Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

October 15 2021 - 4:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2021

Commission File Number 001-39025

9F Inc.

(Translation of registrant’s name into English)

Room 1607, Building No. 5, 5 West Laiguangying

Road

Chaoyang District, Beijing 100102

People's Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F. Form 20-F x Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

9F Inc. Announces Closing of Private Placement

and Amendment to the Corresponding Definitive Agreement

This

current report on Form 6-K was submitted in connection with a certain private placement transaction involving 9F Inc. (the “Company”).

The

Company has recently completed the closing of the first tranche of its private placement, pursuant to the terms of the share subscription

agreement (the “Existing Agreement”) entered into with a certain investor (the “Investor”) as previously reported

on July 19, 2021, and has issued in instalments a total of 4,986,012 class A ordinary shares of the Company (“Ordinary Shares”),

par value $0.00001 per share, to the Investor. Ordinary Shares acquired by the Investor in this transaction are subject to a six-month

lock-up period post-closing.

In conjunction with the closing of the first

tranche investment under the Existing Agreement, the Company, the Investor and a certain other investor (the “Joining Investor”)

have entered into a restated and amended subscription agreement (the “Amended Agreement”), which amends the Existing Agreement.

The key terms (including the per class A ordinary share subscription price and the lock-up requirement) of the Amended Agreement are substantially

similar to those of the Existing Agreement, except that in lieu of the Investor having options to make the second tranche of the investment

as originally contemplated under the Existing Agreement, the Amended Agreement provides that the Joining Investor may invest up to $1,000,000

in the Company (the “Joining Investor Second Tranche Investment”) for newly issued Ordinary Shares. The Joining Investor

Second Tranche Investment closed recently, pursuant to which the Company issued 678,426 Ordinary Shares, par value $0.00001 per share, to the Joining Investor, which shares are also subject to a six-month

lock-up period post-closing.

Safe Harbor Statement

This Form 6-K contains forward-looking statements.

These statements constitute “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act

of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can

be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,”

“plans,” “believes,” “estimates,” “target,” “confident” and similar statements.

Such statements are based upon management’s current expectations and current market, regulatory and operating conditions and relate

to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which

are beyond the Company’s control. Forward-looking statements involve risks, uncertainties and other factors that could cause actual

results to differ materially from those contained in any such statements. Potential risks and uncertainties include, but are not limited

to, general economic conditions in China, and the Company’s ability to meet the standards necessary to maintain listing of its ADSs

on the Nasdaq, including its ability to cure any non-compliance with the Nasdaq’s continued listing criteria. Further information

regarding these and other risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and Exchange

Commission. All information provided in this Form 6-K is as of the date of this Form 6-K, and 9F Inc. does not undertake any obligation

to update any forward-looking statement as a result of new information, future events or otherwise, except as required under applicable

law.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

9F Inc.

|

|

|

|

|

|

By:

|

/s/ Lei Liu

|

|

|

Name:

|

Lei Liu

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

Date: October 15, 2021

|

|

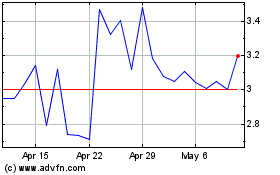

9F (NASDAQ:JFU)

Historical Stock Chart

From May 2024 to Jun 2024

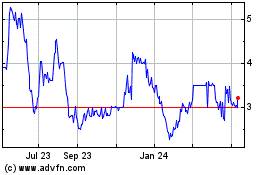

9F (NASDAQ:JFU)

Historical Stock Chart

From Jun 2023 to Jun 2024