8X8 INC /DE/0001023731false00010237312023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

November 1, 2023

Date of Report (Date of earliest event reported)

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38312 | | 77-0142404 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

675 Creekside Way

Campbell, CA 95008

(Address of principal executive offices including zip code)

(408) 727-1885

(Registrant's telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

COMMON STOCK, PAR VALUE $0.001 PER SHARE | | EGHT | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 1, 2023, the Company issued a press release announcing its financial results for the three months ended September 30, 2023. A copy of this press release is furnished as Exhibit 99.1 to this report and should be read in conjunction with the statements regarding forward-looking statements, which are included in the text of the release.

The press release is furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act"), or subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The press release should be read in conjunction with the statements regarding forward-looking statements, which are included in the text of the release.

Item 2.06. Material Impairments.

On October 30, 2023, in support of the Company's office-home hybrid workforce model, the Company's board of directors authorized the cessation of use of approximately 42% of leased space at the Company’s headquarters at 675 Creekside Way, Campbell, CA. The Company plans to continue to hold this space available for sublease.

The Company intends to cease use of the space on November 1, 2023 and currently estimates it will incur total non-cash lease impairment charges of between $9.0 million to $10.0 million in the quarter ending December 31, 2023. The amounts will be recorded as an impairment of operating lease, right-of-use assets, and may vary in amount and timing due to a variety of factors.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 1, 2023

| | | | | | | | |

| | 8x8, Inc. |

| | |

| | By: | /s/ KEVIN KRAUS |

| | | Kevin Kraus |

| | | Chief Financial Officer

(Principal Financial Officer) |

Exhibit 99.1

8x8, Inc. Reports Second Quarter Fiscal 2024 Financial Results

•Service Revenue of $178 million and Total Revenue of $185 million

•Cash flow from operations increased 26% year-over-year to $17.5 million

•Continued momentum in AI-powered solutions, including more than 50% quarter-over-quarter growth in self-service conversations through 8x8 Intelligent Customer Assistant

CAMPBELL, CA, November 1, 2023 – 8x8, Inc. (NASDAQ: EGHT), a leading integrated cloud contact center and unified communications platform provider, today reported financial results for the second quarter of fiscal 2024 ended September 30, 2023.

Second Quarter Fiscal 2024 Financial Results:

•Total revenue of $185.0 million, compared to $187.4 million in the second quarter of fiscal 2023.

•Service revenue of $177.8 million, compared to $178.6 million in the second quarter of fiscal 2023.

•GAAP operating loss was $2.6 million, an improvement of 89.7% compared to GAAP operating loss of $25.0 million in the second quarter of fiscal 2023.

•Non-GAAP operating profit was $23.8 million, an increase of 162% compared to non-GAAP operating profit of $9.1 million in the second quarter of fiscal 2023.

•GAAP net loss was $7.5 million compared to GAAP net loss of $11.6 million in the second quarter of fiscal 2023.

•Non-GAAP net income was $17.1 million, an increase of 181.8% compared to non-GAAP net income of $6.1 million in the second quarter of fiscal 2023.

•Adjusted EBITDA was $30.5 million, or 16% of revenue, an increase of 75% compared to Adjusted EBITDA of $17.4 million, or 9% of revenue, in the second quarter of fiscal 2023.

“I am pleased to report that we met or exceeded our guidance ranges for service revenue, total revenue, and operating margin in the second quarter,” said Samuel Wilson, Chief Executive Officer of 8x8, Inc. “We continue to execute on our innovation-led strategy to build a durable growth engine for the future while becoming more efficient in our operations. I believe this is how we will deliver value to all our stakeholders.”

“8x8 is in the early stages of transforming our XCaaS communications and contact center platform into a complete AI-powered customer engagement platform and ecosystem. We are seeing early success with increasing customer adoption of multiple products in our portfolio and higher customer satisfaction. We believe the growth in the number of interactions with our Intelligent Customer Assistant validates our strategy of approaching the contact center market with a modern, flexible, AI-powered solution designed for rapid innovation and usability,” added Wilson.

Second Quarter Fiscal 2024 Financial Metrics and Recent Business Highlights:

Financial Metrics

•Annual Recurring Subscriptions and Usage Revenue (ARR):

▪Total ARR was $707 million, an increase of 2% from the end of the same period last year.

▪Enterprise ARR was $407 million and represented 58% of total ARR.

•GAAP gross margin was 69%, compared to 67% in the same period last year. Non-GAAP gross margin was 72%, compared to 70% in the same period last year.

•GAAP service revenue gross margin was 72%, compared to 71% in the same period last year. Non-GAAP service revenue gross margin was 75%, compared to 74% in the same period last year.

•Cash provided by operating activities was $17.5 million for the second quarter of fiscal 2024, compared to $13.8 million in the same period last year.

•Cash, cash equivalents, restricted cash and investments were $149.8 million on September 30, 2023, compared to $139.0 million on March 31, 2023.

A reconciliation of the non-GAAP measures to the most directly comparable GAAP measures and other information relating to non-GAAP measures is included in the supplemental reconciliation at the end of this release.

Recent Business Highlights:

Product Innovation

•Expanded AI self-service capabilities with voice interactions for 8x8 Intelligent Customer Assistant. The addition of voice expands 8x8 Intelligent Customer Assistant’s powerful, user-friendly conversational AI self-service capabilities that enable 8x8 Contact Center customers to create simple to complex experiences across digital and voice channels.

•Enhanced 8x8 Contact Center with native secure video interaction functionality. Video escalation allows contact center agents to elevate customer interactions to video directly within 8x8 Agent Workspace, improving first contact resolution and customer engagement.

•Announced the 8x8 Omni Shield CPaaS solution to enable enterprises to proactively safeguard customers against fraudulent SMS activity. The solution proactively detects and prevents fraudulent activities through automated fraud alerts, real-time notifications, live traffic monitoring, and instant phone number assessments.

•Delivered the next generation of the 8x8 Phone App for Microsoft Teams and surpassed 400,000 users of 8x8 Voice for Teams. Built on 8x8's direct routing service, the new app connects the Public Switched Telephone Network (PSTN) with Microsoft Teams to provide organizations with the most cost-effective method to enable native calling in Teams without additional software, desktop plugins, mobile apps, or requiring per user Teams Phone licenses.

Industry Recognition

•Ranked as a top 5 provider in the Metrigy 2023 Contact Center-as-a-Service MetriRank Report, based on market share, financials, market share momentum, product mix, customer sentiment, and customer business success.

•Named a Strong Performer in the The Forrester Wave™: Unified Communications As A Service (UCaaS), 2023 report.

•Named Best Enterprise Service at the 2023 Comms Council UK Awards.

•Won a Gold Stevie® Award for Technology Team of the Year and a Bronze Stevie Award for Customer Service Team of the Year in The 20th Annual International Business Awards®.

•Earned awards for 8x8 CCaaS and UCaaS across 24 different categories in the G2 Fall 2023 Awards.

•Received the 2023 TrustRadius Tech Cares Awards in the UK for demonstrating exceptional corporate social responsibility.

Corporate ESG and Leadership Updates

•Achieved certification under the ISO 14001 Environmental Management framework for deployment, operations, and support within 8x8 UK.

•In support of the hybrid workforce model, on October 30, 2023, the 8x8 Board of Directors approved the cessation of use of approximately 42% of the Company’s headquarters building in Campbell, CA. The Company will continue to hold the space available for sublease and currently estimates it will incur total non-cash lease impairment charges of between $9.0 million and $10.0 million in the quarter ending December 31, 2023.

•Enhanced 8x8's Global Governance, Risk, and Compliance (GRC) program for cybersecurity and data privacy assurance by adding a top tier Security Incident Event Management system for additional monitoring of infrastructure security events. 8x8 has been certified under more than 15 frameworks for cybersecurity, data privacy, and operations management and continues to expand compliance and security initiatives worldwide. A complete list of certifications is available on the company's website at https://www.8x8.com/why-8x8/security.

•Promoted Jamie Snaddon to VP, Managing Director EMEA, with responsibility for 8x8’s growing operations in Europe, the Middle East, and Africa.

•Appointed Bruno Bertini as Chief Marketing Officer. Bertini is a recognized growth marketing executive with more than 15 years in the contact center and customer experience industry.

Third Quarter and Updated Fiscal 2024 Financial Outlook:

Management provides expected ranges for total revenue, service revenue and non-GAAP operating margin based on its evaluation of the current business environment. The Company emphasizes that these expectations are subject to various important cautionary factors referenced in the section entitled "Forward-Looking Statements" below.

Third Quarter Fiscal 2024 Ending December 31, 2023

•Service revenue in the range of $173 million to $178 million.

•Total revenue in the range of $180 million to $186 million.

•Non-GAAP operating margin in the range of 11% to 12%.

Fiscal Year 2024 Ending March 31, 2024

•Service revenue in the range of $701 million to $711 million.

•Total revenue in the range of $732.5 million to $742.5 million.

•Non-GAAP operating margin in the range of 12% to 13%.

The Company does not reconcile its forward-looking estimates of non-GAAP operating margins to the corresponding GAAP measures of GAAP operating margin due to the significant variability of, and difficulty in making accurate forecasts and projections with regards to, the various expenses it excludes. For example, future hiring and employee turnover may not be reasonably predictable, stock-based compensation expense depends on variables that are largely not within the control of nor predictable by management, such as the market price of 8x8 common stock, and may also be significantly impacted by events like acquisitions, the timing and nature of which are difficult to predict with accuracy. The actual amounts of these excluded items could have a significant impact on the Company's GAAP operating margins. Accordingly, management believes that reconciliations of this forward-looking non-GAAP financial measure to the corresponding GAAP measure are not available without unreasonable effort. All projections are on a non-GAAP basis. Additionally, our increased emphasis on profitability and cash flow generation may not be successful. The reduction in our total costs as a percentage of revenue may negatively impact our revenue and our business in ways we don't anticipate and may not achieve the desired outcome. See the Explanation of GAAP to Non-GAAP Reconciliation below for the definition of non-GAAP operating margin.

Conference Call Information:

Management will host a conference call to discuss earnings results on November 1, 2023, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time). The conference call will last approximately 60 minutes. Participants may:

•Register to participate in the live call at

https://register.vevent.com/register/BIcb5fb502a8844741bf5a5c87d1dcec1c.

•Access the live webcast and replay from the Company’s investor relations events and presentations page at https://8x8.gcs-web.com/news-events/events-presentations.

Participants should plan to dial in or log on 10 minutes prior to the start time. The webcast will be archived on 8x8's website for a period of at least 30 days. For additional information, visit http://investors.8x8.com.

About 8x8, Inc.

8x8, Inc. (NASDAQ: EGHT) is transforming the future of business communications as a leading software as a service provider of 8x8 XCaaS™ (Experience Communications as a Service™), an integrated contact center, voice communications, video, chat, and SMS solution built on one global cloud communications platform. 8x8 uniquely eliminates the silos between unified communications as a service (UCaaS) and contact center as a service (CCaaS) to power the communications requirements of all employees globally as they work together to deliver differentiated customer experiences. For additional information, visit www.8x8.com, or follow 8x8 on LinkedIn, Twitter and Facebook.

Forward Looking Statements:

This news release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934. Any statements that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as "may," "will," "should," "estimates," "predicts," "potential," "continue," "strategy," "believes," "anticipates," "plans," "expects," "intends," and similar expressions are intended to identify forward-looking statements. These forward-looking statements, include but are not limited to: changing industry trends; the size of our market opportunity; the potential success and impact of our investments in AI; our strategic framework; our ability to increase profitability and cash flow to deleverage our balance sheet and fund investment in innovation; whether our UC and CC traffic will increase; our future revenue and growth; whether we can sustain an increasing pace of innovation; the success of our go to market engine; our ability to improve G&A synergies; our ability to enhance shareholder value; and our financial outlook, revenue growth, and profitability, including whether we will achieve sustainable growth and profitability.

You should not place undue reliance on such forward-looking statements. Actual results could differ materially from those projected in forward-looking statements depending on a variety of factors, including, but not limited to: a reduction in our total costs as a percentage of revenue may negatively impact our revenues and our business; customer adoption and demand for our products may be lower than we anticipate; the impact of economic downturns on us and our customers; ongoing volatility and conflict in the political environment, including Russia's invasion of Ukraine; inflationary pressures and rising interest rates; competitive dynamics of the cloud communication and collaboration markets, including voice, contact center, video, messaging, and communication application programming interfaces, in which we compete may change in ways we are not anticipating; impact of supply chain disruptions; third parties may assert ownership rights in our IP, which may limit or prevent our continued use of the core technologies behind our solutions; our customer churn rate may be higher than we anticipate; our investments in marketing, channel and value-added resellers, new products, and our acquisition of Fuze, Inc. may not result in revenue growth; and we may not achieve our target service revenue growth, or the revenue, operating margin or other amounts we forecast in our guidance, for a particular quarter or for the full fiscal year. Our increased emphasis on profitability and cash flow generation may not be successful. The reduction in our total costs as a percentage of revenue may negatively impact our revenue and our business in ways we don't anticipate and may not achieve the desired outcome.

For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see "Risk Factors" in the Company's reports on Forms 10-K and 10-Q, as well as other reports that 8x8, Inc. files from time to time with the Securities and Exchange Commission. All forward-looking statements are qualified in their entirety by this cautionary statement, and 8x8, Inc. undertakes no obligation to update publicly any forward-looking statement for any reason, except as required by law, even as new information becomes available or other events occur in the future.

Explanation of GAAP to Non-GAAP Reconciliation

The Company has provided, in this release, financial information that has not been prepared in accordance with Generally Accepted Accounting Principles (GAAP). Management uses these Non-GAAP financial measures internally to understand, manage, and evaluate the business, and to make operating decisions. Management believes they are useful to investors, as a supplement to GAAP measures, in evaluating the Company's ongoing operational performance. Management also believes that some of 8x8’s investors use these Non-GAAP financial measures as an additional tool in evaluating 8x8's ongoing "core operating performance" in the ordinary, ongoing, and customary course of the Company's operations. Core operating performance excludes items that are non-cash, not expected to recur, or not reflective of ongoing financial results. Management also believes that looking at the Company’s core operating performance provides consistency in period-to-period comparisons and trends.

These Non-GAAP financial measures may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies, which limits the usefulness of these measures for comparative purposes. Management recognizes that these Non-GAAP financial measures have limitations as analytical tools, including the fact that management must exercise judgment in determining which types of items to exclude from the Non-GAAP financial information. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of these Non-GAAP financial measures to their most directly comparable GAAP financial measures in the table titled "Reconciliation of GAAP to Non-GAAP Financial Measures". Detailed explanations of the adjustments from comparable GAAP to Non-GAAP financial measures are as follows:

Non-GAAP Costs of Revenue, Costs of Service Revenue and Costs of Other Revenue

Non-GAAP Costs of Revenue includes: (i) Non-GAAP Cost of Service Revenue, which is Cost of Service Revenue excluding amortization of acquired intangible assets, stock-based compensation expense and related employer payroll taxes, certain legal and regulatory costs, and certain severance, transition and contract termination costs; and (ii) Non-GAAP Cost of Other Revenue, which is Cost of Other Revenue excluding stock-based compensation expense and related employer payroll taxes, certain legal and regulatory costs, and certain severance, transition and contract termination costs.

Non-GAAP Service Revenue Gross Margin, Other Revenue Gross Margin, and Total Revenue Gross Margin

Non-GAAP Service Revenue Gross Profit and Margin as a percentage of Service Revenue and Non-GAAP Other Revenue Gross Profit and Margin as a percentage of Other Revenue are computed as Service Revenue less Non-GAAP Cost of Service Revenue divided by Service Revenue and Other Revenue less Non-GAAP Cost of Other Revenue divided by Other Revenue, respectively. Non-GAAP Total Revenue Gross Profit and Margin as a percentage of Total Revenue is computed as Total Revenue less Non-GAAP Cost of Service Revenue and Non-GAAP Cost of Other Revenue divided by Total Revenue. Management believes the Company’s investors benefit from understanding these adjustments and from an alternative view of the Company’s Cost of Service Revenue and Cost of Other Revenue, as well as the Company's Service, Other and Total Revenue Gross Margin performance compared to prior periods and trends.

Non-GAAP Operating Expenses

Non-GAAP Operating Expenses includes Non-GAAP Research and Development expenses, Non-GAAP Sales and Marketing expenses, and Non-GAAP General and Administrative expenses, each of which excludes amortization of acquired intangible assets, stock-based compensation expense and related employer payroll taxes, acquisition and integration expenses, and certain severance, transition and contract termination costs. Management believes that these exclusions provide investors with a supplemental view of the Company’s ongoing operational expenses.

Non-GAAP Operating Profit and Non-GAAP Operating Margin

Non-GAAP Operating Profit excludes: amortization of acquired intangible assets, stock-based compensation expense and related employer payroll taxes, acquisition and integration expenses, certain legal and regulatory costs, and certain severance, transition and contract termination costs from Operating Profit (Loss). Non-GAAP Operating Margin is Non-GAAP Operating Profit divided by Revenue. Management believes that these exclusions provide investors with a supplemental view of the Company’s ongoing operating performance.

Non-GAAP Other Income (expense), net

Non-GAAP Other Income (expense), net excludes: amortization of debt discount and issuance cost, gain or loss on debt extinguishment, gain or loss on remeasurement of warrants, and sub-lease income from Other Income (expense), net. Management believes the Company’s investors benefit from this supplemental information to facilitate comparison of the Company’s other income (expense), performance to prior results and trends.

Non-GAAP Net Income and Adjusted EBITDA

Non-GAAP Net Income excludes: amortization of acquired intangible assets, stock-based compensation expense and related employer payroll taxes, acquisition and integration expenses, certain legal and regulatory costs, certain severance, transition and contract termination costs, amortization of debt discount and issuance cost, gain or loss on debt extinguishment, gain or loss on remeasurement of warrants, and sub-lease income. Adjusted EBITDA excludes interest expense, provision for income taxes, depreciation, amortization of capitalized internal use software, and other income (expense), net from non-GAAP net income. Management believes the Company’s investors benefit from understanding these adjustments and an alternative view of our net income performance as compared to prior periods and trends.

Non-GAAP Net Income Per Share – Basic and Non-GAAP Net Income Per Share - Diluted

Non-GAAP Net Income Per Share – Basic is Non-GAAP Net Income divided by the weighted-average basic shares outstanding. Non-GAAP Net Income Per Share – Diluted is Non-GAAP Net Income divided by the weighted-average diluted shares outstanding. Diluted shares outstanding include the effect of potentially dilutive securities from stock-based benefit plans and convertible senior notes. These potentially dilutive securities are excluded from the computation of net loss per share attributable to common stockholders on a GAAP basis because the effect would have been anti-dilutive. They are added for the computation of diluted net income per share on a non-GAAP basis in periods when 8x8 has net profit on a non-GAAP basis as their inclusion provides a better indication of 8x8’s underlying business performance. Management believes the Company’s investors benefit by understanding our Non-GAAP net income performance as reflected in a per share calculation as ways of measuring performance by ownership in the Company. Management believes these adjustments offer investors a useful view of the Company’s diluted net income per share as compared to prior periods and trends.

Management evaluates and makes decisions about its business operations based on Non-GAAP financial information by excluding items management does not consider to be “core costs” or “core proceeds.” Management believes some of its investors also evaluate our "core operating performance" as a means of evaluating our performance in the ordinary, ongoing, and customary course of our operations. Management excludes the amortization of acquired intangible assets, which primarily represents a non-cash expense of technology and/or customer relationships already developed, to provide a supplemental way for investors to compare the Company’s operations pre-acquisition to those post-acquisition and to those of our competitors that have pursued internal growth strategies. Stock-based compensation expense has been excluded because it is a non-cash expense and relies on valuations based on future conditions and events, such as the market price of 8x8 common stock, that are difficult to predict and/or largely not within the control of management. The related employer payroll taxes for stock-based compensation are excluded since they are incurred only due to the associated stock-based compensation expense. Acquisition and integration expenses consist of external and incremental costs resulting directly from merger and acquisition and strategic investment activities such as legal and other professional services, due diligence, integration, and other closing costs, which are costs that vary significantly in amount and timing. Legal and regulatory costs include litigation and other professional services, as well as certain tax and regulatory liabilities. Severance, transition and contract termination costs include employee termination benefits, executive severance agreements, cancellation of certain contracts, and lease impairments. Debt amortization expenses relate to the non-cash accretion of the debt discount.

8x8, Inc.

Media:

PR@8x8.com

Investor Relations:

Investor.relations@8x8.com

8x8, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Six Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Service revenue | $ | 177,782 | | | $ | 178,556 | | | $ | 353,020 | | | $ | 357,717 | |

| Other revenue | 7,217 | | | 8,833 | | | 15,266 | | | 17,292 | |

| Total revenue | 184,999 | | | 187,389 | | | 368,286 | | | 375,009 | |

| Operating expenses: | | | | | | | |

| Cost of service revenue | 49,144 | | | 51,038 | | | 95,420 | | | 104,585 | |

| Cost of other revenue | 7,958 | | | 11,000 | | | 16,356 | | | 24,126 | |

| Research and development | 34,207 | | | 36,019 | | | 69,499 | | | 70,974 | |

| Sales and marketing | 68,687 | | | 80,487 | | | 137,191 | | | 164,014 | |

| General and administrative | 27,586 | | | 33,835 | | | 53,812 | | | 63,054 | |

| Total operating expenses | 187,582 | | | 212,379 | | | 372,278 | | | 426,753 | |

| Loss from operations | (2,583) | | | (24,990) | | | (3,992) | | | (51,744) | |

| Other (expense) income, net | (5,258) | | | 13,950 | | | (17,732) | | | 15,066 | |

| Loss before (benefit from) provision for income taxes | (7,841) | | | (11,040) | | | (21,724) | | | (36,678) | |

| Provision (benefit) for income taxes | (389) | | | 599 | | | 1,055 | | | 1,004 | |

| Net loss | $ | (7,452) | | | $ | (11,639) | | | $ | (22,779) | | | $ | (37,682) | |

| | | | | | | |

| Net loss per share: | | | | | | | |

| Basic and diluted | $ | (0.06) | | | $ | (0.10) | | | $ | (0.19) | | | $ | (0.32) | |

| Weighted average number of shares: | | | | | | | |

| Basic and diluted | 120,757 | | | 116,013 | | | 118,778 | | | 117,857 | |

SUPPLEMENTAL DETAILS - OTHER (EXPENSE) INCOME, NET

(Unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Six Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Interest expense | $ | (8,929) | | | $ | (4,883) | | | $ | (17,899) | | | $ | (5,508) | |

| Amortization of debt discount and issuance costs | (1,132) | | | (1,169) | | | (2,240) | | | (2,000) | |

| Gain on warrants remeasurement | 2,781 | | | 1,293 | | | 2,531 | | | 1,293 | |

| Gain (loss) on debt extinguishment | — | | | 16,106 | | | (1,766) | | | 16,106 | |

| | | | | | | |

| Gain on foreign exchange | 1,565 | | | 2,124 | | | 761 | | | 4,600 | |

| Other income | 457 | | | 479 | | | 881 | | | 575 | |

| Other (expense) income, net | $ | (5,258) | | | $ | 13,950 | | | $ | (17,732) | | | $ | 15,066 | |

8x8, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited, in thousands)

| | | | | | | | | | | |

| | September 30, 2023 | | March 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 144,030 | | | $ | 111,400 | |

| Restricted cash, current | 521 | | | 511 | |

| Short-term investments | 4,744 | | | 26,228 | |

Accounts receivable, net of allowance for expected credit losses of $3,036 and $3,644

as of September 30, 2023 and March 31, 2023, respectively | 61,063 | | | 62,307 | |

| Deferred sales commission costs, current | 37,610 | | | 38,048 | |

| Other current assets | 33,967 | | | 34,630 | |

| Total current assets | 281,935 | | | 273,124 | |

| Property and equipment, net | 53,508 | | | 57,871 | |

| Operating lease, right-of-use assets | 50,396 | | | 52,444 | |

| Intangible assets, net | 96,914 | | | 107,112 | |

| Goodwill | 265,732 | | | 266,863 | |

| Restricted cash, non-current | 462 | | | 818 | |

| | | |

| Deferred sales commission costs, non-current | 60,440 | | | 67,644 | |

| Other assets, non-current | 14,336 | | | 15,934 | |

| Total assets | $ | 823,723 | | | $ | 841,810 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 49,391 | | | $ | 46,802 | |

| Accrued compensation | 21,793 | | | 29,614 | |

| Accrued taxes | 35,854 | | | 29,570 | |

| Operating lease liabilities, current | 11,623 | | | 11,504 | |

| Deferred revenue, current | 33,223 | | | 34,909 | |

| Convertible senior notes, current | 63,153 | | | 62,932 | |

| Other accrued liabilities | 14,053 | | | 14,556 | |

| Total current liabilities | 229,090 | | | 229,887 | |

| Operating lease liabilities, non-current | 61,926 | | | 65,623 | |

| Deferred revenue, non-current | 10,231 | | | 10,615 | |

| Convertible senior notes | 197,303 | | | 196,821 | |

| Term loan | 210,303 | | | 231,993 | |

| Other liabilities, non-current | 4,460 | | | 6,965 | |

| Total liabilities | 713,313 | | | 741,904 | |

| | | |

| Stockholders' equity: | | | |

Preferred stock: $0.001 par value, 5,000,000 shares authorized, none issued and

outstanding as of September 30, 2023 and March 31, 2023 | — | | | — | |

| Common stock: $0.001 par value, 300,000,000 shares authorized, 121,858,602 shares and 114,659,255 shares issued and outstanding as of September 30, 2023 and March 31, 2023, respectively | 122 | | | 115 | |

| Additional paid-in capital | 941,493 | | | 905,635 | |

| Accumulated other comprehensive loss | (15,509) | | | (12,927) | |

| Accumulated deficit | (815,696) | | | (792,917) | |

| Total stockholders' equity | 110,410 | | | 99,906 | |

| Total liabilities and stockholders' equity | $ | 823,723 | | | $ | 841,810 | |

8x8, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

| | | | | | | | | | | |

| Six Months Ended September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (22,779) | | | $ | (37,682) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation | 4,090 | | | 5,624 | |

| Amortization of intangible assets | 10,198 | | | 10,723 | |

| Amortization of capitalized internal-use software costs | 10,061 | | | 11,494 | |

| Amortization of debt discount and issuance costs | 2,240 | | | 2,000 | |

| Amortization of deferred sales commission costs | 20,099 | | | 18,839 | |

| Allowance for credit losses | 993 | | | 1,781 | |

| Operating lease expense, net of accretion | 5,109 | | | 5,925 | |

| Impairment of right-of-use assets | — | | | 2,424 | |

| Stock-based compensation expense | 32,717 | | | 52,435 | |

| Loss (gain) on debt extinguishment | 1,766 | | | (16,106) | |

| Gain on remeasurement of warrants | (2,531) | | | (1,293) | |

| Other | 52 | | | (192) | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | 299 | | | (4,579) | |

| Deferred sales commission costs | (12,068) | | | (13,834) | |

| Other current and non-current assets | (1,306) | | | 1,223 | |

| Accounts payable and accruals | (2,934) | | | (14,733) | |

| Deferred revenue | (2,070) | | | (4,367) | |

| | | |

| Net cash provided by operating activities | 43,936 | | | 19,682 | |

| | | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (1,558) | | | (1,845) | |

| | | |

| Capitalized internal-use software costs | (7,442) | | | (4,328) | |

| Purchases of investments | (6,174) | | | (27,669) | |

| Sales of investments | — | | | 8,296 | |

| Maturities of investments | 27,909 | | | 36,641 | |

| Acquisition of businesses, net of cash acquired | — | | | (1,250) | |

| Net cash provided by investing activities | 12,735 | | | 9,845 | |

| | | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| Proceeds from issuance of common stock under employee stock plans | 2,365 | | | 1,713 | |

| Repayment of principal on term loan | (25,000) | | | — | |

| Net proceeds from term loan | — | | | 232,861 | |

| Repayment and exchange of convertible senior notes | — | | | (190,553) | |

| Repurchase of common stock | — | | | (60,214) | |

| Net cash used in financing activities | (22,635) | | | (16,193) | |

| Effect of exchange rate changes on cash | (1,752) | | | (12,207) | |

| Net increase in cash, cash equivalents and restricted cash | 32,284 | | | 1,127 | |

| Cash, cash equivalents and restricted cash, beginning of year | 112,729 | | | 100,714 | |

| Cash, cash equivalents and restricted cash, end of year | $ | 145,013 | | | $ | 101,841 | |

Supplemental disclosures of cash flow information:

| | | | | | | | | | | |

| Six Months Ended September 30, |

| 2023 | | 2022 |

| | | |

| | | |

| | | |

| | | |

| | | |

| Interest paid | 17,799 | | | 4,654 | |

| Income taxes paid | 3,118 | | | 1,167 | |

| | | |

| Warrants issued in connection with term loan | — | | | 5,915 | |

| Shares issued in connection with term loan and convertible senior notes | — | | | 5,082 | |

| | | |

8x8, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Unaudited, in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Six Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Costs of Revenue: | | | | | | | | | | | | | | | |

| GAAP cost of service revenue | $ | 49,144 | | | | | $ | 51,038 | | | | | $ | 95,420 | | | | | $ | 104,585 | | | |

| Amortization of acquired intangible assets | (2,118) | | | | | (2,140) | | | | | (4,235) | | | | | (4,509) | | | |

| Stock-based compensation expense and related employer payroll taxes | (1,743) | | | | | (2,457) | | | | | (3,967) | | | | | (5,153) | | | |

| Severance, transition and contract termination costs | (82) | | | | | (281) | | | | | (288) | | | | | (1,178) | | | |

| Non-GAAP cost of service revenue | $ | 45,201 | | | | | $ | 46,160 | | | | | $ | 86,930 | | | | | $ | 93,745 | | | |

| Non-GAAP service margin (as a percentage of service revenue) | $ | 132,581 | | | 74.6% | | | $ | 132,396 | | | 74.1% | | | $ | 266,090 | | | 75.4 | % | | $ | 263,972 | | | 73.8 | % |

| | | | | | | | | | | | | | | | |

| GAAP cost of other revenue | $ | 7,958 | | | | | $ | 11,000 | | | | | $ | 16,356 | | | | | $ | 24,126 | | | |

| Stock-based compensation expense and related employer payroll taxes | (468) | | | | | (937) | | | | | (1,119) | | | | | (2,084) | | | |

| | | | | | | | | | | | | | | |

| Severance, transition and contract termination costs | (28) | | | | | (244) | | | | | (50) | | | | | (777) | | | |

| Non-GAAP cost of other revenue | $ | 7,462 | | | | | $ | 9,819 | | | | | $ | 15,187 | | | | | $ | 21,265 | | | |

| Non-GAAP other margin (as a percentage of other revenue) | $ | (245) | | | (3.4%) | | | $ | (986) | | | (11.2%) | | | $ | 79 | | | 0.5% | | | $ | (3,973) | | | (23.0%) | |

| | | | | | | | | | | | | | | | |

| Non-GAAP gross margin (as a percentage of revenue) | $ | 132,336 | | | 71.5% | | | $ | 131,410 | | | 70.1% | | | $ | 266,169 | | | 72.3% | | | $ | 259,999 | | | 69.3% | |

| | | | | | | | | | | | | | | | |

| Operating Expenses: | | | | | | | | | | | | | | | |

| GAAP research and development | $ | 34,207 | | | | | $ | 36,019 | | | | | $ | 69,499 | | | | | $ | 70,974 | | | |

| Stock-based compensation expense and related employer payroll taxes | (5,345) | | | | | (7,773) | | | | | (12,783) | | | | | (15,966) | | | |

| Acquisition and integration costs | 115 | | | | | — | | | | | (98) | | | | | | | |

| Severance, transition and contract termination costs | (902) | | | | | (107) | | | | | (1,213) | | | | | (144) | | | |

| Non-GAAP research and development (as a percentage of revenue) | $ | 28,075 | | | 15.2% | | | $ | 28,139 | | | 15.0% | | | $ | 55,405 | | | 15.0% | | | $ | 54,864 | | | 14.6% | |

| | | | | | | | | | | | | | | | |

| GAAP sales and marketing | $ | 68,687 | | | | | $ | 80,487 | | | | | $ | 137,191 | | | | | $ | 164,014 | | | |

| Amortization of acquired intangible assets | (2,982) | | | | | (3,107) | | | | | (5,963) | | | | | (6,214) | | | |

| Stock-based compensation expense and related employer payroll taxes | (4,176) | | | | | (6,883) | | | | | (9,430) | | | | | (15,163) | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Severance, transition and contract termination costs | (234) | | | | | (330) | | | | | (403) | | | | | (721) | | | |

| Non-GAAP sales and marketing (as a percentage of revenue) | $ | 61,295 | | | 33.1% | | | $ | 70,167 | | | 37.4% | | | $ | 121,395 | | | 33.0 | % | | $ | 141,916 | | | 37.8 | % |

| | | | | | | | | | | | | | | |

| GAAP general and administrative | $ | 27,586 | | | | | $ | 33,835 | | | | | $ | 53,812 | | | | | $ | 63,054 | | | |

| Stock-based compensation expense and related employer payroll taxes | (3,695) | | | | | (6,763) | | | | | (7,803) | | | | | (14,686) | | | |

| Acquisition and integration costs | (422) | | | | | (1,554) | | | | | (552) | | | | | (2,178) | | | |

| Legal and regulatory costs | (3,879) | | | | | 207 | | | | | (5,347) | | | | | 269 | | | |

| Severance, transition and contract termination costs | (388) | | | | | (1,694) | | | | | (934) | | | | | (2,449) | | | |

| Non-GAAP general and administrative (as a percentage of revenue) | $ | 19,202 | | | 10.4% | | | $ | 24,031 | | | 12.8% | | | $ | 39,176 | | | 10.6 | % | | $ | 44,010 | | | 11.7 | % |

| Non-GAAP Operating Expenses (as a percentage of revenue) | $ | 108,572 | | | 58.7% | | | $ | 122,337 | | | 65.3% | | | $ | 215,976 | | | 58.6 | % | | $ | 240,790 | | | 64.2 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Six Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Operating Profit (Loss): | | | | | | | | | | | | | | | |

| GAAP loss from operations | $ | (2,583) | | | | | $ | (24,990) | | | | | $ | (3,992) | | | | | $ | (51,744) | | | |

| Amortization of acquired intangible assets | 5,100 | | | | | 5,247 | | | | | 10,198 | | | | | 10,723 | | | |

| Stock-based compensation expense and related employer payroll taxes | 15,427 | | | | | 24,813 | | | | | 35,102 | | | | | 53,052 | | | |

| Acquisition and integration costs | 307 | | | | | 1,554 | | | | | 650 | | | | | 2,178 | | | |

| Legal and regulatory costs | 3,879 | | | | | (207) | | | | | 5,347 | | | | | (269) | | | |

| Severance, transition and contract termination costs | 1,634 | | | | | 2,656 | | | | | 2,888 | | | | | 5,269 | | | |

| Non-GAAP operating profit (as a percentage of revenue) | $ | 23,764 | | | 12.8% | | | $ | 9,073 | | | 4.8% | | | $ | 50,193 | | | 13.6 | % | | $ | 19,209 | | | 5.1 | % |

| | | | | | | | | | | | | | | |

| Other Income (Expenses): | | | | | | | | | | | | | | | |

| GAAP other income (expense), net | $ | (5,258) | | | | | $ | 13,950 | | | | | $ | (17,732) | | | | | $ | 15,066 | | | |

| Amortization of debt discount and issuance cost | 1,132 | | | | | 1,169 | | | | | 2,240 | | | | | 2,000 | | | |

| (Gain) loss on debt extinguishment | — | | | | | (16,106) | | | | | 1,766 | | | | | (16,106) | | | |

| Gain on warrants remeasurement | (2,781) | | | | | (1,293) | | | | | (2,531) | | | | | (1,293) | | | |

| | | | | | | | | | | | | | | |

| Sublease Income | (117) | | | | | (116) | | | | | (234) | | | | | (232) | | | |

| Non-GAAP other (expense) income, net (as a percentage of revenue) | $ | (7,024) | | | (3.8%) | | | $ | (2,396) | | | (1.3%) | | | $ | (16,491) | | | (4.5) | % | | $ | (565) | | | (0.2) | % |

| | | | | | | | | | | | | | | |

| Net Income (Loss): | | | | | | | | | | | | | | | |

| GAAP net loss | $ | (7,452) | | | | | $ | (11,639) | | | | | $ | (22,779) | | | | | $ | (37,682) | | | |

| Amortization of acquired intangible assets | 5,100 | | | | | 5,247 | | | | | 10,198 | | | | | 10,723 | | | |

| Stock-based compensation expense and related employer payroll taxes | 15,427 | | | | | 24,813 | | | | | 35,102 | | | | | 53,052 | | | |

| Acquisition and integration costs | 307 | | | | | 1,554 | | | | | 650 | | | | | 2,178 | | | |

| Legal and regulatory costs | 3,879 | | | | | (207) | | | | | 5,347 | | | | | (269) | | | |

| Severance, transition and contract termination costs | 1,634 | | | | | 2,656 | | | | | 2,888 | | | | | 5,269 | | | |

| Amortization of debt discount and issuance cost | 1,132 | | | | | 1,169 | | | | | 2,240 | | | | | 2,000 | | | |

| (Gain) loss on debt extinguishment | — | | | | | (16,106) | | | | | 1,766 | | | | | (16,106) | | | |

| Gain on warrants remeasurement | (2,781) | | | | | (1,293) | | | | | (2,531) | | | | | (1,293) | | | |

| | | | | | | | | | | | | | | |

| Sublease income | (117) | | | | | (116) | | | | | (234) | | | | | (232) | | | |

| Non-GAAP net income (as a percentage of revenue) | $ | 17,129 | | | 9.3% | | | $ | 6,078 | | | 3.2% | | | $ | 32,647 | | | 8.9 | % | | $ | 17,640 | | | 4.7 | % |

| Interest expense | 8,929 | | | | | 4,883 | | | | | 17,899 | | | | | 5,508 | | | |

| Provision for income taxes | (389) | | | | | 599 | | | | | 1,055 | | | | | 1,004 | | | |

| Depreciation | 1,964 | | | | | 2,834 | | | | | 4,090 | | | | | 5,624 | | | |

| Amortization of capitalized internal-use software costs | 4,779 | | | | | 5,529 | | | | | 10,061 | | | | | 11,494 | | | |

| Other expense (income), net | (1,905) | | | | | (2,487) | | | | | (1,408) | | | | | (4,943) | | | |

| Adjusted EBITDA | $ | 30,507 | | | 16.5% | | | $ | 17,436 | | | 9.3% | | | $ | 64,344 | | | 17.5% | | $ | 36,327 | | | 9.7% |

| | | | | | | | | | | | | | | |

| Shares used in computing net loss per share amounts: | | | | | | | | | | | | | | | |

| Basic | 120,757 | | | | | 116,013 | | | | | 118,778 | | | | | 117,857 | | | |

| Diluted | 122,624 | | | | | 116,186 | | | | | 120,599 | | | | | 118,936 | | | |

| GAAP net loss per share - Basic and Diluted | $ | (0.06) | | | | | $ | (0.10) | | | | | $ | (0.19) | | | | | $ | (0.32) | | | |

| Non-GAAP net income per share - Basic | $ | 0.14 | | | | | $ | 0.05 | | | | | $ | 0.27 | | | | | $ | 0.15 | | | |

| Non-GAAP net income per share - Diluted | $ | 0.14 | | | | | $ | 0.05 | | | | | $ | 0.27 | | | | | $ | 0.15 | | | |

8x8, INC.

SELECTED OPERATING METRICS

(Unaudited, in millions, except number of enterprise customers)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal 2023 | | Fiscal 2024 |

| Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | |

TOTAL ARR (1) | $ | 688 | | | $ | 692 | | | $ | 698 | | | $ | 703 | | | $ | 703 | | | $ | 707 | | | |

| Growth % (YoY) | 28 | % | | 25 | % | | 22 | % | | 2 | % | | 2 | % | | 2 | % | | |

| | | | | | | | | | | | | |

| ARR BY CUSTOMER SIZE | | | | | | | | | | | | | |

ENTERPRISE (2) | $ | 403 | | | $ | 401 | | | $ | 400 | | | $ | 405 | | | $ | 404 | | | $ | 407 | | | |

| % of Total ARR | 59 | % | | 58 | % | | 57 | % | | 58 | % | | 58 | % | | 58 | % | | |

| Growth % (YoY) | 54 | % | | 42 | % | | 30 | % | | 3 | % | | — | % | | 1 | % | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

MID-MARKET (3) | $ | 125 | | | $ | 127 | | | $ | 130 | | | $ | 130 | | | $ | 132 | | | $ | 131 | | | |

| % of Total ARR | 18 | % | | 18 | % | | 19 | % | | 19 | % | | 19 | % | | 19 | % | | |

| Growth % (YoY) | 22 | % | | 23 | % | | 27 | % | | 2 | % | | 5 | % | | 3 | % | | |

| | | | | | | | | | | | | |

SMALL BUSINESS (4) | $ | 159 | | | $ | 164 | | | $ | 168 | | | $ | 168 | | | $ | 167 | | | $ | 170 | | | |

| % of Total ARR | 23 | % | | 24 | % | | 24 | % | | 24 | % | | 24 | % | | 24 | % | | |

| Growth % (YoY) | (7 | %) | | (2 | %) | | 4 | % | | 1 | % | | 5 | % | | 4 | % | | |

(1) Annualized Recurring Subscriptions and Usage (ARR) equals the sum of the most recent month of (i) recurring subscription amounts and (ii) platform usage charges for all CPaaS customers (subject to a minimum billings threshold for a period of at least six consecutive months), multiplied by 12.

(2) Enterprise ARR is defined as ARR from customers that generate >$100,000 ARR.

(3) Mid-market ARR is defined as ARR from customers that generate $25,000 to $100,000 ARR.

(4) Small business ARR is defined as ARR from customers that generate <$25,000 ARR.

Selected operating metrics presented in this table have not been derived from financial measures that have been prepared in accordance with U.S. Generally Accepted Accounting Principles. 8x8 provides these selected operating metrics to assist investors in evaluating the Company's operations and assessing its prospects. 8x8’s management periodically reviews the selected operating metrics to evaluate 8x8’s operations, allocate resources, and drive financial performance in the business. Management monitors these metrics together, and not individually, as it does not make business decisions based upon any single metric. 8x8 is not aware of any uniform standards for defining these selected operating metrics and caution that its presentation may not be consistent with that of other companies. Prior period metrics and customer classifications have not been adjusted for current period changes unless noted.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

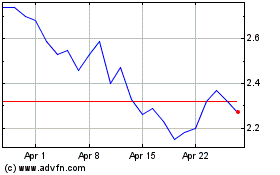

8x8 (NASDAQ:EGHT)

Historical Stock Chart

From Apr 2024 to May 2024

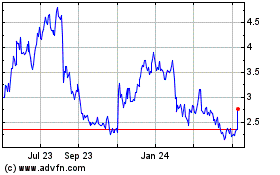

8x8 (NASDAQ:EGHT)

Historical Stock Chart

From May 2023 to May 2024