Current Report Filing (8-k)

May 31 2019 - 4:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

May 31, 2019 (May 26, 2019)

Avis Budget Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-10308

|

|

06-0918165

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification Number)

|

|

|

|

|

|

|

|

6 Sylvan Way

Parsippany, NJ

|

07054

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

|

|

|

|

|

|

(973) 496-4700

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

|

N/A

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

Title Of Each Class

|

|

Trading Symbol(s)

|

|

Name Of Each Exchange

On Which Registered

|

|

Common Stock, par value $.01

|

|

CAR

|

|

The NASDAQ Global Select Market

|

|

|

|

|

|

|

|

Item 5.02

|

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Departure of Officer

On May 28, 2019, Avis Budget Group, Inc. (the “Company”) announced the planned departure of Larry D. De Shon, President and Chief Executive Officer, after a 13-year career with the Company, effective as of the Company’s appointment of a successor. Mr. De Shon will also resign from the Board of Directors of the Company at such time. Mr. De Shon will continue to be employed by the Company until December 31, 2019. The Board of Directors has formed an Executive Search Committee to identify a successor to Mr. De Shon.

Separation Agreement

Mr. De Shon has entered into a Separation and Consulting Agreement with the Company dated May 26, 2019 (the “Separation Agreement”). The Separation Agreement provides for cash severance in the amount of $7,500,000 and continuation of certain specified perquisites for two years as well as certain health benefits and tax services related to Mr. De Shon’s assignment in the United Kingdom from 2011-2015. Consistent with Mr. De Shon’s employment agreement with the Company, the Separation Agreement provides that stock-based awards scheduled to vest by the two-year anniversary of the separation date will immediately vest following the separation date; provided that any such awards that vest based on the achievement of specific objective performance goals will not vest in full, but will remain outstanding and become vested or forfeited at such time(s) as provided in accordance with the terms and conditions of the applicable award agreement. As a result, 105,112 performance-based restricted stock units granted in 2019 will be forfeited. Under the terms of the Separation Agreement, 23,359 time-based restricted stock units, granted to Mr. De Shon in 2019, will vest upon separation, and certain obligations will be imposed on Mr. De Shon, including non-disparagement obligations.

The Separation Agreement also provides for a one-year post-employment consulting arrangement with aggregate consulting fees of $1.0 million. Mr. De Shon’s consulting fees will be paid in full if the consulting arrangement is terminated by the Company for any reason other than for “cause” or due to death or disability.

A copy of the Separation Agreement is attached hereto as an exhibit and is incorporated herein by reference. The foregoing description of the Separation Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Separation Agreement.

|

|

|

|

|

|

|

Item 7.01

|

|

Regulation FD Disclosure

|

On May 28, 2019, Avis Budget Group, Inc. issued a press release announcing CEO succession as described above. A copy of the press release is furnished herewith as Exhibit 99 and is incorporated herein by reference.

|

|

|

|

|

|

|

Item 9.01

|

|

Financial Statements and Exhibits.

|

The following exhibits are filed as part of this report:

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Separation Agreement between Mr. De Shon and Avis Budget Group, Inc. dated May 26, 2019

|

|

99.1

|

|

Press Release Dated May 28, 2019

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereto duly authorized.

|

|

|

|

|

|

|

|

|

AVIS BUDGET GROUP, INC.

|

|

|

By:

|

|

/s/ Jean M. Sera

|

|

|

Name:

|

Jean M. Sera

|

|

|

Title:

|

Senior Vice President and Secretary

|

Date: May 31, 2019

AVIS BUDGET GROUP, INC.

CURRENT REPORT ON FORM 8-K

Report Dated May 31, 2019 (May 26, 2019)

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

|

|

99.1

|

|

|

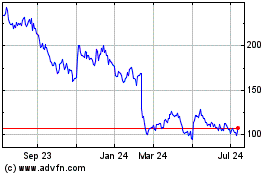

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Jun 2024 to Jul 2024

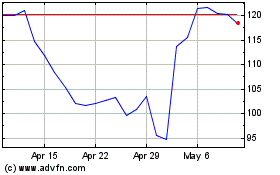

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Jul 2023 to Jul 2024