EVS Broadcast Equipment : EVS reports First quarter 2013 results

May 16 2013 - 12:32AM

> Solid 1Q13, with a soft start and increasing momentum

during the quarter

o Revenue of EUR 32.8 million, +9.2% (+9.4% excl. event

rentals and at constant currency)

o EBIT margin of 44.0%, EPS up by 15.1% to EUR 0.75

> 2013: spring

order book of EUR 32.8 million at May 10, 2013

o -39.0% vs record 2012 spring order book (-26.8% excl. big

events)

o Stronger APAC, stable EMEA and weaker Americas market

conditions

o As usual, low visibility in a non-big sporting event

year

> Execution of new

strategy and organization plan on track

> Total gross dividend of EUR 2.64 (dividend yield of

5.6%)

> Despite a weaker order intake in the Americas we maintain

our guidance for 2013

Key figures

| EUR millions, except earnings per share

expressed (EUR) |

Unaudited |

| 1Q13 |

4Q12 |

1Q12 |

1Q13/1Q12 |

|

Revenue |

32.8 |

25.6 |

30.0 |

+9.2% |

|

Operating profit - EBIT |

14.5 |

5.2 |

13.6 |

+6.7% |

|

Operating margin - EBIT % |

44.0% |

20.3% |

45.1% |

- |

|

Contribution from dcinex |

-0.2 |

0.4 |

0.1 |

N/A |

| Net

profit - Group share |

10.0 |

4.4 |

8.7 |

+15.2% |

| Net

profit from operations, excl. dcinex - Group share (1) |

10.4 |

5.8 |

8.9 |

+17.2% |

|

Basic earnings per share |

0.75 |

0.32 |

0.65 |

+15.1% |

| Basic

earnings per share from operations, excl. dcinex (1) |

0.78 |

0.43 |

0.66 |

+17.0% |

(1) The net profit from

operations, excl. dcinex, is the net profit (share of the group)

excluding non operating items (net of tax) and the dcinex

contribution. Refer to Annex 5.3: use of non-gaap financial

measures.

Comments

"The first quarter delivered by

our company is encouraging," said Joop Janssen, Managing Director

& CEO of EVS. "In an uncertain macro-economic environment, we

posted again a solid performance. While some regions and countries

go through challenging times more than others, the global reach and

EVS' strong brand and product position gives us confidence to

deliver our ambitious plan. We are in particular proud of our very

good progress in APAC where in addition to a strong market

development our share in it seems to grow even more rapidly in the

quarter. Our new strategy, launched in February of this year is now

fully in place and very well received by our markets at the yearly

global Media tradeshow (NAB) in mid April. EVS launched an

impressive number of new products in all of our four target

markets. The execution of the new organization plans is well on

track. As indicated earlier we have brought our headcount growth

further under control while concentrating on leveraging our

investments in new product innovation."

Commenting on the results and

prospects, Jacques Galloy, Director and CFO, said: "The first

quarter of 2013 is in line with our expectations. Sales reach EUR

32.8 million, which is an increase of 9.2% compared to last year

and of 28.4% compared to 4Q12. This revenue growth is higher than

the market. The operating profit grew by 6.7% to EUR 14.5 million

versus 1Q12, which translates into a solid 44.0% operating margin.

This transforming year is on track even if markets are growing

softly. EVS experiences strong momentum in APAC, partly offset by

weaker America's and stable EMEA. The second half is expected to be

better than the first half of the year as it should get traction

from big sporting events to occur in 2014."

Corporate

Calendar:

Tuesday May 21,

2013

Ordinary General Meeting

Tuesday May 28,

2013

Final dividend: ex-date

Thursday May 30,

2013

Final dividend: record date

Friday May 31,

2013

Final dividend: payment date

Thursday August 29,

2013

2Q13 earnings

Thursday November 14,

2013

3Q13 earnings

For more information, please

contact:

Joop JANSSEN, Managing Director & CEO

Jacques GALLOY, Director & CFO

Geoffroy d'OULTREMONT, Vice President Investor Relations

& Corporate Communication

EVS Broadcast Equipment S.A., Liege Science Park, 16 rue du Bois

Saint-Jean, B-4102 Seraing, Belgium

Tel: +32 4 361 70 14. E-mail: corpcom@evs.tv;

www.evs.com |

Forward Looking Statements

This press release contains forward-looking statements with respect

to the business, financial condition, and results of operations of

EVS and its affiliates. These statements are based on the current

expectations or beliefs of EVS's management and are subject to a

number of risks and uncertainties that could cause actual results

or performance of the Company to differ materially from those

contemplated in such forward-looking statements. These risks and

uncertainties relate to changes in technology and market

requirements, the company's concentration on one industry, decline

in demand for the company's products and those of its affiliates,

inability to timely develop and introduce new technologies,

products and applications, and loss of market share and pressure on

pricing resulting from competition which could cause the actual

results or performance of the company to differ materially from

those contemplated in such forward-looking statements. EVS

undertakes no obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date hereof or to reflect the occurrence of unanticipated

events. |

About EVS

EVS provides its customers with reliable and innovative technology

to enable the production of live, enriched video programming,

allowing them to work more efficiently and boost their revenue

streams. Its industry-leading broadcast and media production

systems are used by broadcasters, production companies,

post-production facilities, film studios, content owners and

archive libraries around the globe. It spans four key markets -

Sports, Entertainment, News and Media.

Founded in 1994, its innovative Live Slow Motion system

revolutionised live broadcasting. Its reliable and integrated

tapeless solutions, based around its market-leading XT server

range, are now widely used to deliver live productions worldwide.

Today, it continues to develop practical innovations, such as its

C-Cast second-screen delivery platform, to help customers maximise

the value of their media content.

The company is headquartered in Belgium and has offices in Europe,

the Middle East, Asia and North America. Approximately 465 EVS

professionals from 20 offices are selling its branded products in

over 100 countries, and provide customer support globally. EVS is a

public company traded on Euronext Brussels: EVS, ISIN:

BE0003820371. For more information, please visit

www.evs.com.

dcinex, of which EVS owns 41.3%, is the European leader for Digital

Cinema technology and services in Europe with more than 5,500

committed digital screens in Europe, out of which 3,700 have

already been deployed. www.dcinex.com. |

Press release in pdf

format

This

announcement is distributed by Thomson Reuters on behalf of Thomson

Reuters clients.

The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the

information contained therein.

Source: EVS Broadcast Equipment via Thomson Reuters

ONE

HUG#1702317

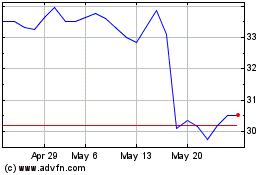

EVS Broadcast Equipment (EU:EVS)

Historical Stock Chart

From Jun 2024 to Jul 2024

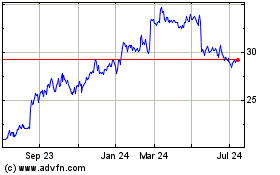

EVS Broadcast Equipment (EU:EVS)

Historical Stock Chart

From Jul 2023 to Jul 2024