MRM : 3rd quarter 2016 financial information

November 10 2016 - 1:30AM

Press release

3rd quarter 2016

financial information

-

3rd quarter 2016

consolidated revenues: €3.1 million, up 5.8% like-for-like

-

Further refocusing on retail properties

-

Maturity extension for more than 80% of the debt

initially falling due in 2017

Paris, 10

November 2016: MRM (Euronext code ISIN FR0000060196), a mixed

real estate investment company specialising in retail and office

property, announced today its consolidated revenues for the third

quarter of 2016, corresponding to gross rental income recorded over

the period.

Consolidated revenues for the

third quarter of 2016 totalled €3.1 million, down 5.1% relative to

the third quarter of 2015. This decrease includes the effect of two

sales[1] of office

properties since 1 July 2015, in accordance with MRM's

strategy of refocusing its business on retail properties. On a

like-for-like basis[2], rental

income increased by 5.8%. This performance reflects primarily the

improved occupancy rate of the office property portfolio, which

will enable MRM to sell these properties on the best possible

terms.

Gross rental income for the first

nine months of 2016 came to €9.9 million, down 3.6% compared with

the same period last year. On a like-for-like basis2, gross rental

income increased by 2.8%.

Retail

property

During the third quarter of 2016,

retail properties generated gross rental income of €2.2 million,

down 4.9%. The arrival of new tenants only partly made up for

strategic vacancies and the adjustment of rental terms granted

during the phase preceding the implementation of retail property

value-enhancement programs.

Over the first nine months of

2016, gross rental income from retail properties totalled €6.6

million, down 6.8% compared with the same period in 2015.

Note that rental income for the

period benefited only very marginally from leases signed since the

last few months of 2015 within the framework of retail property

value-enhancement programs, with the first of these leases coming

into effect only in the course of the third quarter of 2016: at the

end of September 2016, 11 leases concerning a total of 7,680 sqm

have been signed, representing total additional rental income of €1

million, with leases coming into effect staggered until

mid-2017.

Offices

During the third quarter, the

Solis building in Les Ulis was sold for €11.0 million (excluding

transfer taxes).

Gross rental income from office

properties came to €0.9 million in the third quarter of 2016.

This 5.6% drop relative to the third quarter of 2015 was due

to two asset sales1 carried out

since 1 July 2015, the effect of which has been partly

offset by the very sharp rise in rental income from properties

still in the portfolio at the end of September 2016. On a

like-for-like basis2, this

represents an increase of 43.4%. This relates primarily to new

leases at the Cap Cergy building in Cergy-Pontoise.

Over the first nine months of

2016, gross rental income from office properties totalled €3.4

million, up 3.2%. On a like-for-like basis1, rental

income increased by 28.6%.

| Consolidated revenues (€m) |

Q3

2016

|

% of total |

Q3

2015

|

Change

|

Change

like-for-

like2 |

|

9 months

2016 |

% of total |

9

months

2015 |

Change

|

Change

like-for-like2 |

| Retail |

2.19 |

70% |

2.30 |

-4.9% |

-4.9% |

|

6.58 |

66% |

7.06 |

-6.8% |

-6.8% |

| Offices |

0.94 |

30% |

0.99 |

-5.6% |

+43.4% |

|

3.37 |

34% |

3.26 |

+3.2% |

+28.6% |

| Total gross rental income |

3.13 |

100% |

3.29 |

-5.1% |

+5.8% |

|

9.95 |

100% |

10.32 |

-3.6% |

+2.8% |

(Unaudited

figures)

Financial

position

During the third quarter of 2016,

MRM's gross debt - which totalled €101.0 million

at 30 June 2016 - was reduced by €6.0 million

after repayment of the debt relating to the Solis building and bank

loan repayments made during the period.

In addition, MRM announces that it

has accepted today the firm offer from a partner bank for setting

up, by the end of the year, two credit facilities maturing in the

end of 2021. The first €48.6 million credit facility

corresponds to an early refinancing of the credit facility of the

same amount maturing at the end of 2017, and the second €15.2

million credit facility is intended to contribute financing retail

property value-enhancement programs.

MRM also announces that it has

accepted the firm offer for a one-year extension, at the same

conditions, of a €22.0 million loan initially maturing in January

2017.

To date, more than 80% of the

financial debt falling due in 2017 is subject to a maturity

extension.

Lastly, MRM announces the

signature on 8 November 2016 of a preliminary sales agreement

concerning the 12,800 sqm Cap Cergy office building in

Cergy-Pontoise at a price in line with the appraisal value as of 30

June 2016. The transaction is due to be closed within two months.

As there is no debt relating to Cap Cergy, the sale of this

property will have a significant impact on MRM's cash position.

Calendar

Revenues for the fourth quarter of

2016 and 2016 full-year results are due on 24 February 2017 before

market opening and will be presented during an information meeting

to be held on the same day.

About

MRM

MRM is a listed real estate company with a portfolio worth €224.4

million (excluding transfer taxes) as at 30 June 2016, comprising

retail properties (66%) and offices (34%). Since 29 May 2013, SCOR

SE has been MRM's main shareholder, holding a 59.9% stake. MRM is

listed in compartment C of Euronext Paris (ISIN: FR0000060196 -

Bloomberg code: MRM: FP - Reuters code: MRM.PA) and opted for the

SIIC status on 1 January 2008.

For more information:

MRM

5, avenue Kléber

75795 Paris Cedex 16

France

T +33 (0)1 58 44 70 00

relation_finances@mrminvest.com |

Isabelle

Laurent, DDB Financial

54, rue de Clichy

75009 Paris

France

T +33 (0)1 53 32 61 51

isabelle.laurent@ddbfinancial.fr |

Website:

www.mrminvest.com

Appendix 1: Asset

sales since 2013

| Assets sold |

Date of sale |

Price excl. transfer taxes

(€m) |

Office

building,

Rue de la Bourse, Paris (2nd arrondissement) |

December

2013 |

10.4 |

Office

building,

Rue Cadet, Paris (9th arrondissement) |

April

2014 |

12.0 |

Delta

office complex,

Rungis (94) |

September 2014 |

10.5 |

Plaza

office building,

Rue de la Brêche-aux-Loups, Paris (12th arrondissement) |

April

2015 |

16.8 |

Cytéo

office building,

Rueil-Malmaison (92) |

April

2016 |

6.3 |

Solis

office building,

Les Ulis (91) |

July

2016 |

11.0 |

Appendix 2:

Quarterly rental income

Consolidated revenues

(€m) |

Q1

2016 |

Q1

2015 |

Change |

Change

like-for-like |

|

Retail |

2.21 |

2.33 |

-4.8% |

-4.8% |

|

Offices |

1.21 |

1.23 |

-2.4% |

+17.0% |

| Total gross rental income |

3.42 |

3.56 |

-4.0% |

+1.9% |

Consolidated revenues

(€m) |

Q2

2016 |

Q2

2015 |

Change |

Change

like-for-like |

|

Retail |

2.18 |

2.43 |

-10.5% |

-10.5% |

|

Offices |

1.22 |

1.03 |

+18.4% |

+30.9% |

| Total gross rental income |

3.40 |

3.47 |

-1.9% |

+1.0% |

Consolidated revenues

(€m) |

Q3

2016 |

Q3

2015 |

Change |

Change

like-for-like |

|

Retail |

2.19 |

2.30 |

-4.9% |

-4.9% |

|

Offices |

0.94 |

0.99 |

-5.6% |

+43.4% |

| Total gross rental income |

3.13 |

3.29 |

-5.1% |

+5.8% |

[1] See the

list of assets sold provided in the appendix.

[2] Revenues

are calculated on a like-for-like basis by deducting the rental

income generated by acquired assets from the revenues reported for

the current year and deducting the rental income generated by

assets sold from the revenues reported for the previous

year.

A list of office properties sold within the framework of the

refocusing of MRM's activities initiated in mid-2013 is provided in

the appendix. No acquisitions have been made since this date.

MRM Press release in PDF

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: MRM via Globenewswire

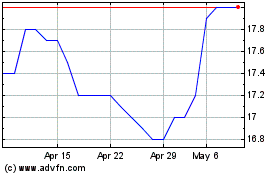

MRM (EU:MRM)

Historical Stock Chart

From Aug 2024 to Sep 2024

MRM (EU:MRM)

Historical Stock Chart

From Sep 2023 to Sep 2024