Regulatory News:

Vetoquinol (Paris:VETO):

Annual sales: €529 million (stable at constant exchange

rates) Essentials sales: €313m (+4.5% at constant exchange

rates) Net income - Group share: €56m (10.5% of sales)

EBITDA: €113m (21.3% of sales) Free Cash flow: €89

m

Matthieu Frechin, Chairman and CEO of Vetoquinol,

commented: “In 2023, Essentials and the USA, our growth

engines, recorded a tenth consecutive year of progression, thanks

to a good 2nd half-year. This momentum has enabled us to deliver

again a solid operating profitability in 2023, and to improve our

cashflow generation. We intend to pursue this strategy with

determination, intensifying the development of our Essentials

portfolio and their territory extensions, particularly in the

United States."

The Board of Directors of Vetoquinol SA met on March 19, 2024 to

review business activity and approve the financial statements for

the year ended December 31, 2023. The audit procedures are

currently being finalized by the Statutory Auditors.

Vetoquinol sales for FY 2023 were €529 million, stable at

constant exchange rates and down -1.9% on a reported basis.

Foreign exchange had a negative impact of €10 million, linked to

the Americas and Asia-Pacific/Rest of World territories.

Rationalization of the complementary products had a negative impact

of around -11 M€ on annual sales. The good level of sales in 2023

2nd half-year, up +4.5% at constant exchange rates, offset a first

half disrupted by cyclical phenomena, notably the impact of the ERP

changeover in the second quarter.

Sales growth was driven by the performance of Essentials and the

USA which over the past 10 years grew in average by more than 10%

and today account for more than 70% of Vetoquinol Group sales.

At December 31, 2023, sales of Essentials totaled €313

million, up +4.5% at constant exchange rates and +2.9% on a

reported basis.

By the end of December 2023, sales of Essentials represented

over 59% of the laboratory's sales, compared with 56% for the same

period in 2022.

The second half of the year was particularly buoyant, with

organic growth of +10% for Essentials, which benefited from the

successful launches of Felpreva®, an anti-parasite for cats in

Europe, and Simplera®, a drug indicated for the treatment of otitis

in dogs in the United States.

The strong performance of Essentials in the United States in

2023 has enabled our total US sales to exceed €120M (2023 published

data), up over 10% (at constant exchange rate) on the previous

year, and consolidate its position as the Group's 1st market.

Developed as a strategic market by Vetoquinol since 2014, business

in the United States has more than doubled in 10 years.

Over the full 12 months of 2023 and at constant exchange rates,

the European territory was stable at -0.3% (vs. -5.5% in H1 2023),

the Americas territory grew by +5.1% (vs. +2.3% in H1 2023) and the

Asia-Pacific/Rest of World territory declined by -10.0% (vs. -16.3%

in H1 2023), mainly due to the distributor business.

Sales of products for companion animals (€372m) rose by +3.6% at

constant exchange rates (vs. -0.4% in H1 2023) and accounted for

70.2% of the laboratory's total sales; these sales were up by +7.5%

in the 2nd half-year. Sales to farm animals came to €157m, down

-7.6% at constant exchange rates (vs. -13.8% in H1 2023); these

sales were down slightly by -1.7% in the 2nd half-year.

The gross margin on purchases is stable at 70.6% compared with

the same period in fiscal year 2022, with significant disparities

recorded in fiscal year 2023; margin gains linked to currency

impacts for 7 M€ vs. a loss of 16 M€ in 2022, higher sales prices,

lower volumes and the positive impact of inventory reduction

resulting in a -10 M€ drop in inventoried production.

The results for the year 2023 are also impacted by a production

activity lower than the laboratory's so-called normal activity.

Also, the product mix by plant was different from 2022.

Other purchases and external charges were down slightly (-1.5%),

by €1.6 million, mainly due to lower sales despite the inflationary

context.

Personnel costs rose by +3.2%, or +4.9 M€ compared with 2022,

and represented 29.7% of 2023 sales. This increase is mainly due to

salary increases implemented by the Group in 2023.

Depreciation and amortization charges resulting from the

application of IFRS 16 generated a depreciation expense of €5.9m,

compared with €5.7m at the end of December 2022.

EBIT before amortization of intangible assets acquired

amounted to €85.0m, for the year ended December 31, 2023, or

16.1% of 2023 sales. (2022: €98.6M, 18.3% of sales)

Depreciation and amortization of assets acquired amounted to

+€13.4m, vs. +€14.1m at the end of December 2022. These mainly

comprise depreciation of assets linked to the Drontal® and

Profender® products.

Group EBIT stood at €71.6m (13.5% of sales),

compared with €84.6m for fiscal 2022.

Group operating income for 2023 was €74.3m (14.0%), compared

with €74m in 2022.

R&D expenditure recorded in 2023 amounted to €40.1m, or 7.6%

of sales vs. 6.0% in 2022. This increase reflects the Group's

determination to sustainably increase investment to support

innovation.

The apparent tax rate was 27.7% (vs. 34.0% at end December

2022). Adjusted for non-recurring items, the apparent tax rate was

28.7%.

EBITDA stood at €113.0 million at December 31, 2023, or

21.3% of sales. It takes into account the outcome of the

renegotiation of the final acquisition price of Clarion in Brazil,

with a gain of +€6.1 million (1.2pt).

Net income for the Vetoquinol laboratory came to €55.6

million, or 10.5% of 2023 sales, after taking into account

non-recurring items of €2.6 million and financial income of €2.6

million.

At the end of December 2023, the Vetoquinol Group had an

overall net cash position of €130.0 million (including IFRS 16), up

€53.6 million on the end of 2022.

Vetoquinol has a solid financial structure to pursue its growth

strategy, which is based on two pillars: the development of

Essential products (new product launches, ramp-ups and geographic

extensions) and the continued strengthening of the laboratory in

the United States. It also has the means to finance its external

growth ambitions.

The Board of Directors will propose a dividend of €0.85 per

share at the Annual General Meeting on May 28, 2024.

The 2023 Annual Results presentation is available on the

laboratory's website:

https://www.vetoquinol.com/en/investors

Next publication: sales 1st quarter 2024, April 29, 2024

after market close

ABOUT VETOQUINOL

Vetoquinol is a leading global animal health company that

supplies drugs and non-medicinal products for the farm animals

(cattle and pigs) and pet (dogs and cats) markets. As an

independent pure player, Vetoquinol designs, develops and sells

veterinary drugs and non-medicinal products in Europe, the Americas

and the Asia Pacific region. Since its foundation in 1933,

Vetoquinol has pursued a strategy combining innovation with

geographical diversification. The Group’s hybrid growth is driven

by the reinforcement of its product portfolio coupled with

acquisitions in high potential growth markets. At December 31,

2023, Vetoquinol employed 2,483 people.

Vetoquinol has been listed on Euronext Paris since 2006 (symbol:

VETO).

The Vetoquinol share is eligible for the French PEA and PEA-PME

personal equity plans.

APPENDIX

SALES

In millions of euros

2023

2022

Change on a reported

basis

Change at constant exchange

rates

Sales 1er quarter

145,4

135,0

+7,7%

+7,2%

Sales 2e quarter

110,8

135,8

-18,3%

-16,3%

Sales 3e quarter

135,8

134,1

+1,3%

+5,1%

Sales 4e quarter

137,3

134,9

+1,7%

+3,9%

Annual sales

529,3

539,8

-1,9%

-0,1%

SIMPLIFIED INCOME STATEMENT

In millions of euros

31/12/2023

31/12/2022

Variation

Total sales

of which Essentials

529,3

313,0

539,8

304,2

-1,9%

+2,9%

EBIT before amortization of acquired

assets

in % of total sales

85,0

16,1

98,6

18,3

-13,7%

Net income, Group share

in % of total sales

55,6

10,5

48,0

8,9

+15,7%

EBITDA

in % of total sales

113,0

21,3

118,0

21,9

-4,3%

EBITDA RECONCILIATION

In millions of euros

31/12/2023

31/12/2022

Net income before equity method

55,6

48,0

Income tax expense

21,6

24,7

Net financial income

(2,6)

1,3

Provisions recognized in other operating

income and expenses

3,6

10,4

Charges to and reversals of provisions

3,5

2,1

Depreciation and amortization (including

IFRS 16)

31,6

31,5

EBITDA

113,0

118,0

ALTERNATIVE PERFORMANCE INDICATORS

Vetoquinol Group management considers that these indicators,

which are not defined by IFRS, provide additional information that

is relevant for shareholders seeking to analyze underlying trends

and Group performance and financial position. They are used by

management for performance analysis.

Essentials products: The products referred to as

“Essentials” comprise veterinary drugs and non-medical products

sold by the Vetoquinol Group. They are existing or potential

market-leading products designed to meet the daily requirements of

vets in the companion animal or livestock sector. They are intended

for sale worldwide and their scale effect improves their economic

performance.

Constant exchange rates: Application of the previous

period’s exchange rates to the current financial year, all other

things remaining equal.

Like-for-like (LFL) growth: Year-on-year sales growth in

terms of volume and/or price at constant consolidation scope and

exchange rates.

EBIT before amortization of acquired assets: This KPI

isolates the non-cash impact of depreciation charges on intangible

assets arising from mergers and acquisitions.

Net cash: Cash and cash equivalents less bank overdrafts

and borrowings, pursuant to IFRS 16.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240320549748/en/

FOR FURTHER INFORMATION PLEASE CONTACT :

VETOQUINOL

Investor Relations Fanny Toillon Tel: +33 (0)3 84

62 59 88 relations.investisseurs@vetoquinol.com

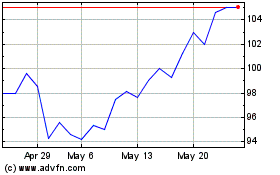

Vetoquinol (EU:VETO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vetoquinol (EU:VETO)

Historical Stock Chart

From Jan 2024 to Jan 2025