As filed with the Securities and Exchange Commission

on June 29, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

Baijiayun Group Ltd

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

Not Applicable |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification No.) |

24F, A1 South Building, No. 32 Fengzhan Road

Yuhuatai District, Nanjing 210000

The People’s Republic of China

Tel: (86)-25 8222-1596

(Address of Principal Executive Offices and Zip

Code)

2023 Share Incentive Plan

(Full title of the plan)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(800) 221-0102

(Name, address and telephone number, including

area code, of agent for service)

Copies to:

|

Gangjiang Li

Chairman and Chief Executive Officer

24F, A1 South Building, No. 32 Fengzhan Road

Yuhuatai District, Nanjing 210000

The People’s Republic of China

Tel: (86)-25 8222-1596 |

|

Dan Ouyang, Esq. |

| |

Wilson Sonsini Goodrich & Rosati |

| |

Professional Corporation |

| |

Unit 2901, 29F, Tower C, Beijing Yintai Centre |

| |

No. 2 Jianguomenwai Avenue |

| |

Chaoyang District, Beijing 100022 |

| |

People’s Republic of China |

| |

Tel: (86) 10-6529-8300 |

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☒ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information*

Item 2. Registrant Information and

Employee Plan Annual Information*

| * |

Information required by Part I to be contained in the Section 10(a) prospectus is omitted from this registration statement in accordance with Rule 428 under the Securities Act and the introductory note to Part I of Form S-8. In accordance with the rules and regulations of the Securities and Exchange Commission (the “Commission”) and the instructions to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424. The documents containing information specified in this Part I will be separately provided to the participants covered by the Plan, as specified by Rule 428(b)(1) under the Securities Act. |

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents

by Reference

The following documents previously filed by Baijiayun

Group Ltd (the “Registrant”) with the Commission are incorporated by reference herein:

| (a) |

The annual report of the predecessor of the Registrant, Fuwei

Films (Holdings) Co., Ltd., on Form 20-F (File No. 001-33176) filed with the Commission on April 28, 2022, which includes audited financial

statements of Fuwei Films (Holdings) Co., Ltd. for the three years ended December 31, 2021; |

| |

|

| (b) |

The Registrant’s transition report on Form 20-F (File

No. 001-33176) filed with the Commission on January 20, 2023, which includes audited financial statements of Baijiayun Limited for the

three fiscal years ended June 30, 2022; and |

| |

|

| (c) |

The description of the Registrant’s Class A ordinary shares as contained in Exhibit 2.2 to the Registrant’s transition report on Form 20-F (File No. 001-33176) filed with the Commission on January 20, 2023. |

All documents subsequently filed by the Registrant

pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after

the date of this registration statement and prior to the filing of a post-effective amendment to this registration statement which indicates

that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated

by reference in this registration statement and to be part hereof from the date of filing of such documents. Any statement in a document

incorporated or deemed to be incorporated by reference in this registration statement will be deemed to be modified or superseded to the

extent that a statement contained in this registration statement or in any other later filed document that also is or is deemed to be

incorporated by reference modifies or supersedes such statement. Any such statement so modified or superseded will not be deemed, except

as so modified or superseded, to be a part of this registration statement.

Item 4. Description of Securities

Not applicable.

Item 5. Interests of Named Experts

and Counsel

Not applicable.

Item 6. Indemnification of Directors and Officers

Cayman Islands law does not limit the extent to

which a company’s articles of association may provide for indemnification of officers and directors, except to the extent any such

provision may be held by the Cayman Islands courts to be contrary to public policy, such as to provide indemnification against fraud or

dishonesty.

The second amended and restated articles of association

of the Registrant provide that each officer or director of the Registrant shall be indemnified out of its assets and profits against all

actions, costs, charges, losses, damages and expenses incurred or sustained by such director or officer, by or by reason of any act done,

concurred in or omitted in or about the execution of their duty, or supposed duty, in their respective offices or trusts, other than by

reason of such person’s own dishonesty or fraud.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers or persons controlling the Registrant pursuant to the foregoing provisions,

the Registrant has been informed that in the opinion of the Commission such indemnification is against public policy as expressed in the

Securities Act and is therefore unenforceable.

Item 7. Exemption from Registration Claimed

Not applicable.

Item 8. Exhibits

See the Exhibit Index attached hereto.

Item 9. Undertakings

| (a) |

The undersigned Registrant hereby undertakes: |

| |

(1) |

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| |

(i) |

to include any prospectus required by Section 10(a)(3) of the Securities Act; |

| |

(ii) |

to reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration statement; and |

| |

(iii) |

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to that information in the registration statement; |

provided, however, that paragraphs (a)(1)(i)

and (a)(1)(ii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained

in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that

are incorporated by reference in this registration statement;

| |

(2) |

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| |

(3) |

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| (b) |

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (c) |

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. |

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Nanjing,

China, on June 29, 2023.

| |

Baijiayun Group Ltd |

| |

|

| |

By: |

/s/ Gangjiang Li |

| |

|

Name: |

Gangjiang Li |

| |

|

Title: |

Chairman and Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature

appears below does hereby constitute and appoint Mr. Gangjiang Li, as his or her true and lawful attorney-in-fact and agent, each with

full power of substitution and re-substitution, for him or her and in his or her name, place and stead, in any and all capacities, to

sign any and all amendments (including post-effective amendments) to this registration statement and to file the same, with all exhibits

thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact

and agent, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith

and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming

all that said attorney-in-fact and agent may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended,

this registration statement has been signed by the following persons on June 29, 2023 in the capacities indicated.

| Signature |

|

Title |

| |

|

|

| /s/ Gangjiang Li |

|

Chairman and Chief Executive Officer

|

| Gangjiang Li |

|

(Principal Executive Officer) |

| |

|

|

| /s/ Yong Fang |

|

Chief Financial Officer |

| Yong Fang |

|

(Principal Financial and Accounting Officer) |

| |

|

|

| /s/ Yi Ma |

|

Director and President |

| Yi Ma |

|

|

| |

|

|

| /s/ Chun Liu |

|

Director |

| Chun Liu |

|

|

| |

|

|

| /s/ Erlu Lin |

|

Director |

| Erlu Lin |

|

|

| |

|

|

| /s/ Ching Chiu |

|

Director |

| Ching Chiu |

|

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN THE

UNITED STATES

Pursuant to the Securities Act of 1933, as amended,

the undersigned, the duly authorized representative in the United States of Baijiayun Group Ltd has signed this registration statement

or amendment thereto in New York on June 29, 2023.

| |

COGENCY GLOBAL INC. |

| |

Authorized U.S. Representative |

| |

|

|

| |

By: |

/s/ Colleen A. De Vries |

| |

|

Name: |

Colleen A. De Vries |

| |

|

Title: |

Senior Vice President on behalf of Cogency Global Inc. |

II-6

Exhibit

5.1

|

|

|

| |

|

CONYERS DILL & PEARMAN |

| |

|

29th Floor |

| |

|

One Exchange Square |

| |

|

8 Connaught Place |

| |

|

Central |

| |

|

Hong Kong |

| |

|

T +852 2524 7106 | F +852 2845 9268 |

| |

|

conyers.com |

29 June 2023

Matter

No.: M#999989

Doc

No.: 109146288

(852)

2842 95556 / 2842 9566

Christopher.Bickley@conyers.com

Rita.Leung@conyers.com

Baijiayun

Group Ltd

Cricket

Square, Hutchins Drive

P.O.

Box 2681, Grand Cayman

KY1-1111,

Cayman Islands

Dear

Sirs,

Re:

Baijiayun Group Ltd (the “Company”)

We

have acted as special Cayman Islands legal counsel to the Company in connection with a registration statement on Form S-8, including

all amendments or supplements thereto (the “Registration Statement” which term does not include any other document

or agreement whether or not specifically referred to therein or attached as an exhibit or schedule thereto), filed with the U.S. Securities

and Exchange Commission (the “Commission”) on or about the date hereof relating to the registration under the U.S.

Securities Act of 1933, as amended, (the “Securities Act”) of 12,855,546 Class A ordinary shares of par value US$0.519008

per share of the Company (the “Class A Ordinary Shares”) issuable upon exercise of options and conversion of restricted

share units and pursuant to other awards granted under the Company’s 2023 share incentive plan (the “Plan”).

For

the purposes of giving this opinion, we have examined the following document(s):

| 1.1. | a

copy of the Registration Statement; |

| 1.3. | a

copy of the third amended and restated memorandum of association and the second amended and

restated articles of association of the Company which became effective on 23 December 2022

(the “Constitutional Documents”); |

| 1.4. | copies

of the written resolutions of its directors dated 21 January 2023 and 27 June 2023 approving

adoption of the Plan and filing of the Registration Statement (collectively, the “Resolutions”); |

| 1.5. | a

copy of a Certificate of Good Standing issued by the Registrar of Companies in relation to

the Company on 20 June 2023 (the “Certificate Date”); |

| 1.6. | a

copy of a certificate issued by a director of the Company dated 28 June 2023; and |

| 1.7. | such

other documents and made such enquiries as to questions of law as we have deemed necessary

in order to render the opinion set forth below. |

We

have assumed:

| 2.1. | the

genuineness and authenticity of all signatures and the conformity to the originals of all

copies (whether or not certified) examined by us and the authenticity and completeness of

the originals from which such copies were taken; |

| 2.2. | that

where a document has been examined by us in draft form, it will be or has been executed and/or

filed in the form of that draft, and where a number of drafts of a document have been examined

by us all changes thereto have been marked or otherwise drawn to our attention; |

| 2.3. | the

accuracy and completeness of all factual representations made in the Registration Statement

and other documents reviewed by us; |

| 2.4. | that

the Resolutions were passed at one or more duly convened, constituted and quorate meetings

or by unanimous written resolutions, remain in full force and effect and have not been rescinded

or amended; |

| 2.5. | that

the Constitutional Documents will not be amended in any manner that would affect the opinions

expressed herein; |

| 2.6. | that

the issuance of the Class A Ordinary Shares will be in accordance with the terms of the Plan; |

| 2.7. | that

on the date of issuance of any of the Class A Ordinary Shares, the Company will have sufficient

authorised but unissued Class A Ordinary Shares; |

| 2.8. | that

on the date of issuance of any award under the Plan, the Company will be able to pay its

liabilities as they become due; |

| 2.9. | that

any conditions to which the Resolutions are subject will have been satisfied and/or waived; |

| 2.10. | that

there is no provision of the law of any jurisdiction, other than the Cayman Islands, which

would have any implication in relation to the opinions expressed herein; |

| 2.11. | that

upon issue of any Class A Ordinary Shares by the Company, the Company will receive consideration

for the full issue price thereof which shall be equal to at least the par value thereof;

and |

| 2.12. | the

validity and binding effect under the laws of the United States of America of the Registration

Statement and that the Registration Statement will be duly filed with and/or declared effective

by the Commission. |

We

have made no investigation of and express no opinion in relation to the laws of any jurisdiction other than the Cayman Islands. This

opinion is to be governed by and construed in accordance with the laws of the Cayman Islands and is limited to and is given on the basis

of the current law and practice in the Cayman Islands. This opinion is issued solely for the purposes of the filing of the Registration

Statement and the issuance of the Class A Ordinary Shares by the Company pursuant to the Plan and is not to be relied upon in respect

of any other matter.

On

the basis of and subject to the foregoing, we are of the opinion that:

| 4.1. | The

Company is duly incorporated and existing under the laws of the Cayman Islands and, based

on the Certificate of Good Standing, is in good standing as at the Certificate Date. Pursuant

to the Companies Act (the “Act”), a company is deemed to be in good standing

if all fees and penalties under the Act have been paid and the Registrar of Companies has

no knowledge that the Company is in default under the Act. |

| 4.2. | The

Class A Ordinary Shares, when issued and paid for in accordance with the Plan, will be validly

issued, fully paid and non-assessable (which term means when used herein that no further

sums are required to be paid by the holders thereof in connection with the issue or holding

of such shares. |

We

hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving this consent, we do not hereby

admit that we are experts within the meaning of Section 11 of the Securities Act or that we come within the category of persons whose

consent is required under Section 7 of the Securities Act or the Rules and Regulations of the Commission promulgated thereunder.

Yours

faithfully,

| /s/

Conyers Dill & Pearman |

|

Conyers

Dill & Pearman

conyers.com

| 3

Exhibit

23.1

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated January 20, 2023 with respect

to the audited consolidated financial statements of BaiJiaYun Limited appearing in the transition report on Form 20-F of Baijiayun Group

Ltd for the year ended June 30, 2022.

| /s/

MaloneBailey, LLP |

|

| www.malonebailey.com |

|

| Houston, Texas |

|

| June 29, 2023 |

|

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by reference in the Registration

Statement on Form S-8 of Baijiayun Group Ltd of our report dated August 12, 2022, relating to the consolidated balance sheet of BaiJiaYun

Limited, its subsidiaries, its variable interest entity (“VIE”) and its VIE’s subsidiaries as of June 30, 2021, and

the related consolidated statements of operations and comprehensive income, changes in shareholders’ deficit, and cash flows for

each of the years in the two-year period ended June 30, 2021, which report appears in the transition report of Baijiayun Group Ltd on

Form 20-F (File No. 001-33176) filed with the Securities and Exchange Commission on January 20, 2023. We ceased to be the auditor of BaiJiaYun

Limited on September 13, 2022 and, accordingly, we have not performed any audit or review procedures with respect to any financial statements

of BaiJiaYun Limited, its subsidiaries, its VIE and its VIE’s subsidiaries appearing in such Registration Statement for the periods

after June 30, 2021.

/s/ Friedman LLP

New York, New York

June 29, 2023

Exhibit 23.3

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by reference

in this Registration Statement on Form S-8 of Baijiayun Group Ltd of our report dated April 28, 2022 relating to the consolidated financial

statements of Fuwei Films (Holdings) Co., Ltd. for the three years ended December 31, 2021, which appears in the Annual Report on Form

20-F of Fuwei Films (Holdings) Co., Ltd. for the year ended December 31, 2021.

Very truly yours,

| /s/ Shandong Haoxin Certified Public Accountants Co., Ltd. | |

| Shandong Haoxin Certified Public Accountants Co., Ltd. | |

Weifang, the People’s Republic of China

June 29, 2023

Exhibit

107

Calculation

of Filing Fee Tables

FORM

S-8

(Form Type)

Baijiayun

Group Ltd

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Newly Registered Securities

| Security Type | |

Security

Class Title | |

Fee

Calculation

Rule | |

Amount

Registered(1)(3) | | |

Proposed

Maximum

Offering Price

Per Share | | |

Maximum

Aggregate

Offering Price | | |

Fee Rate | | |

Amount of

Registration

Fee | |

| Equity | |

Class A ordinary shares, par value $0.519008 per share | |

Rule 457(c)

and (h) | |

| 12,855,546 | (2) | |

$ | 7.8625 | | |

$ | 101,076,730.43 | | |

$ | 0.0001102 | | |

$ | 11,138.66 | |

| Total Offering Amounts | |

| |

| | | |

| | | |

$ | 101,076,730.43 | | |

| | | |

$ | 11,138.66 | |

| Total Fees Previously Paid | |

| |

| | | |

| | | |

| | | |

| | | |

$ | - | |

| Total Fee Offsets | |

| |

| | | |

| | | |

| | | |

| | | |

$ | - | |

| Net Fee Due | |

| |

| | | |

| | | |

| | | |

| | | |

$ | 11,138.66 | |

| (1) |

Represents Class A ordinary

shares which are issuable under the 2023 Share Incentive Plan of the Registrant. Pursuant to Rule 416(a) under the Securities Act

of 1933, as amended (the “Securities Act”), this registration statement is deemed to cover an indeterminate number of

Class A ordinary shares which may be offered and issued to prevent dilution resulting from share splits, share dividends or similar

transactions as provided in the 2023 Share Incentive Plan. |

| (2) |

Represents Class A ordinary

shares to be issued pursuant to the 2023 Share Incentive Plan. The proposed maximum offering price per share, which is estimated

solely for the purposes of calculating the registration fee under Rule 457(h) and Rule 457(c) under the Securities Act, is based

on US$7.8625 per share, the average of the high and low prices for the Registrant’s Class A ordinary shares as quoted on the

Nasdaq Capital Market on June 23, 2023. |

| (3) |

Any Class A ordinary share

covered by an award granted under the 2023 Share Incentive Plan (or portion of an award) that is forfeited, cancelled or otherwise

expired for any reason without having been exercised shall be deemed not to have been issued for purposes of determining the maximum

aggregate number of Class A ordinary shares which may be issued under the 2023 Share Incentive Plan. |

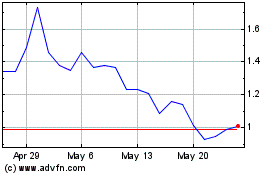

Baijiayun (NASDAQ:RTC)

Historical Stock Chart

From Apr 2024 to May 2024

Baijiayun (NASDAQ:RTC)

Historical Stock Chart

From May 2023 to May 2024