Ares Capital Corporation (Nasdaq: ARCC) announced that it has

priced a public offering of 10,500,000 shares of its common stock.

The offering was upsized from its previously announced offering

size of 9,000,000 shares. Ares Capital has granted the underwriters

an option to purchase up to an additional 1,575,000 shares of

common stock. The offering is subject to customary closing

conditions and is expected to close on January 18, 2023. The

offering of the shares is being made under Ares Capital’s shelf

registration statement filed with the Securities and Exchange

Commission on June 3, 2021, which became effective automatically

upon filing. On January 12, 2023, the official close price of Ares

Capital’s common stock on The NASDAQ Global Select Market under the

symbol “ARCC” was $19.61 per share.

Morgan Stanley & Co. LLC, BofA Securities, UBS Investment

Bank, RBC Capital Markets, LLC and Wells Fargo Securities are

acting as joint lead book-running managers for this offering. Keefe

Bruyette & Woods, A Stifel Company, and Raymond James &

Associates, Inc. are acting as joint book-running managers for this

offering. Goldman Sachs & Co. LLC, Janney Montgomery Scott LLC,

J.P. Morgan, Oppenheimer & Co. Inc., Academy Securities, Inc.,

Compass Point Research & Trading, LLC, Loop Capital Markets

LLC, Samuel A. Ramirez & Company, Inc., R. Seelaus & Co.,

LLC and Siebert Williams Shank & Co., LLC are acting as

co-managers for this offering.

The underwriters may offer the shares of common stock from time

to time for sale in one or more transactions on The NASDAQ Global

Select Market, in the over-the-counter market, through negotiated

transactions or otherwise at market prices prevailing at the time

of sale, at prices related to prevailing market prices or at

negotiated prices.

Ares Capital expects to use the net proceeds of this offering to

repay certain outstanding indebtedness under its credit facilities.

Ares Capital may reborrow under its credit facilities for general

corporate purposes, which include investing in portfolio companies

in accordance with its investment objective.

Investors are advised to carefully consider the investment

objective, risks, charges and expenses of Ares Capital before

investing. The preliminary prospectus supplement dated January 12,

2023 and the accompanying prospectus dated June 3, 2021, which have

been filed with the Securities and Exchange Commission, contain

this and other information about Ares Capital and should be read

carefully before investing.

The information in the preliminary prospectus supplement, the

accompanying prospectus and this press release is not complete and

may be changed. The preliminary prospectus supplement, the

accompanying prospectus and this press release are not offers to

sell any securities of Ares Capital and are not soliciting an offer

to buy such securities in any jurisdiction where such offer and

sale is not permitted.

The offering may be made only by means of a preliminary

prospectus supplement and an accompanying prospectus. Copies of the

preliminary prospectus supplement (and accompanying prospectus) may

be obtained from Morgan Stanley & Co. LLC, 180 Varick Street,

2nd Floor, New York, NY 10014, Attn: Prospectus Department; BofA

Securities, NC1-004-03-43, 200 North College Street, 3rd floor,

Charlotte NC 28255-0001, Attn: Prospectus Department, or email

dg.prospectus_requests@bofa.com; UBS Securities LLC at 1285 Avenue

of the Americas, New York, New York, 10019, Attn: Prospectus

Department, by telephone at (888) 827-7275, or by email:

ol-prospectus-request@ubs.com; RBC Capital Markets, LLC at 200

Vesey Street, 8th Floor, New York, New York, 10281, Attn:

Prospectus Department, or by telephone at (877) 822-4089; or Wells

Fargo Securities at 500 West 33rd Street, New York, New York,

10001, Attn: Equity Syndicate Department, by calling toll free

1-800-326-5897, or by e-mail at

cmclientsupport@wellsfargo.com.

ABOUT ARES CAPITAL CORPORATION

Founded in 2004, Ares Capital is a leading specialty finance

company focused on providing direct loans and other investments in

private middle market companies in the United States. Ares

Capital’s objective is to source and invest in high-quality

borrowers that need capital to achieve their business goals, which

often leads to economic growth and employment. Ares Capital

believes its loans and other investments in these companies can

generate attractive levels of current income and potential capital

appreciation for investors. Ares Capital, through its investment

manager, utilizes its extensive, direct origination capabilities

and incumbent borrower relationships to source and underwrite

predominantly senior secured loans but also subordinated debt and

equity investments. Ares Capital has elected to be regulated as a

business development company (“BDC”) and is the largest publicly

traded BDC by market capitalization as of December 31, 2022. Ares

Capital is externally managed by a subsidiary of Ares Management

Corporation (NYSE: ARES), a publicly traded, leading global

alternative investment manager.

FORWARD-LOOKING STATEMENTS

Statements included herein may constitute “forward-looking

statements,” which relate to future events or Ares Capital’s future

performance or financial condition. These statements are not

guarantees of future performance, condition or results and involve

a number of risks and uncertainties. Actual results and conditions

may differ materially from those in the forward-looking statements

as a result of a number of factors, including those described from

time to time in Ares Capital’s filings with the Securities and

Exchange Commission. Ares Capital undertakes no duty to update any

forward-looking statements made herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230112005923/en/

INVESTOR RELATIONS Ares Capital Corporation Carl G. Drake

or John Stilmar 888-818-5298 irarcc@aresmgmt.com

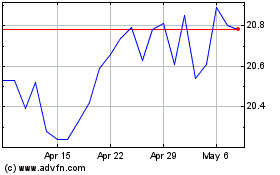

Ares Capital (NASDAQ:ARCC)

Historical Stock Chart

From Apr 2024 to May 2024

Ares Capital (NASDAQ:ARCC)

Historical Stock Chart

From May 2023 to May 2024