Bitcoin Demands Exceeds Miner Supply By 1,300%, Why A Push To $237,000 Is Possible

February 23 2024 - 1:00PM

NEWSBTC

As the Bitcoin Halving draws nearer, there is so much optimism

about what could happen to Bitcoin’s price in the aftermath of this

event. This optimism is further heightened by a recent development

showing how Bitcoin’s demand far outpaces its supply, which could

see the flagship crypto token rise to as high as $237,000.

Bitcoin Demand Significantly Outpacing Its Demand Crypto analyst

Willy Woo mentioned in an X (formerly Twitter) post that the

Bitcoin network receives an average of $607 million of new investor

demand daily. On the other hand, this demand is said to be met by a

supply of just $46 million daily in terms of Bitcoin mined. This

development is more significant considering that the Halving is

fast approaching. Related Reading: Bitcoin Millionaire Takes

A Shot At Cardano For Being A ‘Wannabe Ethereum’ – Details This is

when Bitcoin Miners’ rewards are cut in half, acting as a

deflationary measure and reducing the rate at which more BTC comes

into circulation. This also offers a bullish narrative, as the

already insufficient supply will decline further after the Halving

event. Once that happens, Bitcoin is expected to become more

valuable, with more price increases imminent. Industry expert

Anthony Pompliano also highlighted this phenomenon when he noted

how institutional investors were gobbling up BTC almost 13x faster

than its production rate. He added that the flagship crypto token

was bound to see a new all-time high (ATH) if this trend

continues. This institutional demand for BTC is mainly driven

by the Spot Bitcoin ETFs, which were approved in January. Due to

the impressive demand for these funds, fund issuers like BlackRock

have continued to accumulate a significant portion of the BTC

supply on a daily. Interestingly, these Bitcoin ETFs were reported

to hold 3.3% of Bitcoin’s circulating supply earlier in the

month. Bitcoin’s Road To $237,000 In response to Willy Woo’s

post, crypto analyst MacronautBTC made a “conservative” calculation

of how Bitcoin’s price could rise to $237,000. Using a multiplier

of 3x the Dollar currently flowing into the Bitcoin ecosystem, the

analyst mentioned that Bitcoin could see an added market cap of

4.38 trillion. Related Reading: Is Ripple Dumping Millions Of

XRP? CTO Addresses Reasons Behind $34 Million Transaction He then

added the 4.38 trillion to Bitcoin’s current market cap of 1

trillion, which sums up to a 5.38 trillion market cap. This

potentially puts Bitcoin’s price at $273,000 (a year from now,

going by MacronautBTC’s calculation. The analyst also

highlighted how this price level coincides with predictions made by

notable Bitcoin bulls. One of them is Tim Draper, who recently

stated that BTC will hit $250,000 in 2025. At the time of

writing, Bitcoin is trading at around $50,900, down almost 2%% in

the last 24 hours, according to data from CoinMarketCap. BTC

price sits above $51,200 | Source: BTCUSD on Tradingview.com

Featured image from CNBC, chart from Tradingview.com

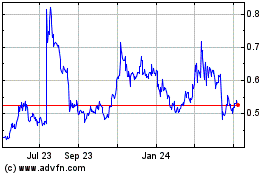

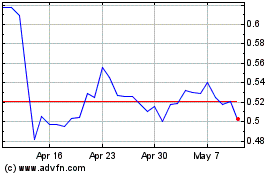

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024