AAON Reports Earnings & Backlog for the Third Quarter of 2020

November 05 2020 - 7:00AM

AAON, INC. (NASDAQ-AAON), today announced its results for the third

quarter of 2020.

| Financial Highlights: |

Three Months Ended September

30, |

|

% |

|

|

|

Nine Months Ended September

30, |

|

% |

| |

2020 |

|

2019 |

|

Change |

|

|

|

2020 |

|

2019 |

|

Change |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(in thousands, except share and per share data) |

|

|

|

(in thousands, except share and per share data) |

|

Net sales |

$ |

134,772 |

|

|

$ |

113,500 |

|

|

18.7 |

|

% |

|

|

|

$ |

397,851 |

|

|

$ |

346,759 |

|

|

14.7 |

% |

| Gross profit |

40,848 |

|

|

27,410 |

|

|

49.0 |

|

% |

|

|

|

121,926 |

|

|

83,044 |

|

|

46.8 |

% |

| Gross profit % |

30.3 |

% |

|

24.1 |

% |

|

|

|

|

|

30.6 |

% |

|

23.9 |

% |

|

|

| Selling, general and admin.

expenses |

$ |

14,716 |

|

|

$ |

12,374 |

|

|

18.9 |

|

% |

|

|

|

$ |

45,869 |

|

|

$ |

38,963 |

|

|

17.7 |

% |

| SG&A % |

10.9 |

% |

|

10.9 |

% |

|

|

|

|

|

11.5 |

% |

|

11.2 |

% |

|

|

| Net income |

20,460 |

|

|

14,290 |

|

|

43.2 |

|

% |

|

|

|

60,117 |

|

|

36,438 |

|

|

65.0 |

% |

| Net income % |

15.2 |

% |

|

12.6 |

% |

|

|

|

|

|

15.1 |

% |

|

10.5 |

% |

|

|

| Effective Tax Rate |

21.8 |

% |

|

4.9 |

% |

|

|

|

|

|

21.1 |

% |

|

16.8 |

% |

|

|

| Earnings per diluted

share |

$ |

0.38 |

|

|

$ |

0.26 |

|

|

46.2 |

|

% |

|

|

|

$ |

1.14 |

|

|

$ |

0.69 |

|

|

65.2 |

% |

| Diluted average shares |

53,151,295 |

|

|

52,722,127 |

|

|

0.8 |

|

% |

|

|

|

52,955,049 |

|

|

52,624,583 |

|

|

0.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

September 30, |

|

December 31, |

|

% |

|

|

|

|

|

|

|

|

| |

2020 |

|

2019 |

|

Change |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(in thousands) |

|

|

|

|

|

|

|

|

|

|

| Backlog |

$ |

84,885 |

|

|

$ |

142,747 |

|

|

(40.5 |

) |

% |

|

|

|

|

|

|

|

|

| Cash & cash equivalents

& restricted cash |

78,601 |

|

|

44,373 |

|

|

77.1 |

|

% |

|

|

|

|

|

|

|

|

| Total current liabilities |

61,506 |

|

|

56,028 |

|

|

9.8 |

|

% |

|

|

|

|

|

|

|

|

Gary Fields, CEO, said "We are pleased to report

that our net sales for the third quarter were an all-time

record for any quarter in our Company’s history. I

am especially proud we achieved these results despite a slow start

to the quarter due to a planned maintenance shutdown at our Tulsa

facilities during the beginning of July. In addition, the continued

challenges presented by the COVID-19 pandemic resulted in higher

medical expenses. Our third quarter results demonstrate the

ongoing progress in our transition from entrepreneurial leadership

to a collaborative team-based management approach and

validate our Company’s capability to produce great results

even through challenging times. It should also be

noted that the record sales along with favorable raw material costs

and improved productivity had a significant impact on our

gross profit, which increased to 30.3% from 24.1% for the

corresponding quarter a year ago."

Mr. Fields continued, "The outlook for 2021

continues to present a lot of uncertainty. The Architecture

Billings Index has been down for several months, indicating a

decline in construction, which may start to impact the new

nonresidential construction market in late 2020. Although

construction may decline, our equipment is uniquely positioned to

address COVID challenges by providing heightened filtration and

sanitation through the use of MERV 13 filters, UV lights and

bi-polar ionization installed in the factory. We are

beginning to see increases in raw materials costs, which we are

offsetting in part with our previously announced price increase,

which will be effective January 2021. With approximately 50%

of our total sales already represented by the replacement market,

we are confident of our ability to grow our market share in the

replacement market while we continue to pursue opportunities in the

new construction market. With our improved lead

times, we have been able to continue our planned reduction

of our backlog to a more manageable level and we believe this will

also allow our order intake to stay consistent but

do not see significant growth opportunities in the near term."

Mr. Fields added "Our financial condition

remains strong as evidenced by our current ratio of 3.7:1 at

September 30, 2020. We had unrestricted

cash and cash equivalents of $70.6 million as of September 30,

2020. Our capital expenditures during the nine months

ended September 30, 2020 were $49.0 million, as compared to $30.8

million for the same period a year ago, and we anticipate our

full-year 2020 capital expenditures will total approximately $73.2

million, with $41.3 million directed to our new facility in

Longview Texas."

Mr. Fields concluded, "Our expansion project at

our Longview, Texas facility is nearing completion and the new

building is expected to be operational by January 2021. This

project will not only add 220,000 square feet of additional

capacity to the Longview facility, but will also create additional

space and capacity at our Tulsa facility for future growth

potential."

The Company will host a conference call today at

4:15 P.M. (Eastern Time) to discuss the third quarter 2020 results.

To participate, call 1-833-634-8218 (code 1233199); or, for

rebroadcast available through November 12, 2020, call

1-855-859-2056 (code 1233199).

About AAONAAON, Inc. is engaged

in the engineering, manufacturing, marketing and sale of air

conditioning and heating equipment consisting of standard,

semi-custom and custom rooftop units, chillers, packaged outdoor

mechanical rooms, air handling units, makeup air units, energy

recovery units, condensing units, geothermal/water-source heat

pumps, coils and controls. Since the founding of AAON in 1988, AAON

has maintained a commitment to design, develop, manufacture and

deliver heating and cooling products to perform beyond all

expectations and demonstrate the value of AAON to our customers.

For more information, please visit www.AAON.com.

Forward-Looking

StatementsCertain statements in this news release may be

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933. Statements regarding future prospects

and developments are based upon current expectations and involve

certain risks and uncertainties, including risks related to the

impact of the error correction, that could cause actual results and

developments to differ materially from the forward-looking

statements.

Contact InformationJerry R.

LevinePhone: (914) 244-0292Fax: (914)

244-0295Email: jrladvisor@yahoo.com

|

AAON, Inc. and Subsidiaries |

|

Consolidated Statements of Income |

|

(Unaudited) |

| |

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

|

|

|

|

|

|

|

| |

(in thousands, except share and per share data) |

|

Net sales |

$ |

134,772 |

|

|

$ |

113,500 |

|

|

$ |

397,851 |

|

|

$ |

346,759 |

|

| Cost of sales |

93,924 |

|

|

86,090 |

|

|

275,925 |

|

|

263,715 |

|

| Gross profit |

40,848 |

|

|

27,410 |

|

|

121,926 |

|

|

83,044 |

|

| Selling, general and

administrative expenses |

14,716 |

|

|

12,374 |

|

|

45,869 |

|

|

38,963 |

|

| Loss (gain) on disposal of

assets |

1 |

|

|

6 |

|

|

(61 |

) |

|

296 |

|

| Income from operations |

26,131 |

|

|

15,030 |

|

|

76,118 |

|

|

43,785 |

|

| Interest income, net |

10 |

|

|

9 |

|

|

90 |

|

|

49 |

|

| Other income (expense),

net |

15 |

|

|

(7 |

) |

|

20 |

|

|

(16 |

) |

| Income before taxes |

26,156 |

|

|

15,032 |

|

|

76,228 |

|

|

43,818 |

|

| Income tax provision |

5,696 |

|

|

742 |

|

|

16,111 |

|

|

7,380 |

|

| Net income |

$ |

20,460 |

|

|

$ |

14,290 |

|

|

$ |

60,117 |

|

|

$ |

36,438 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.39 |

|

|

$ |

0.27 |

|

|

$ |

1.15 |

|

|

$ |

0.70 |

|

|

Diluted |

$ |

0.38 |

|

|

$ |

0.26 |

|

|

$ |

1.14 |

|

|

$ |

0.69 |

|

| Cash dividends declared per

common share: |

$ |

— |

|

|

$ |

— |

|

|

$ |

0.19 |

|

|

$ |

0.16 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

52,260,551 |

|

|

52,111,444 |

|

|

52,174,705 |

|

|

52,086,209 |

|

|

Diluted |

53,151,295 |

|

|

52,722,127 |

|

|

52,955,049 |

|

|

52,624,583 |

|

|

AAON, Inc. and Subsidiaries |

|

Consolidated Balance Sheets |

|

(Unaudited) |

| |

September 30, 2020 |

|

December 31, 2019 |

| |

|

|

|

| Assets |

(in thousands, except share and per share data) |

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

70,603 |

|

|

$ |

26,797 |

|

|

Restricted cash |

7,998 |

|

|

17,576 |

|

|

Accounts receivable, net of allowance for credit losses of $546 and

$353, respectively |

62,195 |

|

|

67,399 |

|

|

Income tax receivable |

3,914 |

|

|

772 |

|

|

Note receivable |

29 |

|

|

29 |

|

|

Inventories, net |

78,819 |

|

|

73,601 |

|

|

Prepaid expenses and other |

1,973 |

|

|

1,375 |

|

| Total current assets |

225,531 |

|

|

187,549 |

|

| Property, plant and

equipment: |

|

|

|

|

Land |

3,804 |

|

|

3,274 |

|

|

Buildings |

115,600 |

|

|

101,113 |

|

|

Machinery and equipment |

267,763 |

|

|

236,087 |

|

|

Furniture and fixtures |

18,342 |

|

|

16,862 |

|

|

Total property, plant and equipment |

405,509 |

|

|

357,336 |

|

|

Less: Accumulated depreciation |

196,631 |

|

|

179,242 |

|

| Property, plant and equipment,

net |

208,878 |

|

|

178,094 |

|

| Intangible assets, net |

97 |

|

|

272 |

|

| Goodwill |

3,229 |

|

|

3,229 |

|

| Right of use assets |

1,618 |

|

|

1,683 |

|

| Note receivable |

560 |

|

|

597 |

|

| Total assets |

$ |

439,913 |

|

|

$ |

371,424 |

|

| |

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Revolving credit facility |

$ |

— |

|

|

$ |

— |

|

|

Accounts payable |

16,038 |

|

|

11,759 |

|

|

Accrued liabilities |

45,468 |

|

|

44,269 |

|

| Total current liabilities |

61,506 |

|

|

56,028 |

|

| Deferred tax liabilities |

22,973 |

|

|

15,297 |

|

| Other long-term

liabilities |

4,191 |

|

|

3,639 |

|

| New market tax credit

obligation |

6,351 |

|

|

6,320 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders' equity: |

|

|

|

|

Preferred stock, $.001 par value, 5,000,000 shares authorized, no

shares issued |

— |

|

|

— |

|

|

Common stock, $.004 par value, 100,000,000 shares authorized,

52,264,801 and 52,078,515 issued and outstanding at

September 30, 2020 and December 31, 2019, respectively |

209 |

|

|

208 |

|

|

Additional paid-in capital |

8,175 |

|

|

3,631 |

|

|

Retained earnings |

336,508 |

|

|

286,301 |

|

| Total stockholders'

equity |

344,892 |

|

|

290,140 |

|

| Total liabilities and

stockholders' equity |

$ |

439,913 |

|

|

$ |

371,424 |

|

|

AAON, Inc. and Subsidiaries |

|

Consolidated Statements of Cash Flows |

|

(Unaudited) |

| |

Nine Months Ended September

30, |

| |

2020 |

|

2019 |

| |

|

|

|

| Operating

Activities |

(in thousands) |

|

Net income |

$ |

60,117 |

|

|

$ |

36,438 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

18,971 |

|

|

17,627 |

|

|

Amortization of debt issuance cost |

31 |

|

|

— |

|

|

Provision for losses on accounts receivable, net of

adjustments |

193 |

|

|

91 |

|

|

Provision for excess and obsolete inventories |

1,776 |

|

|

1,003 |

|

|

Share-based compensation |

8,546 |

|

|

9,854 |

|

|

(Gain) loss on disposition of assets |

(61 |

) |

|

296 |

|

|

Foreign currency transaction loss (gain) |

18 |

|

|

(17 |

) |

|

Interest income on note receivable |

(19 |

) |

|

(19 |

) |

|

Deferred income taxes |

7,676 |

|

|

3,614 |

|

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable |

5,011 |

|

|

(2,096 |

) |

|

Income taxes |

(3,142 |

) |

|

2,283 |

|

|

Inventories |

(6,994 |

) |

|

(4,014 |

) |

|

Prepaid expenses and other |

(598 |

) |

|

(513 |

) |

|

Accounts payable |

3,654 |

|

|

782 |

|

|

Deferred revenue |

1,128 |

|

|

263 |

|

|

Accrued liabilities |

688 |

|

|

4,991 |

|

|

Net cash provided by operating activities |

96,995 |

|

|

70,583 |

|

| Investing

Activities |

|

|

|

|

Capital expenditures |

(48,955 |

) |

|

(30,831 |

) |

|

Proceeds from sale of property, plant and equipment |

61 |

|

|

68 |

|

|

Investment in certificates of deposits |

— |

|

|

(6,000 |

) |

|

Maturities of certificates of deposits |

— |

|

|

6,000 |

|

|

Principal payments from note receivable |

38 |

|

|

39 |

|

|

Net cash used in investing activities |

(48,856 |

) |

|

(30,724 |

) |

| Financing

Activities |

|

|

|

|

Stock options exercised |

18,519 |

|

|

11,283 |

|

|

Repurchase of stock |

(21,390 |

) |

|

(15,437 |

) |

|

Employee taxes paid by withholding shares |

(1,130 |

) |

|

(1,023 |

) |

|

Cash dividends paid to stockholders |

(9,910 |

) |

|

(8,303 |

) |

|

Net cash used in financing activities |

(13,911 |

) |

|

(13,480 |

) |

| Net increase in cash,

cash equivalents and restricted cash |

34,228 |

|

|

26,379 |

|

| Cash, cash equivalents

and restricted cash, beginning of period |

44,373 |

|

|

1,994 |

|

| Cash, cash equivalents

and restricted cash, end of period |

$ |

78,601 |

|

|

$ |

28,373 |

|

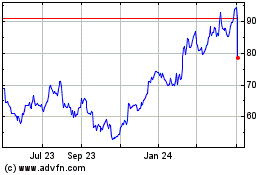

AAON (NASDAQ:AAON)

Historical Stock Chart

From Jun 2024 to Jul 2024

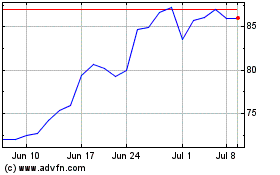

AAON (NASDAQ:AAON)

Historical Stock Chart

From Jul 2023 to Jul 2024