XRP Sale Controversy: Ripple Faces Heated Legal Debate Amid Market Turbulence

January 17 2024 - 6:00PM

NEWSBTC

The crypto community is currently embroiled in a debate over the

right for Ripple to sell XRP tokens, sparked by a recent exchange

between XRP advocate Bill Morgan and a crypto analyst known as

“Darkhorse” on social media platform X. This discussion delves into

the legal complexities and market implications of Ripple’s actions

concerning XRP sales. There is nothing that prevents Ripple selling

its XRP. Anyone can sell an asset it owns. The issue is whether in

the US it needs to register its sales and offers of XRP with the

SEC. If Ripple sells XRP programmatically as it has in the past it

does not need to register the sales… https://t.co/vHbeCTpeP0 — bill

morgan (@Belisarius2020) January 16, 2024 Legal Debate: Ripple’s

Rights To Sell XRP Bill Morgan, a staunch defender of XRP, argued

that Ripple has no legal constraints on “selling its XRP tokens

except in the context of institutional sales.” This assertion was

in response to a crypto analyst, Darkhorse’s reference to a ruling

by Judge Analisa Torres in July 2023, which, according to the

analyst, did not permit Ripple to sell XRP. Morgan maintained that

Ripple is legally allowed to sell its XRP holdings, clarifying that

the company’s sales should not be viewed as investment contracts

under the United States Securities law. Morgan further noted that

nothing is “stopping Ripple from selling its XRP.” “The issue is

whether in the US it needs to register its sales and offers of XRP

with the [Securities and Exchange Commission] SEC.” After Judge

Torres ‘ decision, another user on X highlighted a significant

point regarding Ripple’s XRP sales. Based on the judge’s reasoning,

these sales might “now be considered securities transactions.” This

change in classification, the user explained, is because Ripple’s

involvement with XRP is now publicly acknowledged, which could lead

to expectations of value increase due to the payment company’s

activities. Previously, such sales weren’t classified as securities

transactions due to a “lack of evidence” that retail buyers knew

about Ripple’s role with XRP. However, this has changed post-Judge

Torres’ decision, making Ripple’s involvement a publicly recognized

fact. Responding to this, Morgan suggested that despite this public

awareness, the past five years’ performance of XRP’s price

indicates that expecting profits from Ripple’s efforts might not be

“reasonable.” The XRP advocate further implied that those who

bought XRP after the July 13th decision with such expectations

might be “irrational or need help.” Put on notice or not the price

performance by XRP for the last 5 years suggests anyone who

acquired XRP since the 13 July decision who thinks Ripple’s efforts

are going to lead to profits from an increase in price of the asset

does not have a ‘reasonable expectation’ and may be…

https://t.co/WhKCyGWpA0 — bill morgan (@Belisarius2020) January 17,

2024 Ripple XRP Sale And Market Impact Notably, the debate comes on

the heels of Ripple’s recent transfer of 80 million XRP tokens,

valued at approximately $46.18 million, to an undisclosed wallet.

This transaction, reported by blockchain tracking service Whale

Alert, has ignited speculation in the XRP community. Amid these

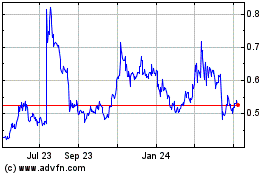

developments, XRP’s market performance has seen fluctuations. The

asset experienced a 1.5% decline in the past 24 hours, dropping its

price to $0.566. However, over the past week, XRP has shown

resilience, recording a 2.6% increase. The trading volume for XRP

also saw a dip, falling from over $1 billion last Wednesday to $827

million in the last 24 hours. Featured image from Unsplash, Chart

from TradingView

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

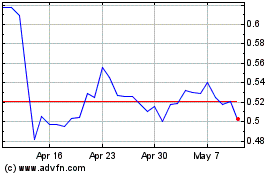

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025