false

0001635077

0001635077

2025-01-14

2025-01-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

As filed with the Securities and Exchange Commission

on January 14, 2025.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM

S-1MEF

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT

OF 1933

Aclarion,

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

8071 |

|

47-3324725 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

8181 Arista Place, Suite

100

Broomfield, Colorado 80021

(833) 275-2266

(Address, including zip code,

and telephone number, including area code, of registrant’s principal executive offices)

John Lorbiecki

Chief Financial Officer

Aclarion, Inc.

8181 Arista Place, Suite

100

Broomfield, Colorado 80021

(833) 275-2266

(Name, address, including

zip code, and telephone number, including area code, of agent for service)

Copies to:

| James H. Carroll, Esq. |

|

Ralph V. De Martino, Esq. |

| Carroll Legal LLC |

|

Marc E. Rivera, Esq. |

| 1449 Wynkoop Street, Suite 507 |

|

ArentFox Schiff LLP |

| Denver, CO 80202 |

|

1717 K Street NW |

| (303) 888-4859 |

|

Washington, D.C. 20006 |

|

|

(202) 724-6848 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check

the following box. ☐

If this Form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☒ 333-283724

If this Form is a

post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

| Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

| |

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registration Statement shall become effective upon filing in

accordance with Rule 462(b) promulgated under the Securities Act of 1933, as amended.

EXPLANATORY NOTE AND INCORPORATION BY REFERENCE

This Registration Statement is being filed by Aclarion, Inc. (the

“Registrant”) pursuant to Rule 462(b) as promulgated under the Securities Act of 1933, as amended (the “Securities

Act”), and includes the registration statement facing page, this page, the signature page, an exhibit index and the required

opinion and consents solely to register up to an aggregate of $8,100,000 in additional (i) common

stock, (ii) pre-funded warrants to purchase common stock, (iii) Series A common warrants to purchase common

stock (the “Series A Common Warrants”), (iv) Series B common warrants to purchase common stock (the “Series B

Common Warrants”), (v) common stock underlying pre-funded warrants, (vi) common stock Series A Common Warrants,

(vii) common stock underlying Series B Common Warrants, and (viii) securities that may be sold upon exercise of the

underwriter’s over-allotment option. The contents of the Registration Statement on Form

S-1 (Registration No. 333-283274), as amended, including the exhibits and powers of attorney included

therein (the “Prior Registration Statement”), which was declared effective by the Securities and Exchange Commission on

January 14, 2025, are incorporated by reference in this Registration Statement. The additional securities that are being registered

for sale are in an amount and at a price that together represent no more than 20% of the maximum aggregate offering price set forth

in the Filing Fee Table (Exhibit 107) filed as an exhibit to the Prior Registration Statement.

The required opinion and consents are listed on the Exhibit Index attached

hereto and filed herewith.

EXHIBIT INDEX

| * |

Previously filed on the signature page to the Registrant’s Registration Statement on Form S-1, as amended (File No. 333-283274), originally filed with the Securities and Exchange Commission on December 11, 2024 and incorporated by reference herein. |

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, as amended, the registrant has duly caused this Registration Statement on Form S-1 to be signed on its

behalf by the undersigned, thereunto duly authorized, in the city of Broomfield, in the State of Colorado, on this 14th day of January,

2025.

| |

ACLARION, INC. |

| |

|

|

| |

By: |

|

/s/ John Lorbiecki |

| |

|

|

John Lorbiecki |

| |

|

|

Chief Financial Officer |

Pursuant to the requirements

of the Securities Act of 1933, as amended, this Registration Statement on Form S-1 has been signed by the following persons in the capacities

and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Brent Ness |

|

Chief Executive Officer and Director |

|

January 14, 2025 |

| Brent Ness |

|

(Principal Executive Officer) |

|

|

| |

|

President and Director |

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ John Lorbiecki |

|

Chief Financial Officer |

|

January 14, 2025 |

| John Lorbiecki |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| |

|

|

|

|

| * |

|

Executive Chairman and Director |

|

January 14, 2025 |

| Jeffrey Thramann |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

January 14, 2025 |

| David Neal |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

January 14, 2025 |

| William Wesemann |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

January 14, 2025 |

| Amanda Williams |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

January 14, 2025 |

| Stephen Deitsch |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

January 14, 2025 |

| Scott Breidbart |

|

|

|

|

* /s/ John Lorbiecki

John Lorbiecki

Attorney-in-Fact

Exhibit 5.1

Carroll Legal LLC

1449 Wynkoop Street

Suite 507

Denver, CO 80202

January 14, 2025

Aclarion, Inc.

8181 Arista Place

Broomfield, CO 80021

Re: Registration Statement on Form S-1

Ladies and Gentlemen:

We have acted as special counsel to Aclarion, Inc., a Delaware corporation

(the “Company”), in connection with the filing of (i) a Registration Statement (as amended, the “Initial Registration

Statement”) on Form S-1 (File No. 333-283724) with the Securities and Exchange Commission (the “Commission”) under the

Securities Act of 1933, as amended (the “Act”), and (ii) a second Registration Statement on Form S-1 filed pursuant to Rule

462(b) promulgated under the Securities Act (the “462(b) Registration Statement,” and together with the Initial Registration

Statement, the “Registration Statement”).

The Registration Statement relates to the proposed offering and sale

of up to $16.5 million of (i) shares of the Company’s common stock (the “Common Stock”), $0.00001 par value per share

(the “Common Shares”); (ii) Series A warrants to purchase shares of Common Stock (the “Series A Warrants”); (iii)

shares of Common Stock issuable upon exercise of the Series A Warrants (the “Series A Warrant Shares”); (iv) Series B warrants

to purchase shares of Common Stock (the “Series B Warrants”); (v) shares of Common Stock issuable upon exercise of the Series

B Warrants (the “Series B Warrant Shares”); (vi) prefunded warrants to purchase shares of Common Stock (the “Prefunded

Warrants”); and (vii) shares of Common Stock issuable upon exercise of the Prefunded Warrants (the “Prefunded Warrant Shares”).

The Series A Warrants, the Series B Warrants, and the Prefunded Warrants

are collectively referred to herein as the “Warrants.” The Series A Warrant Shares, the Series B Warrant Shares, and the Prefunded

Warrant Shares are collectively referred to herein as the “Warrant Shares.”

The Common Shares and the Warrants are to be sold by the Company in

accordance with an Underwriting Agreement to be entered into by the Company and Dawson James Securities, Inc. (the “Placement Agent

Agreement”), the form of which has been filed as Exhibit 1.1 to the Initial Registration Statement. The securities are to be offered

and sold in the manner described in the Registration Statement and the related prospectus included therein (the “Prospectus”).

In connection herewith, we have examined the Registration Statement

and the Prospectus. We have also examined originals or copies, certified or otherwise identified to our satisfaction, of the Company’s

Certificate of Incorporation and Bylaws (both as amended to date), and such other records, agreements and instruments of the Company,

certificates of public officials and officers of the Company, and such other documents, records and instruments, and we have made such

legal and factual inquiries, as we have deemed necessary or appropriate as a basis for us to render the opinions hereinafter expressed.

In our examination of the foregoing, we have assumed the genuineness

of all signatures, the legal competence and capacity of natural persons, the authenticity of documents submitted to us as originals and

the conformity with authentic original documents of all documents submitted to us as copies or by facsimile or other means of electronic

transmission, or which we obtained from the Commission’s Electronic Data Gathering, Analysis and Retrieval system (“Edgar”)

or other sites maintained by a court or governmental authority or regulatory body and the authenticity of the originals of such latter

documents. If any documents we examined in printed, word processed or similar form has been filed with the Commission on Edgar or such

court or governmental authority or regulatory body, we have assumed that the document so filed is identical to the document we examined

except for formatting changes. When relevant facts were not independently established, we have relied without independent investigation

as to matters of fact upon statements of governmental officials and certificates and statements of appropriate representatives of the

Company.

Based upon the foregoing and in reliance thereon, and subject to the

assumptions, comments, qualifications, limitations and exceptions set forth herein, we are of the opinion, that:

(i) the Common Shares, when issued against payment

therefor as set forth in the Registration Statement, will be validly issued, fully paid and non-assessable;

(ii) the Warrants, when issued as set forth in

the Registration Statement, will be legal, valid and binding obligations of the Company, enforceable against the Company in accordance

with their terms; and

(iii) the Warrant Shares, when issued upon exercise

of the Warrants against payment therefor as set forth in the Registration Statement, will be validly issued, fully paid and non-assessable.

Our opinions herein reflect only the application of the General Corporation

Law of the State of Delaware. The opinions set forth herein are made as of the date hereof and are subject to, and may be limited by,

future changes in factual matters, and we undertake no duty to advise you of the same. The opinions expressed herein are based upon the

law in effect (and published or otherwise generally available) on the date hereof, and we assume no obligation to revise or supplement

these opinions should such law be changed by legislative action, judicial decision or otherwise. In rendering our opinions, we have not

considered, and hereby disclaim any opinion as to, the application or impact of any laws, cases, decisions, rules or regulations of any

other jurisdiction, court or administrative agency.

We do not render any opinions except as set forth above. We hereby

consent to the filing of this opinion letter as Exhibit 5.1 to the 462(b) Registration Statement and to the use of our name under the

caption “Legal Matters” in the prospectus filed as a part of the Initial Registration Statement. We also consent to your filing

copies of this opinion letter as an exhibit to the Registration Statement with agencies of such states as you deem necessary in the course

of complying with the laws of such states regarding the offering and sale of the Shares. In giving such consent, we do not thereby concede

that we are within the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission

thereunder.

| |

CARROLL LEGAL LLC |

| |

|

| |

|

| |

By: |

/s/ James H. Carroll |

| |

|

James H. Carroll |

| |

|

Managing Member |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-1 of Aclarion, Inc. of our report dated February

20, 2024 and March 28, 2024, with respect to the financial statements of Aclarion, Inc. as of December 31, 2023, and for the year then

ended. Our audit report includes an explanatory paragraph relating to Aclarion, Inc.’s ability to continue as a going concern.

/s/ Haynie & Company

Salt Lake City, Utah

January 14, 2025

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We consent to the incorporation by reference in this Registration Statement

on Form S-1 of our report dated June 12, 2023, except for Note 1, 2024 Reverse Stock Split, Note 7, SUPPLEMENTAL FINANCIAL INFORMATION,

Prepaids and other current assets and Accrued and other liabilities, and Note 14, Net Loss Per Share of Common Stock, as to which the

date is February 21, 2024, with respect to the restated financial statements of Aclarion, Inc. as of December 31, 2022 and for the year

then ended, appearing in the Registration Statement on Form S-1 (File No. 333-283724), as amended. Our audit report includes an explanatory

paragraph relating to Aclarion, Inc.’s ability to continue as a going concern.

/s/ CohnReznick LLP

Sunrise, Florida

January 14, 2025

Exhibit 107

Calculation of Filing Fee Tables

S-1

(Form Type)

Aclarion, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward

Securities

| |

|

Security

Type |

|

Security

Class Title |

|

Fee

Calculation

or Carry

Forward

Rule |

|

Amount

Registered |

|

Proposed

Maximum

Offering

Price Per

Share |

|

Maximum

Aggregate

Offering

Price(1)(2) |

|

Fee Rate |

|

Amount of

Registration

Fee |

| Fees to be Paid |

|

|

Equity |

|

|

Common Stock, $0.00001 par value per share |

|

|

457 |

(o) |

|

|

— |

|

|

|

— |

|

|

|

$ |

2,700,000 |

(3) |

|

|

0.00015310 |

|

|

$ |

413.37 |

|

| Fees to be Paid |

|

|

Equity |

|

|

Series A Common Warrants accompanying the Common Stock or Pre-Funded

Warrants |

|

|

Other |

(4) |

|

|

— |

|

|

|

— |

|

|

|

|

|

(4) |

|

|

— |

|

|

|

— |

|

| Fees to be Paid |

|

|

Equity |

|

|

Series B Common Warrants accompanying the Common Stock or Pre-Funded

Warrants |

|

|

Other |

(4) |

|

|

— |

|

|

|

— |

|

|

|

|

|

(4) |

|

|

— |

|

|

|

— |

|

| Fees to be Paid |

|

|

Equity |

|

|

Pre-Funded Warrants |

|

|

Other |

(4) |

|

|

— |

|

|

|

— |

|

|

|

|

|

(3)(4) |

|

|

— |

|

|

|

— |

|

| Fees to be Paid |

|

|

Equity |

|

|

Common Stock underlying the Pre-Funded Warrants (3) |

|

|

457 |

(o) |

|

|

— |

|

|

|

— |

|

|

|

|

|

(3) |

|

|

— |

|

|

|

— |

|

| Fees to be Paid |

|

|

Equity |

|

|

Common Stock underlying the Series A Common Warrants |

|

|

457 |

(o) |

|

|

— |

|

|

|

— |

|

|

|

$ |

2,700,000 |

|

|

|

0.00015310 |

|

|

$ |

413.37 |

|

| Fees to be Paid |

|

|

Equity |

|

|

Common Stock underlying the Series B Common Warrants |

|

|

457 |

(o) |

|

|

— |

|

|

|

— |

|

|

|

$ |

2,700,000 |

|

|

|

0.00015310 |

|

|

$ |

413.37 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees Previously Paid |

|

|

Equity |

|

|

Common Stock, par value $0.00001 per share |

|

|

457 |

(o) |

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Carry Forward Securities |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Total Offering Amounts |

|

|

|

|

|

|

|

|

|

|

|

$ |

8,100,000 |

|

|

|

|

|

|

$ |

1,240.11 |

|

| Total Fees Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

| Total Fee Offset |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

| Net Fee Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

1,240.11 |

|

| (1) |

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). Represents only the additional number of shares being registered. This does not include the securities that the Registrant previously registered on the Registration Statement on Form S-1, as amended (File No. 333-283274) (the “Prior Registration Statement”). |

| (2) |

Pursuant to Rule 416(a) under the Securities Act, there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from share splits, share dividends or similar transactions. |

| (3) |

The proposed maximum aggregate offering price of the Common Stock proposed to be sold in the offering will be reduced on a dollar-for-dollar basis based on the offering price of any Pre-Funded Warrants sold in the offering and the proposed maximum aggregate offering price of the Pre-Funded Warrants proposed to be sold in the offering will be reduced on a dollar-for-dollar basis based on the offering price of any Common Stock sold in the offering. |

| (4) |

Pursuant to Rule 457(g) of the Securities Act, no separate registration fee is required for the warrants because the warrants are being registered in the same registration statement as the Common Stock issuable upon exercise of the warrants. |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

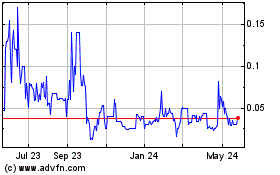

Aclarion (NASDAQ:ACONW)

Historical Stock Chart

From Jan 2025 to Feb 2025

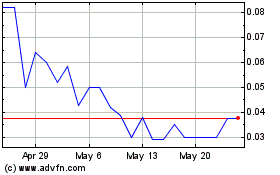

Aclarion (NASDAQ:ACONW)

Historical Stock Chart

From Feb 2024 to Feb 2025