UPDATE: Randstad Expects Healthy Growth In Staffing Markets

October 28 2010 - 4:15AM

Dow Jones News

Dutch staffing group Randstad Holding NV (RAND.AE) said Thursday

it expects healthy growth in coming months as it reported an 18%

rise in third-quarter net profit due to a strong recovery in most

of its markets.

Randstad, which generates the bulk of its revenue in Western

Europe and the U.S., said that the recovery is robust and that it

expects "continued healthy growth" in the fourth quarter.

"The worldwide human resources services markets show cyclical

and structural growth trends," the company said in a statement.

This echoed comments from Swiss rival Adecco SA (ADEN.VX), the

world's biggest temporary staffing agency by sales, which last

month gave a similarly upbeat outlook and said it didn't see any

signs of a slowdown. U.S. peer Manpower Inc. (MAN) last week also

flagged encouraging trends in most of its markets.

Staffing companies were hit hard by the economic downturn as

companies cut staff in order to reduce their costs. This year has

seen a pickup in demand, although concerns remain. Some analysts

say growth may come to a halt in coming months due to the ongoing

uncertain economic prospects in the U.S. and Europe.

However, Randstad says it also creates opportunities as

companies, still recovering from the downturn, are reluctant to

hire permanent workers and instead opt to hire temporary staff.

The Diemen-based company, the world's second-largest staffing

firm by sales after Adecco, said net profit rose 18.4% to EUR70.2

million in the third quarter from EUR59.3 million a year

earlier.

Revenue rose 19% to EUR3.78 billion, with growth mainly coming

from Germany, the U.S. and the industrial and logistics sectors.

Randstad said that the late-cyclical white-collar segment, a more

lucrative business where the major staffing companies are pushing

to expand, is also showing improvement.

In the Netherlands, where Randstad generates about one-fifth of

total revenue, sales were still down due to the late-cyclical

nature of the country's economy, the company said. But the Dutch

market is slowly recovering and Randstad recorded organic growth

here in September, Chief Financial Officer Robert-Jan van de Kraats

told Dow Jones Newswires, without specifying.

Earnings before interest, taxes and amortization, or Ebita, a

figure closely watched by analysts to gauge operational

performance, rose 64% to EUR153 million.

Analysts said Randstad's results confirmed market trends in the

past months and noted that the outlook contained few surprises.

"Staffing markets continue to grow buoyantly," SNS Securities

analyst Frank van Wijk said in a report. "These conditions bode

well for Randstad and should result in another solid quarter," he

said.

At 0726 GMT, Randstad shares were up 0.7% at EUR35.24, slightly

higher than the AEX market in Amsterdam which was up 0.3%.

- By Maarten van Tartwijk; Dow Jones Newswires; +31 20 571 5201;

maarten.vantartwijk@dowjones.com

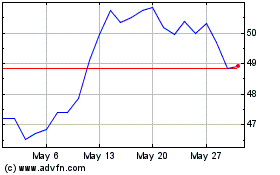

Randstad NV (EU:RAND)

Historical Stock Chart

From Jun 2024 to Jul 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Jul 2023 to Jul 2024