Filed by Ansys, Inc. Pursuant to Rule 425 under the Securities Act of

1933, as amended, and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended Subject Company: Ansys, Inc.; Synopsys, Inc.; Commission File No.: 000-20853 Creating a Leader in Silicon to Systems Design Solutions

January 16, 2024

Ansys Fiscal Year 2023 Preliminary Results Ansys has not completed

preparation of its financial statements for the fourth quarter or the fiscal year ended December 31, 2023. The annual contract value (“ACV”), recurring ACV and ACV growth figures provided here as of and for the fiscal year ended December

31, 2023, are preliminary and unaudited and are thus subject to change as Ansys completes its financial results. Synopsys Cautionary Statement Regarding Forward Looking Statements This document contains certain forward-looking statements within the

meaning of the federal securities laws with respect to the proposed transaction between Synopsys and Ansys, including, but not limited to, statements regarding the proposed transaction and the anticipated timing of the closing thereof; Ansys’

anticipated results of operations for fiscal year 2023; the market outlook, products and business of Synopsys, Ansys and the combined company, and the benefits of and cost and revenue synergies from the transaction to Synopsys; pro forma financial

information; the expected structure and the proposed financing for the transaction and long- term leverage and debt paydown targets; short-term and long-term financial targets of the companies; Synopsys’ expectations and objectives; strategies

related to Synopsys’ and Ansys’ products, technology and services; trends, opportunities, strategies and technological trends, such as artificial intelligence; customer demand and market expansion of each of Synopsys and Ansys and the

combined company; Synopsys’ planned product releases and capabilities; industry growth rates; the total addressable markets of Synopsys, Ansys and the combined company; software trends; planned acquisitions and stock repurchases; the

exploration of strategic alternatives; Synopsys’ expected tax rate; and the impact and result of pending legal, administrative and tax proceedings. These forward-looking statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,”

“should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions or the negatives of these words or other comparable terminology to convey

uncertainty of future events or outcomes. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and

uncertainties. Many risks, uncertainties and other factors could cause actual future events to differ materially from the forward-looking statements in this press release, including, but not limited to: (i) the completion of the proposed transaction

on anticipated terms and timing, anticipated tax treatment and unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, pricing trends, future

prospects, credit ratings, business and management strategies which may adversely affect each of Synopsys’ and Ansys’ business, financial condition, operating results and the price of their common stock, (ii) the failure to satisfy the

conditions to the consummation of the transaction, including the adoption of the merger agreement by the stockholders of Ansys and the receipt of certain governmental and regulatory approvals on the terms expected, in a timely manner, or at all,

(iii) the risk that such regulatory approvals may result in the imposition of conditions that could adversely affect, following completion of the proposed transaction (if completed), the combined company or the expected benefits of the proposed

transaction (including as noted in any forward-looking financial information), (iv) uncertainties as to access to available financing (including any future refinancing of Ansys’ or the combined company’s debt) to consummate the proposed

transaction upon acceptable terms and on a timely basis or at all, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, (vi) the effect of the announcement or pendency of the

transaction on Ansys’ or Synopsys’ business relationships, competition, business, financial condition, and operating results, (vii) risks that the proposed transaction disrupts current plans and operations of Ansys or Synopsys and the

ability of Ansys or Synopsys to retain and hire key personnel, (viii) risks related to diverting either management team’s attention from ongoing business operations of Ansys or Synopsys, (ix) the outcome of any legal proceedings that may be

instituted against Ansys or Synopsys related to the merger agreement or the transaction, (x) the ability of Synopsys to successfully integrate Ansys’ operations and product lines, (xi) the ability of Synopsys to implement its plans, forecasts,

expected financial performance and other expectations with respect to Ansys’ business or the combined business after the completion of the proposed mergers and realize additional opportunities, develop customer relationships, additional

products and Ansys’ existing operations and product lines, (xii) the ability of Synopsys to manage additional debt and successfully de-lever following the transaction and the outcome of any strategic review and any resulting transactions,

(xiii) risks associated with third party contracts containing consent and/or other provisions that may be triggered by the proposed transaction, (xiv) macroeconomic conditions and geopolitical uncertainty in the global economy, (xv) uncertainty in

the growth of the semiconductor, electronics and artificial intelligence industries, (xvi) the highly competitive industries Synopsys and Ansys operate in, (xvii) actions by the U.S. or foreign governments, such as the imposition of additional

export restrictions or tariffs, (xviii) consolidation among Synopsys’ customers and Synopsys’ dependence on a relatively small number of large customers, (xix) legislative, regulatory and economic developments affecting Ansys’ and

Synopsys’ businesses, (xx) the evolving legal, regulatory and tax regimes under which Ansys and Synopsys operate, (xxi) restrictions during the pendency of the proposed transaction that may impact Ansys’ or Synopsys’ ability to

pursue certain business opportunities or strategic transactions, and (xxii) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as Ansys’ and

Synopsys’ response to any of the aforementioned factors. The foregoing list of risks, uncertainties and factors is not exhaustive. Unlisted factors may present significant additional obstacles to the realization of forward looking statements.

You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Synopsys and Ansys described in the “Risk Factors” section of their respective Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q and other documents filed by either of them from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those

contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. All forward-looking statements by their nature address matters that involve risks and uncertainties, many of which are beyond

Synopsys’ and Ansys’ control, and are not guarantees of future results. Readers are cautioned not to put undue reliance on forward-looking statements, and Synopsys and Ansys assume no obligation and do not intend to update or revise

these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. Neither Synopsys nor Ansys gives any assurance that either Synopsys or Ansys will achieve its expectations. © 2024

Synopsys, Inc. 2

Ansys Cautionary Statement Regarding Forward-Looking Statements This

document contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements are based on Ansys’ current expectations, estimates and projections about the expected date of closing of the proposed transaction and the potential benefits thereof, its business and industry,

management’s beliefs and certain assumptions made by Ansys and Synopsys, all of which are subject to change. In this context, forward-looking statements often address expected future business and financial performance and financial condition,

and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “could,” “seek,” “see,” “will,” “may,”

“would,” “might,” “potentially,” “estimate,” “continue,” “expect,” “target,” similar expressions or the negatives of these words or other comparable terminology that

convey uncertainty of future events or outcomes. Examples of such forward-looking statements include, but are not limited to, statements regarding our preliminary results, expected ACV, recurring ACV, ACV growth and additional 2023 guidance which

are subject to change through our audit and customary year-end close and review process. All forward-looking statements by their nature address matters that involve risks and uncertainties, many of which are beyond our control, and are not

guarantees of future results, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking statements, including the failure to consummate the proposed transaction or to

make or take any filing or other action required to consummate the transaction on a timely matter or at all, are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ

materially from those expressed in any forward-looking statements. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place

undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: (i) the completion of the proposed transaction on

anticipated terms and timing, including obtaining shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness,

financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of Ansys’ and Synopsys’ businesses and other conditions to the completion of the transaction; (ii) failure to

realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the transaction or integrating the businesses of Ansys and Synopsys; (iii) Ansys’ ability to implement its business strategy; (iv)

pricing trends, including Ansys’ and Synopsys’ ability to achieve economies of scale; (v) potential litigation relating to the proposed transaction that could be instituted against Ansys, Synopsys or their respective directors; (vi) the

risk that disruptions from the proposed transaction will harm Ansys’ or Synopsys’ business, including current plans and operations; (vii) the ability of Ansys or Synopsys to retain and hire key personnel; (viii) potential adverse

reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; (ix) uncertainty as to the long-term value of Synopsys’ common stock; (x) legislative, regulatory and economic

developments affecting Ansys’ and Synopsys’ businesses; (xi) general economic and market developments and conditions; (xii) the evolving legal, regulatory and tax regimes under which Ansys and Synopsys operate; (xiii) potential business

uncertainty, including changes to existing business relationships, during the pendency of the Transaction that could affect Ansys’ or Synopsys’ financial performance; (xiv) restrictions during the pendency of the proposed transaction

that may impact Ansys’ or Synopsys’ ability to pursue certain business opportunities or strategic transactions; (xv) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of

war or hostilities, as well as Ansys’ and Synopsys’ response to any of the aforementioned factors; and (xvi) failure to receive the approval of the stockholders of Ansys. These risks, as well as other risks associated with the proposed

transaction, are more fully discussed in the proxy statement/prospectus to be filed with the U.S. Securities and Exchange Commission in connection with the proposed transaction. While the list of factors presented here is, and the list of factors

presented in the proxy statement/prospectus will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to

the realization of forward looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems,

financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Ansys’ or Synopsys’ consolidated financial condition, results of operations, or liquidity. Neither Ansys nor

Synopsys assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by

securities and other applicable laws. Important Information and Where to Find It This document relates to a proposed transaction between Synopsys and Ansys. Synopsys will file a registration statement on Form S-4 with the SEC, which will include a

document that serves as a prospectus of Synopsys and a proxy statement of Ansys referred to as a proxy statement/prospectus. A proxy statement/prospectus will be sent to all Ansys shareholders. Each party also will file other documents regarding the

proposed transaction with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED

TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and

security holders will be able to obtain free copies of the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Synopsys or Ansys through the website maintained by the SEC at

www.sec.gov. The documents filed by Synopsys with the SEC also may be obtained free of charge at Synopsys’ website at https://investor.synopsys.com/overview/default.aspx or upon written request to Synopsys at Synopsys, Inc., 675 Almanor

Avenue, Sunnyvale, California 94085, Attention: Investor Relations Department. The documents filed by Ansys with the SEC also may be obtained free of charge at Ansys’ website at https://investors.ansys.com/ or upon written request to

kelsey.debriyn@ansys.com. Participants in Solicitation Synopsys, Ansys and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Ansys’ shareholders in connection with the

proposed transaction. Information about Ansys’ directors and executive officers and their ownership of Ansys’ common stock is set forth in Ansys’ proxy statement for its 2023 Annual Meeting of Shareholders on Schedule 14A filed

with the SEC on March 28, 2023. To the extent that holdings of Ansys’ securities have changed since the amounts printed in Ansys’ proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4

filed with the SEC. Information about Synopsys’ directors and executive officers is set forth in Synopsys’ proxy statement for its 2023 Annual Meeting of Shareholders on Schedule 14A filed with the SEC on February 17, 2023 and

Synopsys’ subsequent filings with the SEC. Additional information regarding the direct and indirect interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy

statement/prospectus regarding the proposed transaction when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph. © 2024 Synopsys, Inc. 3

No Offer or Solicitation This document is for informational purposes only

and is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of

Section 10 of the U.S. Securities Act of 1933, as amended. Non-GAAP Financial Information This document includes certain forward looking financial measures that are not in accordance with the U.S. generally accepted accounting principles

(“GAAP”). • Adjusted EBITDA (“Adj. EBITDA”) is calculated as GAAP Operating Income excluding depreciation and amortization, stock compensation, non-qualified deferred compensation plan, acquisition-related costs and

restructuring charges • Free Cash Flow (“FCF”) is calculated as cash provided from operating activities less capital expenditures and capitalization of software development costs • Unlevered Free Cash Flow

(“uFCF”) is calculated as Free Cash Flow excluding tax-effected cash net interest • Unlevered Free Cash Flow Margin is calculated as Unlevered Free Cash Flow for a period divided by revenue for the same period • Non-GAAP

Earnings Per Share (“EPS”) is calculated as GAAP net income excluding amortization of intangible assets, stock compensation, acquisition-related costs, restructuring charges, and legal matters, adjusted for the difference between GAAP

and non-GAAP tax rates, divided by fully diluted outstanding shares • Non-GAAP Operating Income is calculated as GAAP Operating Income, excluding amortization of intangible assets, stock compensation, non-qualified deferred compensation plan,

acquisition-related costs and restructuring charges • Non-GAAP Operating Margin is Non-GAAP Operating income for a period divided by revenue for the same period Synopsys and Ansys present non-GAAP financial measures to provide their investors

with an additional tool to evaluate Synopsys’ and Ansys’ respective operating results in a manner that focuses on what Synopsys and Ansys each believe to be their respective core business operations and what Synopsys and Ansys each use

to evaluate their respective business operations and for internal budgeting and resource allocation purposes. These non-GAAP measures may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based

on any comprehensive set of accounting rules or principles, and management exercises judgment in determining which items should be excluded in the calculation of non-GAAP measures. The presentation of non-GAAP financial information is not meant to

be considered in isolation from, as superior to or as a substitute for the directly comparable financial measures prepared in accordance with GAAP. These non-GAAP financial measures are meant to supplement, and be viewed in conjunction with, the

corresponding GAAP financial measures. When possible with respect to non-GAAP financial measures presented with respect to historical periods, Synopsys and Ansys, respectively, provide a reconciliation of their historic non-GAAP financial measures

to their most closely applicable GAAP financial measures in the documents filed by Synopsys and Ansys with the SEC. Synopsys and Ansys, respectively, are unable to provide a reconciliation of certain non-GAAP guidance measures to the corresponding

GAAP measures on a forward-looking basis because doing so would not be possible without unreasonable effort due to, among other things, the potential variability and limited visibility of the excluded items and expectations as to the financial of

performance of each of Synopsys and Ansys upon the completion of the mergers. For the same reasons, Synopsys and Ansys are each unable to address the probable significance of the unavailable information. Synopsys and Ansys are presenting forward

looking non-GAAP financial measures for illustrative purposes and may not report on this basis going forward. Combined company measures for historical periods are based on combining Synopsys’ historical financial results and Ansys’

historical or preliminary financial results, as applicable, without pro forma adjustments and are included for illustrative purposes in order to provide investors with estimates of what the combined company results could have been. Combined company

estimates are not pro forma financial measures, are not prepared in accordance with Regulation S-X under the U.S. Securities Act of 1933, as amended, and are not necessarily indicative of the results that actually would have been realized had

Synopsys and Ansys been a single entity during the relevant periods. Other Key Business Metrics Annual Contract Value (“ACV”) is a key performance metric for Ansys and is useful to investors in assessing the strength and trajectory of

the business. ACV is a supplemental metric to help evaluate the annual performance of the business. Over the life of the contract, ACV equals the total value realized from a customer. ACV is not impacted by the timing of license revenue recognition.

ACV is used by Ansys’ management in financial and operational decision-making and in setting sales targets used for compensation. ACV is not a replacement for, and should be viewed independently of, GAAP revenue and deferred revenue as ACV is

a performance metric and is not intended to be combined with any of these items. There is no GAAP measure comparable to ACV. ACV is composed of the following: 1) the annualized value of maintenance and subscription lease contracts with start dates

or anniversary dates during the period, plus; 2) the value of perpetual license contracts with start dates during the period, plus; 3) the annualized value of fixed-term services contracts with start dates or anniversary dates during the period,

plus; 4) the value of work performed during the period on fixed-deliverable services contracts. © 2024 Synopsys, Inc. 4

Today’s Presenters Sassine Ghazi Ajei Gopal Shelagh Glaser

President and Chief Executive Officer President and Chief Executive Officer Chief Financial Officer © 2024 Synopsys, Inc. 5

Creating a Leader in Silicon to Systems Design Solutions Strategic Vision

and Transaction Overview Ansys: A Global Leader in Simulation Value Creation for Shareholders © 2024 Synopsys, Inc. 6

+ Builds on Seven-Year Partnership to Create a Leader in Silicon to

Systems Design Solutions Strategic Logic Expected Significant Shareholder Value Creation • Combines leaders in semiconductor design technology and • Industry-leading double-digit revenue growth and simulation & analysis to address

customer need for fusion immediately expands margins of electronics and physics, augmented with AI • Expected to be accretive to non-GAAP EPS in • Enhances and accelerates Synopsys’ Silicon to Systems second full year post close

and substantially accretive 2 strategy, both in core electronic design automation thereafter (EDA) and new attractive adjacent growth areas • Expected to achieve ~$400 million of cost synergies by • Expands Synopsys’ TAM by ~1.5x

to ~$28B, growing at year 3 and ~$400 million of revenue synergies by year 4 1 ~11% CAGR • Strong free cash flow generation to enable rapid • Extends pioneering AI and Cloud leadership in EDA deleveraging (<2x Adj. EBITDA leverage

expected within and simulation 2 years post close) 1. Synopsys management estimates; excludes the Software Integrity Group’s TAM. CAGR forecast for 2023 to 2028 period. © 2024 Synopsys, Inc. 7 2. Expected to be accretive in second full

year post close including cost synergies only, substantially accretive thereafter including cost and revenue synergies.

Synopsys at a Glance ~$6B FY23 Revenue by Product FY23 Revenue Group

& Region 1 Mission IP EDA 26% 65% Empower technology Design Automation innovators everywhere ~15% Industry Leader FY23 Revenue Growth Rate Purpose SIG 9% Power innovation today that ignites the ingenuity of tomorrow Other ~35% Design IP U.S. 16%

48% FY23 Non-GAAP #2 IP Vendor Value Operating Margin Europe Proposition 10% We maximize customers’ R&D capabilities and multiply their Korea 11% productivity ~20K Software Integrity Employees China Industry Leader 15% Source: Company

filings. Synopsys FY23 financial metrics for fiscal year ending on October 31, 2023. Note: Software Integrity business is undergoing a strategic review as announced on November 29, 2023. © 2024 Synopsys, Inc. 8 1. Segment includes the EDA and

Other revenue groups.

Track Record of Shareholder Value Creation STRATEGIC PRIORITIES FY20

– FY23 RESULTS • 3nm/2nm leadership across EDA stack Technology and • Enabling the multi-die industry transition Innovation Leadership • Pioneering AI/Cloud in EDA • Next-gen IP across all leading foundries ~120% 2 3

Year TSR Industry-Leading • ~17% revenue CAGR Growth 1 (>200bps above Synopsys’ TAM CAGR) ~3.5x vs. S&P 500 Margin Expansion • +~700bps non-GAAP operating margin increase (from ~28% to ~35%) 1. Sources: ESDA, Ipnest,

Synopsys management estimates. © 2024 Synopsys, Inc. 9 2. Total Shareholder Return (TSR) as of December 21, 2023 (the last trading day prior to media speculation regarding a potential transaction).

The Era of Pervasive Intelligence Pervasive Intelligence Data Center

Edge Insatiable demand for Compute deployed high-performance compute in broad array of devices New generations of advanced Proliferation of electronic chips pushing the boundaries software-defined systems of semiconductor design © 2024

Synopsys, Inc. 10

Systems to Silicon Fundamental Changes in Silicon and Systems Design

SYSTEMS SPECTRUM Electronics Electro-Mechanical Semiconductor Companies Systems Companies “Classic” Advanced Industrial Chips Computing High-Tech Automotive Aerospace Equipment Others MECHANICAL MECHANICAL MECHANICAL MECHANICAL

MECHANICAL ELECTRIC ELECTRIC ELECTRIC ELECTRIC ELECTRIC ELECTRONIC ELECTRONIC ELECTRONIC ELECTRONIC ELECTRONIC ELECTRONIC ELECTRONIC Hardware Hardware Hardware Hardware Hardware Embedded Software Software Software Software Software control Silicon

Silicon Silicon Silicon Silicon Silicon New Complexity Challenges Angstrom scale, Silicon/Software/ In-field monitoring multi-die chips Hardware co-design and optimization © 2024 Synopsys, Inc. 11 Silicon to Systems

Our Strategy for Sustained, Value-Creating Growth STRATEGIC PRIORITIES

STRATEGY From Silicon … … to Systems Technology and Innovation Leadership Expand into new adjacent growth Lead innovation in EDA and IP for areas in software-defined systems the era of Pervasive Intelligence Industry-Leading Growth

Optimize Go-to-Market (GTM) to achieve full growth potential across all regions and increase penetration beyond Semiconductor accounts Unleash productivity gains through digital transformation Margin Expansion of engineering and operations ©

2024 Synopsys, Inc. 12

Solving Today’s Silicon Design Complexity with Digital Fusion and

AI ™ Fusion Design Platform Harnessing AI Partnership with Ansys has been an integral part of 2017 2020 TODAY Synopsys Fusion since 2017 Industry-leading Digital Pioneering Implementation Platform AI-powered EDA • Technology and GTM

partnership AI Place & Route Timing Power System Architecture Integrity • Joint solution qualified at leading foundries Design Capture Test Physical Verification Verification Synthesis Implementation • The vast majority of Synopsys

Fusion Signoff Test & SLM TM Compiler users incorporate Ansys Silicon Manufacturing Fusion ™ technology Compiler © 2024 Synopsys, Inc. 13 Hyper Convergence

New Complexity Challenges Require Fusion of Electronics and Physics

Next-Gen Multi-Die for Co-Optimized ™ Fusion Design Platform Harnessing AI High-Performance Compute Intelligent Systems 2017 2020 TODAY Industry-leading Digital Pioneering Multi-Die Implementation Platform AI-powered EDA AI Power Place &

Route Thermal Electrical Timing Power System Architecture Integrity HPC, Data Center Aerospace Design Capture Test Physical Verification Verification Synthesis Implementation Signoff Test & SLM Silicon Manufacturing Fusion Electromagnetic

Structures ™ Compiler Interference (EMI) Automotive Industrial Automation + Technology and Combination to deliver fusion of electronics and GTM partnership physics, augmented with AI © 2024 Synopsys, Inc. 14 Hyper Convergence

Creating a Leader in Silicon to Systems Design Solutions Design Design

Software Simulation & Automation IP Integrity Analysis Industry Leader #2 IP Vendor Industry Leader Industry Leader 1 ~$6B ~$2B FY23 Revenue FY23 Revenue Guidance Building on our successful seven-year partnership 1. Ansys FY2023 revenue guidance

provided in November 2023. Final results may differ. © 2024 Synopsys, Inc. 15

Combination Enhances and Accelerates Silicon to Systems Strategy From

Silicon … … to Systems Strengthens capabilities Accelerates expansion in advanced chip into new growth design technology verticals 31% 22% Semiconductor / Aerospace • Opportunities to improve EDA • Extends portfolio with

High-Tech penetration industry-leading simulation and analysis solutions • Scale fast-growing Synopsys system software businesses • Enables fusion of through Ansys GTM multi-physics analysis into Prelim. FY23 digital design flows •

High-potential verticals ACV ~$2B for digital twin and functional 18% • Allows development safety solutions combining Automotive of joint solutions in physics and electronics new areas (e.g., Analog/RF) 13% 9% Other 7% Industrial Energy

Equipment Note: Ansys’ financial metrics based on preliminary unaudited 2023 results. Final results may differ. © 2024 Synopsys, Inc. 16

Provides Access to Attractive ~$10B Simulation & Analysis TAM

Estimated TAM CAGR 2 2023 TAM 2023-28 Underlying Secular 1 R&D Growth Trends ~$28B ~11% • Sustainability Systems • Autonomy ~$10B • IoT ~1.5x ~10% Simulation • Engineering Digital Transformation ~6-7% & Analysis

• Model-Based Systems Engineering • Availability of compute (Cloud) ~$7B • Engineering complexity ~12% IP • AI-powered design & analysis • Talent constraints ~8-9% • Software-defined systems ~$11B •

Domain-specific silicon ~12% • Multi-die EDA • Angstrom-size nodes Silicon Expect combined company revenue growth to outpace TAM growth 1. Wall Street Research and Synopsys management estimates; growth for the period 2007-2021; Systems

R&D growth rate calculated as a blended rate across sectors applying Ansys ACV industry mix. © 2024 Synopsys, Inc. 17 2. Synopsys management estimates; excludes the Software Integrity Group’s TAM.

Extends Pioneering AI and Cloud Leadership in EDA and Simulation

Synopsys.ai – industry’s first AI-driven EDA suite: Industry pioneer (I) Self-optimizing tools with DSO.ai™ (II) Designer assistants First AI-designed (III) Generative design chip tapeout AI Well-positioned to 2019 2020 2021 2022

2023 2024 continue innovating ahead AnsysGPT: virtual customer support assistant Common underlying SimAI: physics-agnostic, technology and know-how cloud-enabled AI engine Combined total R&D of ~$2B 1 (~2x industry peer median) Bring Cloud

FlexEDA Your Own EDA business Cloud (SaaS) model Highly talented workforce with deep engineering expertise Cloud 2019 2020 2021 2022 2023 2024 Cross-domain system data, Marketplace / APIs to components Bring Your for new custom-made from in-design

to in-field Own Licenses solutions Industry pioneer with Ansys Cloud 1. Combined R&D spend based on Synopsys’ and Ansys’ respective FY22 R&D spends. Industry peer median based on reported FY22 R&D spend from publicly

available filings. Peers defined as Altair Engineering, Autodesk, Cadence © 2024 Synopsys, Inc. 18 Design Systems, Dassault Systèmes, Keysight Technologies and PTC.

Highly Compelling Combination: Transaction Highlights • Synopsys

to acquire 100% of Ansys outstanding shares – $197.00 in cash and 0.3450 shares of Synopsys common stock per Ansys share 1 1 1 Overview– $390.19 implied total consideration represents premium of ~29% and ~35% over Ansys’ closing

price and 60-day VWAP, respectively • Ansys shareholders expected to own ~16.5% of combined company 2 • Annual revenue of ~$8B ; industry-leading double-digit growth outpacing TAM growth • Non-GAAP operating margin expansion of

~125bps and uFCF margin expansion of ~75bps in year 1 Expected Combined 3 • Accretive to non-GAAP EPS in second full year post close and substantially accretive thereafter Company Financial Benefits • ~$400M of run-rate cost synergies by

year 3 and ~$400M of run-rate revenue synergies by year 4 4 • Synopsys intends to fund the $19B of cash consideration through a combination of cash and debt Expected Transaction • Expect $16B of fully-committed financing Financing

Expected Combined • Plan to de-lever to <2x Adj. EBITDA within 2 years post close Company Leverage • Expect to maintain investment grade credit ratings and long-term leverage target <1x given strong FCF • Teams know each

other well, have collaborated successfully in partnership since 2017 Management & Integration • Dedicated team to execute detailed and actionable plan for smooth integration and realization of identified synergies • Targeting close

in the first half of 2025 (subject to customary closing conditions, including approval by Ansys’ Timing & Next Steps shareholders and required regulatory approvals) 1. Implied total consideration based on Synopsys’ common stock

closing price as of December 21, 2023 (the last trading day prior to media speculation regarding a potential transaction); premium calculated over Ansys’ common stock closing price as of December 21, 2023, and Ansys’ volume-weighted

average price for the 60-day period ending on the same date. 2. Based on Synopsys FY2023 revenue and Ansys FY2023 revenue guidance provided in November 2023. Ansys final financial results may differ. © 2024 Synopsys, Inc. 19 3. Expected to be

accretive in second full year post close, including cost synergies only, and substantially accretive thereafter including cost and revenue synergies. 4. Includes the refinancing of Ansys’ existing debt and transaction expenses.

Creating a Leader in Silicon to Systems Design Solutions Strategic

Vision and Transaction Overview Ansys: A Global Leader in Simulation Value Creation for Shareholders © 2024 Synopsys, Inc. 20

Ansys Is a Leader in Simulation and Analysis Broad and Deep Powerful

Broad, Diversified Highly Recurring Physics Portfolio Secular Trends Customer Base Business Model Best-in-class portfolio Megatrends driving Thousands of customers Subscription lease model with from component design customer need for more worldwide

across three vectors of growth: to mission level engineering simulation geographies, industries and • More users powered by • Electrification customer types • More products • Numerics • Autonomy • More

computations Top 100 represent ~45% of • HPC • Connectivity ACV • AI/ML • Industrial IoT • Cloud & Experience • Sustainability • Digital Engineering 3 ~$2B ~$2B ~83% ~13% 41-42% 92% 1 1 Prelim. FY23

FY23E Guidance Prelim. FY23 Prelim. FY23 FY23E Guidance 2023 Customer 2 ACV Revenue Recurring ACV ACV Growth Non-GAAP Satisfaction Score Operating Margin Note: Unless otherwise noted, Ansys financial metrics based on Ansys’ preliminary

unaudited 2023 results. Final results may differ. 1. Financial metrics based on Ansys’ FY2023 guidance range provided in November 2023. © 2024 Synopsys, Inc. 21 2. Recurring ACV includes both subscription lease ACV and all maintenance ACV

(including maintenance from perpetual licenses). Non-recurring ACV includes perpetual license ACV and service ACV. 3. Source: Ansys customer satisfaction program.

Consistent, High Quality Double-Digit Top Line Growth Industry-Leading

Growth Sustained Growth over Time Quality Growth Total ACV Y-o-Y Constant Currency ACV Growth ~11% (Constant currency at 2022 rates) Prelim. FY23 Consistently performing above ACV Growth 1 financial targets ex-Dynamore acquisition $2.3B ~16% ~83%

~14% $1.5B ~13% 1 12% Prelim. FY23 Recurring ACV ~16% Prelim. FY23 Recurring ACV Growth (Subscription lease + Maintenance) 2021 2022 Prelim. 2023 2020 Prelim. 2023 Non-recurring ACV Recurring ACV (Subscription lease + Maintenance) Note: Unless

otherwise noted, financial metrics based on Ansys’ preliminary unaudited 2023 results. Final results may differ. © 2024 Synopsys, Inc. 22 1. Represents Ansys’ long-term outlook presented in its 2022 Investor Day of 12% constant

currency ACV CAGR, including tuck-in M&A, from 2022 to 2025.

Creating a Leader in Silicon to Systems Design Solutions Strategic

Vision and Transaction Overview Ansys: A Global Leader in Simulation Value Creation for Shareholders © 2024 Synopsys, Inc. 23

Attractive Financial Benefits Drive Shareholder Value High Quality

Revenue High Margin Better Together Expected to add high quality, Expected to immediately Significant synergy durable revenue stream expand margins opportunity expected ~125 bps ~75 bps ~$8B ~$400M ~$400M Year 1 Non-GAAP Year 1 1 Combined Revenue

Run-rate Run-rate Operating Margin uFCF Margin Cost Synergies Revenue Synergies Expansion Expansion • High growth (industry-leading • Two high-margin businesses • Expected to be accretive to non- double-digit) GAAP EPS within the

second full • ~37% combined non-GAAP year post close and substantially 2 • Neutral to Synopsys revenue operating margin 3 accretive thereafter growth by first full year and • Opportunity for further margin accretive thereafter

• Identified and actionable run-rate expansion as cost synergies are cost synergies of ~$400M by year 3 • Combined company revenue realized growth expected to outpace TAM • Run-rate revenue synergies of growth ~$400M by year 4,

growing to ~$1B+ annually in the longer-term • High quality recurring revenue 1. Based on Synopsys FY2023 revenue and Ansys FY2023 revenue guidance provided in November 2023. Final results may differ. 2. Based on Synopsys FY2023 non-GAAP

operating margin of ~35% and Ansys FY2023 non-GAAP operating margin guidance range of ~41% - 42%, provided in November 2023 guidance. Final results may differ. © 2024 Synopsys, Inc. 24 3. Expected to be accretive in second full year post close

including cost synergies only, substantially accretive thereafter including cost and revenue synergies.

Strong Combined Balance Sheet with Strong Free Cash Flow Generation

Supporting Financial Flexibility Expected Rapid Financial Flexibility for Disciplined 1 Deleveraging Capital Allocation Debt / Adj. EBITDA • Expect rapid deleveraging to <2x within 2 years 3.9x post close Deleveraging • Long-term

gross leverage target of <1x • Maintain investment grade credit rating <2x • Temporary suspension of share buybacks Share Buybacks • Expected to resume as leverage approaches <2x <1x • Focused on successful

integration M&A • Strong free cash flow to support financial flexibility for future M&A At Close 2 Years Long-Term Post Close Target © 2024 Synopsys, Inc. 25 1. Does not include any proceeds from potential divestitures.

Highly Achievable, Identified Synergies and Potential for More ~$400M

~$400M ~$1B+ of run-rate cost synergies of run-rate revenue synergies of annual revenue synergies expected by year 3 expected by year 4 expected over longer-term • Streamlining and realizing the benefits • Integration of multi-physics

system • Full potential realization of current of scale analysis for advanced chip design identified synergies and TAM growth • Integration of engineering platforms • Expansion of direct account coverage • Significant

potential for additional and technology reuse for AI and Cloud for Ansys portfolio in Semiconductor / revenue synergies from High-Tech sector • Further penetration beyond • Joint semiconductor solutions (e.g., Semiconductor / High-Tech

sector Analog/RF) • New joint innovative system • Accelerated expansion in Automotive, solutions (e.g., digital twin, functional Aerospace, and Industrial Equipment safety) We have identified specific, substantial and actionable cost and

revenue synergies © 2024 Synopsys, Inc. 26

1 Long-Term Financial Objectives Combined company long-term, multi-year

objectives Revenue Margin Free EPS Cash Flow Industry-leading Long-term non-GAAP Long-term unlevered Non-GAAP EPS double-digit growth operating margins in free cash flow margins growth in the mid 40s in mid 30s high-teens range Near-term

prioritization of our strong cash flow for debt paydown © 2024 Synopsys, Inc. 27 1. These multi-year objectives are provided as of January 16, 2024.

Committed to a Successful Integration Highly complementary Dedicated

team in place to execute integration businesses Objectives Key Functional Areas Common underlying secular Manage risk ❑ Engineering trends and customer needs ❑ GTM Maintain business continuity Shared deep tech and ❑ People

science core competences Retain critical talent and ❑ Corporate Functions capabilities Very similar talent profile and cultures Realize identified synergies Builds on success of Committed to providing quarterly updates on our integration

efforts seven-year partnership Rigorous integration planning approach informed by comprehensive diligence © 2024 Synopsys, Inc. 28

Highly Strategic and Financially Compelling Combination Combines leaders

in semiconductor design technology and simulation & analysis Addresses customer need for fusion of electronics and physics, augmented with AI Enhances and accelerates our Silicon to Systems strategy, both in core EDA and new attractive adjacent

growth areas 1 Expands Synopsys’ TAM by ~1.5x to ~$28B, forecasted to grow at ~11% CAGR Highly attractive combined company financial profile with improved margin, unlevered free cash flow and EPS Expected to deliver identified and actionable

run-rate cost synergies of ~$400M by year 3 and run-rate revenue synergies of ~$400M by year 4, growing to over ~$1B annually in the longer-term Combines two best-in-class, highly complementary organizations with deep tech underpinnings 2 Synopsys

delivered ~120% TSR in the past 3 years and expects to continue to deliver meaningful value creation with the addition of Ansys 1. Synopsys management estimates. CAGR forecast for 2023 to 2028 period. © 2024 Synopsys, Inc. 29 2. Total

Shareholder Return (TSR) as of December 21, 2023 (the last trading day prior to media speculation regarding a potential transaction).

Appendix © 2024 Synopsys, Inc. 30

Creating a Leader in Silicon to Systems Design Solutions Industry Leader

Design Automation Simulation & Complementary Industry Leader 1 + Industry Leaders Analysis Design IP #2 IP Vendor ~$18B ~12% ~$10B ~10% Leaders in + 2 1 EDA and IP 2023-2028 Simulation & Analysis 2023-2028 Growing TAM 2023 TAM TAM CAGR 2023

TAM TAM CAGR ~85% ~15% ~30% ~70% Complementary + 3 2 Semiconductor / Other Systems Semiconductor / Other Systems Customers High-Tech Verticals High-Tech Verticals ~35% ~11% ~41 – 42% High Growth, 4 ~15% + FY23 Non-GAAP Prelim. FY23 ACV Growth

FY23 Guidance High Margin FY23 Revenue Growth 3 4 Operating Margin ex-Dynamore Acquisition Non-GAAP Op. Margin AI / Cloud Pioneer in AI-enhanced EDA Advancing AI innovation powered 5 + Launched first cloud-based EDA by Ansys’ third generation

cloud Capabilities 1. Synopsys management estimates. 4. Based on Ansys’ FY2023 guidance range provided in November 2023. Final results may differ. 2. Synopsys based on FY2023 revenue. Ansys based on preliminary unaudited FY2023 ACV. Final

results may differ. © 2024 Synopsys, Inc. 31 3. Based on Ansys’ preliminary unaudited FY2023 results. Final results may differ.

Ansys Is Recognized by Customers as a Segment Leader & Innovator 1

Third-Party Survey of Simulation & Analysis Users Leading in innovating Best in technical and unlocking Segment Leader capabilities new use cases Leading closest Highest rating Leading closest competitors by (8.0 out of 10) competitors by 2 2

1.5 - 4x 1.2 - 2x In each major sector: Semiconductor / High-Tech, Automotive, Aerospace 1. Source: Third-party consulting firm Simulation & Analysis User Survey – Key Insights (January 2024). © 2024 Synopsys, Inc. 32 2. Across all

core simulation segments surveyed: Structural Mechanics, CFD / Thermal, Electromagnetics.

Ansys’ Comprehensive Portfolio Built through Decades of Investment

• Best-in-class engineering simulation portfolio with an open and integrated ecosystem • Addressing new multi-physics use cases from component to mission analyses, safety and software • Model-Based Systems Engineering and digital

twin expansion opportunities KEY TECHNOLOGY PILLARS • Ongoing accuracy, speed and scalability algorithmic advancements High-Performance Numerics AI & ML Cloud & Digital Computing Experience Engineering • Continually advancing

customer value with new products and features • Significant investments in Cloud and AI © 2024 Synopsys, Inc. 33

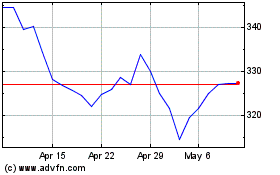

ANSYS (NASDAQ:ANSS)

Historical Stock Chart

From Apr 2024 to May 2024

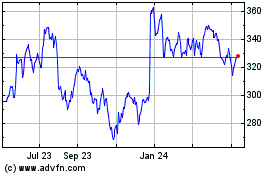

ANSYS (NASDAQ:ANSS)

Historical Stock Chart

From May 2023 to May 2024