Current Report Filing (8-k)

February 16 2023 - 4:03PM

Edgar (US Regulatory)

0001554818

false

0001554818

2023-02-10

2023-02-10

0001554818

us-gaap:CommonStockMember

2023-02-10

2023-02-10

0001554818

AUUD:CommonStockWarrantsMember

2023-02-10

2023-02-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): February 16, 2023 (February 10, 2023)

AUDDIA INC.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

001-40071 |

|

45-4257218 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| 2100 Central Avenue, Suite 200 |

|

|

| Boulder, Colorado |

|

80301 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (303) 219-9771

Not Applicable

Former name or former address, if changed since

last report

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of exchange on which registered |

| Common Stock |

AUUD |

Nasdaq Stock Market |

| Common Stock Warrants |

AUUDW |

Nasdaq Stock Market |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01 | Entry into a Material Definitive Agreement. |

On February 13, 2023, the Company entered into an employment agreement

(the “Employment Agreement”), with Timothy J. Ackerman, the Company’s newly appointed Chief Financial Officer. The Employment

Agreement is effective as of February 6, 2023. The terms of the Employment Agreement are summarized below.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

| Item 5.02 (c) | Appointment of New Chief Financial Officer. |

On February 10, 2023, the Company’s board of directors appointed

Timothy J. Ackerman as the Company’s new Chief Financial Officer.

Timothy J. Ackerman, age 59, brings over twenty years of finance

and operational experience in the software and services industry with both publicly traded and privately held companies. From 2020 to

2022, he served as Chief Financial Officer and a board member at Premier Crop Systems, LLC (“PCS”), a venture capital backed

and leading precision agronomy data processing and analytics software and services company. PCS was sold to another privately held company

in 2022. From 2016 to 2020, Mr. Ackerman attended business school and also took a career sabbatical. From 1997 to 2016, Mr. Ackerman served

as Vice President of Finance with CSG Systems International, Inc. (Nasdaq: CSGS), a leading multinational SaaS software and services company.

Mr. Ackerman is a certified public accountant and a chartered global management accountant. He earned both his MBA and BS in Business

Administration from the University of Nebraska.

| Item 5.02(e) | Compensatory Arrangements of Certain Officers. |

Under the terms of the Employment Agreement, Mr. Ackerman will receive

an annual base salary, subject to annual adjustments as determined by the board or compensation committee, equal to $225,000. He will

also be eligible for an annual bonus of up to 50% of his base salary as determined at the sole discretion of the board or the compensation

committee. In addition, the Employment Agreement provides that the executive will be eligible to participate in the Company’s standard

incentive and welfare benefit plans and programs.

In connection with Mr. Ackerman's appointment, the compensation committee

of Auddia's board of directors granted Mr. Ackerman (i) an inducement stock option to purchase an aggregate of 150,200 shares of Auddia

common stock, and (ii) 37,500 restricted stock units for Auddia common stock. These stock options and RSUs were agreed to and granted

as an inducement material to Mr. Ackerman entering into employment with Auddia in accordance with Nasdaq Listing Rule 5635(c)(4).

The options have an exercise price of $1.12 per share, which was equal

to the closing price of Auddia's common stock on the grant date. One-fourth of the options vest on the one-year anniversary of the vesting

commencement date and the remainder vest in equal annual installments over the next three years, subject to continued service with the

Company. The options have a 10-year term. The RSUs will vest in 12 monthly increments over one (1) year and shall settle (to the extent

then outstanding and vested) on February 6, 2024. The options and RSUs will become fully vested if Mr. Ackerman is terminated without

cause or he terminates for good reason during the 12-month period following a change in control.

Under the Employment Agreement, if the Company terminates the executive

without cause or the executive terminates for good reason, the executive is entitled to receive six months of base salary, (ii) six months

of paid health insurance under COBRA, and (iii) any earned but unpaid bonus for a prior completed fiscal year.

The Employment Agreement requires Mr. Ackerman to maintain confidential

information regarding the Company and third parties, and to execute the Company’s standard employee invention assignment and non-disclosure

agreement. The Employment Agreement also includes typical non-competition and non-solicitation provisions that the executive must comply

with for a period of twelve months after termination of employment with the Company.

The above summary does not purport to be a complete summary of the

Employment Agreement and is qualified in its entirety by reference to the full text of the Employment agreement, a copy of which is filed

herewith as an exhibit and is incorporated by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

|

|

|

|

| |

|

|

|

AUDDIA INC. |

| |

|

|

|

| February 16, 2023 |

|

|

|

By: |

|

/s/ Timothy J. Ackerman |

| |

|

|

|

|

|

|

|

Name: Timothy J. Ackerman |

| |

|

|

|

|

|

|

|

Title: Chief Financial Officer |

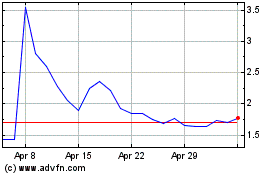

Auddia (NASDAQ:AUUD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Auddia (NASDAQ:AUUD)

Historical Stock Chart

From Sep 2023 to Sep 2024