Turkish Lira Rises To 6-day High Vs U.S. Dollar After Turkey Rate Decision

July 27 2017 - 5:25AM

RTTF2

The Turkish Lira climbed against the U.S. dollar in the European

session on Thursday, as Turkey's central bank left its key interest

rates unchanged and asserted to maintain a tight stance of monetary

policy until inflation outlook displays a significant

improvement.

The Monetary Policy Committee, led by Governor Murat Cetinkaya,

kept the key lending rate, known as the Marginal Funding Rate, at

9.25 percent. This rate was last hiked in January by 75 basis

points.

The overnight borrowing rate was maintained at 7.25 percent and

the one-week repo rate was kept unchanged at 8.00 percent. The

decision came in line with economists' expectations.

Despite expected partial correction in food prices, current

elevated levels of inflation pose risks on the pricing behavior.

The committee decided to maintain the tight stance of monetary

policy.

The Turkish Lira firmed to a 6-day high of 3.5206 against the

greenback, compared to Wednesday's closing value of 3.5327.

Continuation of the Lira's uptrend may see it challenging

resistance around the 3.5 region.

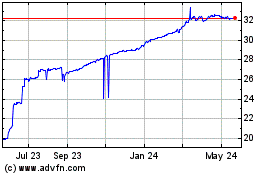

US Dollar vs TRY (FX:USDTRY)

Forex Chart

From Apr 2024 to May 2024

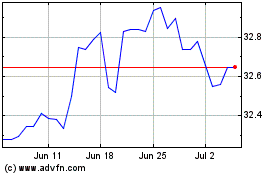

US Dollar vs TRY (FX:USDTRY)

Forex Chart

From May 2023 to May 2024