Ethereum Correction: Key Level Break Can Shift Price Course

May 29 2023 - 12:50AM

NEWSBTC

The Ethereum price has shown attempts at recovery during recent

trading sessions. Over the past 24 hours, the price of this altcoin

has experienced a modest increase of nearly 2%. However, when

observing the weekly chart, the price has only managed to

appreciate by 3%. In terms of technical analysis, the outlook has

favored the bulls, with buying strength exhibiting an uptick.

Additionally, both demand and accumulation have displayed positive

changes. As the price began to rise, ETH successfully surpassed a

significant resistance level, crossing the $1,790 mark. Related

Reading: XRP Revisits $0.47 – What Can Be Expected For Short-Term

Price Movement? This breakthrough has enabled the bulls to gain

control of the price action. Nevertheless, an important hurdle

still remains to be overcome for ETH to witness a substantial

rally. Notably, with the Bitcoin price demonstrating uncertain

price action, several major altcoins have struggled to surpass

their key price resistance levels. As BTC surpassed $27,000, the

broader market’s increased strength might also contribute to the

Ethereum upward price movement on its chart. The market

capitalization of Ethereum witnessed an increase in the last

trading session, indicating a return of buyers to the market.

Ethereum Price Analysis: One-Day Chart At the time of writing, ETH

was priced at $1,840. The altcoin has exhibited gradual

appreciation following its breakthrough of the $1,790 resistance

level. However, ETH has experienced intermittent corrections, and

in order to halt this pattern, it needs to surpass the overhead

price ceiling of $1,870. Surmounting this level would pave the way

for ETH to trade near $1,900. Conversely, a drop from this level

would bring ETH to $1,790 and subsequently to $1,740. The volume of

ETH traded in the last session appeared positive, indicating

reduced selling pressure on the chart. Technical Analysis Following

ETH’s breakthrough of the $1,840 price level, buyers made further

attempts to reenter the market. This resulted in a shift in demand

into the positive zone. Additionally, the Relative Strength Index

(RSI) surged past the half-line, signaling that buyers outnumbered

sellers in the market. In line with this, the ETH price also moved

above the 20-Simple Moving Average (SMA) line, indicating that

buyers were steering the price momentum in the market. In addition

to the aforementioned technical indicators, ETH displayed further

buy signals. The Moving Average Convergence Divergence (MACD)

indicated the price momentum and reversals through the formation of

green histograms, which were growing in size. Related Reading:

Bullish Case For Litecoin Grows Stronger As LTC Halving Draws Close

These expanding histograms aligned with buy signals for Ethereum.

Furthermore, the Chaikin Money Flow (CMF) indicator was positive,

as it remained above the half-line. This indicated that capital

inflows outweighed capital outflows at the time of observation,

emphasizing positive market sentiment for ETH. -Featured Image From

UnSplash, Charts From TradingView.com

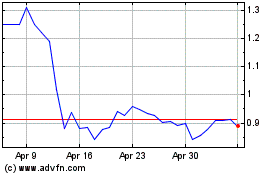

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024