Pharnext Successfully Raises €16 Million via Private Placement

April 11 2018 - 11:46AM

Business Wire

Regulatory News:

Pharnext SA (Paris:ALPHA) (FR0011191287 - ALPHA),

a biopharmaceutical company pioneering a new approach to the

development of innovative drug combinations based on big genomic

data and artificial intelligence, today announced that it

successfully closed a €16 million private placement.

The private placement includes 725,513 shares with warrants

attached (“ABSA”) subscribed by CB LUX, generating gross income of

€6.058 million, and convertible bonds (“CB”) for gross quasi-equity

of €10.0 million subscribed by the Chinese pharmaceutical partner

Tasly.

The proceeds from the private placement will provide the Company

with additional resources to fund its strategy and continue its

growth in the perspective of the forthcoming results of the Phase 3

trial of its most advanced PLEODRUG™, PXT3003 in the treatment of

Charcot-Marie-Tooth disease type 1A.

“We would like to sincerely thank our partners for their trust

and continued support of our Company and its innovative

technological platform, PLEOTHERAPY™” said Prof. Daniel Cohen,

M.D., Ph.D., Co-Founder and Chief Executive Officer of

Pharnext. “We are thrilled by the major strategic and clinical

advances we have achieved in our programmes, and look forward to

reporting the results of the Phase 3 trial of our first-in-class

product PXT3003 for the treatment of Charcot-Marie-Tooth disease

type 1A in the second half of 2018.”

PRIVATE PLACEMENT DETAILS

ABSA has been issued in accordance with the approval of the

Board of Directors implemented according to the Eighth Resolution

of the Shareholders’ Meeting of 28 June 2017 (the

“Shareholders’ Meeting”), without pre-emptive subscription rights,

to the Company CBLUX S.A.R.L, already a 16.3% shareholder in

Pharnext prior to this operation Pharnext (but not represented on

its Board of Directors), and in which it will own 21.4% after the

issuance.

A total of 725,513 ABSAs were issued via private placement, with

a price of each equal to €8.35 (including premium), and each

comprising an ordinary share and an ordinary warrant (“BSA”). The

725,513 new shares will be entirely assimilated into existing

Pharnext shares and will represent approximately 6.48% of the

number of outstanding shares after the private placement. Each BSA

entitles to subscribe for 0.20 ordinary Pharnext shares,

representing an additional issuance of 145,102 shares with a

maximum exercise price of €8.27 per share. The shares that may be

issued on exercise of the BSAs represent approximately 1.30% of the

number of shares issued before the private placement. The BSAs may

be exercised within 5 years from issuance. In the event all BSAs

are exercised, the gross resulting income for Pharnext will be

approximately 2 million euros. The theoretical value of five BSA

giving right to one Pharnext share would be equal to 35% of a share

price under Black & Scholes model.

CB has been issued in accordance with the approval of the Board

of Directors implemented according to the Tenth Resolution of the

Shareholders’ Meeting, without pre-emptive subscription rights, to

Tasly, a leading Chinese pharmaceutical group and partner of

Pharnext, already shareholder in Pharnext prior to this

operation (but not represented on its Board of Directors) and with

a 3.4%of the share capital after the operation.

A total of 10 convertible bonds were issued, each with a par

value of 1 million euros, representing a total nominal

amount of 10 million euros and bearing interest at a rate of 6.9%

per year. The convertible bonds have a maturity of 3 years from

their date of issue, and may be converted prior to the maturity

date at a conversion price of €13 per share, representing a premium

of 57% over the weighted average price during the last three

trading sessions prior to their date of issue (automatic conversion

at a price of 13 euros per share where the market price exceeds

this value, on average, during three consecutive months, or

conversion by the bondholder at any time, at a price of 13 euros).

At the maturity date, the amount payable in respect of the

convertible bonds will either be reimbursed, or converted at a rate

representing 80% of the average value of the share price on the

market, weighted by volume observed over a period of the last 20

trading sessions preceding the maturity date. On this basis, the

shares that may be issued on conversion of the CB represent

approximately a maximum of 6.8% of the number of shares issued

prior to the issuance of both CB and ABSA, or 14,58% together with

the ABSA. The CB will not be listed or admitted for trading on the

Euronext Growth Paris market.

Pursuant to Article 211-3 of the AMF (Autorité des Marchés

Financiers) General Regulations, it should be noted that neither of

the above-mentioned issues has resulted or will result in the

drafting of a prospectus submitted to the AMF for approval.

About Pharnext

Pharnext is an advanced clinical-stage biopharmaceutical company

developing novel therapeutics for orphan and common

neurodegenerative diseases that currently lack curative and/or

disease-modifying treatments. Pharnext has two lead products in

clinical development. PXT3003 is currently in an international

Phase 3 trial for the treatment of Charcot-Marie-Tooth disease type

1A and benefits from orphan drug status in Europe and the United

States. The results of this trial are expected in the second half

of 2018. PXT864 has generated positive Phase 2 results in

Alzheimer’s disease. Pharnext has developed a new drug discovery

paradigm based on big genomic data and artificial intelligence:

PLEOTHERAPY™. The Company identifies and develops synergic

combinations of drugs called PLEODRUG™ offering several key

advantages: efficacy, safety and robust intellectual property. The

Company was founded by renowned scientists and entrepreneurs

including Professor Daniel Cohen, a pioneer in modern genomics and

is supported by a world-class scientific team.

Pharnext is listed on Euronext Growth Stock Exchange in Paris

(ISIN code: FR0011191287).For more information, visit

www.pharnext.com.

Disclaimer

This press release has been issued to fulfil Pharnext's

permanent reporting obligations. It does not constitute a public

offering, subscription offering or a solicitation in view of a

public offering.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180411006019/en/

PharnextAmit KohliChief Operating

Officerinvestors@pharnext.com+33 (0)1 41 09 22 3030orInvestor

Relations (Europe)MC Services AGAnne

Henneckeanne.hennecke@mc-services.eu+49 211 529252 22orInvestor

Relations (U.S.)Stern Investor Relations, Inc.Matthew

Shinsekimatthew@sternir.com+1 212 362 1200orFinancial

Communication (France)ActifinStéphane Ruizsruiz@actifin.fr+33

(0)1 56 88 11 15orMedia Relations (Europe)ALIZE RPCaroline

CarmagnolAurore Gangloffpharnext@alizerp.com+33 (0)1 44 54 36

66orMedia Relations (U.S.)RooneyPartnersMarion

Janicmjanic@rooneyco.com+1 212 223 4017

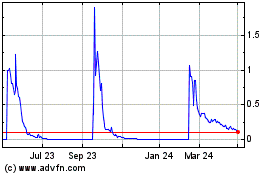

Pharnext (EU:ALPHA)

Historical Stock Chart

From Dec 2024 to Jan 2025

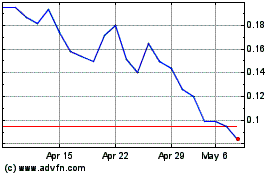

Pharnext (EU:ALPHA)

Historical Stock Chart

From Jan 2024 to Jan 2025