false

0001427925

0001427925

2023-11-08

2023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2023

ACELRX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

Delaware

|

|

001-35068

|

|

41-2193603

|

|

(State of incorporation)

|

|

(Commission File No.)

|

|

(IRS Employer Identification No.)

|

25821 Industrial Boulevard, Suite 400

Hayward, CA 94545

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (650) 216-3500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

ACRX

|

The Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On November 8, 2023, AcelRx Pharmaceuticals, Inc. (the “Company”) issued a press release announcing its financial results for the three months ended September 30, 2023 and providing a corporate update (the “Release”). A copy of the Release is furnished herewith as Exhibit 99.1.

The information contained in this Item 2.02 and in Exhibit 99.1 shall be deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The information contained in this Item 2.02 and in Exhibit 99.1 shall not be incorporated by reference into any filing under the Securities Act or the Exchange Act made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

|

Exhibit No.

|

Description

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: November 8, 2023

|

ACELRX PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Raffi Asadorian

|

|

|

|

|

Raffi Asadorian

|

|

|

|

|

Chief Financial Officer

|

|

Exhibit 99.1

AcelRx Reports Third Quarter 2023 Financial Results and Provides Corporate Update

Niyad™ Investigational Device Exemption (IDE) approval by the FDA achieved in third quarter

Company plans to begin its Niyad registrational study this quarter with topline data expected mid-2024

Cash and investments of $13.4 million as of September 30, 2023

Financing closed in July led by new healthcare investors providing up to $26.3 million, of which $10 million was made immediately available

Key Opinion Leader panel discussion on Niyad planned for December 6th

Webcast and conference call to be held today at 4:30 p.m. ET

SAN MATEO, Calif., November 8, 2023 /PRNewswire/ -- AcelRx Pharmaceuticals, Inc. (Nasdaq: ACRX), (AcelRx), a specialty pharmaceutical company focused on the development and commercialization of innovative therapies for use in medically supervised settings, today reported its third quarter 2023 financial results and provided a corporate update.

“We continue to advance our lead product candidate Niyad™, that has FDA Breakthrough Device designation, by prioritizing our resources to achieve regulatory and development milestones on this asset,” said Vince Angotti, Chief Executive Officer of AcelRx. “Importantly, at the close of the third quarter, we received IDE approval from the FDA to proceed with the Niyad NEPHRO CRRT Study. NEPHRO stands for Nafamostat Efficacy in Phase 3 Registrational Continuous Renal Replacement Therapy Study. The NEPHRO study is set to start this quarter with top-line data expected by mid-2024 and submission of an application for Premarket Approval, or PMA, planned in the second half of next year. Niyad would be the first-ever U.S. approved regional anticoagulant for use in a dialysis circuit.”

“In addition, we have a Key Opinion Leader panel discussion that we will host on December 6th featuring nephrology and critical care experts where we plan to discuss the results from our market research, as well as the NEPHRO Study,” continued Angotti.

The NEPHRO Study, which recently received central Institutional Review Board (IRB) approval, is designed as a prospective, double-blinded trial to be conducted at up to 10 U.S. hospital intensive care units. The study will enroll and evaluate 166 adult patients undergoing renal replacement therapy, who cannot tolerate heparin or are at risk for bleeding. The primary endpoint of the study is mean post-filter activated clotting time using Niyad versus placebo over the first 24 hours. Key secondary endpoints include filter lifespan, number of filter changes over 72 hours, number of transfusions over 72 hours and dialysis efficacy (based on urea concentration) over the first 24 hours.

2023 Third Quarter and Recent Corporate Highlights

| |

●

|

In October, AcelRx announced the approval of an Investigational Device Exemption (IDE) submission to the United States Food and Drug Administration (FDA) allowing the Company to advance Niyad into a registrational study. This study will evaluate the safety and efficacy of Niyad to support a PMA application expected to be submitted to the FDA in the second half of 2024.

|

| |

●

|

In July, AcelRx announced a private placement of common stock, pre-funded warrants and common warrants for aggregate gross proceeds to the Company of $10 million, before deducting the placement agent’s fees and other offering expenses payable by the Company, with an additional potential $16.3 million upon the exercise of common warrants, which include an acceleration feature should the Company achieve certain performance milestones. This financing provides up to $26.3 million in gross proceeds upon the exercise of milestone-affected warrants. The private placement was priced "at-the-market" under the rules and regulations of The Nasdaq Stock Market LLC. The private placement was led by new investors including Nantahala Capital Management and closed on July 21, 2023.

|

Third Quarter 2023 Financial Information

| |

●

|

The cash and cash equivalents balance was $13.4 million as of September 30, 2023. The senior debt with Oxford was fully repaid in the second quarter of 2023.

|

| |

●

|

Revenues of $0.1 million for the third quarter primarily represent the royalty revenue earned on the sales of DSUVIA by Alora, principally driven by sales to the Department of Defense. Revenues in the prior period are included within the net loss from discontinued operations line item of the Statement of Operations.

|

| |

●

|

Combined R&D and SG&A expenses for the third quarter of 2023 totaled $3.4 million compared to $4.5 million for the third quarter of 2022. Excluding non-cash stock-based compensation expense, these amounts were $3.0 million for the third quarter of 2023, compared to $3.9 million for the third quarter of 2022. The decrease in combined R&D and SG&A expenses in the third quarter of 2023 was primarily due to a reduction in headcount partially offset by an increase in Niyad-related research and development costs.

|

| |

●

|

The divestment of DSUVIA represents a discontinued operation; accordingly, all historical operating results for the business are reflected within discontinued operations. For the three months ended September 30, 2023, the Company recognized net loss from continuing operations of $1.4 million. For the three months ended September 30, 2022, the Company recognized a net loss from continuing operations of $4.6 million.

|

| |

●

|

Net loss attributable to common shareholders for the third quarter of 2023 was $1.4 million, or $0.08 per basic and diluted share, compared to a net loss of $6.9 million, or $0.94 per basic and diluted share, for the third quarter of 2022.

|

Conference Call and Webcast Information

AcelRx will host a live webcast and conference call today, Wednesday, November 8, 2023 at 4:30 p.m. Eastern Standard Time/1:30 p.m. Pacific Standard Time to discuss the results and provide an update on the Company’s business.

The webcast can be accessed here or by visiting the Investors section of the Company's website at www.acelrx.com and clicking on the webcast link within Investors/News & Events/Upcoming Events section. The webcast will include a slide presentation and a replay will be available on the AcelRx website for 90 days following the event.

Investors who wish to participate in the conference call may do so by dialing 1-866-361-2335 for domestic callers, 1-855-669-9657 for Canadian callers, or 1-412-902-4204 (toll applies) for international callers. The conference ID is 10182244.

About Nafamostat

Nafamostat is a broad spectrum, synthetic serine protease inhibitor with anticoagulant, anti-inflammatory and potential anti-viral activities. Niyad™ is a lyophilized formulation of nafamostat and is currently being studied under an investigational device exemption, or IDE, as an anticoagulant for the extracorporeal circuit, and has received Breakthrough Device Designation Status from the FDA. LTX-608 is a proprietary nafamostat formulation for direct IV infusion that will be investigated and developed as a potential anti-viral for the treatment of COVID, acute respiratory distress syndrome (ARDS), disseminated intravascular coagulation (DIC) and acute pancreatitis.

About AcelRx Pharmaceuticals, Inc.

AcelRx Pharmaceuticals, Inc. is a specialty pharmaceutical company focused on the development and commercialization of innovative therapies for use in medically supervised settings. AcelRx's lead product candidate, Niyad™ is a lyophilized formulation of nafamostat and is currently being studied under an investigational device exemption, or IDE, as an anticoagulant for the extracorporeal circuit, and has received Breakthrough Device Designation Status from the FDA. AcelRx is also developing two pre-filled syringes in-licensed from its partner Aguettant: Fedsyra™, a pre-filled ephedrine syringe, and PFS-02, a pre-filled phenylephrine syringe. This release is intended for investors only. For additional information about AcelRx, please visit www.acelrx.com.

Forward-looking statements

This press release contains forward-looking statements based upon AcelRx's current expectations. These and any other forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking terminology such as "potential," "believe," "expect," "expects," "expected," "anticipate," "may," "will," "enable," "should," "seek," "approximately," "intends," "intended," "plans," "planned," "planning," "estimates," "benefits," or the negative of these words or other comparable terminology. The discussion of financial trends, strategy, plans or intentions may also include forward-looking statements, which are predictions, projections and other statements about future events that are based on current expectations and assumptions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied by such statements, including: (i) risks relating to AcelRx's product development activities and ongoing commercial business operations; (ii) risks related to the ability of AcelRx and its business partners to implement development plans, launch plans, forecasts and other business expectations; (iii) risks related to unexpected variations in market growth and demand for AcelRx's commercial and developmental products and technologies; (iv) risks related to AcelRx's liquidity and our ability to maintain capital resources sufficient to conduct the clinical studies required for our developmental products; (v) risks related to AcelRx's ability to retain its listing on the Nasdaq exchange; (vi) risks related to the ability of AcelRx to successfully design and conduct safe, effective and timely clinical studies for our developmental products; and (vii) risks relating to AcelRx’s ability to fund, seek and obtain regulatory approvals for our developmental product candidates. Although it is not possible to predict or identify all such risks and uncertainties, they may include, but are not limited to, those described under the caption "Risk Factors" and elsewhere in AcelRx's annual, quarterly and current reports (i.e., Form 10-K, Form 10-Q and Form 8-K) as filed or furnished with the Securities and Exchange Commission (SEC) and any subsequent public filings. You are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date such statements were first made. To the degree financial information is included in this press release, it is in summary form only and must be considered in the context of the full details provided in AcelRx's most recent annual, quarterly or current report as filed or furnished with the SEC. AcelRx's SEC reports are available at www.acelrx.com under the "Investors" tab. Except to the extent required by law, AcelRx undertakes no obligation to publicly release the result of any revisions to these forward-looking statements to reflect new information, events or circumstances after the date hereof, or to reflect the occurrence of unanticipated events.

Investor Contacts:

AcelRx

Raffi Asadorian, CFO

650-216-3500

investors@acelrx.com

LifeSci Advisors

Kevin Gardner

617-283-2856

kgardner@lifesciadvisors.com

Chris Calabrese

917-680-5608

ccalabrese@lifesciadvisors.com

###

|

Selected Financial Data

|

|

(in thousands, except per share data)

|

|

(unaudited)

|

| |

|

Three Months Ended

|

|

| |

|

September 30

|

|

| |

|

2023

|

|

|

2022

|

|

|

Statement of Comprehensive Income (Loss) Data

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Royalty revenue

|

|

$ |

117 |

|

|

$ |

- |

|

|

Operating costs and expenses:

|

|

|

|

|

|

|

|

|

|

Research and development (1)

|

|

|

1,178 |

|

|

|

799 |

|

|

Selling, general and administrative (1)

|

|

|

2,248 |

|

|

|

3,724 |

|

|

Impairment of property and equipment

|

|

|

- |

|

|

|

- |

|

|

Total operating costs and expenses

|

|

|

3,426 |

|

|

|

4,523 |

|

|

Loss from operations

|

|

|

(3,309 |

) |

|

|

(4,523 |

) |

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

- |

|

|

|

(245 |

) |

|

Interest income and other income (expense), net

|

|

|

1,893 |

|

|

|

140 |

|

|

Non-cash interest income on liability related to sale of future royalties

|

|

|

- |

|

|

|

- |

|

|

Gain on extinguishment of liability related to sale of future royalties

|

|

|

- |

|

|

|

- |

|

|

Total other income (expense)

|

|

|

1,893 |

|

|

|

(105 |

) |

|

Net income (loss) before income taxes

|

|

|

(1,416 |

) |

|

|

(4,628 |

) |

|

Provision for income taxes

|

|

|

(2 |

) |

|

|

(11 |

) |

|

Net income (loss) from continuing operations

|

|

|

(1,418 |

) |

|

|

(4,639 |

) |

|

Net income (loss) from discontinued operations

|

|

|

61 |

|

|

|

(2,111 |

) |

|

Net income (loss)

|

|

|

(1,357 |

) |

|

|

(6,750 |

) |

|

Deemed dividends related to Series A Redeemable Convertible Preferred Stock

|

|

|

- |

|

|

|

(186 |

) |

|

Income allocated to participating securities

|

|

|

- |

|

|

|

- |

|

|

Net income (loss) attributable to Common Shareholders, basic

|

|

$ |

(1,357 |

) |

|

$ |

(6,936 |

) |

|

Net income (loss) attributable to Common Shareholders, diluted

|

|

$ |

(1,357 |

) |

|

$ |

(6,936 |

) |

|

Net income (loss) per share attributable to stockholders:

|

|

|

|

|

|

|

Basic earnings (loss) per share

|

|

|

|

|

|

|

|

|

|

Income (loss) from continuing operations

|

|

$ |

(0.08 |

) |

|

$ |

(0.65 |

) |

|

Income (loss) from discontinued operations

|

|

$ |

0.00 |

|

|

$ |

(0.29 |

) |

|

Net income (loss)

|

|

$ |

(0.08 |

) |

|

$ |

(0.94 |

) |

|

Diluted earnings (loss) per share

|

|

|

|

|

|

|

|

|

|

Income (loss) from continuing operations

|

|

$ |

(0.08 |

) |

|

$ |

(0.65 |

) |

|

Income (loss) from discontinued operations

|

|

$ |

0.00 |

|

|

$ |

(0.29 |

) |

|

Net income (loss)

|

|

$ |

(0.08 |

) |

|

$ |

(0.94 |

) |

| |

|

|

|

|

|

|

|

|

|

Shares used in computing net income (loss) per share of common stock, basic

|

|

|

16,758 |

|

|

|

7,377 |

|

| |

|

|

|

|

|

|

|

|

|

Shares used in computing net income (loss) per share of common stock, diluted

|

|

|

16,758 |

|

|

|

7,377 |

|

| |

|

|

|

|

|

|

|

|

|

(1) Includes the following non-cash stock-based compensation expense:

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

$ |

210 |

|

|

$ |

139 |

|

|

Selling, general and administrative

|

|

|

168 |

|

|

|

519 |

|

|

Discontinued operations

|

|

|

- |

|

|

|

43 |

|

|

Total

|

|

$ |

378 |

|

|

$ |

701 |

|

|

Selected Balance Sheet Data

|

|

(in thousands)

|

| |

|

September 30, 2023

|

|

|

December 31, 2022(1)

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

|

Cash, cash equivalents, restricted cash and investments

|

|

$ |

13,389 |

|

|

$ |

20,770 |

|

|

Total assets

|

|

|

23,261 |

|

|

|

47,487 |

|

|

Total liabilities

|

|

|

4,954 |

|

|

|

25,673 |

|

|

Total stockholders' equity

|

|

|

18,307 |

|

|

|

21,814 |

|

|

(1) Derived from the audited financial statements as of that date included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

|

|

Reconciliation of Non-GAAP Financial Measures

|

|

(Operating Expenses less stock-based compensation expense)

|

| |

|

Three Months Ended

|

|

| |

|

September 30

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses (GAAP):

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

$ |

1,178 |

|

|

$ |

799 |

|

|

General and administrative

|

|

|

2,248 |

|

|

|

3,724 |

|

|

Total operating expenses

|

|

|

3,426 |

|

|

|

4,523 |

|

|

Less stock-based compensation expense

|

|

|

378 |

|

|

|

658 |

|

|

Operating expenses (non-GAAP)

|

|

$ |

3,048 |

|

|

$ |

3,865 |

|

v3.23.3

Document And Entity Information

|

Nov. 08, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ACELRX PHARMACEUTICALS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 08, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35068

|

| Entity, Tax Identification Number |

41-2193603

|

| Entity, Address, Address Line One |

25821 Industrial Boulevard, Suite 400

|

| Entity, Address, City or Town |

Hayward

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94545

|

| City Area Code |

650

|

| Local Phone Number |

216-3500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ACRX

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001427925

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

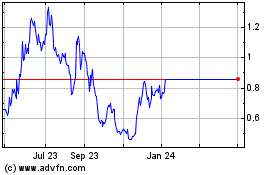

AcelRX Pharmaceuticals (NASDAQ:ACRX)

Historical Stock Chart

From Apr 2024 to May 2024

AcelRX Pharmaceuticals (NASDAQ:ACRX)

Historical Stock Chart

From May 2023 to May 2024