American Rebel Announces $19.9+ Million Public 8.53% Preferred Offering

March 15 2024 - 8:58AM

American Rebel Holdings, Inc. (NASDAQ: AREB) ("American Rebel" or

the "Company"), is pleased to announce the launch of a Regulation

A+, equity financing of up to

$19,999,995 of 8.53%

Series C Redeemable Convertible Preferred Stock (the “Public

Offering”). This Public Offering is a watershed event for the

Company and allows anyone 18 years or older to log onto the

American Rebel Public Offering website at

https://invest.americanrebel.com/ and with a click of a button

subscribe to the offering. A copy of the Company’s offering

circular for the Public Offering has been posted at

https://www.sec.gov/Archives/edgar/data/1648087/000149315224009903/form253g2.htm.

Investors may also review other securities filings on the Security

and Exchange Commission’s website at

https://www.sec.gov/Archives/edgar/data/1648087/000149315224009322/partiiandiii.htm.

This offering makes 2.6+ million shares of the

Company’s Series C Redeemable Convertible Preferred Stock, par

value $0.001 per share, which we refer to as the Series C Preferred

Stock, available for purchase at $7.50 per share. The Series C

Preferred Stock pays a $0.16 per share per quarter dividend at an

annual yield of approximately 8.53% and is convertible into five

shares of the Company’s common stock for each share of the Series C

Preferred Stock. In addition, investors will receive perks based on

the size of investment, such as hats, koozies, t-shirts, tank tops,

guitars and VIP experiences to proudly display their participation

as a shareholder of American Rebel.

Digital Offering, LLC, is acting as the sole

lead managing selling agent for the Offering.

In addition to the launch of the Reg A capital

offering, American Rebel is launching America’s Patriotic,

God-Fearing, Constitution-Loving, National Anthem Singing, Stand

Your Ground Beer with a proven beverage development company and

co-packer. For more information on American Rebel Light Beer, go to

americanrebelbeer.com.

Andy Ross, Chief Executive Officer of American

Rebel, commented, “American Rebel is America’s Patriotic brand. Our

greatest asset has long been our relationship with our customers

who purchase our products to proclaim their love for this country

and freedom and making an investment in American Rebel available to

the general public through Regulation A+ expands our relationship

with our patriotic family. Bringing our customers closer while

aligning our interests and providing them another avenue for those

customers to express themselves through stock ownership will serve

to strengthen American Rebel as we position for the future.

American Rebel Beer is the only beer we’re drinking round

here!”

About American Rebel Holdings,

Inc.American Rebel Holdings, Inc. (NASDAQ: AREB) operates

primarily as a designer, manufacturer and marketer of branded safes

and personal security and self-defense products. The Company also

designs and produces branded apparel and accessories and is

entering the beverage business. To learn more, visit

www.americanrebel.com. For more information on American Rebel Beer,

visit www.americanrebelbeer.com. For investor information, visit

www.americanrebel.com/investor-relations.

The Offering will be made by means of the

Offering Circular. The securities offered by American Rebel are

highly speculative. Investing in shares of American Rebel involves

significant risks. The investment is suitable only for persons who

can afford to lose their entire investment. Furthermore, investors

must understand that such investment could be illiquid for an

indefinite period of time. No public market currently exists for

the securities, and if a public market develops following the

offering, it may not continue. American Rebel intends to list the

Series C Preferred Stock offered under Offering Circular on Nasdaq

Capital Market and doing so entails significant ongoing corporate

obligations including but not limited to disclosure, filing and

notification requirements, as well compliance with applicable

continued quantitative and qualitative listing standards. The

listing of the Company’s Series C Preferred Stock on the Nasdaq

Capital Market is not a condition of the Company’s proceeding with

the Public Offering, and no assurance can be given that our

application to list on Nasdaq Capital Market will be approved or

that an active trading market for our Series C Preferred will

develop. For additional information on American Rebel, the Offering

and any other related topics, please review the Offering Statement

that can be found at:

sec.gov/Archives/edgar/data/1648087/000149315224009322/partiiandiii.htm

Additional information concerning risk factors related to the

Offering, including those related to the business, government

regulations, intellectual property and the offering in general, can

be found in the section titled “Risk Factors” of the Offering

Statement.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

American Rebel Holdings, Inc., (NASDAQ: AREB; AREBW) (the

“Company,” "American Rebel,” “we,” “our” or “us”) desires to take

advantage of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and is including this cautionary

statement in connection with this safe harbor legislation. The

words "forecasts" "believe," "may," "estimate," "continue,"

"anticipate," "intend," "should," "plan," "could," "target,"

"potential," "is likely," "expect" and similar expressions, as they

relate to us, are intended to identify forward-looking statements.

We have based these forward-looking statements primarily on our

current expectations and projections about future events and

financial trends that we believe may affect our financial

condition, results of operations, business strategy, and financial

needs. Important factors that could cause actual results to differ

from those in the forward-looking statements include actual use of

proceeds from the private placement, effects of the private

placement on the trading price of our securities, implied or

perceived benefits resulting from the receipt of funds from the

private placement, our ability to comply with the covenants,

representations and warranties contained in the purchase agreement

with the investor in the private placement, our ability to

effectively execute our business plan, and the Risk Factors

contained within our filings with the SEC, including our Annual

Report on Form 10-K for the year ended December 31, 2022. Any

forward-looking statement made by us herein speaks only as of the

date on which it is made. Factors or events that could cause our

actual results to differ may emerge from time to time, and it is

not possible for us to predict all of them. We undertake no

obligation to publicly update any forward-looking statements,

whether as a result of new information, future developments or

otherwise, except as may be required by law.

Company Contact:info@americanrebel.com

Investor Relations:Brian M. Prenoveau, CFAMZ

Group – MZ North AmericaAREB@mzgroup.us+561 489 5315

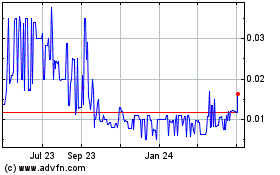

American Rebel (NASDAQ:AREBW)

Historical Stock Chart

From Oct 2024 to Nov 2024

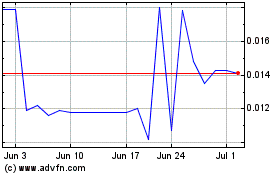

American Rebel (NASDAQ:AREBW)

Historical Stock Chart

From Nov 2023 to Nov 2024