Avenue Therapeutics Reports Second Quarter 2023 Financial Results and Recent Corporate Highlights

August 10 2023 - 4:15PM

Avenue Therapeutics, Inc. (Nasdaq: ATXI) (“Avenue” or the

“Company”), a specialty pharmaceutical company focused on the

development and commercialization of therapies for the treatment of

neurologic diseases, today reported financial results and recent

corporate highlights for the second quarter ended June 30, 2023.

“Avenue continues to make significant progress

across our compelling pipeline of first- and best-in-class

neurologic therapies for patients facing great unmet need," said

Alexandra MacLean, M.D., Chief Executive Officer of Avenue.

“Recently, we advanced our lead product candidate AJ201 into the

clinic, dosing the first patient in the Phase 1b/2a clinical trial

for spinal and bulbar muscular atrophy (“SBMA”), a rare and

devastating disease with no effective approved therapies.

Additionally, we reported promising preclinical results for

BAER-101 that show robust anti-seizure activity in a translational

animal model of absence epilepsy. These results, combined with

BAER-101’s safety and tolerability profile in multiple clinical

trials, demonstrate its potential to overcome treatment limitations

of both current standard-of-care as well as investigational

therapies in development, and we look forward to initiating a Phase

2a trial in 2024. Importantly, we also reached alignment with the

U.S. Food and Drug Administration (“FDA”) on the final Phase 3

safety study design for IV tramadol, a crucial milestone for the

program as positive results have the potential to support the

submission of a complete response to the second Complete Response

Letter from the FDA and a subsequent U.S. approval. Pending

additional financing, we aim to initiate this Phase 3 safety study

shortly. We look forward to providing updates as we continue to

advance these much-needed drugs for patients in the coming months,

and execute on our mission of providing impactful therapies to

patients suffering from neurologic diseases.”

Recent Corporate

Highlights:

AJ201

- In July 2023, the first patient was

dosed in the Phase 1b/2a clinical trial of AJ201 for the treatment

of SBMA, also known as Kennedy's Disease. The 12-week, multicenter,

randomized, double-blind Phase 1b/2a clinical trial of AJ201 is

expected to enroll approximately 24 patients, randomly assigned to

AJ201 (600 mg/day) or placebo. Topline data for the Phase 1b/2a

clinical trial of AJ201 in SBMA are expected in the first half of

2024. More information about this study can be found at

ClinicalTrials.gov (Identifier: NCT05517603). Information on

clinicaltrials.gov does not constitute part of this release.

BAER-101

- In August 2023, Avenue reported

preclinical results for BAER-101, a potentially best-in-class

selective GABA-A α2,3 positive allosteric modulator, demonstrating

that it significantly suppressed seizures in a translational animal

model of absence epilepsy. In an in vivo evaluation using the

SynapCell's Genetic Absence Epilepsy Rat from Strasbourg (“GAERS”)

model of absence epilepsy, BAER-101 fully suppressed seizure

activity with a minimal effective dose of 0.3 mg/kg, PO.

The effect was fast in onset and stable throughout the duration of

testing. The detailed preclinical results will be presented at an

upcoming scientific meeting. The combination of safety and

tolerability in hundreds of patients and the preclinical efficacy

data support BAER-101’s continued development in a Phase 2a trial,

which the Company plans to initiate in 2024.

IV Tramadol

- In July 2023, Avenue reached an

agreement with the FDA on the trial design and analysis approach of

the Phase 3 safety study for intravenous (“IV”) tramadol, which is

in development for the treatment of acute post-operative pain in a

medically supervised setting. The non-inferiority study is designed

to assess the theoretical risk of opioid-induced respiratory

depression related to opioid stacking on IV tramadol compared to IV

morphine. The study will randomize post bunionectomy patients to IV

tramadol or IV morphine for pain relief administered during a

48-hour post-operative period. Patients will have access to IV

hydromorphone, a Schedule II opioid, for rescue of breakthrough

pain. Avenue is submitting the revised protocol to the FDA

including the statistical plan, which reflects the now agreed upon

study design, for final review. Pending additional financing,

Avenue aims to initiate the Phase 3 safety study as soon as

feasible.

Financial Results:

- Cash

Position: As of June 30, 2023, our cash and cash

equivalents totaled $1.6 million, compared to $6.7 million at

December 31, 2022, a decrease of $5.1 million.

- R&D

Expenses: Research and development expenses for the

second quarter of 2023 were $3.0 million, compared to $0.2 million

for the second quarter of 2022.

- G&A

Expenses: General and administrative expenses for the

second quarter of 2023 were $0.9 million, compared to $0.5 million

for the second quarter of 2022.

- Net Loss: Net

loss attributable to common stockholders for the second quarter of

2023 was $4.0 million, or $0.52 per share, compared to a net loss

of $0.6 million, or $0.41 per share, for the second quarter of

2022.

About Avenue TherapeuticsAvenue

Therapeutics, Inc. (Nasdaq: ATXI) is a specialty pharmaceutical

company focused on the development and commercialization of

therapies for the treatment of neurologic diseases. The Company is

currently developing three assets including AJ201, a first-in-class

asset for spinal and bulbar muscular atrophy, BAER-101, an oral

small molecule selective GABA-A α2/3 receptor positive allosteric

modulator for CNS diseases, and IV tramadol, which is in Phase 3

clinical development for the management of acute postoperative pain

in adults in a medically supervised healthcare setting. Avenue is

headquartered in Miami, FL and was founded by Fortress Biotech,

Inc. (Nasdaq: FBIO). For more information, visit

www.avenuetx.com.

Forward-Looking StatementsThis

press release contains predictive or “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. All statements other than statements of current or

historical fact contained in this press release, including

statements that express our intentions, plans, objectives, beliefs,

expectations, strategies, predictions or any other statements

relating to our future activities or other future events or

conditions are forward-looking statements. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “plan,” “predict,” “project,” “will,” “should,” “would” and

similar expressions are intended to identify forward-looking

statements. These statements are based on current expectations,

estimates and projections made by management about our business,

our industry and other conditions affecting our financial

condition, results of operations or business prospects. These

statements are not guarantees of future performance and involve

risks, uncertainties and assumptions that are difficult to predict.

Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in, or implied by, the

forward-looking statements due to numerous risks and uncertainties.

Factors that could cause such outcomes and results to differ

include, but are not limited to, risks and uncertainties arising

from: expectations for increases or decreases in expenses;

expectations for the clinical and pre-clinical development,

manufacturing, regulatory approval, and commercialization of our

pharmaceutical product candidate or any other products we may

acquire or in-license; our use of clinical research centers and

other contractors; expectations for incurring capital expenditures

to expand our research and development and manufacturing

capabilities; expectations for generating revenue or becoming

profitable on a sustained basis; expectations or ability to enter

into marketing and other partnership agreements; expectations or

ability to enter into product acquisition and in-licensing

transactions; expectations or ability to build our own commercial

infrastructure to manufacture, market and sell our product

candidates; acceptance of our products by doctors, patients or

payors; our ability to compete against other companies and research

institutions; our ability to secure adequate protection for our

intellectual property; our ability to attract and retain key

personnel; availability of reimbursement for our products;

estimates of the sufficiency of our existing cash and cash

equivalents and investments to finance our operating requirements,

including expectations regarding the value and liquidity of our

investments; the volatility of our stock price; expected losses;

expectations for future capital requirements; and those risks

discussed in our filings which we make with the SEC. Any

forward-looking statements speak only as of the date on which they

are made, and we undertake no obligation to publicly update or

revise any forward-looking statements to reflect events or

circumstances that may arise after the date of this press release,

except as required by applicable law. Investors should evaluate any

statements made by us in light of these important factors.

Contact: Jaclyn JaffeAvenue Therapeutics, Inc.

(781) 652-4500ir@avenuetx.com

|

|

|

AVENUE THERAPEUTICS, INC. |

|

Condensed Balance Sheets |

|

($ in thousands, except for share and per share amounts) |

|

|

| |

June 30, |

|

December 31, |

| |

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

1,571 |

|

|

$ |

6,708 |

|

|

Other receivables - related party |

|

26 |

|

|

|

— |

|

|

Prepaid expenses and other current assets |

|

69 |

|

|

|

137 |

|

|

Total assets |

$ |

1,666 |

|

|

$ |

6,845 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

$ |

886 |

|

|

$ |

949 |

|

|

Accounts payable and accrued expenses - related party |

|

54 |

|

|

|

21 |

|

|

Accrued licenses acquired |

|

1,000 |

|

|

|

— |

|

|

Warrant liability |

|

5,872 |

|

|

|

2,609 |

|

|

Total current liabilities |

|

7,812 |

|

|

|

3,579 |

|

| |

|

|

|

|

|

|

|

|

Total liabilities |

|

7,812 |

|

|

|

3,579 |

|

| |

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Stockholders’ equity (deficit) |

|

|

|

|

|

|

|

|

Preferred stock ($0.0001 par value), 2,000,000 shares

authorized |

|

|

|

|

|

|

|

|

Class A Preferred Stock, 250,000 shares issued and outstanding as

of June 30, 2023 and December 31, 2022 |

|

— |

|

|

|

— |

|

|

Common stock ($0.0001 par value), 75,000,000 shares

authorized |

|

|

|

|

|

|

|

|

Common shares, 7,920,485 and 4,773,841 shares issued and

outstanding as of June 30, 2023 and December 31, 2022,

respectively |

|

1 |

|

|

|

— |

|

|

Additional paid-in capital |

|

86,757 |

|

|

|

84,456 |

|

|

Accumulated deficit |

|

(92,094 |

) |

|

|

(80,551 |

) |

|

Total stockholders’ equity attributed to the Company |

|

(5,336 |

) |

|

|

3,905 |

|

| |

|

|

|

|

|

|

|

|

Non-controlling interests |

|

(810 |

) |

|

|

(639 |

) |

|

Total stockholders’ equity (deficit) |

|

(6,146 |

) |

|

|

3,266 |

|

|

Total liabilities and stockholders’ equity |

$ |

1,666 |

|

|

$ |

6,845 |

|

| |

|

|

|

|

|

|

|

|

AVENUE THERAPEUTICS, INC. |

|

Condensed Statements of Operations |

|

($ in thousands, except for share and per share amounts) |

|

(Unaudited) |

|

|

| |

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

3,027 |

|

|

$ |

151 |

|

|

$ |

4,242 |

|

|

$ |

1,959 |

|

|

Research and development - licenses acquired |

|

— |

|

|

|

— |

|

|

|

4,230 |

|

|

|

— |

|

|

General and administrative |

|

896 |

|

|

|

454 |

|

|

|

1,880 |

|

|

|

1,509 |

|

| Loss from operations |

|

(3,923 |

) |

|

|

(605 |

) |

|

|

(10,352 |

) |

|

|

(3,468 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

57 |

|

|

|

1 |

|

|

|

94 |

|

|

|

3 |

|

|

Financing costs – warrant liabilities |

|

— |

|

|

|

— |

|

|

|

(332 |

) |

|

|

— |

|

|

Change in fair value of warrant liabilities |

|

(150 |

) |

|

|

— |

|

|

|

(1,028 |

) |

|

|

— |

|

| Total other income

(expense) |

|

(93 |

) |

|

|

1 |

|

|

|

(1,266 |

) |

|

|

3 |

|

| Net loss |

$ |

(4,016 |

) |

|

$ |

(604 |

) |

|

$ |

(11,618 |

) |

|

$ |

(3,465 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to

non-controlling interests |

|

9 |

|

|

|

— |

|

|

|

75 |

|

|

|

— |

|

| Net loss attributable

to common stockholders |

$ |

(4,007 |

) |

|

$ |

(604 |

) |

|

$ |

(11,543 |

) |

|

$ |

(3,465 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per common share

attributable to common stockholders, basic and diluted |

$ |

(0.52 |

) |

|

$ |

(0.41 |

) |

|

$ |

(1.73 |

) |

|

$ |

(2.42 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding, basic and diluted |

|

7,758,153 |

|

|

|

1,461,067 |

|

|

|

6,667,550 |

|

|

|

1,429,283 |

|

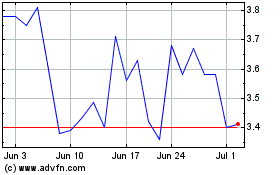

Avenue Therapeutics (NASDAQ:ATXI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Avenue Therapeutics (NASDAQ:ATXI)

Historical Stock Chart

From Nov 2023 to Nov 2024