Proxy Statement (definitive) (def 14a)

June 07 2013 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange

Act of 1934

(Amendment No. _________________)

Filed by

the Registrant [X]

Filed by

a Party other than the Registrant [ ]

Check the

appropriate box:

[ ]

Preliminary Proxy Statement

[ ]

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ]

Definitive Proxy Statement

[ ]

Definitive Additional Materials

[X]

Soliciting Material Pursuant to Sec. 240.14a-12

THE CALVERT FUND

---------------------------------------------------------------------------------

(Name of Registrant as Specified In Its Charter)

---------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

[X] No

fee required.

[ ] Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1. Title

of each class of securities to which transaction applies:

2. Aggregate

number of securities to which transaction applies:

3. Per

unit price or other underlying value of transaction computed pursuant to Exchange

Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how

it was

determined):

4. Proposed

maximum aggregate value of transaction:

5. Total

fee paid:

[ ] Fee

paid previously with preliminary proxy materials.

[ ] Check box if any part of the

fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the

offsetting fee was paid previously. Identify the previous

filing by registration statement number, or

the Form or Schedule and the date of its filing.

1) Amount

Previously Paid:

------------------------------------------------------------

2) Form,

Schedule or Registration Statement No.:

------------------------------------------------------------

3) Filing

Party:

------------------------------------------------------------

4) Date

Filed:

------------------------------------------------------------

IMPORTANT

INFORMATION FOR SHAREHOLDERS OF

Calvert Tax-Free Reserves

Money Market Portfolio

Calvert First Government

Money Market Fund

Calvert Money Market

Portfolio

Dear Money Market Fund Shareholder:

Effective June 6, 2013, the boards of the above-listed Calvert money

market funds approved the reorganization of each fund into Calvert Ultra-Short

Income Fund (CULAX), a taxable bond fund with a variable NAV. A proxy statement

will be sent to shareholders of record in the above funds for approval of this

proposed merger.

We are contacting you today to let

you know of an important change to the draft writing service that will occur

prior to the proposed merger.

Effective immediately, no new requests for drafts reorders will be

processed. Drafts that you write will continue to be honored up through

August 31, 2013

. After August 31, 2013,

however, the draft-writing service will no longer be offered, and any money

market drafts that are presented for payment after that date will not be

honored.

If you require check writing or have any questions, please call Calvert

Client Services at 1-800-368-2745 to discuss your options. Enclosed please find

additional information and details regarding the proposed mergers and how they

affect you.

Sincerely,

Calvert Client Services

Investment

Risk

Investment in mutual

funds involves risk, including possible loss of principal invested. You could

lose money on your investment in the Calvert Ultra-Short Income Fund or the

Fund could underperform because of the following risks: the market prices of

bonds held by the Fund may fall; individual investments of the Fund may not

perform as expected; and/or the Fund’s portfolio management practices may not

achieve the desired result. Bond funds are subject to interest rate risk and

credit risk. When interest rates rise, the value of fixed-income securities

will generally fall. In addition, the credit quality of the securities may

deteriorate, which could lead to default or bankruptcy of the issuer where the

issuer becomes unable to pay its obligations when due. Because a significant

portion of securities held by the Fund may have variable or floating interest

rates, the amount of the Fund’s monthly distributions to shareholders are

expected to vary. Generally when market interest rates fall, the amount of the

distributions will decrease. Investments in high-yield, high risk bonds can

involve a substantial risk of loss. An active trading style can result in

higher turnover (exceeding 100%), may translate to higher transaction costs,

may increase your tax liability, and may affect Fund performance. The Fund is

nondiversified and may be more volatile than a diversified fund.

For

more information on any Calvert fund, please contact Calvert at

800.368.2748

for a free summary prospectus

and/or prospectus. An investor should consider the investment objectives,

risks, charges, and expenses of an investment carefully before investing. The

summary prospectus and prospectus contain this and other information. Read them

carefully before you invest or send money.

Calvert mutual funds are

underwritten and distributed by Calvert Investment Distributors, Inc., member,

FINRA, and a subsidiary of Calvert Investments, Inc.

Additional

Information and Where to Find It

In connection with the

proposed reorganizations, The Calvert Fund will file with the Securities and

Exchange Commission (“SEC”), and will furnish to the shareholders of the

applicable Merging Portfolio, a prospectus/proxy statement and other relevant

documents. These materials do not constitute a solicitation of any vote or approval.

SHAREHOLDERS OF EACH MERGING PORTFOLIO ARE URGED TO READ THE PROSPECTUS/PROXY

STATEMENT WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS TO BE FILED WITH

THE SEC IN CONNECTION WITH THE PROPOSED REORGANIZATIONS, OR INCORPORATED BY

REFERENCE IN THE PROSPECTUS/PROXY STATEMENT, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED REORGANIZATIONS.

Investors will be able to

obtain a free copy of documents filed with the SEC at the SEC’s website at

http://www.sec.gov. In addition, investors may obtain a free copy of the SEC

filings made by The Calvert Fund and each registered investment company of

which a Merging Portfolio is a series (each, a “Merging RIC”) by directing a

request to: Calvert Investments, Inc., Attention: Client Services, 4550

Montgomery Avenue, Suite 1125N, Bethesda, Maryland 20814; (800) 368-2745. With

respect to each Reorganization, The Calvert Fund, each Merging RIC and their

trustees and officers may be deemed to be “participants” in the solicitation of

proxies from shareholders of the applicable Merging Portfolio in favor of that

Reorganization. Information regarding the persons who may, under the rules of

the SEC, be considered participants in the solicitation of the shareholders of

each Merging Portfolio is set forth in the Statement of Additional Information

dated January 31, 2013 or April 30, 2013, as applicable, of each Merging

Portfolio, and in the Statement of Additional Information of Calvert

Ultra-Short Income Fund dated January 31, 2013. These documents have been

filed with the SEC and are available at www.calvert.com.

#13225 (05/2013)

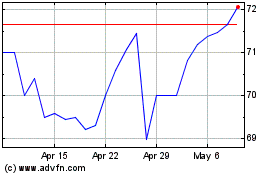

Bel Fuse (NASDAQ:BELFA)

Historical Stock Chart

From Jun 2024 to Jul 2024

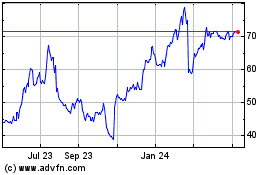

Bel Fuse (NASDAQ:BELFA)

Historical Stock Chart

From Jul 2023 to Jul 2024