|

106,368 |

REVENUE, FLIGHT PROFIT, FLIGHT MARGIN,

ADJUSTED CORPORATE EXPENSES, ADJUSTED EBITDA(in thousands

except percentages, unaudited)

| |

Three Months Ended December 31, |

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

GAAP Revenue |

$ |

47,478 |

|

|

$ |

38,135 |

|

|

$ |

225,180 |

|

|

$ |

146,120 |

|

|

Flight Profit |

|

9,010 |

|

|

|

5,439 |

|

|

|

42,122 |

|

|

|

22,887 |

|

|

Flight Margin |

|

19.0 |

% |

|

|

14.3 |

% |

|

|

18.7 |

% |

|

|

15.7 |

% |

|

Adjusted Corporate Expense |

|

14,258 |

|

|

|

13,394 |

|

|

|

58,755 |

|

|

|

50,338 |

|

|

Adjusted Corporate Expense as a percentage of Revenue |

|

30.0 |

% |

|

|

35.1 |

% |

|

|

26.1 |

% |

|

|

34.4 |

% |

|

Adjusted EBITDA |

$ |

(5,248 |

) |

|

$ |

(7,955 |

) |

|

$ |

(16,633 |

) |

|

$ |

(27,451 |

) |

|

Adjusted EBITDA as a percentage of Revenue |

|

(11.1) |

% |

|

|

(20.9) |

% |

|

|

(7.4) |

% |

|

|

(18.8) |

% |

RECONCILIATION OF REVENUE LESS COST OF

REVENUE TO FLIGHT PROFIT AND LOSS FROM OPERATIONS(in

thousands except percentages, unaudited)

| |

Three Months Ended December 31, |

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenue |

$ |

47,478 |

|

|

$ |

38,135 |

|

|

$ |

225,180 |

|

|

$ |

146,120 |

|

|

Cost of revenue (1) |

|

(38,468 |

) |

|

|

(33,160 |

) |

|

|

(183,058 |

) |

|

|

(123,845 |

) |

|

Non-cash timing of ROU asset amortization |

|

— |

|

|

|

464 |

|

|

|

— |

|

|

|

612 |

|

|

Flight Profit |

$ |

9,010 |

|

|

$ |

5,439 |

|

|

$ |

42,122 |

|

|

$ |

22,887 |

|

|

Flight Margin |

|

19.0 |

% |

|

|

14.3 |

% |

|

|

18.7 |

% |

|

|

15.7 |

% |

| |

|

|

|

|

|

|

|

|

Flight Profit |

$ |

9,010 |

|

|

$ |

5,439 |

|

|

$ |

42,122 |

|

|

$ |

22,887 |

|

|

Reconciling items: |

|

|

|

|

|

|

|

|

Non-cash timing of ROU asset amortization |

|

— |

|

|

|

(464 |

) |

|

|

— |

|

|

|

(612 |

) |

|

Software development |

|

(988 |

) |

|

|

(1,622 |

) |

|

|

(4,627 |

) |

|

|

(5,545 |

) |

|

General and administrative |

|

(41,242 |

) |

|

|

(20,576 |

) |

|

|

(95,174 |

) |

|

|

(62,510 |

) |

|

Selling and marketing |

|

(2,413 |

) |

|

|

(2,455 |

) |

|

|

(10,438 |

) |

|

|

(7,749 |

) |

|

Loss from operations |

$ |

(35,633 |

) |

|

$ |

(19,678 |

) |

|

$ |

(68,117 |

) |

|

$ |

(53,529 |

) |

|

(1) Cost of revenue consists of flight costs paid to operators of

aircraft and cars, landing fees, ROU asset amortization and

internal costs incurred in generating organ ground transportation

revenue using the Company's owned cars. |

RECONCILIATION OF SEGMENT REVENUE TO

SEGMENT FLIGHT PROFIT AND SEGMENT LOSS(in thousands except

percentages, unaudited)

| |

|

Three Months Ended December 31, 2023 |

|

Three Months Ended December 31, 2022 |

| |

|

Passenger |

|

Medical |

|

|

Passenger |

|

Medical |

|

|

Revenue |

|

$ |

15,487 |

|

|

$ |

31,991 |

|

|

|

$ |

16,499 |

|

|

$ |

21,636 |

|

|

|

Cost of revenue |

|

|

(12,907 |

) |

|

|

(25,561 |

) |

|

|

|

(15,077 |

) |

|

|

(18,083 |

) |

|

|

Non-cash timing of ROU asset amortization |

|

|

— |

|

|

|

— |

|

|

|

|

464 |

|

|

|

— |

|

|

|

Flight Profit |

|

$ |

2,580 |

|

|

$ |

6,430 |

|

|

|

$ |

1,886 |

|

|

$ |

3,553 |

|

|

|

Flight Margin |

|

|

16.7 |

% |

|

|

20.1 |

% |

|

|

|

11.4 |

% |

|

|

16.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Flight Profit |

|

$ |

2,580 |

|

|

$ |

6,430 |

|

|

|

$ |

1,886 |

|

|

$ |

3,553 |

|

|

|

Reconciling items: |

|

|

|

|

|

|

|

|

|

|

|

Non-cash timing of ROU asset amortization |

|

|

— |

|

|

|

— |

|

|

|

|

(464 |

) |

|

|

— |

|

|

|

All other operating expenses(1) |

|

|

(27,929 |

) |

|

|

(8,873 |

) |

|

|

|

(7,193 |

) |

|

|

(8,698 |

) |

|

|

Segment loss |

|

$ |

(25,349 |

) |

|

$ |

(2,443 |

) |

|

|

$ |

(5,771 |

) |

|

$ |

(5,145 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, 2023 |

|

Year Ended December 31, 2022 |

|

|

|

Passenger |

|

Medical |

|

|

Passenger |

|

Medical |

|

|

Revenue |

|

$ |

98,576 |

|

|

$ |

126,604 |

|

|

|

$ |

74,341 |

|

|

$ |

71,779 |

|

|

|

Cost of revenue |

|

|

(79,132 |

) |

|

|

(103,926 |

) |

|

|

|

(63,658 |

) |

|

|

(60,187 |

) |

|

|

Non-cash timing of ROU asset amortization |

|

|

— |

|

|

|

— |

|

|

|

|

612 |

|

|

|

— |

|

|

|

Flight Profit |

|

$ |

19,444 |

|

|

$ |

22,678 |

|

|

|

$ |

11,295 |

|

|

$ |

11,592 |

|

|

|

Flight Margin |

|

|

19.7 |

% |

|

|

17.9 |

% |

|

|

|

15.2 |

% |

|

|

16.1 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Flight Profit |

|

$ |

19,444 |

|

|

$ |

22,678 |

|

|

|

$ |

11,295 |

|

|

$ |

11,592 |

|

|

|

Reconciling items: |

|

|

|

|

|

|

|

|

|

|

|

Non-cash timing of ROU asset amortization |

|

|

— |

|

|

|

— |

|

|

|

|

(612 |

) |

|

|

— |

|

|

|

All other operating expenses(1) |

|

|

(52,947 |

) |

|

|

(24,066 |

) |

|

|

|

(24,712 |

) |

|

|

(14,522 |

) |

|

|

Segment loss |

|

$ |

(33,503 |

) |

|

$ |

(1,388 |

) |

|

|

$ |

(14,029 |

) |

|

$ |

(2,930 |

) |

|

|

(1) All other operating expenses refer to the total of software

development, general and administrative and selling and marketing

expense. |

RECONCILIATION OF TOTAL OPERATING

EXPENSES TO ADJUSTED CORPORATE EXPENSES(in thousands

except percentages, unaudited)

| |

Three Months Ended December 31, |

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenue |

$ |

47,478 |

|

|

$ |

38,135 |

|

|

$ |

225,180 |

|

|

$ |

146,120 |

|

| |

|

|

|

|

|

|

|

|

Total operating expenses |

|

83,111 |

|

|

|

57,813 |

|

|

|

293,297 |

|

|

|

199,649 |

|

|

Subtract: |

|

|

|

|

|

|

|

|

Cost of revenue |

|

38,468 |

|

|

|

33,160 |

|

|

|

183,058 |

|

|

|

123,845 |

|

|

Corporate Expenses |

$ |

44,643 |

|

|

$ |

24,653 |

|

|

$ |

110,239 |

|

|

$ |

75,804 |

|

|

Corporate Expenses as percentage of Revenue |

|

94.0 |

% |

|

|

64.6 |

% |

|

|

49.0 |

% |

|

|

51.9 |

% |

|

Adjustments to reconcile Corporate Expenses to Adjusted

Corporate Expenses |

|

|

|

|

|

|

|

|

Subtract: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

1,806 |

|

|

|

1,984 |

|

|

|

7,111 |

|

|

|

5,725 |

|

|

Stock-based compensation |

|

3,153 |

|

|

|

2,650 |

|

|

|

12,501 |

|

|

|

8,277 |

|

|

Legal and regulatory advocacy fees (1) |

|

46 |

|

|

|

(180 |

) |

|

|

686 |

|

|

|

1,874 |

|

|

Executive severance costs |

|

182 |

|

|

|

269 |

|

|

|

447 |

|

|

|

269 |

|

|

SOX readiness costs |

|

72 |

|

|

|

— |

|

|

|

252 |

|

|

|

— |

|

|

Contingent consideration compensation (earn-out) (2) |

|

4,373 |

|

|

|

6,289 |

|

|

|

9,734 |

|

|

|

6,289 |

|

|

M&A transaction costs |

|

— |

|

|

|

247 |

|

|

|

— |

|

|

|

3,032 |

|

|

Impairment of intangible assets (3) |

|

20,753 |

|

|

|

— |

|

|

|

20,753 |

|

|

$ |

— |

|

|

Adjusted Corporate Expenses |

$ |

14,258 |

|

|

$ |

13,394 |

|

|

$ |

58,755 |

|

|

$ |

50,338 |

|

|

Adjusted Corporate Expenses as percentage of Revenue |

|

30.0 |

% |

|

|

35.1 |

% |

|

|

26.1 |

% |

|

|

34.4 |

% |

|

(1) Represents certain legal and regulatory advocacy fees for

matters (primarily the proposed restrictions at East Hampton

Airport and the potential operational restrictions on large jet

aircraft at Westchester Airport) that we do not consider

representative of legal and regulatory advocacy costs that we will

incur from time to time in the ordinary course of our business. It

is worth noting that we do not anticipate incurring any further

legal fees related to the Westchester litigation.(2) Represents

contingent consideration compensation for the three months and year

ended December 31, 2023 of $4,373 and $10,073, respectively, in

connection with the Trinity acquisition in respect of 2023 results

and a $339 credit recorded in connection with the settlement of the

equity-based portion of Trinity's contingent consideration that was

paid in the first quarter of 2023 in respect of 2022 results.(3)

Represents impairment in Blade Europe’s intangible assets,

specifically its exclusive rights to air transportation rights. The

impairment was as a result of adjustments made to the near term

projections for revenue, expenses and expected EVA introduction, to

reflect our experience operating Blade Europe since September 2022

as well as expected delays in the commercialization of EVA. |

RECONCILIATION OF NET LOSS TO ADJUSTED

EBITDA (in thousands except percentages, unaudited)

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net loss |

$ |

(33,941 |

) |

|

$ |

(15,415 |

) |

|

$ |

(56,076 |

) |

|

$ |

(27,260 |

) |

| |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

1,806 |

|

|

|

1,984 |

|

|

|

7,111 |

|

|

|

5,725 |

|

|

Stock-based compensation |

|

3,153 |

|

|

|

2,650 |

|

|

|

12,501 |

|

|

|

8,277 |

|

|

Change in fair value of warrant liabilities |

|

1,698 |

|

|

|

(1,984 |

) |

|

|

(2,125 |

) |

|

|

(24,225 |

) |

|

Realized (gain) loss from sales of short-term investments |

|

(103 |

) |

|

|

91 |

|

|

|

(8 |

) |

|

|

2,162 |

|

|

Interest income, net |

|

(2,264 |

) |

|

|

(1,542 |

) |

|

|

(8,442 |

) |

|

|

(3,434 |

) |

|

Income tax expense (benefit) |

|

(1,023 |

) |

|

|

(828 |

) |

|

|

(1,466 |

) |

|

|

(772 |

) |

|

Legal and regulatory advocacy fees (1) |

|

46 |

|

|

|

(180 |

) |

|

|

686 |

|

|

|

1,874 |

|

|

Executive severance costs |

|

182 |

|

|

|

269 |

|

|

|

447 |

|

|

|

269 |

|

|

SOX readiness costs |

|

72 |

|

|

|

— |

|

|

|

252 |

|

|

|

— |

|

|

Contingent consideration compensation (earn-out) (2) |

|

4,373 |

|

|

|

6,289 |

|

|

|

9,734 |

|

|

|

6,289 |

|

|

M&A transaction costs |

|

— |

|

|

|

247 |

|

|

|

— |

|

|

|

3,032 |

|

|

Impairment of intangible assets (3) |

|

20,753 |

|

|

|

— |

|

|

|

20,753 |

|

|

|

— |

|

|

Non-cash timing of ROU asset amortization |

|

— |

|

|

|

464 |

|

|

|

— |

|

|

|

612 |

|

|

Adjusted EBITDA |

$ |

(5,248 |

) |

|

$ |

(7,955 |

) |

|

$ |

(16,633 |

) |

|

$ |

(27,451 |

) |

|

Adjusted EBITDA as a percentage of Revenue |

(11.1) |

% |

|

(20.9 |

)% |

|

(7.4 |

)% |

|

(18.8 |

)% |

|

(1) Represents certain legal and regulatory advocacy fees for

matters (primarily the proposed restrictions at East Hampton

Airport and the potential operational restrictions on large jet

aircraft at Westchester Airport) that we do not consider

representative of legal and regulatory advocacy costs that we will

incur from time to time in the ordinary course of our business. It

is worth noting that we do not anticipate incurring any further

legal fees related to the Westchester litigation.(2) Represents

contingent consideration compensation for the three months and year

ended December 31, 2023 of $4,373 and $10,073, respectively,

in connection with the Trinity acquisition in respect of 2023

results and a $339 credit recorded in connection with the

settlement of the equity-based portion of Trinity's contingent

consideration that was paid in the first quarter of 2023 in respect

of 2022 results.(3) Represents impairment in Blade Europe’s

intangible assets, specifically its exclusive rights to air

transportation rights. The impairment was as a result of

adjustments made to the near term projections for revenue, expenses

and expected EVA introduction, to reflect our experience operating

Blade Europe since September 2022 as well as expected delays in the

commercialization of EVA. |

RECONCILIATION OF NET CASH PROVIDED BY /

(USED IN) OPERATING ACTIVITIES TO FREE CASH FLOW (in

thousands, unaudited)

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net cash used in operating activities |

$ |

(9,320 |

) |

|

$ |

(9,104 |

) |

|

$ |

(32,349 |

) |

|

$ |

(37,130 |

) |

|

Purchase of property and equipment |

|

(24 |

) |

|

|

(11 |

) |

|

|

(2,109 |

) |

|

|

(730 |

) |

|

Free Cash Flow |

$ |

(9,344 |

) |

|

$ |

(9,115 |

) |

|

$ |

(34,458 |

) |

|

$ |

(37,860 |

) |

RECONCILIATION OF SEGMENT INCOME (LOSS)

TO SEGMENT NET INCOME (LOSS) AND SEGMENT ADJUSTED

EBITDA(in thousands, unaudited)

| |

|

Three Months Ended December 31, 2023 |

|

Three Months Ended December 31, 2022 |

| |

|

Passenger |

|

Medical |

|

Unallocated Corporate expenses and software

development |

|

Passenger |

|

Medical |

|

Unallocated Corporate expenses and software

development |

|

Segment income (loss) |

|

$ |

(25,349 |

) |

|

$ |

(2,443 |

) |

|

$ |

(7,841 |

) |

|

$ |

(5,771 |

) |

|

$ |

(5,145 |

) |

|

$ |

(8,762 |

) |

|

Total other non-operating income |

|

|

— |

|

|

|

— |

|

|

|

669 |

|

|

|

— |

|

|

|

— |

|

|

|

3,435 |

|

|

Income tax benefit |

|

|

— |

|

|

|

— |

|

|

|

1,023 |

|

|

|

— |

|

|

|

— |

|

|

|

828 |

|

|

Segment net loss |

|

$ |

(25,349 |

) |

|

$ |

(2,443 |

) |

|

$ |

(6,149 |

) |

|

$ |

(5,771 |

) |

|

$ |

(5,145 |

) |

|

$ |

(4,499 |

) |

|

Reconciling items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,331 |

|

|

|

424 |

|

|

|

51 |

|

|

|

1,447 |

|

|

|

364 |

|

|

|

173 |

|

|

Stock-based compensation |

|

|

402 |

|

|

|

151 |

|

|

|

2,600 |

|

|

|

271 |

|

|

|

79 |

|

|

|

2,300 |

|

|

Change in fair value of warrant liabilities |

|

|

— |

|

|

|

— |

|

|

|

1,698 |

|

|

|

— |

|

|

|

— |

|

|

|

(1,984 |

) |

|

Realized (gain) loss from sales of short-term investments |

|

|

— |

|

|

|

— |

|

|

|

(103 |

) |

|

|

— |

|

|

|

— |

|

|

|

91 |

|

|

Interest income, net |

|

|

— |

|

|

|

— |

|

|

|

(2,264 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1,542 |

) |

|

Income tax expense (benefit) |

|

|

— |

|

|

|

— |

|

|

|

(1,023 |

) |

|

|

— |

|

|

|

— |

|

|

|

(828 |

) |

|

Legal and regulatory advocacy fees (1) |

|

|

46 |

|

|

|

— |

|

|

|

— |

|

|

|

(180 |

) |

|

|

— |

|

|

|

— |

|

|

Executive severance costs |

|

|

182 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

269 |

|

|

SOX readiness costs |

|

|

— |

|

|

|

— |

|

|

|

72 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Contingent consideration compensation (earn-out) (2) |

|

|

— |

|

|

|

4,373 |

|

|

|

— |

|

|

|

— |

|

|

|

6,289 |

|

|

|

— |

|

|

Non-cash timing of ROU asset amortization |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

464 |

|

|

|

— |

|

|

|

— |

|

|

M&A transaction costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

247 |

|

|

Impairment of intangible assets (3) |

|

|

20,753 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Segment Adjusted EBITDA |

|

$ |

(2,635 |

) |

|

$ |

2,505 |

|

|

$ |

(5,118 |

) |

|

$ |

(3,769 |

) |

|

$ |

1,587 |

|

|

$ |

(5,773 |

) |

| |

|

Year Ended December 31, 2023 |

|

Year Ended December 31, 2022 |

| |

|

Passenger |

|

Medical |

|

Unallocated Corporate expenses and software

development |

|

Passenger |

|

Medical |

|

Unallocated Corporate expenses and software

development |

|

Segment income (loss) |

|

$ |

(33,503 |

) |

|

$ |

(1,388 |

) |

|

$ |

(33,226 |

) |

|

$ |

(14,029 |

) |

|

$ |

(2,930 |

) |

|

$ |

(36,570 |

) |

|

Total other non-operating income |

|

|

— |

|

|

|

— |

|

|

|

10,575 |

|

|

|

|

|

|

|

25,497 |

|

|

Income tax benefit |

|

|

— |

|

|

|

— |

|

|

|

1,466 |

|

|

|

|

|

|

|

772 |

|

|

Segment net loss |

|

$ |

(33,503 |

) |

|

$ |

(1,388 |

) |

|

$ |

(21,185 |

) |

|

$ |

(14,029 |

) |

|

$ |

(2,930 |

) |

|

$ |

(10,301 |

) |

|

Reconciling items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

5,204 |

|

|

|

1,703 |

|

|

|

204 |

|

|

|

3,949 |

|

|

|

1,488 |

|

|

|

288 |

|

|

Stock-based compensation |

|

|

1,497 |

|

|

|

705 |

|

|

|

10,299 |

|

|

|

1,227 |

|

|

|

269 |

|

|

|

6,781 |

|

|

Change in fair value of warrant liabilities |

|

|

— |

|

|

|

— |

|

|

|

(2,125 |

) |

|

|

— |

|

|

|

— |

|

|

|

(24,225 |

) |

|

Realized (gain) loss from sales of short-term investments |

|

|

— |

|

|

|

— |

|

|

|

(8 |

) |

|

|

— |

|

|

|

— |

|

|

|

2,162 |

|

|

Interest income, net |

|

|

— |

|

|

|

— |

|

|

|

(8,442 |

) |

|

|

— |

|

|

|

— |

|

|

|

(3,434 |

) |

|

Income tax expense (benefit) |

|

|

— |

|

|

|

— |

|

|

|

(1,466 |

) |

|

|

|

|

|

|

(772 |

) |

|

Legal and regulatory advocacy fees (1) |

|

|

686 |

|

|

|

— |

|

|

|

— |

|

|

|

1,874 |

|

|

|

— |

|

|

|

— |

|

|

Executive severance costs |

|

|

375 |

|

|

|

— |

|

|

|

72 |

|

|

|

— |

|

|

|

— |

|

|

|

269 |

|

|

SOX readiness costs |

|

|

— |

|

|

|

— |

|

|

|

252 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Contingent consideration compensation (earn-out) (2) |

|

|

— |

|

|

|

9,734 |

|

|

|

— |

|

|

|

— |

|

|

|

6,289 |

|

|

|

— |

|

|

Non-cash timing of ROU asset amortization |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

612 |

|

|

|

— |

|

|

|

— |

|

|

M&A transaction costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

3,032 |

|

|

Impairment of intangible assets (3) |

|

|

20,753 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

— |

|

— |

|

|

|

— |

|

|

Segment Adjusted EBITDA |

|

$ |

(4,988 |

) |

|

$ |

10,754 |

|

|

$ |

(22,399 |

) |

|

$ |

(6,367 |

) |

|

$ |

5,116 |

|

|

$ |

(26,200 |

) |

|

(1) Represents certain legal and regulatory advocacy fees for

matters (primarily the proposed restrictions at East Hampton

Airport and the potential operational restrictions on large jet

aircraft at Westchester Airport) that we do not consider

representative of legal and regulatory advocacy costs that we will

incur from time to time in the ordinary course of our business. It

is worth noting that we do not anticipate incurring any further

legal fees related to the Westchester litigation.(2) Represents

contingent consideration compensation for the three months and year

ended December 31, 2023 of $4,373 and $10,073, respectively, in

connection with the Trinity acquisition in respect of 2023 results

and a $339 credit recorded in connection with the settlement of the

equity-based portion of Trinity's contingent consideration that was

paid in the first quarter of 2023 in respect of 2022 results.(3)

Represents impairment in Blade Europe’s intangible assets,

specifically its exclusive rights to air transportation rights. The

impairment was as a result of adjustments made to the near term

projections for revenue, expenses and expected EVA introduction, to