Yen Extends Fall Amid Risk Appetite

December 09 2016 - 4:02AM

RTTF2

The Japanese yen extended its early slide against its major

rivals in the European session on Friday amid risk appetite, as

European shares rallied tracking record close from the Wall Street

and oil prices advanced ahead of a summit of major crude producers

in Vienna this weekend.

The European Central Bank on Thursday signaled that it would

extend stock purchases through December 2017, although it scaled

back the purchase amount to EUR 60 billion a month, starting in

April. The decision pulled down the euro and euro area bond yields,

while lifting stocks.

Oil prices climbed, with investors awaiting a meeting of OPEC

and non-OPEC countries taking place in Vienna on December 10, in

order to finalize output cuts agreed last week.

Investors look ahead to next week's Federal Reserve meeting amid

expectations the U.S. central bank will raise rates by a quarter

percentage point to a target range of 0.5 percent to 0.75

percent.

Data from the Bank of Japan showed that Japan M2 money stock

rose 4.0 percent on year in November, coming in at 951.8 trillion

yen.

That exceeded forecasts for 3.7 percent, which would have been

unchanged from the October reading.

The currency has been trading in a negative territory in the

Asian session.

The yen weakened to more than a 10-month low of 115.16 against

the greenback and a 3-day low of 145.10 against the pound, from

yesterday's closing values of 114.03 and 143.49, respectively.

Continuation of the yen's downtrend may see it challenging support

around 118.00 versus the greenback and 148.5 against the pound.

The yen dropped to 121.69 against the euro and 113.05 against

the Swiss franc, compared to Thursday's closing quotes of 121.02

and 112.19, respectively. The next possible support for the yen may

be found around 126.00 against the euro and 116.00 against the

franc.

The yen declined to a 1-year low of 82.52 against the kiwi,

7-1/2-month lows of 86.09 against the aussie and 87.36 against the

loonie, down from Thursday's closing values of 81.79, 85.09 and

86.44, respectively. If the yen extends slide, it may possibly find

support around 84.00 against the kiwi, 88.00 against the aussie and

89.00 against the loonie.

Looking ahead, U.S. wholesale inventories data for October, U.S.

University of Michigan's preliminary consumer sentiment index for

December and U.S. Baker Hughes rig count data are set to be

published in the New York session.

At 10:15 am ET, European Central Bank Executive Board Member

Benoit Coeure is expected to participate in a panel discussion on

"Policy Responses: Restoring Public Trust in Economic Reforms" at a

conference on "Challenges to More Sustainable and Inclusive Growth

in Europe", hosted by the Council of Europe Development Bank in

Paris.

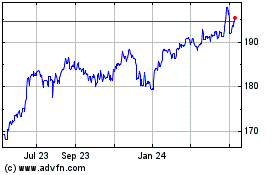

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2024 to May 2024

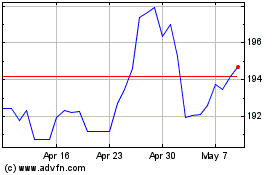

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From May 2023 to May 2024