Activision Blizzard Posts Big Rise in Revenue and Profit, Upgrades Outlook

November 03 2016 - 6:14PM

Dow Jones News

By Sarah E. Needleman

Activision Blizzard Inc. reported significant increases in

quarterly revenue and profit and raised its full-year outlook, as

videogame players snapped up digital content designed to keep them

hooked between bigger new releases.

Revenue in the third quarter rose 58% to $1.57 billion from a

year ago, exceeding the company's own forecast last quarter of

$1.49 billion.

Activision Blizzard, the biggest videogame company in the U.S.

by market value, released few major franchise games during the

quarter. Still, customers more than doubled their spending on

digitally delivered content, including full games and add-ons for

existing games, it said.

A new "World of Warcraft" expansion sold 3.3 million copies on

its first day, prompting more players who had abandoned the aging

franchise to come back than expected, the company said. It credited

shortening the period in between expansion releases by about five

months in part for the surge in sales. The company stopped

disclosing subscriber figures last year.

"Overwatch," a team-based shooter game released in May, now has

more than 20 million registered players, putting it among the

company's most popular series such as "Call of Duty," analysts

say.

The company hit some bumps during the quarter. King Digital

Entertainment, the "Candy Crush Saga" developer it acquired in

February, contributed 29% of Activision Blizzard's total revenue,

down 5% from the second quarter. Monthly active users for King fell

4% to 394 million.

Activision Blizzard's net income climbed 56% to $199 million, or

26 cents a share.

The videogame company boosted its sales outlook for the current

holiday quarter, which will include a new "Call of Duty"

installment. The company expects revenue of $1.86 billion, up from

last quarter's projection of $1.49 billion. It lowered its

per-share earnings forecast to 5 cents from 6 cents, blaming a

shift in timing on costs related to debt.

The company also raised its full-year outlook, optimistic about

its slate of games for consoles, computers and mobile devices,

Chief Financial Officer Dennis Durkin said in an interview. "It's

based on the strong fundamentals of what we have inside the

portfolio," he added.

Activision Blizzard now expects to close out 2016 with $6.45

billion in revenue, up from $6.4 billion. It expects profit of 98

cents a share, up from 87 cents.

Still, investors sent shares down as much as 4% in after-hours

trading, having expected a more robust outlook, analysts said. The

stock recently was down 0.9% to $43.

Under U.S. generally accepted accounting principles, companies

must defer some revenue from online-enabled games for as long as

they expect to provide services for those titles, generally six to

nine months. Activision Blizzard said it deferred a net $62 million

in revenue in the third quarter, up from $50 million a year

ago.

Like its peers, Activision Blizzard has scaled back reporting

so-called non-GAAP results. Many analysts and investors, though,

continue to evaluate game companies based on measures adjusted to

account for deferred revenue. Activision Blizzard's results show

adjusted per-share quarterly profit of 52 cents, exceeding Wall

Street's forecast of 42 cents, according to Thomson Reuters.

Write to Sarah E. Needleman at sarah.needleman@wsj.com

(END) Dow Jones Newswires

November 03, 2016 17:59 ET (21:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

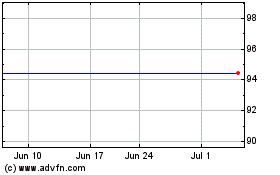

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Jun 2024 to Jul 2024

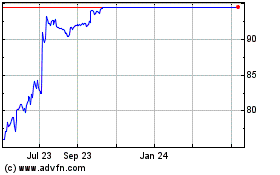

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Jul 2023 to Jul 2024