false

0000741516

0000741516

2023-12-22

2023-12-22

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 22, 2023

AMERICAN NATIONAL BANKSHARES INC.

(Exact name of registrant as specified in its charter)

|

Virginia

(State or other jurisdiction

of incorporation)

|

0-12820

(Commission

File Number)

|

54-1284688

(I.R.S. Employer

Identification No.)

|

|

628 Main Street, Danville, Virginia 24541

(Address of principal executive offices) (Zip Code)

|

Registrant’s telephone number, including area code: (434) 792-5111

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $1.00 par value

|

AMNB

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 22, 2023, American National Bankshares Inc. (the “Company”) and/or its wholly-owned bank subsidiary, American National Bank and Trust Company (the “Bank”), entered into amendments to employment agreements with (i) Jeffrey V. Haley, President and Chief Executive Officer of the Company and the Bank, (ii) Jeffrey W. Farrar, Senior Executive Vice President, Chief Operating Officer and Chief Financial Officer of the Company and the Bank, (iii) Edward C. Martin, Senior Executive Vice President and Chief Administrative Officer of the Company and the Bank, (iv) Rhonda P. Joyce, Executive Vice President and Co-Head of Banking – Commercial of the Bank, and (v) Alexander Jung, Executive Vice President and Co-Head of Banking – Consumer and Financial Services of the Bank. Such amendments were made in contemplation of the Company’s previously disclosed proposed merger (the “Merger”) with Atlantic Union Bankshares Corporation (“Atlantic Union”), pursuant to the Agreement and Plan of Merger, dated as of July 24, 2023, between the Company and Atlantic Union.

Pursuant to the amendments, the Company or the Bank, as applicable, has agreed to make a lump sum cash payment to each officer on or before December 31, 2023 (the “Change in Control Payment”), which payment will offset any future payment to which the officer is expected to become entitled, in connection with the effectiveness of the Merger. The Change in Control Payments are as follows: Mr. Haley, $2,648,351, Mr. Farrar, $702,205, Mr. Martin, $746,865, Ms. Joyce, $525,468, and Mr. Jung, $386,790. Each officer has agreed to repay the net after-tax portion of the Change in Control Payment (the “Repayment Amount”) if: (i) the officer’s employment is terminated by the Company or the Bank, as applicable, for “Cause” or due to resignation without “Good Reason” (as such terms are defined in the employment agreements) prior to the effectiveness of the Merger; (ii) the officer does not execute, or the officer revokes, an applicable release of claims (which release shall be in a form acceptable to Atlantic Union); (iii) the Merger is not completed; or (iv) the officer’s employment is terminated by the Company or the Bank, as applicable, without Cause or due to resignation with Good Reason prior to the effectiveness of the Merger; provided, that if the officer is required to repay due to clause (iv) and the officer executes, without revoking, an applicable release of claims, the Repayment Amount will be reduced by an amount equal to the difference, if any, between the net after-tax portion of the Change in Control Payment and the net after-tax portion of the severance benefits the officer would have received in the event of a termination of employment not involving a change in control.

The foregoing description of the amendments to employment agreements do not purport to be complete and is qualified in its entirety by reference to the full text of the form of amendment, which is attached to this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

| 10.1 |

|

Form of Amendment to Employment Agreement.

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

Forward-Looking Statements

Certain statements in this report may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, statements regarding projections, predictions, expectations, or beliefs about future events or results, or otherwise are not statements of historical fact. Such forward-looking statements are based on certain assumptions as of the time they are made, and are inherently subject to known and unknown risks and uncertainties, some of which cannot be predicted or quantified, that may cause actual results, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. Although we believe that our expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of our existing knowledge of our business and operations, there can be no assurance that actual future results, performance, or achievements of, or trends affecting, us will not differ materially from any projected future results, performance, achievements or trends expressed or implied by such forward-looking statements. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

American National Bankshares Inc.

|

|

| |

(Registrant) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Date: December 22, 2023

|

By:

|

/s/ Jeffrey W. Farrar

|

|

|

|

|

Jeffrey W. Farrar

|

|

|

|

|

Senior Executive Vice President, Chief Operating

|

|

| |

|

Officer and Chief Financial Officer |

|

Exhibit 10.1

AMENDMENT TO

[AMENDED AND RESTATED] EMPLOYMENT AGREEMENT

This amendment (this “Amendment”) to that certain [amended and restated] employment agreement dated as of [_______], by and among [American National Bankshares Inc., a Virginia corporation (the “Company”),] American National Bank and Trust Company, a national banking association (the “Bank”), and [_______] (the “Executive”) (the “Employment Agreement”), is made this 22nd day of December, 2023.

WITNESSETH

WHEREAS, [the Company,] the Bank, and the Executive are parties to the Employment Agreement;

WHEREAS, Section 9(c) of the Employment Agreement provides that the Employment Agreement may be amended by an agreement signed by the parties thereto;

WHEREAS, on July 24, 2023, [the Company] [American National Bankshares Inc., a Virginia corporation (the “Company”)] entered into an agreement and plan of merger with Atlantic Union Bankshares Corporation (“Atlantic Union”) (the “Merger Agreement”), pursuant to which the Company will merge with and into Atlantic Union (the “Merger”);

WHEREAS, the Merger is anticipated to constitute a “Change in Control” as such term is defined in the Employment Agreement; and

WHEREAS, in connection with the Merger, [the Company,] the Bank, and the Executive each desire to amend the Employment Agreement to provide for the payment of certain amounts thereunder on or before December 31, 2023.

NOW, THEREFORE, in consideration of the promises and obligations of the parties and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

| |

1.

|

Section 6(a) of the Employment Agreement is amended by adding a new paragraph to the end thereto, which shall read as follows:

|

Notwithstanding any other provision in this Agreement to the contrary, the [Company] [Bank] will pay you an amount equal to $[_______], in a lump sum cash payment on or before December 31, 2023 (the “Change in Control Payment”), less withholding of applicable taxes and subject to the remainder of this paragraph; provided, that the amount of such Change in Control Payment shall offset any future payment to which you may later become entitled upon a subsequent termination of your employment under this Section 6(a) or under Sections 5(e) or 5(f). You acknowledge and agree that you shall repay the net after-tax portion of the Change in Control Payment (the “Repayment Amount”) to the [Company] [Bank] in the event that: (A) your employment hereunder is terminated by the [Company] [Bank] for Cause pursuant to Section 5(b), or due to your resignation without Good Reason pursuant to Section 5(d), in either case, prior to the Effective Time, as such term is defined in that certain merger agreement entered into on July 24, 2023 by the Company and Atlantic Union Bankshares Corporation (the “Merger Agreement”); (B) you do not timely execute, or you revoke, the [Release described in that certain Separation and Release Agreement by and between you, the Company and the Bank, attached as Appendix A to that certain Consulting Agreement by and between you and Atlantic Union Bank] [applicable release of claims contemplated by Section 6(a), in a form acceptable to Atlantic Union]; (C) the merger of the Company with Atlantic Union Bankshares Corporation, as contemplated by the Merger Agreement, is not completed; or (D) your employment hereunder is terminated by the [Company] [Bank] without Cause pursuant to Section 5(e), or due to your resignation with Good Reason pursuant to Section 5(f), in either case, prior to the Effective Time; provided, that if you are required to repay due to clause (D) and you execute, without revoking, the applicable release contemplated by Section 5(e) or Section 5(f), as applicable, the Repayment Amount shall be reduced to equal the difference, if any, between the net after-tax portion of the Change in Control Payment and the net after-tax portion of the severance benefits you would have received under Section 5(e) or Section 5(f), as applicable.

| |

2.

|

The Executive acknowledges that this Amendment is a modification of [the Separation Benefits (as defined in that certain Separation and Release Agreement by and between the Executive, the Company, and the Bank, attached as Appendix A to that certain Consulting Agreement by and between the Executive and Atlantic Union Bank (the “Separation Agreement”))] [Section 6(a) of the Employment Agreement] in accordance with Section 6.5(g) of the Merger Agreement and will offset and reduce the amount of the Separation Benefits that may become payable in accordance with the Employment Agreement [and the Separation Agreement].

|

| |

3.

|

Except as herein amended, the terms of the Employment Agreement shall remain in full force and effect.

|

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have duly executed this Amendment as of the date first set forth above.

[AMERICAN NATIONAL BANKSHARES INC.

By:

[Name]

[Title]]

AMERICAN NATIONAL BANK AND TRUST COMPANY

By:

[Name]

[Title]

[Name]

v3.23.4

Document And Entity Information

|

Dec. 22, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

AMERICAN NATIONAL BANKSHARES INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 22, 2023

|

| Entity, Incorporation, State or Country Code |

VA

|

| Entity, File Number |

0-12820

|

| Entity, Tax Identification Number |

54-1284688

|

| Entity, Address, Address Line One |

628 Main Street

|

| Entity, Address, City or Town |

Danville

|

| Entity, Address, State or Province |

VA

|

| Entity, Address, Postal Zip Code |

24541

|

| City Area Code |

434

|

| Local Phone Number |

792-5111

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AMNB

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000741516

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

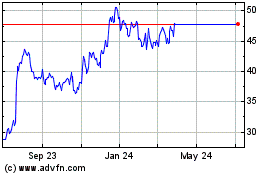

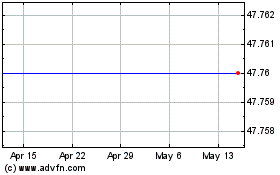

American National Banksh... (NASDAQ:AMNB)

Historical Stock Chart

From Apr 2024 to May 2024

American National Banksh... (NASDAQ:AMNB)

Historical Stock Chart

From May 2023 to May 2024