0001633070

false

--12-31

0001633070

2023-09-18

2023-09-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 18, 2023

AXCELLA

HEALTH INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-38901 |

|

26-3321056 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

P.O. Box 1270

Littleton,

Massachusetts |

01460 |

| (Address

of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area

code: (857) 320-2200

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions ( see General Instruction A.2. below):

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common Stock, $0.001 Par Value |

|

AXLA |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 5.03. |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On September 18,

2023, Axcella Health Inc. (the “Company”) filed an amendment (the “Certificate of Amendment”) to its Restated

Certificate of Incorporation to effectuate a reverse stock split of the Company’s issued and outstanding shares of common stock,

par value of $0.001 per share (the “Common Stock”).

As previously disclosed,

at its annual meeting of stockholders held on September 11, 2023 (the “Annual Meeting”), the stockholders of the Company

approved a proposal to authorize the Company’s Board of Directors, in its discretion following the Annual Meeting to amend the Company’s

Restated Certificate of Incorporation (the “Certificate of Incorporation”), to effect a reverse stock split of all of the

outstanding shares of the Company’s Common Stock, at a ratio ranging from any whole number between 1-for-2 and 1-for-25, as determined

by the Company’s Board of Directors in its discretion. On September 11, 2023, following the Annual Meeting, the Company’s

Board of Directors approved a reverse stock split of the Company’s common stock at a ratio of 1-for-25. Effective as of at 5:00

p.m., Eastern Time on September 18, 2023, the Company filed the Certificate of Amendment and effected a 1-for-25 reverse stock split

of its shares of common stock (the “Reverse Stock Split”).

As a result of the Reverse

Stock Split, every twenty-five shares of the Company’s common stock issued or outstanding were automatically reclassified into one

validly issued, fully-paid and non-assessable share new share of common stock, subject to the treatment of fractional shares as described

below, without any action on the part of the holders. Proportionate adjustments will be made to the exercise prices and the number of

shares underlying the Company’s outstanding equity awards, as applicable, and certain existing agreements. The common stock issued

pursuant to the Reverse Stock Split remain fully paid and non-assessable. The Reverse Stock Split did not affect the number of authorized

shares of common stock or the par value of the common stock.

No fractional shares

will be issued in connection with the Reverse Stock Split. Stockholders who would otherwise be entitled to receive fractional shares as

a result of the Reverse Stock Split will be entitled to a cash payment in lieu thereof at a price equal to the fraction to which the stockholder

would otherwise be entitled multiplied by the closing sales price per share of the common stock (as adjusted for the Reverse Stock Split)

on The Nasdaq Global Market on September 18, 2023, the last trading day immediately preceding the effective time of the Reverse Stock

Split.

Trading of the Company’s

common stock on The Nasdaq Global Market is expected to commence on a split-adjusted basis when the market opens on September 19,

2023, under the existing trading symbol “AXLA.” The new CUSIP number for the Company’s common stock following the Reverse

Stock Split is 05454B204.

The foregoing description

of the Certificate of Amendment is qualified in its entirety by reference to the full text of the Certificate of Amendment, a copy of

which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference. A copy of the new

form of stock certificate for the Company’s post-reverse stock split shares of common stock is attached hereto as Exhibit 4.1

to this Current Report on Form 8-K and is incorporated herein by reference.

Forward Looking Statements

This Current Report on

Form 8-K contains forward-looking statements, including within the meaning of the Private Securities Litigation Reform Act of 1995.

All statements contained in this Current Report on Form 8-K that do not relate to matters of historical fact should be considered

forward-looking statements, including, without limitation, statements regarding the Reverse Stock Split and related timing. These forward-looking

statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known

and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially

different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but

not limited to, the important factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for

the fiscal year ended December 31, 2022, Quarterly Report on Form 10-Q for the three months ended June 30, 2023, and our

other reports filed with the U.S. Securities and Exchange Commission. Any such forward-looking statements represent management’s

estimates as of the date of this Current Report on Form 8-K. While we may elect to update such forward-looking statements at some

point in the future, except as required by law, we disclaim any obligation to do so, even if subsequent events cause our views to change.

These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this Current

Report on Form 8-K.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Axcella Health Inc. |

| |

|

| Date: September 18, 2023 |

By: |

/s/ William R. Hinshaw, Jr. |

| |

Name: |

/s/ William R. Hinshaw, Jr. |

| |

Title: |

President, Chief Executive Officer and Director |

Exhibit 3.1

CERTIFICATE OF AMENDMENT

TO

RESTATED CERTIFICATE OF INCORPORATION

OF

AXCELLA HEALTH INC.

Axcella Health Inc., a corporation organized and

existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”), does hereby certify

as follows:

FIRST: That the Board of Directors of the Corporation duly adopted

resolutions recommending and declaring advisable that the Restated Certificate of Incorporation of the Corporation be amended and that

such amendment be submitted to the stockholders of the Corporation for their consideration, as follows:

RESOLVED,

that the first sentence of Article FOURTH of the Restated Certificate of Incorporation be, and hereby is, amended and restated in

its entirety to read as follows:

“That, effective at 5:00 p.m., Eastern

time, on the date this Certificate of Amendment to the Restated Certificate of Incorporation is filed with the Secretary of State of the

State of Delaware (the “Effective Time”), a one-for-twenty-five reverse stock split of the Common Stock (as defined below)

shall become effective, pursuant to which each 25 shares of Common Stock issued and held of record by each stockholder of the Corporation

(including treasury shares) immediately prior to the Effective Time shall be reclassified and combined into one validly issued, fully

paid and nonassessable share of Common Stock automatically and without any action by the holder thereof upon the Effective Time and shall

represent one share of Common Stock from and after the Effective Time (such reclassification and combination of shares, the “Reverse

Stock Split”). No fractional shares of Common Stock shall be issued as a result of the Reverse Stock Split and, in lieu thereof,

(a) with respect to holders of one or more certificates, if any, which formerly represented shares of Common Stock that were issued

and outstanding immediately prior to the Effective Time, upon surrender after the Effective Time of such certificate or certificates,

any holder who would otherwise be entitled to a fractional share of Common Stock as a result of the Reverse Stock Split, following the

Effective Time, shall be entitled to receive a cash payment (the “Fractional Share Payment”) equal to the fraction of which

such holder would otherwise be entitled multiplied by the closing price per share of Common Stock on the date of the Effective Time as

reported by The Nasdaq Global Market (as adjusted to give effect to the Reverse Stock Split); provided that, whether or not fractional

shares would be issuable as a result of the Reverse Stock Split shall be determined on the basis of (i) the total number of shares

of Common Stock that were issued and outstanding immediately prior to the Effective Time formerly represented by certificates that the

holder is at the time surrendering and (ii) the aggregate number of shares of Common Stock after the Effective Time into which the

shares of Common Stock formerly represented by such certificates shall have been reclassified; and (b) with respect to holders of

shares of Common Stock in book-entry form in the records of the Corporation’s transfer agent that were issued and outstanding immediately

prior to the Effective Time, any holder who would otherwise be entitled to a fractional share of Common Stock as a result of the Reverse

Stock Split (after aggregating all fractional shares), following the Effective Time, shall be entitled to receive the Fractional Share

Payment automatically and without any action by the holder.

The total number of shares of all classes of stock

which the Corporation shall have authority to issue is 160,000,000 shares, consisting of (a) 150,000,000 shares of Common Stock,

$0.001 par value per share (“Common Stock”), and (b) 10,000,000 shares of Preferred Stock, $0.001 par value per share

(“Preferred Stock”).”

SECOND: That, at a meeting of stockholders of the Corporation, the

aforesaid amendment was duly adopted by the stockholders of the Corporation.

THIRD: That the aforesaid amendment was duly adopted in accordance

with the applicable provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, the Corporation has caused

this Certificate of Amendment to be signed by its Chief Executive Officer on this 18th day of September, 2023.

| |

AXCELLA

HEALTH INC. |

| |

|

| |

By: |

/s

William Hinshaw, Jr. |

| |

Name: |

William

Hinshaw, Jr. |

| |

Title: |

President &

Chief Executive Officer |

Exhibit

4.1

| THIS CERTIFIES THAT

is the owner of

CUSIP

DATED

COUNTERSIGNED AND REGISTERED:

COMPUTERSHARE TRUST COMPANY, N.A.

TRANSFER AGENT AND REGISTRAR,

COMMON STOCK

PAR VALUE $0.001

COMMON STOCK

SEE REVERSE FOR CERTAIN DEFINITIONS

Certificate

Number

Shares

..

President & CEO

Senior Vice President, Chief Legal Officer and Secretary By AUTHORIZED SIGNATURE

AXCELLA HEALTH INC.

INCORPORATED UNDER THE LAWS OF THE STATE OF DELAWARE

FULLY-PAID AND NON-ASSESSABLE SHARES OF COMMON STOCK OF

Axcella Health Inc. (hereinafter called the “Company”), transferable on the books of the Company in person

or by duly authorized attorney, upon surrender of this Certificate properly endorsed. This Certificate and the

shares represented hereby, are issued and shall be held subject to all of the provisions of the Certificate of

Incorporation, as amended, and the By-Laws, as amended, of the Company (copies of which are on file with the

Company and with the Transfer Agent), to all of which each holder, by acceptance hereof, assents. This

Certificate is not valid unless countersigned and registered by the Transfer Agent and Registrar.

Witness the facsimile seal of the Company and the facsimile signatures of its duly authorized officers.

August 27,

2008

DELAWARE

INCORPORATE

AXCELLA HEALTH, INC.

ZQ|CERT#|COY|CLS|RGSTRY|ACCT#|TRANSTYPE|RUN#|TRANS#

05454B 20 4

DD-MMM-YYYY

**000000 ******************

***000000 *****************

**** 000000 ****************

***** 000000 ***************

****** 000000 **************

** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample

**** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David

Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander

David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr.

Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample ****

Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample

**** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David

Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander

David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr.

Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample ****

Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Sample **** Mr. Sample

**000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares***

*000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****

000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****0

00000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****00

0000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000

000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****0000

00**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****00000

0**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000

**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000*

*Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**

Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**S

***ZERO HUNDRED THOUSAND

ZERO HUNDRED AND ZERO***

MR. SAMPLE & MRS. SAMPLE &

MR. SAMPLE & MRS. SAMPLE

ZQ00000000

Total Transaction

1234567890/1234567890

1234567890/1234567890

1234567890/1234567890

1234567890/1234567890

1234567890/1234567890

1234567890/1234567890

Certificate Numbers Num/No.

6

5

4

3

2

1

Denom.

6

5

4

3

2

1

Total

7

6

5

4

3

2

1

ADD 4

ADD 3

ADD 2

ADD 1

DESIGNATION (IF ANY)

MR A SAMPLE

PO BOX 505006, Louisville, KY 40233-5006

CUSIP/IDENTIFIER XXXXXX XX X

Holder ID XXXXXXXXXX

Insurance Value 1,000,000.00

Number of Shares 123456

DTC 12345678 123456789012345

THIS CERTIFICATE IS TRANSFERABLE IN

CITIES DESIGNATED BY THE TRANSFER

AGENT, AVAILABLE ONLINE AT

www.computershare.com |

| The IRS requires that the named transfer agent (“we”) report the cost

basis of certain shares or units acquired after January 1, 2011. If your

shares or units are covered by the legislation, and you requested to sell

or transfer the shares or units using a specific cost basis calculation

method, then we have processed as you requested. If you did not

specify a cost basis calculation method, then we have defaulted to the

first in, first out (FIFO) method. Please consult your tax advisor if you

need additional information about cost basis.

If you do not keep in contact with the issuer or do not have any

activity in your account for the time period specified by state law,

your property may become subject to state unclaimed property

laws and transferred to the appropriate state.

For value received, ____________________________hereby sell, assign and transfer unto

________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________ Shares

_______________________________________________________________________________________________________________________ Attorney

Dated: __________________________________________20__________________

Signature: ____________________________________________________________

Signature: ____________________________________________________________

Notice: The signature to this assignment must correspond with the name

as written upon the face of the certificate, in every particular,

without alteration or enlargement, or any change whatever.

PLEASE INSERT SOCIAL SECURITY OR OTHER IDENTIFYING NUMBER OF ASSIGNEE

(PLEASE PRINT OR TYPEWRITE NAME AND ADDRESS, INCLUDING POSTAL ZIP CODE, OF ASSIGNEE)

of the common stock represented by the within Certificate, and do hereby irrevocably constitute and appoint

to transfer the said stock on the books of the within-named Axcella Health Inc. with full power of substitution in the premises.

..

AXCELLA HEALTH INC.

THE COMPANY WILL FURNISH WITHOUT CHARGE TO EACH SHAREHOLDER WHO SO REQUESTS, A SUMMARY OF THE POWERS, DESIGNATIONS,

PREFERENCES AND RELATIVE, PARTICIPATING, OPTIONAL OR OTHER SPECIAL RIGHTS OF EACH CLASS OF STOCK OF THE COMPANY AND THE

QUALIFICATIONS, LIMITATIONS OR RESTRICTIONS OF SUCH PREFERENCES AND RIGHTS, AND THE VARIATIONS IN RIGHTS, PREFERENCES AND

LIMITATIONS DETERMINED FOR EACH SERIES, WHICH ARE FIXED BY THE ARTICLES OF INCORPORATION OF THE COMPANY, AS AMENDED, AND THE

RESOLUTIONS OF THE BOARD OF DIRECTORS OF THE COMPANY, AND THE AUTHORITY OF THE BOARD OF DIRECTORS TO DETERMINE VARIATIONS

FOR FUTURE SERIES. SUCH REQUEST MAY BE MADE TO THE OFFICE OF THE SECRETARY OF THE COMPANY OR TO THE TRANSFER AGENT, THE

BOARD OF DIRECTORS MAY REQUIRE THE OWNER OF A LOST OR DESTROYED STOCK CERTIFICATE, OR HIS LEGAL REPRESENTATIVES. TO GIVE

THE COMPANY A BOND TO INDEMNIFY IT AND ITS TRANSFER AGENTS AND REGISTRARS AGAINST ANY CLAIM THAT MAY BE MADE AGAINST THEM

ON ACCOUNT OF THE ALLEGED LOSS OR DESTRUCTION OF ANY SUCH CERTIFICATE.

Signature(s) Guaranteed: Medallion Guarantee Stamp

THE SIGNATURE(S) SHOULD BE GUARANTEED BY AN ELIGIBLE GUARANTOR INSTITUTION (Banks,

Stockbrokers, Savings and Loan Associations and Credit Unions) WITH MEMBERSHIP IN AN APPROVED

SIGNATURE GUARANTEE MEDALLION PROGRAM, PURSUANT TO S.E.C. RULE 17Ad-15.

The following abbreviations, when used in the inscription on the face of this certificate, shall be construed as though they were written out in full

according to applicable laws or regulations:

TEN COM - as tenants in common UNIF GIFT MIN ACT -............................................Custodian ................................................ (Cust) (Minor)

TEN ENT - as tenants by the entireties under Uniform Gifts to Minors Act ........................................................ (State)

JT TEN - as joint tenants with right of survivorship UNIF TRF MIN ACT -............................................Custodian (until age ................................) and not as tenants in common (Cust)

.............................under Uniform Transfers to Minors Act ................... (Minor) (State)

Additional abbreviations may also be used though not in the above list. |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

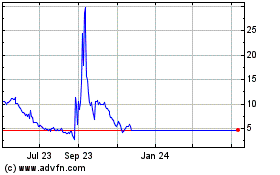

Axcella Health (NASDAQ:AXLA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Axcella Health (NASDAQ:AXLA)

Historical Stock Chart

From Mar 2024 to Mar 2025