UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant

| ý

|

Filed by a Party other than the Registrant

| o

|

| Check the appropriate box: |

|

|

o

| Preliminary Proxy Statement

|

o

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

ý

| Definitive Proxy Statement

|

o

| Definitive Additional Materials

|

o

| Soliciting Material Pursuant to §240.14a-12

|

LanzaTech Global, Inc.

|

(Name of Registrant as Specified in its Charter)

|

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| Payment of Filing Fee (Check

all boxes that apply): |

| |

ý

| No fee required

|

o

| Fee paid previously with preliminary materials

|

o

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

| | |

A MESSAGE FROM OUR CEO & BOARD CHAIR,

AND OUR LEAD INDEPENDENT DIRECTOR

Dear LanzaTech Stockholders,

2023 was a landmark year for LanzaTech, full of commercial

and technological progress. Yet it was also a landmark year for the planet in a different sense, with record-breaking weather and environmental

events that signal ever more urgency for climate-focused solutions to scale and meet the challenge at hand. As we share this proxy statement,

we want to reaffirm LanzaTech’s unwavering mission to recycle carbon with biology to create a circular carbon economy.

This past year, our work took on even greater significance

as three additional commercial-scale facilities using our technology started up, doubling both our technology’s carbon abatement

and nameplate production capacity and expanding its global footprint. Overall, we had a strong year of growth and, as compared to 2022,

increased our revenue by 68% to $62.6 million.

Our achievements in 2023, including becoming the

world’s first publicly traded carbon recycling company, reflect our growth trajectory and commitment to innovation in service of

our planet and our stockholders.

Reflecting on 2023, we made significant strides on

multiple fronts:

Intellectual Property (IP) and Research & Development:

| - | We received 208 granted patents

and filed 190 new applications globally, covering advances in biocatalysts, bio-based liquid petroleum gas and multiplex fermentation

processes, and bringing our overall IP portfolio to 1,473 patents granted and 634 patents pending. |

| - | Technological advancements,

such as our second-generation bioreactor in collaboration with Suncor, continue to position us at the leading edge of innovation. |

Data and Artificial Intelligence (AI) Integration:

| - | Our AI team has capitalized

on proprietary datasets comprising over 2 million hours of fermentation to refine machine-learning models for predicting experimental

outcomes, reducing trial requirements, and enhancing our synthetic biology capabilities. |

Strategic and CarbonSmart Partnerships:

| - | New alliances with global leaders

across sectors have facilitated access to a broader customer base and the development of innovative, sustainable products. Our partnerships

have yielded an array of products made from recycled steel mill emissions, from Adidas's Melbourne Cup tennis collection to Coty’s

Gucci fragrance Where My Heart Beats and On's Pace Collection of apparel. |

Sustainability Certifications:

| - | Achieving Roundtable on Sustainable

Biomaterials Association (RSB) Advanced Product and International Sustainability and Carbon Certification (ISCC) PLUS and ISCC Carbon

Offsetting and Reduction Scheme for International Aviation (CORSIA) certifications underscores our dedication to quality and sustainable

impact, enabling us to provide premium, certified products across the value chain, from consumer products with ISCC PLUS to sustainable

aviation fuels with ISCC CORSIA. |

Our technology characterizes a strategic intervention

to keep fossil inputs in the ground and redefine how we value carbon, making sustainable choices universally accessible. This goes beyond

ethanol-based applications for fuels and sustainable aviation fuel production, and includes the direct production of new chemicals, including

isopropanol, a key feedstock for polypropylene (approx. $123 billion annual market) and monoethylene glycol (approx. $25 billion annual

market), a key material for PET/polyester production. In both cases this has the potential to replace fossil-based chemicals across multiple

supply chains.

We are more than a technology provider; we are building

an ecosystem of players across the circular carbon economy to redesign our material world. Together with our partners and stockholders,

we have the power to create an enduring, positive impact on the world.

The new 2023 LanzaTech Board of Directors, prompted

by our public listing, focused on establishing robust processes that advance our vision and mission. These, in turn, have been instrumental

in operating a sustainable business by aligning revenue generation with positive environmental impact and ensuring our corporate commitments

remain steadfast.

We've reshaped our Board with the right blend of

experience, expertise and representation. The existing committee structures persist, updated to reflect U.S. Securities and Exchange Commission

and Nasdaq requirements and additional best practices for corporate governance, each with clear charters to direct critical areas of our

business. The Board works hand in hand with the LanzaTech Executive Team on our joint objective of sustainable and strategic growth, done

ethically and responsibly.

As we continue our journey, driven by innovation

and guided by our values, we thank you for your steadfast support. Our achievements, encapsulated in this year's highlights, do not just

belong to us; they belong to every stockholder and partner who believes in a cleaner, fairer and more sustainable world.

Yours sincerely,

|

Dr. Jennifer Holmgren

CEO and Chair of The LanzaTech Board of Directors |

| |

|

|

Jim Messina

Lead Independent Director |

8045 Lamon Avenue

Suite 400

Skokie, Illinois 60077

(847) 324-2400

| |

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, JUNE 25, 2024 |

| |

To the Stockholders of LanzaTech Global, Inc.:

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”)

of LanzaTech Global, Inc. (the “Company,” “we,” “us” or “our”) will be held at 2:00 p.m.,

Central Time, on Tuesday, June 25, 2024. The Annual Meeting will be held entirely online via audio webcast to allow for greater stockholder

attendance and to reduce the carbon footprint that is required for travel to, and in-person attendance at, the Annual Meeting. The Annual

Meeting may be accessed at https://www.cstproxy.com/lanzatech/2024, where you will be able to listen to the Annual Meeting live, submit

questions and vote. We have designed the virtual Annual Meeting to provide stockholders with substantially the same opportunities to participate

as if the Annual Meeting were held in person.

The Annual Meeting will be held for the following purposes:

| 1. | To elect two Class I directors to the Board of Directors to serve until the 2027 Annual Meeting of Stockholders; |

| 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending

December 31, 2024; |

| 3. | To cast an advisory (non-binding) vote to approve the compensation of our named executive officers; |

| 4. | To cast an advisory (non-binding) vote on the frequency of future advisory votes to approve the compensation of our named executive

officers; and |

| 5. | To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

If you owned our common stock at the close of business on April

26, 2024, you may virtually attend and vote at the Annual Meeting. A list of stockholders eligible to vote at the Annual Meeting will

be available for review during our regular business hours at our headquarters in Skokie, Illinois for the ten days prior to the date of

the Annual Meeting for any purpose related to the Annual Meeting. The list of stockholders will also be available during the Annual Meeting

through the Annual Meeting website for those stockholders who choose to attend.

We are pleased to take advantage of the U.S. Securities and Exchange

Commission rule that allows companies to furnish proxy materials to their stockholders over the Internet. On or before May 16, 2024, we

will commence mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of a paper copy of this

proxy statement and our 2023 Annual Report on Form 10-K. We believe that this process allows us to provide our stockholders with the information

they need in a more timely manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy

materials. The Notice contains instructions on how to access our proxy materials over the Internet, which are available at https://www.cstproxy.com/lanzatech/2024.

The Notice also contains instructions on how to request a paper copy of our proxy materials, including this proxy statement and a form

of proxy card.

|

|

Your vote is important. Whether or not you plan to virtually

attend the Annual Meeting, we hope that you will vote as soon as possible. You may vote your shares over the Internet. If you received

a proxy card or voting instruction card by mail, you may submit your proxy card or voting instruction card by completing, signing, dating

and mailing your proxy card or voting instruction card in the envelope provided. Any stockholder virtually attending the Annual Meeting

may vote electronically at the Annual Meeting, even if you have already returned a proxy card or voting instruction card.

By Order of the Board of Directors,

/s/ Joseph Blasko

Joseph Blasko

General Counsel & Corporate Secretary

April 29, 2024

Skokie, Illinois

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING TO BE HELD ON TUESDAY, JUNE 25, 2024: The 2023 Annual Report and proxy statement are available online at https://www.cstproxy.com/lanzatech/2024.

TABLE OF CONTENTS

|

|

8045 Lamon Avenue

Suite 400

Skokie, Illinois 60077

(847) 324-2400

INFORMATION CONCERNING SOLICITATION AND

VOTING

The Board of Directors (the “Board”) of LanzaTech Global,

Inc. (the “Company,” “we,” “us” or “our”) is soliciting proxies for the Company’s

2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Tuesday, June 25, 2024 at 2:00 p.m. Central Time.

The Annual Meeting will be held entirely online live via audio webcast. You will be able to attend the virtual Annual Meeting live, vote

and submit your questions during the Annual Meeting via live webcast by visiting: https://www.cstproxy.com/lanzatech/2024 and entering

your 12-digit control number included in your Notice (as defined below), on your proxy card or on the instructions that accompanied your

proxy materials.

On or before May 16, 2024, we will commence mailing a Notice of

Internet Availability of Proxy Materials (the “Notice”). The Notice contains instructions on how to access this proxy statement

and our 2023 Annual Report on Form 10-K (the “2023 Annual Report”) over the Internet, which are available at https://www.cstproxy.com/lanzatech/2024.

The Notice also contains instructions on how to request a paper copy of our proxy materials, including this proxy statement, the 2023

Annual Report and a form of proxy card. The Notice is being sent to stockholders who owned our common stock at the close of business on

April 26, 2024, the record date for the Annual Meeting (the “Record Date”). This proxy statement contains important information

for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

| Q: | Who may vote at the Annual Meeting? |

| A: | The Board has fixed April 26, 2024 as the Record Date for the Annual Meeting. Only stockholders of record at the close of business

on the Record Date will be entitled to notice of, and to vote, at the Annual Meeting. Each stockholder is entitled to one vote for each

share of common stock held on all matters to be voted on. As of the Record Date, 197,734,876 shares of common stock were outstanding and

entitled to vote at the Annual Meeting. |

| Q: | What proposals will be voted on at the Annual Meeting? |

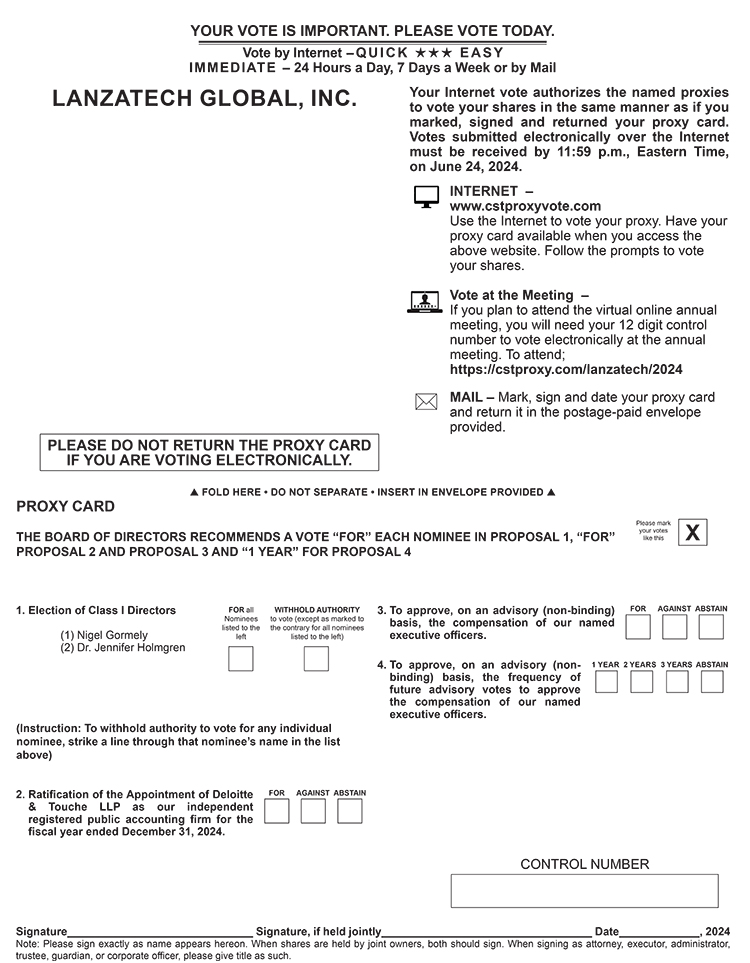

| A: | There are four proposals scheduled to be voted on at the Annual Meeting: |

| 1. | Election of two Class I director nominees to the Board to serve until the 2027 Annual Meeting of Stockholders (“Proposal 1”); |

| 2. | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year

ending December 31, 2024 (“Proposal 2”); |

| 3. | An advisory (non-binding) vote to approve the compensation of our named executive officers (“Proposal 3”); and |

| 4. | An advisory (non-binding) vote on the frequency of future advisory votes to approve the compensation of our named executive officers

(“Proposal 4”). |

We will also consider any other business that properly comes

before the Annual Meeting. As of the date hereof, we are not aware of any other matters to be submitted for consideration at the Annual

Meeting. If any other matters are properly brought before the Annual Meeting, the persons named on the proxy card or voter instruction

card will vote the shares they represent using their best judgment.

|

1 |

| Q: | What is the quorum requirement for the Annual Meeting? |

| A: | A quorum of stockholders is necessary to hold a valid meeting of stockholders. A quorum will be present if at least a majority of

our outstanding shares of common stock are represented in person, including by means of remote communication, or by proxy at the Annual

Meeting. At the close of business on the Record Date, there were 197,734,876 shares of common stock outstanding. Thus, a total of 197,734,876

shares are entitled to vote at the Annual Meeting and holders of common stock representing at least 98,867,439 votes must be represented

at the Annual Meeting in person, including by means of remote communication, or by proxy to have a quorum. The inspector of elections

appointed for the Annual Meeting by the Board will count the shares represented in person, including by means of remote communication,

or by proxy at the Annual Meeting to determine whether or not a quorum is present. |

Your shares will be counted as present

at the Annual Meeting if you:

| · | are present and entitled to vote electronically at the

Annual Meeting; or |

| · | have voted over the Internet, or properly submitted a proxy

card or voting instruction card. |

Both abstentions and broker non-votes (as described below)

will be included in the calculation of the number of shares considered to be present at the Annual Meeting for the purpose of determining

the presence of a quorum. In the event that we are unable to obtain a quorum, the chairperson of the Annual Meeting or a majority of the

shares present at the Annual Meeting may adjourn the Annual Meeting to another date.

| Q: | How are votes counted at the Annual Meeting? |

| A: | In the election of directors (Proposal 1), you may vote “FOR” all of the nominees or your vote may be “WITHHELD”

with respect to one or more of the nominees. For Proposal Nos. 2 and 3, you may vote “FOR,” “AGAINST” or “ABSTAIN.”

For Proposal 4, you may vote “ONE YEAR,” “TWO YEARS,” “THREE YEARS” or “ABSTAIN.” |

If you provide specific instructions in your proxy card or

voting instruction card with regard to a certain item, your shares will be voted as you instruct on such items. If you are a stockholder

of record and you sign and return your proxy card without giving specific instructions, your shares will be voted in accordance with the

recommendations of the Board. See “What are the recommendations of the Board?” below.

| Q: | What votes are required to elect directors and to approve the other proposals at the Annual Meeting? |

| A: | For Proposal 1, the election of directors, members of the Board are elected by a plurality of the votes cast. Accordingly, the two

candidates who receive the greatest number of votes “FOR” will be elected as a director. “WITHHOLD” votes and

broker non-votes will have no effect on the outcome of this proposal. Cumulative voting is not permitted for the election of directors. |

Proposal 2, the ratification of our independent registered

public accounting firm, requires the affirmative vote of a majority of the shares of common stock present in person, including by means

of remote communication, or represented by proxy and entitled to vote at the Annual Meeting. Abstentions will have the same effect as

a vote against this proposal. Broker non-votes will have no effect on the outcome of this proposal.

Proposal 3, the advisory vote on the compensation of our

named executive officers, requires the affirmative vote of a majority of the shares of common stock present in person, including by means

of remote communication, or represented by proxy and entitled to vote at the Annual Meeting. Abstentions will have the same effect as

a vote against this proposal. Broker non-votes will have no effect on the outcome of this proposal.

For Proposal 4, the advisory vote to approve the frequency of

future advisory votes on the compensation of our named executive officers, the voting frequency option that receives the highest number

of votes cast on the matter, in person (including by means of remote communication) or by proxy, at the Annual Meeting will be deemed

the frequency recommended by stockholders. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

|

2 |

| Q: | Which ballot measures are considered “routine” or “non-routine?” |

| A: | If your shares are held in street name and you do not provide your voting instructions to your broker, bank or other nominee, your

shares may be voted by your broker, bank or other nominee but only under certain circumstances. Specifically, under applicable rules,

shares held in the name of your broker, bank or other nominee may be voted by your broker, bank or other nominee on certain “routine”

matters if you do not provide voting instructions. Only Proposal 2, regarding the ratification of the appointment of Deloitte & Touche

LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, is considered a “routine”

matter for which brokers, banks or other nominees may vote uninstructed shares. Consequently, no broker non-votes are expected in connection

with Proposal 2. |

Proposal 1, regarding the election of directors, Proposal

3, the advisory vote to approve the compensation of our named executive officers, and Proposal 4, the advisory vote to approve the frequency

of future advisory votes on the compensation of our named executive officers, are generally considered “non-routine matters”

under applicable rules, meaning a broker, bank or other nominee cannot vote without your instructions on such non-routine matters. If

you do not provide voting instructions on a non-routine matter, your shares will not be voted on that matter, which is referred to as

a “broker non-vote.” Therefore, it is critical that you indicate your vote on those proposals if you want your vote to be

counted.

| Q: | What are the recommendations of the Board? |

| A: | The Board recommends that you vote as follows: |

| · | “FOR” each of the Class I director nominees

to the Board (Proposal 1); |

| · | “FOR” the ratification of the appointment

of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal

2); |

| · | “FOR” the advisory vote to approve the

compensation of our named executive officers (Proposal 3); and |

| · | “ONE YEAR” for the advisory vote on

the frequency of future advisory votes on the compensation of our named executive officers (Proposal 4). |

| Q: | What does it mean if I receive more than one set of proxy materials? |

| A: | If you received more than one Notice (or full set of printed proxy materials), each containing a different control number, this means

that you have multiple accounts holding shares of our common stock. These may include accounts with our transfer agent, Continental

Stock Transfer & Trust Company (“CST”), and accounts with a broker, bank or other holder of record. Please

vote all proxy cards for which you receive a Notice (or full set of printed proxy materials) to ensure that all of your shares are voted. |

| Q: | How can I get electronic access to the proxy materials? |

| A: | You will be able to view the proxy materials on the Internet at https://www.cstproxy.com/lanzatech/2024. |

| Q: | How may I attend and vote my shares at the Annual Meeting? |

| A: | This year’s Annual Meeting will be held entirely online live via audio webcast. We have designed the virtual Annual Meeting

to provide stockholders with substantially the same opportunities to participate as if the Annual Meeting were held in person. Any stockholder

can attend the Annual Meeting live online at www.cstproxy.com/lanzatech/2024. If your shares are registered directly in your name with

our transfer agent, CST, you are considered, with respect to those shares, the stockholder

of record. If you were a stockholder as of the record date for the Annual Meeting and you have your 12-digit control number included in

your Notice, on your proxy card or on the instructions that accompanied your proxy materials, you can vote at the Annual Meeting. |

|

3 |

A summary of the information you need

to attend the Annual Meeting online is provided below:

| · | To attend and participate in the Annual Meeting, you will

need the 12-digit control number included in your Notice, on your proxy card or on the instructions that accompanied your proxy materials. |

| · | The Annual Meeting webcast will begin promptly at 2:00

p.m. Central Time. We encourage you to access the Annual Meeting at least 15 minutes prior to the start time. |

| · | The virtual meeting platform is fully supported across

browsers (Edge, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable

software and plugins. Participants should ensure that they have a strong Internet connection wherever they intend to participate in the

Annual Meeting. Participants should also give themselves at least 15 minutes to log in and ensure that they can hear streaming audio prior

to the start of the Annual Meeting. |

| · | Instructions on how to attend and participate via the Internet

are posted at www.cstproxy.com/lanzatech/2024. |

| · | Assistance with questions regarding how to attend and participate

via the Internet will be provided via CST’s toll-free telephone support number at (917) 262-2373. |

| · | If you want to submit a question during the Annual Meeting,

log into the virtual meeting platform at www.cstproxy.com/lanzatech/2024 and follow the instructions for submitting a question. |

| · | Questions pertinent to Annual Meeting matters may be answered

during the Annual Meeting or after the Annual Meeting by direct communication with the stockholder. Questions regarding personal or other

improper matters, including those related to employment, product or service issues, or suggestions for business opportunities, are not

pertinent to Annual Meeting matters and therefore will not be answered. |

| · | If your shares are held in an account at a brokerage firm,

bank, dealer or other similar organization, you are considered the beneficial owner of shares held in “street name.” If your

shares are held in “street name,” you should contact your broker, trustee, bank or other holder of record to obtain a legal

proxy and e-mail a copy (a legible PDF or other photographic copy is sufficient) to proxy@continentalstock.com. CST will issue a control

number and email it back with the meeting information. Only stockholders with a valid 12-digit control number, will be able to attend

the Annual Meeting and vote, ask questions, and access the list of stockholders as of the close of business on the record date for the

Annual Meeting. |

| Q: | What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting

website? |

| A: | CST will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website.

If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the CST technical

support number that will be posted on the Annual Meeting login page, which is (917) 262-2373. |

| Q: | How can I vote my shares without attending the Annual Meeting? |

| A: | Whether you hold shares directly as a stockholder of record or beneficially in street name, you may vote without attending the Annual

Meeting. You may vote by granting a proxy or, for shares held beneficially in street name, by submitting voting instructions to your broker,

bank or other agent. In most cases, you will be able to do this by using the Internet or by mail if you received a printed set of the

proxy materials. |

By Internet - If you have Internet access,

you may vote your shares by logging into the secure website, which will be listed on your Notice or the proxy card, and following the

instructions provided.

|

4 |

By Mail - If you requested printed copies of

the proxy materials, you may submit your proxy by mail by signing your proxy card if your shares are registered or, for shares held beneficially

in street name, by following the voting instructions included by your broker, bank or other agent, and mailing it in accordance with the

instructions provided. If you provide specific voting instructions, your shares will be voted as you have instructed.

Votes submitted via the Internet must be received by 11:59

p.m. Eastern Daylight Time on June 24, 2024. Submitting your proxy via the Internet or by mail will not affect your right to vote electronically

at the Annual Meeting should you later decide to virtually attend the Annual Meeting. Even if you plan to virtually attend the Annual

Meeting, we encourage you to submit your proxy to vote your shares in advance of the Annual Meeting.

We provide Internet proxy voting with procedures designed

to ensure the authenticity and correctness of your proxy vote instructions.

| Q: | What happens if I do not give specific voting instructions? |

| A: | Stockholder of Record - If, at the close of business on the Record Date, you are a stockholder of record and you indicate when

voting on the Internet that you wish to vote as recommended by the Board, or sign and return a proxy card without giving specific voting

instructions, then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this proxy

statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at

the Annual Meeting. |

Beneficial Owners of Shares Held in Street Name -

If, at the close of business on the Record Date, you are a beneficial owner of shares held in street name and do not provide the organization

that holds your shares with specific voting instructions, the organization that holds your shares may generally vote at its discretion

on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from

you on how to vote your shares on a non-routine matter, the organization will inform the inspector of election that it does not have the

authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” In tabulating

the voting results for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal.

| Q: | How can I revoke my proxy and change my vote after I return my proxy card? |

| A: | You may revoke your proxy and change your vote before the final vote at the Annual Meeting. If you are a stockholder of record you

may do this: (i) by voting using the Internet, which must be completed by 11:59 p.m. Eastern Daylight Time on June 24, 2024 (your latest

Internet proxy will be counted); or (ii) by virtually attending the Annual Meeting and voting electronically. Virtually attending the

Annual Meeting alone will not revoke your proxy unless you specifically request your proxy to be revoked. If you hold shares through a

broker, bank or other agent, you must contact that broker, bank or other agent directly to revoke any prior voting instructions. |

| Q: | Who will pay the costs of this proxy solicitation? |

| A: | We will bear the entire cost of solicitation of proxies, including maintenance of the Internet website used to access the proxy materials

and to vote; and preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished

to our stockholders who request paper copies of such materials. We have retained Morrow Sodali LLC to assist in the solicitation of proxies.

We expect to pay Morrow Sodali LLC a fee of $10,000, plus reimbursement of reasonable expenses. We and our directors, officers and regular

employees may solicit proxies by mail, personally, by telephone or by other appropriate means. No additional compensation will be paid

to directors, officers or other regular employees for such services. Copies of solicitation materials will be furnished to banks, brokerage

houses, fiduciaries and custodians holding shares of our common stock in their names for others to send proxy materials to and obtain

proxies from the beneficial owners of such shares, and we may reimburse them for their costs in forwarding the solicitation materials

to such beneficial owners. |

|

5 |

| Q: | Why hold a virtual Annual Meeting? |

| A: | We believe that hosting a virtual Annual Meeting is in the best interest of the Company and its stockholders. We believe a virtual

Annual Meeting enables increased stockholder attendance and participation because stockholders can participate from any location around

the world while reducing the carbon footprint that would be required for stockholders to travel to and attend an in-person meeting. |

| Q: | Where can I find the voting results of the Annual Meeting? |

| A: | The preliminary voting results will be announced at the Annual Meeting. The final voting results will be reported in a Current Report

on Form 8-K, which will be filed with the U.S. Securities and Exchange Commission (“SEC”) within four business days after

the Annual Meeting. |

|

6 |

INFORMATION CONCERNING OUR BUSINESS COMBINATION

On February 8, 2023 (the “Closing Date”), AMCI Acquisition

Corp. II, a Delaware corporation and our predecessor company (“AMCI”), consummated the business combination (the “Business

Combination”) pursuant to the terms of the Agreement and Plan of Merger, dated as of March 8, 2022, as amended on December 7, 2022

(the “Merger Agreement”), by and among AMCI, AMCI Merger Sub, Inc., a Delaware corporation (“Merger Sub”) and

LanzaTech NZ, Inc., a Delaware corporation (“Legacy LanzaTech”). Pursuant to the Merger Agreement, on the Closing Date: (i)

AMCI changed its name to “LanzaTech Global, Inc.” (“New LanzaTech”); and (ii) Merger Sub merged with and into

Legacy LanzaTech, with Legacy LanzaTech as the surviving company in the Business Combination. After giving effect to such Business Combination,

Legacy LanzaTech became a wholly owned subsidiary.

Immediately prior to the Business Combination, all issued and outstanding

shares of preferred stock of Legacy LanzaTech were automatically converted into shares of common stock based on the applicable conversion

ratio. The number of shares of the common stock payable in the Business Combination in respect of each share of Legacy LanzaTech capital

stock were determined based on the applicable exchange ratio of 4.374677 (the “Exchange Ratio”). In addition, the accumulated

dividends payable to the holders of Legacy LanzaTech preferred shares were settled by delivery of the common stock, as part of the merger

consideration.

Pursuant to the Merger Agreement, at the effective time of the

Business Combination (the “Effective Time”):

| · | each warrant to purchase Legacy LanzaTech common stock

that was outstanding and unexercised immediately prior to the Effective Time and would automatically be exercised or exchanged in full

in accordance with its terms by virtue of the occurrence of the Business Combination, was automatically exercised or exchanged in full

for the applicable shares of Legacy LanzaTech capital stock, and each such share of Legacy LanzaTech common stock was treated as being

issued and outstanding immediately prior to the Effective Time and was cancelled and converted into the right to receive the applicable

number of shares of common stock; |

| · | each Legacy LanzaTech warrant that was outstanding and

unexercised prior to the Effective Time and was not automatically exercised in full as described above was converted into a warrant to

purchase shares of common stock, in which case (a) the number of shares underlying such warrant was determined by multiplying the number

of shares of Legacy LanzaTech capital stock subject to such warrant immediately prior to the Effective Time, by the Exchange Ratio, and

(b) the per share exercise price of such warrant was determined by dividing the per share exercise price of such warrant immediately prior

to the Effective Time by the Exchange Ratio, except that in the case of the AM Warrant, such exercise price is $10.00; |

| · | the extent not converted in full immediately prior to the

Effective Time, the Simple Agreement for Future Equity (“SAFE”) with BGTF LT Aggregator LP, an affiliate of Brookfield Asset

Management Inc., was assumed by New LanzaTech and convertible into shares of common stock; and |

| · | each option to purchase shares of Legacy LanzaTech common

stock outstanding as of the Effective Time was converted into an option to purchase a number of shares of common stock (rounded down to

the nearest whole share) equal to the product of (i) the number of shares of Legacy LanzaTech common stock subject to such option multiplied

by (ii) the Exchange Ratio. The exercise price of such options is equal to the quotient of (a) the exercise price per share of such option

in effect immediately prior to the Effective Time divided by (b) the Exchange Ratio. |

In connection with the execution of the Merger Agreement, AMCI

entered into subscription agreements (as amended on December 7, 2022, the “Initial Subscription Agreements”) with certain

investors (the “Initial PIPE Investors”). AMCI also entered into additional subscription agreements with certain institutional

and accredited investors (the “PIPE Investors”) on October 8, 2022 (as amended on December 7, 2022) and February 6, 2023 (collectively,

the “PIPE Subscription Agreements” and together with the subscription agreement between AMCI and ArcelorMittal, the “Subscription

Agreements”). Pursuant to the Subscription Agreements, the PIPE Investors purchased an aggregate of 18,500,000 shares of common

stock in a private placement at a price of $10.00 per share for an aggregate purchase price of $185 million (the “PIPE Investment”).

Such aggregate number of shares and aggregate purchase price include 3,000,000 shares of common stock issued to ArcelorMittal pursuant

to a Simple Agreement for Future Equity (SAFE) with Legacy LanzaTech. The PIPE Investment was consummated in connection with the consummation

of the Business Combination.

|

7 |

PROPOSAL 1

ELECTION OF DIRECTORS

Overview

Our Board currently consists of six directors and is divided into

three classes, designated Class I, Class II and Class III. Each class consists, as nearly as possible, of one-third of the total number

of directors constituting the entire Board and each class has a three-year term. At each annual meeting of stockholders, the successors

to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting

following election.

Our Second Amended and Restated Certificate of Incorporation (the

“Certificate of Incorporation”) provides that the authorized number of directors may be changed only by resolution of the

Board. Directors may be removed only for cause by the affirmative vote of the holders of at least sixty-six and two-thirds percent (66

2/3%) of the votes that all our stockholders would be entitled to vote generally in an election of directors voting together as a single

class. Any vacancy on the Board, including a vacancy resulting from an enlargement of the Board, may be filled only by vote of a majority

of our directors then in office, even if less than a quorum. Each director so chosen shall hold office until the next election of the

class for which such director shall have been chosen and until his or her successor shall have been duly elected and qualified.

At this Annual Meeting, the term of our current Class I directors, Nigel

Gormly and Dr. Jennifer Holmgren, will expire. Previously, Mr. Nimesh Patel served as a Class I director; however, on April 25, 2024,

Mr. Patel tendered his resignation from the Board of Directors effective immediately. We wish to thank Mr. Patel for his service to the

Board and the Company. As a result, only Mr. Gormly and Dr. Holmgren have been nominated for re-election at the Annual Meeting.

Our stockholders will vote for the Class I director nominees listed

above to serve until our 2027 Annual Meeting of Stockholders and until such director’s successor has been elected and qualified,

or until such director’s earlier death, resignation or removal. The members of the Board who are Class II and Class III directors

will be considered for nomination for election in 2025 and 2026, respectively.

Nominees for Election as Class I Directors with

Terms Expiring in 2027

The nominees listed below have been recommended by the Nominating

and Governance Committee to be elected to serve as Class I directors. There are no family relationships among our directors or executive

officers. If any director nominee is unable or declines to serve as a director, the Board may designate another nominee to fill the vacancy

and the proxy will be voted for that nominee.

Nigel Gormly has served as a director since the Business

Combination and previously served as a director of Legacy LanzaTech from 2014 until the Business Combination. Mr. Gormly has served as

the Founder and Director of Waihou Capital since 2019. Since 2020, he has also served as Chief Investment Officer of Toha Foundry, a fin-tech

company creating a global marketplace with climate and environmental impact at its heart to enable the true value of impact to be recognized

and traded in the market, enabling impact investment to be unleashed at scale. Mr. Gormly previously served as Head of International Direct

Investment for the New Zealand Superannuation Fund, New Zealand’s sovereign wealth fund, from 2013 to 2019, where he was primarily

responsible for the Fund’s direct investments in energy, infrastructure and expansion capital as well as leading the Fund’s

collaboration efforts with global investment partners. Prior to joining the New Zealand Superannuation Fund, Mr. Gormly spent 10 years

with Fonterra, where he held a number of strategic development and commercial leadership roles, most recently as General Manager of Commercial

Ventures. Mr. Gormly’s early career was focused on M&A and corporate finance advisory based in London, with assignments throughout

Asia, Latin America and Europe. He has also served on the board of View, Inc. (Nasdaq: VIEW) since 2015. A Chartered Financial Analyst,

Mr. Gormly holds a Graduate Diploma in Finance, and a B.Sc. and a B.Com. from the University of Auckland.

We believe that Mr. Gormly is qualified to serve as a director

based on his extensive experience in the venture capital and investment banking industries. Mr. Gormly was nominated as a director on

the board of directors of Legacy LanzaTech by the New Zealand Superannuation Fund.

|

8 |

Jennifer Holmgren, Ph.D. has served as our Chief

Executive Officer and as a director since the Business Combination, and previously served as Chief Executive Officer and as a director

of Legacy LanzaTech from 2010 until the Business Combination. Previously, she served as Vice President and General Manager of the Renewable

Energy and Chemicals business unit at UOP LLC, a Honeywell Company, where she held various commercial and technical leadership positions

from 1987-2010. In 2003, she was the first woman awarded the Malcolm E. Pruitt Award from the Council for Chemical Research (CCR). In

2010, she was the recipient of the Leadership Award from the Commercial Aviation Alternative Fuels Initiative (CAAFI) for her work in

establishing the technical and commercial viability of sustainable aviation biofuels. In 2015, Dr. Holmgren and her team at Legacy

LanzaTech were awarded the U.S. Environmental Protection Agency Presidential Green Chemistry Award, and Dr. Holmgren was awarded

the BIO Rosalind Franklin Award for Leadership in Industrial Biotechnology. Sustainability magazine, Salt, named Dr. Holmgren as

the world’s most compassionate businesswoman in 2015. In October 2015, Dr. Holmgren was awarded the Outstanding Leader

Award in Corporate Social Innovation from the YWCA Metropolitan Chicago. The Digest named Dr. Holmgren #1 of the 100 most influential

leaders in the Bioeconomy in 2017 and awarded her the Global Bioenergy Leadership Award in 2018 and the 2020 William C. Holmberg Award

for Lifetime Achievement in the Advanced Bioeconomy. Dr. Holmgren was also the 2018 recipient of the AIChE Fuels & Petrochemicals

Division Award. In 2021, she received the Edison Achievement Award for making a significant and lasting contribution to the world of innovation,

and the Prix Voltaire Award, awarded by the Prix Voltaire International Foundation, which award is based on the 17 sustainable development

goals initiated by the United Nations. In 2022, she was included in ICIS’s Top 40 Power Players ranking. Dr. Holmgren has an

honorary doctorate from Delft University of Technology. Dr. Holmgren is the author or co-author of 50 U.S. patents and more than

30 scientific publications and is a member of the National Academy of Engineering. She is on the Governing Council for the Bio Energy

Research Institute in India, which was established by the Department of Biotechnology, Indian Government, and IndianOil Corporation. Dr. Holmgren

also sits on the Advisory Council for the Andlinger Center for Energy and the Environment at Princeton University, the Halliburton Labs

Advisory Board, the Universiti Teknologi PETRONAS International Advisory Council, and the Founder Advisory for The Engine, a venture capital

fund built by MIT that invests in early-stage science and engineering companies. Dr. Holmgren holds a Ph.D. from the University of

Illinois at Urbana-Champaign in Inorganic Materials Synthesis, an M.B.A. from the Booth School of Business at the University of Chicago

and a B.Sc. from Harvey Mudd College in Chemistry.

We believe that Dr. Holmgren is qualified to serve as a director

based on her extensive industry experience and her status as an internationally recognized expert in the development and commercialization

of fuels and chemical technologies in the energy sector.

Vote Required and Board Recommendation

The affirmative vote of a plurality of the votes cast in person, including

by means of remote communication, or by proxy at the Annual Meeting is required to elect Mr. Gormly and Dr. Holmgren as Class I directors

to serve until the 2027 Annual Meeting of Stockholders. A “plurality” means, with regard to the election of directors, that

the nominee for director receiving the greatest number of “FOR” votes from the votes cast at the Annual Meeting will be elected.

Abstentions and broker non-votes will have no effect on the outcome of this proposal.

THE BOARD RECOMMENDS A VOTE “FOR” THE

ELECTION OF EACH CLASS I DIRECTOR NOMINEE. |

Incumbent Class II Directors with Terms Expiring in 2025

Barbara Byrne has served as a director since the

Business Combination. Ms. Byrne is the former Vice Chairman, Investment Banking at Barclays PLC, where she worked until 2018. During her

more than 35 years of financial services experience, Ms. Byrne served as team leader for some of Barclays’ most important multinational

corporate clients and was the primary architect of several of Barclays’ marquee transactions. She is a member of various industry

councils and participates as a forum leader on strategic issues and trends facing the financial services sector and global markets. Ms.

Byrne has served as a director of Paramount Global since 2018, Hennessy Capital Investment Corp. V and PowerSchool, Inc. since 2021, and

as a director of Slam Corp (2021-2023).

|

9 |

Ms. Byrne holds a B.A. in Economics from Mount Holyoke College.

We believe that Ms. Byrne is qualified to serve as a director based on her extensive experience in the investment banking industry and

her business and financial expertise.

Gary Rieschel has served as a director since the

Business Combination, and previously served as a director of Legacy LanzaTech from 2010 until the Business Combination. Mr. Rieschel has

served as the Founder and Managing Partner of Qiming Venture Partners since 2005, when he founded the venture capital firm. Qiming Venture

Partners primarily invests in the technology and consumer and healthcare industries, and has over $9 billion in assets under management.

Prior to founding Qiming Venture Partners, Mr. Rieschel was a senior executive at Intel, Sequent Computer, Cisco Systems, and Softbank

Corporation. Mr. Rieschel has in total 27 years of experience as a venture capital investor.

Mr. Rieschel holds a B.A. in Biology from Reed College and an M.B.A.

from Harvard Business School. We believe that Mr. Rieschel is qualified to serve as a director based on his business experience and 27

years of experience in the venture capital industry. Mr. Rieschel was nominated as a director on the board of directors of Legacy LanzaTech

by Qiming Venture Partners.

Incumbent Class III Directors with Terms Expiring

in 2026

Dorri McWhorter has served as a director since the

Business Combination. Ms. McWhorter has served as the President and Chief Executive Officer of YMCA of Metropolitan Chicago since 2021.

From 2011 to 2021, Ms. McWhorter served as the Chief Executive Officer of YWCA of Metropolitan Chicago. Prior to joining the YWCA, she

was a partner at Crowe Horwath, LLP, and also held senior positions with Snap-on Incorporated and Booz Allen Hamilton. Ms. McWhorter is

a former licensed certified public accountant and currently sits on the Financial Accounting Standards Advisory Council. Ms. McWhorter

has served as a director of Lifeway Foods, Inc. since 2020, and also serves on the boards of William Blair Funds and Skyway Concession

Company.

Ms. McWhorter holds a Bachelor of Business Administration degree

from the University of Wisconsin- Madison, an M.B.A. from Northwestern University’s Kellogg School of Management, and an honorary

Doctor of Humane Letters from Lake Forest College. We believe that Ms. McWhorter is qualified to serve as a director based on her experience

as a chief executive officer and her business and financial expertise.

Jim Messina has served as a director since the Business

Combination and previously served as a director of Legacy LanzaTech from 2013 until the Business Combination. Mr. Messina has served as

the President and CEO of The Messina Group, a strategic consulting firm specializing in advising political leaders, corporations, and

advocacy organizations, since 2013. Previously, Mr. Messina served as White House Deputy Chief of Staff to President Barack Obama from

2009 to 2011 and was Campaign Manager for President Obama’s 2012 re-election campaign. Previously, Mr. Messina served as Chief of

Staff for various Senate and House offices on Capitol Hill where he worked to pass key legislation. Mr. Messina serves on the boards of

several private companies including Blockchain.com, Fortera, Vectra.ai, the United States Soccer Foundation, and the Montana Land Reliance.

Mr. Messina is a graduate of the University of Montana where he earned a B.A. in political science and journalism.

We believe that Mr. Messina is qualified to serve as a director

based on his corporate advisory expertise and his extensive experience in executive management.

|

10 |

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

The Audit Committee has appointed Deloitte & Touche LLP as

our independent registered public accounting firm for the fiscal year ending December 31, 2024 and urges you to vote for the ratification

of Deloitte & Touche LLP’s appointment. Deloitte & Touche LLP has served as our independent registered public accounting

firm since the fiscal year ended December 31, 2016. Stockholder ratification of the appointment of Deloitte & Touche LLP as our independent

registered public accounting firm is not required by our Certificate of Incorporation our Bylaws (“Bylaws”) or otherwise.

However, the Board is submitting the appointment of Deloitte & Touche LLP to the stockholders for ratification as a matter of good

corporate governance. If the stockholders do not ratify the selection, the Board and the Audit Committee will reconsider whether or not

to retain Deloitte & Touche LLP. Even if the selection is ratified, the Board and the Audit Committee may, in their discretion, direct

the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a

change would be in the best interests of our Company and our stockholders.

We expect representatives of Deloitte & Touche LLP to virtually

attend the Annual Meeting and be available to respond to appropriate questions by stockholders. Additionally, the representatives of Deloitte

& Touche LLP will have the opportunity to make a statement if they so desire.

Principal Accountant Fees and Services

The following table presents the aggregate fees billed or accrued for

professional services rendered by Deloitte & Touche LLP during the last two fiscal years:

| Type |

|

2023 |

|

2022 |

| Audit Fees |

|

$ |

2,409,666 |

|

$ |

2,908,499 |

| Audit-Related Fees |

|

|

– |

|

|

– |

| Tax Fees |

|

|

– |

|

|

– |

| All Other Fees |

|

|

68,805 |

|

|

– |

| Total Fees |

|

$ |

2,478,471 |

|

$ |

2,908,499 |

Audit Fees - These fees are associated with professional

services rendered for the audit of our consolidated financial statements, audit of the Company’s internal controls over financial

reporting in 2023, reviews of our quarterly financial statements, and services that are normally provided by the independent auditor in

connection with statutory and regulatory filings made by the Company. 2022 audit fees also include services related to the reviews under

PCAOB standards of our 2021 comparative quarterly financial statements which the Company prepared for a first time in 2022.

All Other Fees – These fees are associated

with a preliminary gap assessment of the Company’s internal controls over financial reporting.

Audit Committee’s Pre-Approval Policies and Procedures

Before our independent registered public accounting firm is engaged

by us to render audit or non-audit services, each such engagement is approved by our Audit Committee. From time to time, our Audit Committee

may pre-approve specified types of services that are expected to be provided to us by our registered public accounting firm during the

next 12 months. Any such pre-approval is detailed as to the particular service or type of services to be provided and is also generally

subject to a maximum dollar amount. The Audit Committee pre-approved all services performed by, and fees paid to, our independent registered

public accounting firm during fiscal years 2023 and 2022.

Our Audit Committee may delegate the authority to approve any audit

or non-audit services to be provided to us by our registered public accounting firm to one or more subcommittees (including a subcommittee

consisting of a single member). Any approval of services by a subcommittee of our Audit Committee pursuant to this delegated authority

is reported at the next meeting of our Audit Committee.

|

11 |

Vote Required and Board Recommendation

Stockholder ratification of Deloitte & Touche LLP as our independent

registered public accounting firm requires the affirmative vote of a majority of the shares of common stock present in person, including

by means of remote communication, or represented by proxy and entitled to vote at the Annual Meeting. Abstentions will be treated as shares

present and entitled to vote and will therefore have the same effect as a vote against this proposal.

THE BOARD RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF

DELOITTE & TOUCHE LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024. |

AUDIT COMMITTEE REPORT

The Audit Committee assists the Board with its oversight responsibilities

regarding the Company’s financial reporting process. The Company’s management is responsible for the preparation, presentation

and integrity of the Company’s financial statements and the reporting process, including the Company’s accounting policies,

internal control over financial reporting and disclosure controls and procedures. Deloitte & Touche LLP, the Company’s independent

registered public accounting firm, is responsible for performing an audit of the Company’s financial statements.

We have reviewed and discussed with management and Deloitte &

Touche LLP the Company’s audited financial statements. We discussed with Deloitte & Touche LLP the overall scope and plans of

their audit. We met with Deloitte & Touche LLP, with and without management present, to discuss the results of its examinations, its

evaluation of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

With regard to the fiscal year ended December 31, 2023, the Audit

Committee has (i) reviewed and discussed with management the Company’s audited consolidated financial statements as of December

31, 2023, and for the year then ended; (ii) discussed with Deloitte & Touche LLP the matters required by the applicable requirements

of the Public Company Accounting Oversight Board (PCAOB) and the SEC; (iii) received the written disclosures and the letter from Deloitte

& Touche LLP required by applicable requirements of the PCAOB regarding Deloitte & Touche LLP’s communications with the

Audit Committee concerning independence; and (iv) discussed with Deloitte & Touche LLP their independence.

Based on the review and discussions described above, the Audit

Committee recommended to the Board that the Company’s audited financial statements be included in the Company’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2023, for filing with the SEC.

Respectfully submitted,

AUDIT COMMITTEE

Dorri McWhorter, Chair

Barbara Moakler Byrne

Nigel Gormly

|

12 |

PROPOSAL 3

ADVISORY VOTE TO APPROVE THE COMPENSATION

OF OUR NAMED EXECUTIVE OFFICERS

Pursuant to Section 14A of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), we are providing our stockholders the opportunity to vote on a non-binding, advisory resolution,

commonly known as a “say-on-pay” vote, to approve the compensation of our named executive officers as described in this proxy

statement in the compensation tables in the section entitled “Executive Compensation” and any related narrative discussion

contained in this proxy statement. This will be our first “say-on-pay” vote.

This proposal gives our stockholders the opportunity to express

their views on the design and effectiveness of our executive compensation program. While this stockholder vote on executive compensation

is an advisory vote that is not binding on our Company or the Board, we value the opinions of our stockholders and will consider the outcome

of the vote when making future compensation decisions. The advisory vote to approve the compensation of our named executive officers requires

the affirmative vote of a majority of the shares of common stock present, including by means of remote communication, or represented by

proxy and entitled to vote at the Annual Meeting. The Board and the Compensation Committee will consider the outcome of this vote when

making future compensation decisions for our named executive officers.

We encourage stockholders to read the sections titled “Compensation

Discussion and Analysis” and “Executive Compensation” in this proxy statement, including the compensation tables and

the related narrative disclosure, which describes the structure and amounts of the compensation of our named executive officers in fiscal

year 2023. The compensation of our named executive officers is designed to enable us to attract and retain talented and experienced executives

to lead us successfully in a competitive environment. The Compensation Committee and the Board believe that our executive compensation

strikes the appropriate balance between utilizing responsible, measured pay practices and effectively incentivizing our named executive

officers to dedicate themselves fully to value creation for our stockholders.

Accordingly, the following resolution will be submitted for a stockholder

vote at the Annual Meeting:

“RESOLVED, that the stockholders approve, on an advisory

and non-binding basis, the compensation of our named executive officers, as disclosed in this proxy statement pursuant to Item 402 of

Regulation S-K, including the compensation tables and narrative discussion in this proxy statement.”

Vote Required and Board Recommendation

This vote is not intended to address any specific element of compensation,

but rather the overall compensation of our named executive officers and the compensation philosophy, policies and practices described

in this proxy statement. Approval of the above resolution requires the affirmative vote of a majority of the shares of common stock present

in person, including by means of remote communication, or represented by proxy and entitled to vote at the Annual Meeting. Abstentions

will be treated as shares present and entitled to vote and will therefore have the same effect as a vote against this proposal. Broker

non-votes will have no effect on the outcome of this proposal.

THE BOARD RECOMMENDS A VOTE “FOR” THE ADVISORY VOTE TO APPROVE THE

COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS. |

|

13 |

PROPOSAL 4

ADVISORY VOTE ON THE FREQUENCY OF FUTURE

ADVISORY VOTES TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

At least every six years, we are required under Section 14A of

the Exchange Act to hold a separate non-binding, advisory shareholder vote with respect to the frequency of future votes we will hold

on “say on pay” proposals. Companies must give stockholders the choice of whether to cast an advisory vote on the “say

on pay” proposal every year, every two years or every three years (commonly known as the “say on pay” frequency vote).

The Board of Directors recommends that stockholders vote to hold

an advisory vote on executive compensation on an annual basis. This recommendation is based upon the premise that the Board of Directors

and the Compensation Committee evaluate executive compensation policies on an annual basis, and an annual vote would provide more direct

stockholder input on the Board of Directors and the Compensation Committee’s decision making. The Board of Directors also believes

that giving our stockholders the right to cast an advisory vote every year on their approval of the compensation arrangements of our named

executive officers is a good corporate governance practice. If such vote takes place less frequently, the Compensation Committee may not

be able to effectively address concerns and feedback from stockholders in a timely manner and may not allow us to fully understand which

policies are most supported by our stockholders.

Vote Required and Board Recommendation

You may cast your vote on your preferred voting frequency by choosing

one year, two years, three years or abstaining from voting when you vote in response to this proposal. The voting frequency option that

receives the highest number of votes cast by stockholders will be deemed the frequency that has been selected by stockholders. However,

because this vote is advisory and not binding on the Board of Directors or the Company in any way, the Board of Directors may decide that

it is in the best interests of our Company and our stockholders to hold an advisory vote on executive compensation more or less frequently

than the option approved by our stockholders. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR A FREQUENCY OF “ONE YEAR”

FOR FUTURE ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS. |

|

14 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

General

This section describes key corporate governance guidelines and

practices that we have adopted. Complete copies of our Corporate Governance Overview, the charters of the committees of the Board and

our Code of Conduct and Ethics described below may be viewed on our website at https://ir.lanzatech.com/ under the heading “Corporate

Governance” and the sub-heading “Documents & Charters.” You can also request a copy of any of these documents free

of charge by writing to LanzaTech Global, Inc., 8045 Lamon Avenue, Suite 400, Skokie, Illinois 60077, Attn: Corporate Secretary.

Board Composition

The Board directs the management of our business and affairs, as provided

by Delaware law, and conducts its business through meetings of the Board and its standing committees. There are currently six directors

currently serving on the Board. Dr. Holmgren serves as chair of the Board. The primary responsibilities of the Board are to provide the

Company with risk oversight and strategic guidance and to counsel and direct management. The Board meets on a regular basis and will convene

additional meetings, as required.

The Board is divided into three classes, with only one class of

directors being elected in each year and each class serving a three-year term. Thus, at each annual meeting of stockholders, a class of

directors will be elected for a three-year term to succeed the class whose term is then expiring.

Independence of Directors

As required by Nasdaq listing standards, a majority of the members

of the Board must qualify as “independent,” as affirmatively determined by the Board. The Board consults with legal counsel

to ensure that its determinations are consistent with all relevant securities and other laws and regulations regarding the definition

of “independent,” including those set forth in the applicable Nasdaq listing standards.

We adhere to the rules of Nasdaq in determining whether a director

is independent. The Nasdaq listing standards generally define an “independent director” as a person who is not an executive

officer or employee, or who does not have a relationship which, in the opinion of the company’s board of directors, would interfere

with the exercise of independent judgment in carrying out his or her responsibilities as a director. The Board has determined that Nigel

Gormly, Barbara Byrne, Jim Messina, Dorri McWhorter and Gary Rieschel are independent directors of the Company. Our independent directors

have regularly scheduled meetings at which only independent directors are present.

Board Leadership Structure and Role in Risk Oversight

The Board recognizes that the leadership structure and combination

or separation of the Chief Executive Officer and Chairperson roles is driven by the needs of the Company at any point in time. As a result,

no policy exists requiring combination or separation of leadership roles, and our governing documents do not mandate a particular structure.

This has allowed the Board the flexibility to establish the most appropriate structure for the Company at any given time.

The Board oversees the risk management activities designed and

implemented by its management. The Board does not have a standing risk management committee, but rather executes its oversight responsibility

both directly and through its standing committees. The Board also considers specific risk topics, including risks associated with our

strategic initiatives, business plans and capital structure. Our management, including our executive officers, are primarily responsible

for managing the risks associated with the operation and business of the Company and providing appropriate updates to the Board and the

Audit Committee. The Board delegates to the Audit Committee oversight of its risk management process, and the other Board committees also

consider risks as they perform their respective committee responsibilities. All committees of the Board report to the Board as appropriate,

including, but not limited to, when a matter rises to the level of a material or enterprise risk.

|

15 |

The Board recognizes the importance of appointing a strong lead

independent director to maintain a counterbalancing structure to ensure the Board functions in an appropriately independent manner. Jim

Messina serves as our lead independent director. Our lead independent director’s responsibilities include, among other things:

| · | presiding at all meetings of the Board in the absence of,

or upon the request of, the Chairperson of the Board; |

| · | lead regular executive sessions of the independent members

of the Board; |

| · | call special meetings of the Board as necessary to address

important or urgent issues affecting the Company; |

| · | call meetings of the non-employee or independent members

of the Board, with appropriate notice; |

| · | advise the Nominating and Governance Committee and the

Chairperson of the Board on the membership of the various Board committees and the selection of committee chairpersons; |

| · | serve as principal liaison between the non-employee and

independent members of the Board, as a group, and the Chief Executive Officer and the Chairperson of the Board, as necessary; |

| · | engage when necessary and appropriate, after consultation

with the Chairperson of the Board and the Chief Executive Officer, as the liaison between the Board and our stockholders and other stakeholders;

and |

| · | foster open dialogue and constructive feedback among the

independent directors. |

Board Meetings and Annual Stockholders Meetings

We keep our directors informed of our business at meetings and

through reports and analyses presented to the Board and the Board committees. Regular communications between our directors and management

also occur apart from meetings of the Board and Board committees. During 2023, there were five meetings of the Board. Each director attended

at least 75% of the aggregate number of the total number of meetings of the Board (held during the period for which he or she has been

a director) and the total number of meetings of the Board committees on which he or she served (during the periods that he or she served).

While we do not have a formal policy requiring our directors to attend stockholder meetings, directors are invited and encouraged to attend

all meetings of stockholders. Our 2024 Annual Meeting is our first meeting as a public company.

Information Regarding Board Committees

The Board has an Audit Committee, a Nominating and Governance Committee

and a Compensation Committee. In addition, from time to time, special committees may be established under the direction of the Board when

necessary to address specific issues. Copies of each board committee’s charter are posted on our website at https://ir.lanzatech.com/

under the heading “Corporate Governance” and the sub-heading “Documents & Charters.” The following table provides

membership as of April 29, 2024 and meeting information for 2023 for each of the Board committees.

| Name |

|

Audit

Committee |

|

Compensation

Committee |

|

Nominating and

Corporate

Governance

Committee |

| Nigel Gormly |

|

|

|

|

|

|

| Dorri McWhorter |

|

|

|

|

|

|

| Jim Messina |

|

|

|

|

|

|

| Barbara Moakler Byrne |

|

|

|

|

|

|

| Gary Rieschel |

|

|

|

|

|

|

| Total Meetings Held in 2023 |

|

8 |

|

4 |

|

4 |

– Chairperson

– Chairperson

–

Member

–

Member

|

16 |

Below is a description of each committee of the Board. Each of

the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities.

The Board has determined that each member of each committee meets the applicable rules and regulations regarding “independence”

and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with

regard to the Company.

Audit Committee

The Audit Committee consists of Barbara Byrne, Nigel Gormly and

Dorri McWhorter. Dorri McWhorter serves as the chairperson of the Audit Committee. Each of Barbara Byrne, Nigel Gormly and Dorri McWhorter

is independent under Nasdaq listing standards and Rule 10A-3 of the Exchange Act. Each member of the Audit Committee is financially

literate. Dorri McWhorter is an “audit committee financial expert” within the meaning of SEC regulations.

The Audit Committee has the following responsibilities, among others,

as set forth in the Audit Committee charter:

| · | selecting a firm to serve as the independent registered

public accounting firm to audit the Company’s financial statements; |

| · | ensuring the independence of the independent registered

public accounting firm; |

| · | discussing the scope and results of the audit with the

independent registered public accounting firm and reviewing, with management and that firm, the Company’s interim and year-end operating

results; |

| · | establishing procedures for employees to anonymously submit

concerns about questionable accounting or audit matters; |

| · | considering the adequacy of the Company’s internal

controls; |

| · | reviewing material related party transactions or those

that require disclosure; and |

| · | pre-approving audit and non-audit services to be performed

by the independent registered public accounting firm. |

Nominating and Governance Committee

The Nominating and Governance Committee consists of Nigel Gormly,

Dorri McWhorter and Jim Messina. Jim Messina serves as the chairperson of the Nominating and Governance Committee. Each of Nigel Gormly,

Dorri McWhorter and Jim Messina is independent under Nasdaq listing standards.

The Nominating and Governance Committee has the following responsibilities,

among others, as set forth in the Nominating and Governance Committee’s charter:

| · | identifying and recommending candidates for membership

on the Board; |

| · | reviewing and recommending our corporate governance guidelines

and policies; |

| · | overseeing the process of evaluating the performance of

the Board; |

| · | assisting the Board on corporate governance matters; and |

| · | reviewing proposed waivers of our Code of Conduct and Ethics

for directors and executive officers. |

Compensation Committee

The Compensation Committee consists of Barbara Byrne, Jim Messina

and Gary Rieschel. Gary Rieschel serves as the chairperson of the Compensation Committee. Each of Barbara Byrne, Jim Messina and Gary

Rieschel is independent under applicable SEC rules and Nasdaq listing standards and a “non-employee director” as defined

in Rule 16b-3 promulgated under the Exchange Act.

|

17 |

The Compensation Committee has the following responsibilities,

among others, as set forth in the Compensation Committee’s charter:

| · | reviewing and approving, or recommending that the Board

approve, the compensation of executive officers; |

| · | reviewing and recommending to the Board the compensation

of its directors; |

| · | administering the Company’s stock and equity incentive

plans; |

| · | reviewing and approving, or making recommendations to the

Board with respect to, incentive compensation and equity plans; and |

| · | reviewing our overall compensation philosophy. |

Board Diversity

We are committed to diversity and inclusion, and the highly

diverse nature of our Board reflects that commitment. We believe that a variety of experiences and points of view contributes to a more

effective decision-making process.

The below Board Diversity Matrix reports self-identified diversity

statistics for the Board in the format required by Nasdaq’s rules.

| Board Diversity Matrix (as of April 29, 2024) |

| Total Number of Directors: 6 |

| |

Female |

Male |

Non-Binary |

Did Not

Disclose Gender |

| Directors |

3 |

3 |

0 |

0 |

| Demographic Background: |

| African American or Black |

1 |

– |

– |

– |

| Asian |

– |

– |

– |

– |

| Hispanic or Latinx |

1 |

– |

– |

– |

| White |

1 |

3 |

– |

– |

| LGBTQ+ |

– |

– |

– |

– |

Consideration of Director Nominees

Director Qualifications

There are no specific minimum qualifications that the Board

requires to be met by a director nominee recommended for a position on the Board, nor are there any specific qualities or skills that

are necessary for one or more members of the Board to possess, other than as are necessary to meet the requirements of the rules and regulations

applicable to us. The Nominating and Governance Committee considers a potential director candidate’s experience, areas of expertise

and other factors relative to the overall composition of the Board and its committees, including the following characteristics: experience,