Absci Corporation (Nasdaq: ABSI) (“Absci”), a data-first generative

AI drug creation company, today announced the pricing of an

underwritten public offering of 16,700,000 shares of its common

stock at a public offering price of $4.50 per share, before

deducting underwriting discounts and commissions. In addition,

Absci has granted the underwriters a 30-day option to purchase up

to an additional 2,505,000 shares of its common stock on the same

terms and conditions. The gross proceeds from the offering, before

deducting underwriting discounts and commissions and offering

expenses, are expected to be approximately $75.2 million, excluding

any exercise of the underwriters' option to purchase additional

shares. All of the shares in the offering are to be sold by Absci.

Absci intends to use the net proceeds from the offering to fund

the development of its internal asset programs, continued

investment in its Integrated Drug Creation™ platform, including

related AI and wet-lab technologies, and for working capital and

other general corporate purposes.

Morgan Stanley and TD Cowen are acting as joint book-running

managers for the offering. The offering is expected to close on or

about March 1, 2024, subject to the satisfaction of customary

closing conditions.

The shares of common stock are being offered by Absci pursuant

to an effective shelf registration statement on Form S-3 (File No.

333-267043) that was previously filed with the U.S. Securities and

Exchange Commission (SEC) on August 24, 2022 and became effective

on September 2, 2022. A preliminary prospectus supplement and

accompanying prospectus relating to and describing the terms of the

offering was filed with the SEC on February 27, 2024. The final

prospectus supplement and accompanying prospectus relating to the

offering will be filed with the SEC and may be obtained, when

available, from Morgan Stanley & Co LLC, Attention: Prospectus

Department, 180 Varick Street, 2nd Floor, New York, New York 10014,

by telephone: (866) 718-1649, or by email at

prospectus@morganstanley.com; Cowen and Company, LLC, 599 Lexington

Avenue, New York, NY 10022, by telephone at (833) 297-2926 or by

email at Prospectus_ECM@cowen.com; or by accessing the SEC’s

website at www.sec.gov.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Absci

Absci is a data-first generative AI drug creation company that

combines AI with scalable wet lab technologies to create better

biologics for patients, faster. Our Integrated Drug Creation™

platform unlocks the potential to accelerate time to clinic and

increase the probability of success by simultaneously optimizing

multiple drug characteristics important to both development and

therapeutic benefit. With the data to train, the AI to create, and

the wet lab to validate, we can screen billions of cells per week,

allowing us to go from AI-designed antibodies to wet lab-validated

candidates in as little as six weeks. Absci’s headquarters is in

Vancouver, WA, with its AI Research Lab in New York City and an

Innovation Center in Zug, Switzerland.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended, including, without limitation, statements

regarding Absci’s anticipated public offering. The words “may,”

“might,” “will,” “could,” “would,” “should,” “expect,” “plan,”

“anticipate,” “intend,” “believe,” “expect,” “estimate,” “seek,”

“predict,” “future,” “project,” “potential,” “continue,” “target”

and similar words or expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words.

Any forward-looking statements in this press release, such as

the intended offering terms, are based on management’s current

expectations and beliefs and are subject to a number of risks,

uncertainties and important factors that may cause actual events or

results to differ materially from those expressed or implied by any

forward-looking statements contained in this press release,

including, without limitation, uncertainties related to market

conditions, statements about the expected gross proceeds from the

offering and use of proceeds, and the completion of the offering on

the anticipated terms or at all. These and other risks and

uncertainties are described in greater detail in the section

entitled “Risk Factors” in Absci’s Annual Report on Form 10-K for

the year ended December 31, 2022, as amended, and Quarterly Reports

on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023

and September 30, 2023, as well as discussions of potential risks,

uncertainties, and other important factors in Absci’s other filings

with the SEC, including those contained or incorporated by

reference in the preliminary prospectus supplement and accompanying

prospectus related to the public offering filed with the SEC. In

addition, any forward-looking statements contained in this press

release represent Absci’s views only as of the date hereof and

should not be relied upon as representing its views as of any

subsequent date. Absci explicitly disclaims any obligation to

update any forward-looking statements, except as required by law.

No representations or warranties (expressed or implied) are made

about the accuracy of any such forward-looking statements.

Investor ContactAlex KhanVP, Finance &

Investor Relationsinvestors@absci.com

Media Contactpress@absci.com

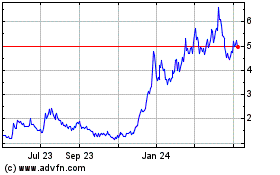

AbSci (NASDAQ:ABSI)

Historical Stock Chart

From Dec 2024 to Jan 2025

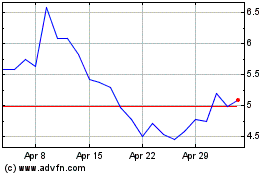

AbSci (NASDAQ:ABSI)

Historical Stock Chart

From Jan 2024 to Jan 2025