false

0001641631

0001641631

2024-11-11

2024-11-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported): November 11, 2024

Beyond

Air, Inc.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

001-38892 |

|

47-3812456 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

900

Stewart Avenue, Suite 301

Garden

City, NY 11530

(Address

of Principal Executive Offices and Zip Code)

(516)

665-8200

Registrant’s

Telephone Number, Including Area Code

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $.0001 per share |

|

XAIR |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

November 11, 2024, Beyond Air, Inc. (the “Company”) issued a press release announcing financial results for its fiscal quarter

ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1, and is incorporated herein by reference.

This

information, including the exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall

be expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

BEYOND

AIR, Inc. |

| |

|

|

| Date:

November 18, 2024 |

By: |

/s/

Steven A. Lisi |

| |

Name:

|

Steven

A. Lisi |

| |

Title |

Chief

Executive Officer |

Exhibit

99.1

Beyond

Air® Reports Fiscal Second Quarter 2025 Financial Results and Provides Corporate Update

Revenues

increased 17% compared to the previous quarter ended June 30, 2024

Strengthened

balance sheet is expected to provide sufficient cash runway through June 2026

Completed

a $20.6 million private placement offering with multiple healthcare-focused institutional funds and Company insiders

Retired

$17.5 million in debt from Avenue Capital and entered into a $11.5 million loan agreement with an insider-led investor group

Conference

call scheduled for 4:30 p.m. ET today, November 11th

Garden

City, NY, November 11, 2024 – Beyond Air, Inc. (NASDAQ: XAIR) (“Beyond Air” or the “Company”),

a commercial stage medical device and biopharmaceutical company focused on harnessing the power of nitric oxide (NO) to improve the lives

of patients, today announced its financial results for the fiscal second quarter ended September 30, 2024, and provided a corporate update.

“Our

commercial strategy continued to drive results throughout the quarter with our total number of customers increasing by over 60%,”

said Steve Lisi, Chairman and Chief Executive Officer of Beyond Air. “We believe this is just the beginning of a pivotal year for

our Company as we leverage our expanding network of reference customers that have implemented LungFit PH in their hospitals. We have

a strong foundation of customer success stories that speak to the cost savings, workflow improvements and additional value our technology

delivers in a real-world setting, compared to traditional cylinder-based systems. In addition, since joining our team four months ago,

our new Chief Commercial Officer, David Webster, has won key partners to rapidly accelerate our topline growth, including TrillaMed,

Healthcare Links and Business Asia Consultants, among others, resetting our commercial strategy and reorganizing our sales, marketing

and support teams.”

Lisi

added: “Our executive team and board of directors have taken decisive actions this year to enhance the Company’s financial

health and commercial execution as we continue accelerating our revenue growth. We recently implemented a capital conservation strategy

to preserve cash, executed a series of financial transactions that increased our capital resources and eliminated approximately $12 million

in debt-related payments through mid-2026. We are confident that these strategic initiatives, in conjunction with projected revenue growth,

will extend our cash runway to support our current operating plans through June 2026.”

Recent

Commercial Execution, Portfolio Highlights and Upcoming Milestones

LungFit®

PH

| ○ | Increased

commercial demand for LungFit PH, as evidenced by: |

| § | A

17% increase in revenue for the quarter ended September 30, 2024, compared with the previous

quarter ended June 30, 2024 |

| § | The

number of hospital contracts increased by 60% over the course of the second fiscal quarter

of 2025 |

| § | Announced

the U.S. Naval Hospital Guam has deployed the LungFit PH system in its mission to provide

top-tier neonatal care |

| § | Annualized

contracted revenue was $3.5 million on October 1, 2024; with an additional four hospitals

slated to start later in fiscal 3Q 2025 further increasing the annualized run rate |

| ○ | Entered

a strategic partnership with Healthcare Links, a renowned healthcare advisory and contracting

firm, that will focus on expanding access to the LungFit® PH system by streamlining entry

into Group Purchasing Organizations (GPOs) and Integrated Delivery Networks (IDNs) across

the United States |

| ○ | Partnered

with Business Asia Consultants, Inc. - an international sales, marketing and business development

consulting company with extensive experience in Europe, the Pacific Rim and Latin America

- to help accelerate the global expansion of the LungFit PH |

| ○ | Partnered

with TrillaMed, a premier provider of medical supplies and technologies to government and

healthcare systems globally, to bring LungFit PH to the U.S. Veterans Administration and

Department of Defense hospitals |

| ○ | Cardiac

surgery PMA supplement review ongoing at FDA |

| § | Currently

no FDA approved nitric oxide system is labeled for cardiac surgery |

| § | Approval

would increase LungFit PH’s rate of market penetration and support long-term revenue

growth |

| ○ | A

decision on CE Mark for LungFit PH in Europe expected before year-end 2024 |

| ○ | LungFit

PH transport-ready PMA supplement submission to FDA anticipated in CY 1Q 2025 |

Beyond

Cancer - Solid Tumor Program

| ● | Clinical

Development Execution |

| ○ | Ultra-high

concentration Nitric Oxide (UNO) therapy is in an ongoing Phase 1a trial evaluating advanced,

relapsed or refractory unresectable, primary or metastatic cutaneous and subcutaneous solid

tumors |

| § | Promising

preclinical data presented in two posters at the Society for Immunotherapy of Cancer (SITC)

Annual Meeting 2024 showed the efficacy of low volume (LV) UNO – less than 10% of the

UNO dose that showed an acceptable safety profile in the ongoing Phase 1a study – when

combined with immune checkpoint inhibitors. In a study using MAT B III tumor-bearing rats,

LV UNO combined with anti-rPD-L1 doubled the tumor growth inhibition rate and led to improved

survival outcomes compared to anti-rPD-L1 alone. Based on these data, the Beyond Cancer team

believes LV UNO may positively influence PD-1 progressors and broaden the pool of patients

who could benefit from immunotherapy, including those previously ineligible for treatment |

| § | Upon

clearance from regulators in Israel, expected shortly, a Phase 1b trial is planned to enroll

up to 20 subjects with prior exposure to anti-PD-1 antibody that have either progressed,

not achieved a response, or have prolonged stable disease (≥ 12 weeks) on single agent

anti-PD-1 without radiographic evidence of continued tumor reduction. Subjects enrolled in

the Phase 1b trial will be treated with UNO + anti-PD-1 combination |

| ● | Beyond

Cancer intends to seek additional capital to perform human studies in addition to the planned

Phase Ib trial |

Recent

Corporate Updates

| ● | Completed

a private placement offering for gross proceeds of approximately $20.6 million, which included

participation by multiple healthcare-focused institutional funds, as well as Company insiders |

| ● | Retired

$17.5 million in Avenue Capital debt, eliminating approximately $12 million in debt-related

payments through June 2026. In addition, Avenue Capital invested $3.35 million in the private

placement offering |

| ● | Entered

into an $11.5 million loan agreement with an insider-led investor group, which utilizes an

8% royalty on net sales beginning in July 2026 to repay the loan. The royalty would cease

upon complete loan repayment |

Financial

Results for the Fiscal Second Quarter Ended September 30, 2024

Revenues

for the fiscal quarter ended September 30, 2024 were $0.8 million compared to $0.2 million for the fiscal quarter ended September 30,

2023 and $0.7 million for the previous quarter ended June 30, 2024. Cost of revenue of $1.9 million was recognized for the three months

ended September 30, 2024, compared to $0.4 million for the three months ended September 30, 2023. Cost of revenue exceeded revenue primarily

driven by depreciation of LungFit devices and one-time upgrade costs to systems.

Research

and development expenses for the three months ended September 30, 2024, were $4.6 million as compared to $7.1 million for the three months

ended September 30, 2023. The decrease of $2.5 million was primarily attributed to a decrease in salaries, stock-based compensation and

pre-clinical studies expenses.

Selling,

general and administrative expenses for the three months ended September 30, 2024 and September 30, 2023 were $7.2 million and $10.2

million, respectively. The decrease of $3.0 million was attributed primarily to a reduction in stock-based compensation cost.

Other

income and expense for the three months ended September 30, 2024 was a loss of $1.2 million compared to a gain of $0.1 million for the

three months ended September 30, 2023. The decrease of $1.3 million was mainly due to the impact of the partial retirement of the Avenue

Capital debt. Cash burn in the fiscal quarter ended September 30, 2024, excluding financing and one-time items was $11.5 million.

As

of September 30, 2024, the Company reported cash, cash equivalents, and marketable securities of $28.4 million, and total debt outstanding

of $12.5 million. Due to the timing of cash settlements associated with the aforementioned financial transactions that were completed

subsequent to September 30, 2024, pro forma cash was $18.5 million, and pro forma outstanding debt was $11.5 million. The Company’s

strengthened balance sheet, along with our cash conservation strategy and anticipated revenue growth, is expected to provide sufficient

cash runway to support current operating plans through June 2026.

Conference

Call & Webcast

Monday,

November 11th @ 4:30 PM ET

| Domestic: | 1-877-407-0784 |

| International: | 1-201-689-8560 |

| Conference ID: |

13749670 |

| Webcast: | A

webcast of the live conference call can be accessed by visiting the Events section of the

Company’s website (click here) or directly (click here). An online replay

will be available on the Company’s website or via the direct link an hour after the

call. |

About

Beyond Air®, Inc.

Beyond

Air is a commercial stage medical device and biopharmaceutical company dedicated to harnessing the power of endogenous and exogenous

nitric oxide (NO) to improve the lives of patients suffering from respiratory illnesses, neurological disorders, and solid tumors. The

Company has received FDA approval for its first system, LungFit® PH, for the treatment of term and near-term neonates with hypoxic

respiratory failure. Beyond Air is currently advancing its other revolutionary LungFit systems in clinical trials for the treatment of

severe lung infections such as viral community-acquired pneumonia (including COVID-19), and nontuberculous mycobacteria (NTM) among others.

Also, the Company has also partnered with The Hebrew University of Jerusalem to advance a pre-clinical program dedicated to the treatment

of autism spectrum disorder (ASD) and other neurological disorders. Additionally, Beyond Cancer, Ltd., an affiliate of Beyond Air, is

investigating ultra-high concentrations of NO with a proprietary delivery system to target certain solid tumors in the pre-clinical setting.

For more information, visit www.beyondair.net.

About

LungFit®*

Beyond

Air’s LungFit is a cylinder-free, phasic flow generator and delivery system and has been designated as a medical device by the

U.S. Food and Drug Administration (FDA). The ventilator compatible version of the device can generate NO from ambient air on demand for

delivery to the lungs at concentrations ranging from 1 ppm to 80 ppm. The LungFit system could potentially replace large, high-pressure

NO cylinders providing significant advantages in the hospital setting, including greatly reducing inventory and storage requirements,

improving overall safety with the elimination of NO2 purging steps, and other benefits. LungFit can also deliver NO at concentrations

at or above 80 ppm for potentially treating severe acute lung infections in the hospital setting (e.g. COVID-19, bronchiolitis)

and chronic, refractory lung infections in the home setting (e.g. NTM). With the elimination of cylinders, Beyond Air intends

to offer NO treatment in the home setting.

*

Beyond Air’s LungFit PH is approved for commercial use only in the United States of America to treat term and near-term neonates

with hypoxic respiratory failure. Beyond Air’s other LungFit systems are not approved for commercial use and are for investigational

use only. Beyond Air is not suggesting NO use over 80 ppm or use at home.

About

PPHN

Persistent

pulmonary hypertension of the newborn (PPHN) is a lethal condition and secondary to failure of normal circulatory transition at birth.

It is a syndrome characterized by elevated pulmonary vascular resistance (PVR) that causes labile hypoxemia due to decreased pulmonary

blood flow and right-to-left shunting of blood. Its incidence has been reported as 1.9 per 1000 live births (0.4–6.8/1000 live

births) with mortality rate ranging between 4–33%. This syndrome complicates the course of about 10% of infants with respiratory

failure and remains a source of considerable morbidity and mortality. NO gas is a vasodilator, is approved in dozens of countries to

improve oxygenation and reduces the need for extracorporeal membrane oxygenation (ECMO) in term and near-term (>34 weeks gestation)

neonates with hypoxic respiratory failure associated with clinical or echocardiographic evidence of pulmonary hypertension in conjunction

with ventilator support and other appropriate agents.

About

Beyond Cancer, Ltd.

Beyond

Cancer, Ltd., an affiliate of Beyond Air, Inc., is a development-stage biopharmaceutical and medical device company utilizing (UNO via

a proprietary delivery platform to treat primary tumors and prevent metastatic disease. Nitric oxide at ultra-high concentrations has

been reported to show anticancer properties and to potentially serve as a chemosensitizer and radiotherapy enhancer. A first-in-human

study is underway in patients with solid tumors. The Company is conducting preclinical studies of UNO in multiple solid tumor models

to inform additional treatment protocols.

For

more information, visit www.beyondcancer.com.

Forward

Looking Statements

This

press release contains “forward-looking statements” concerning the potential safety and efficacy of inhaled nitric oxide

and the ultra-high concentration nitric oxide product candidate, as well as its therapeutic potential in a number of indications; and

the potential impact on patients and anticipated benefits associated with inhaled nitric oxide and the ultra-high concentration nitric

oxide product candidate. Forward-looking statements include statements about expectations, beliefs, or intentions regarding product offerings,

business, results of operations, strategies or prospects. You can identify such forward-looking statements by the words “appears,”

“expects,” “plans,” “anticipates,” “believes” “expects,” “intends,”

“looks,” “projects,” “goal,” “assumes,” “targets” and similar expressions

and/or the use of future tense or conditional constructions (such as “will,” “may,” “could,” “should”

and the like) and by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking

statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking

statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could

cause actual results to differ materially from any future results expressed or implied by the forward-looking statements. These forward-looking

statements are only predictions and reflect views as of the date they are made with respect to future events and financial performance.

Many factors could cause actual activities or results to differ materially from the activities and results anticipated in forward-looking

statements, including risks related to the ability to raise additional capital; the timing and results of future pre-clinical studies

and clinical trials; the potential that regulatory authorities, including the FDA and comparable non-U.S. regulatory authorities, may

not grant or may delay approval for our product candidates; the approach to discover and develop novel drugs, which is unproven and may

never lead to efficacious or marketable products; the ability to fund and the results of further pre-clinical studies and clinical trials

of our product candidates; obtaining, maintaining and protecting intellectual property utilized by products; obtaining regulatory approval

for products; competition from others using similar technology and others developing products for similar uses; dependence on collaborators;

and other risks, which may, in part, be identified and described in the “Risk Factors” section of Beyond Air’s most

recent Annual Report on Form 10-K and other of its filings with the Securities and Exchange Commission, all of which are available on

Beyond Air’s website. Beyond Air and Beyond Cancer undertake no obligation to update, and have no policy of updating or revising,

these forward-looking statements, except as required by applicable law.

CONTACTS:

Investor

Relations contacts

Corey

Davis, Ph.D.

LifeSci

Advisors, LLC

Cdavis@lifesciadvisors.com

(212)

915-2577

BEYOND

AIR, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(amounts

in thousands, except share and per share data)

| | |

September 30, 2024 | | |

March 31, 2024 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 28,447 | | |

$ | 11,378 | |

| Marketable securities | |

| - | | |

| 23,090 | |

| Restricted cash | |

| 230 | | |

| 230 | |

| Accounts receivable | |

| 556 | | |

| 319 | |

| Inventory, net | |

| 2,527 | | |

| 2,127 | |

| Other current assets and prepaid expenses | |

| 6,275 | | |

| 6,792 | |

| Total current assets | |

| 38,036 | | |

| 43,936 | |

| Licensed right to use technology | |

| 1,325 | | |

| 1,427 | |

| Right-of-use lease assets | |

| 1,897 | | |

| 2,121 | |

| Property and equipment, net | |

| 11,648 | | |

| 9,364 | |

| Other assets | |

| 105 | | |

| 113 | |

| TOTAL ASSETS | |

$ | 53,010 | | |

$ | 56,961 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,490 | | |

$ | 1,948 | |

| Accrued expenses and other current liabilities | |

| 4,470 | | |

| 8,402 | |

| Operating lease liability, current portion | |

| 381 | | |

| 418 | |

| Loans payable, current portion | |

| 258 | | |

| 800 | |

| Total current liabilities | |

| 6,599 | | |

| 11,567 | |

| | |

| | | |

| | |

| Operating lease liability, net | |

| 1,690 | | |

| 1,898 | |

| Long-term debt, net | |

| 10,940 | | |

| 14,721 | |

| Long term liability, related party | |

| 4,427 | | |

| - | |

| Warrant Liability | |

| 60 | | |

| 275 | |

| Derivative liability | |

| - | | |

| 1,314 | |

| Total liabilities | |

| 23,716 | | |

| 29,775 | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred Stock, $0.0001 par value per share: 10,000,000 shares authorized, 0 shares issued and outstanding | |

| - | | |

| - | |

| Common Stock, $0.0001 par value per share: 100,000,000 shares authorized, 72,187,636 and 45,900,821 shares issued and outstanding as of September 30, 2024 and March 31, 2024, respectively | |

| 7 | | |

| 5 | |

| Treasury stock | |

| (25 | ) | |

| (25 | ) |

| Additional paid-in capital | |

| 293,391 | | |

| 264,780 | |

| Accumulated deficit | |

| (265,255 | ) | |

| (239,697 | ) |

| Accumulated other comprehensive income (loss) | |

| 9 | | |

| (15 | ) |

| Total stockholders’ equity attributable to Beyond Air, Inc | |

| 28,127 | | |

| 25,048 | |

| Non-controlling interest | |

| 1,167 | | |

| 2,138 | |

| Total equity | |

| 29,294 | | |

| 27,186 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 53,010 | | |

$ | 56,961 | |

BEYOND

AIR, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(amounts

in thousands, except share and per share data)

(UNAUDITED)

| | |

For the Three Months Ended | | |

For the Six Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 798 | | |

$ | 239 | | |

$ | 1,481 | | |

$ | 298 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 1,882 | | |

| 432 | | |

| 2,897 | | |

| 735 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross loss | |

| (1,084 | ) | |

| (193 | ) | |

| (1,416 | ) | |

| (437 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| (4,585 | ) | |

| (7,130 | ) | |

| (10,594 | ) | |

| (11,826 | ) |

| Selling, general and administrative | |

| (7,163 | ) | |

| (10,211 | ) | |

| (14,402 | ) | |

| (21,147 | ) |

| Total Operating expenses | |

| (11,748 | ) | |

| (17,342 | ) | |

| (24,995 | ) | |

| (32,972 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from Operations | |

| (12,833 | ) | |

| (17,535 | ) | |

| (26,412 | ) | |

| (33,410 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Dividend/interest income | |

| 150 | | |

| 641 | | |

| 511 | | |

| 1,050 | |

| Interest and finance expense | |

| (927 | ) | |

| (914 | ) | |

| (1,891 | ) | |

| (1,072 | ) |

| Change in fair value of warrant liability | |

| (4 | ) | |

| 324 | | |

| 214 | | |

| 647 | |

| Change in fair value of derivative liability | |

| 256 | | |

| 500 | | |

| 1,314 | | |

| 1,012 | |

| Foreign exchange gain/ (loss) | |

| 74 | | |

| (42 | ) | |

| (72 | ) | |

| (34 | ) |

| Loss on extinguishment of debt | |

| (624 | ) | |

| - | | |

| (624 | ) | |

| - | |

| Loss on disposal of fixed assets | |

| (171 | ) | |

| - | | |

| (171 | ) | |

| - | |

| Estimated liability for contingent loss | |

| - | | |

| (400 | ) | |

| - | | |

| (598 | ) |

| Other income / (expense) | |

| 49 | | |

| - | | |

| 48 | | |

| (77 | ) |

| Total other income/ (expense) | |

| (1,196 | ) | |

| 109 | | |

| (671 | ) | |

| 929 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss before income taxes | |

$ | (14,029 | ) | |

$ | (17,426 | ) | |

$ | (27,083 | ) | |

$ | (32,481 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (14,029 | ) | |

$ | (17,426 | ) | |

$ | (27,083 | ) | |

$ | (32,481 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Less : net loss attributable to non-controlling interest | |

| (671 | ) | |

| (1,205 | ) | |

| (1,525 | ) | |

| (2,165 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to Beyond Air, Inc. | |

| (13,358 | ) | |

| (16,220 | ) | |

| (25,559 | ) | |

| (30,315 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation loss | |

| (79 | ) | |

| (35 | ) | |

| 24 | | |

| (9 | ) |

| Comprehensive loss attributable to Beyond Air, Inc. | |

$ | (13,438 | ) | |

$ | (16,255 | ) | |

$ | (25,535 | ) | |

$ | (30,325 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net basic and diluted loss per share attributable to Beyond Air, Inc. | |

$ | (0.28 | ) | |

$ | (0.51 | ) | |

$ | (0.55 | ) | |

$ | (0.96 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares, outstanding, basic and diluted | |

| 47,118,535 | | |

| 31,800,492 | | |

| 46,513,005 | | |

| 31,592,880 | |

v3.24.3

Cover

|

Nov. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 11, 2024

|

| Entity File Number |

001-38892

|

| Entity Registrant Name |

Beyond

Air, Inc.

|

| Entity Central Index Key |

0001641631

|

| Entity Tax Identification Number |

47-3812456

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

900

Stewart Avenue

|

| Entity Address, Address Line Two |

Suite 301

|

| Entity Address, City or Town |

Garden

City

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11530

|

| City Area Code |

(516)

|

| Local Phone Number |

665-8200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $.0001 per share

|

| Trading Symbol |

XAIR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

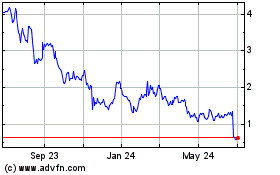

Beyond Air (NASDAQ:XAIR)

Historical Stock Chart

From Nov 2024 to Dec 2024

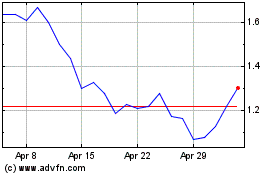

Beyond Air (NASDAQ:XAIR)

Historical Stock Chart

From Dec 2023 to Dec 2024