Elon Musk Points Out ‘Most Serious Looming Issue’ In Banking, Bitcoin To Moon?

March 27 2023 - 4:30AM

NEWSBTC

Tesla CEO Elon Musk has pointed to the “most serious looming issue”

in the banking system in a new tweet. On Twitter, Musk was

responding to an analysis by The Kobeissi Letter, which noted that

more than $2.5 trillion in commercial real estate debt will come

due in the next five years. As the analysts state, this is by far

more than any other five-year period in history. “Meanwhile, rates

have more than doubled and commercial real estate is only 60-70%

occupied. Refinancing these loans is going to be incredibly

expensive and likely lead to the next major crisis,” The Kobeissi

Letter explains. The worst part, however, is that the small banks,

which are currently struggling badly, are at the center of this

crisis as well. 70% of commercial real estate loans are made by

small banks. “This is by far the most serious looming issue.

Mortgages too,” wrote Elon Musk, who has commented on the US

banking crisis several times in recent weeks, calling for all banks

to be protected by the FDIC, something Treasury Secretary Janet

Yellen has refused to do. This is by far the most serious looming

issue. Mortgages too. — Elon Musk (@elonmusk) March 27, 2023 The

analysts at The Kobeissi Letter responded to Elon Musk, saying that

from the banking crisis to a commercial real estate crisis, the US

Federal Reserve (Fed) is playing an important role by raising

interest rates too quickly. Banking Crisis Will Intensify As Elon

Musk notes, falling commercial mortgage bond prices are a growing

problem for smaller banks, which are already suffering from

declining demand for commercial real estate and fleeing depositors.

Related Reading: Dogecoin: Can Elon Musk’s McDonald’s Offer Give

DOGE A ‘Happy’ Price? Meanwhile, interest rates have more than

doubled, making refinancing these loans much more difficult and

costly. At the same time, occupancy rates for commercial real

estate are only 60-70%, putting additional pressure on the market.

This difficult situation could lead to a major new financial

crisis, as refinancing the loans under these conditions is

extremely expensive and risky. Regional banks hold the most

commercial real estate debt. 😬 pic.twitter.com/YUNC9qLLb3 — Markets

& Mayhem (@Mayhem4Markets) March 23, 2023 As Scott Rechler,

Chairman & CEO of RXR and Director at the NY Fed, admitted in a

recent Twitter thread, most of this debt was financed when prime

rates were near zero. This debt must be refinanced in an

environment where interest rates are higher, values are lower, and

the market is less liquid. Rechner therefore calls for a program

“that provides lenders the leeway and the flexibility from

regulators to work with borrowers to develop responsible,

constructive refinancing plans. A similar program was implemented

in 2009 and during the heat of COVID-19.” Related Reading: 3

Reasons To Remain Bullish On Bitcoin In Coming Months At the same

time, Rechner warns of a serious systemic crisis in the banking

system, especially regional banks. “We have been experiencing a

proverbial slow-moving train wreck that has been picking up speed

throughout this past year with the unprecedented spike in interest

rates”, explained Rechner who added: The events of the last couple

of weeks highlight that the train is now out of control. We need to

slow the train down and take the proper precautions to minimize the

damage. Bitcoin Becomes A ‘Higher Beta Version Of Gold’ For

Bitcoin, this could be a turning point, as has already been

demonstrated with the collapse of Silicon Valley Bank (SVB). As the

banking crisis unfolds, possibly surpassing the great financial

crisis of 2008 that led Satoshi Nakamoto to create Bitcoin, the

need for a decentralized, permission-free “freedom money” may

become clearer to many. If banks continue to fall like dominoes,

this will likely have a significant impact on the value of Bitcoin.

People will turn to Bitcoin to protect their wealth. As Mike

McGlone, senior commodity strategist for Bloomberg Intelligence,

recently explained, Bitcoin is turning into a “higher beta version

of gold” in the face of the banking crisis. Bloomberg Intelligence

strategist @Mikemcglone11 says, “People are realizing #bitcoin is

more like gold and treasury bonds. It’s happening.”

pic.twitter.com/xYEl0Jc1UO — Documenting ₿itcoin 📄

(@DocumentingBTC) March 26, 2023 At press time, the Bitcoin price

stood at $27,832, further consolidating below the key resistance

around $28,700. Featured image from iStock, chart from

TradingView.com

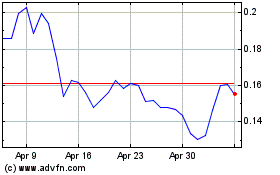

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Sep 2023 to Sep 2024