Bitcoin dips below $80K as Trump Canada tariffs halt BTC price comeback

March 11 2025 - 10:44AM

Cointelegraph

Bitcoin (BTC) cooled a 7% rebound after the

March 11 Wall Street open as familiar headwinds sparked market

jitters.

BTC/USD 1-hour chart. Source:

Cointelegraph/TradingView

Bitcoin, stocks deflate on fresh tariffs letdown

Data from Cointelegraph

Markets Pro and TradingView

followed BTC/USD as it touched local highs of $82,154 on Bitstamp

before consolidating.

US JOLTS job openings data delivered a slight overshoot versus

expectations, but it was confirmation of further trade tariffs on

Canada by US President Donald Trump that spoiled

risk-asset

relief.

The S&P 500 thus traded down 0.5% on the day at the time of

writing, while stock indexes continued to see volatility.

“The S&P 500 was up +5% at this point in Trump’s first term.

Instead, it’s now down -7% since January 20th,” trading resource

The Kobeissi Letter observed in part

of a reaction on X.

“A polar opposite start to his term so

far.”

S&P 500 comparison. Source: The Kobeissi

Letter/X

Trading firm QCP Capital added that Trump’s apparent

“indifference to recession risks” made life harder for risk assets

but acknowledged that some silver linings remained.

“Despite the market turmoil, not all signals are bearish,” it

summarized in its latest bulletin to Telegram channel

subscribers.

“This wave of risk-off sentiment has driven 10-year

Treasury yields down by around 60 bps and weakened the US dollar —

a historically positive factor for USD-denominated risk assets like

US equities and crypto.”

US dollar index (DXY) 1-day chart. Source:

Cointelegraph/TradingView

The US dollar index (DXY) dropped to 103.32 on the day, marking

its lowest level since mid-October 2024.

New BTC price lows still “possible”

Bitcoin price analysis meanwhile saw BTC/USD at a crossroads

amid a lack of clear upside catalysts.

Related: Biggest red weekly candle ever: 5 things to know

in Bitcoin this week

Trading channel More Crypto Online used Elliott Wave theory to

delineate key support and resistance levels, warning that price

could still head to new long-term lows.

“The price is still undecided after the New York open. A bottom

could be forming here, but another low is possible as long as

resistance holds,” it told X

followers.

“A confirmed low needs a sustained break above

yesterday’s high in 5 waves. The market, as always, enjoys keeping

traders guessing.”

BTC/USD 1-hour chart. Source: More Crypto Online/X

Popular trader CrypNuevo meanwhile described a

“great reaction” at the 50-week simple moving average (SMA) at

around $75,500.

As Cointelegraph

reported, that support trendline has remained without a candle

close below it since March 2023.

BTC/USD 1-week chart with 50SMA. Source:

Cointelegraph/TradingView

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading Bitcoin dips below $80K as Trump

Canada tariffs halt BTC price comeback

The post

Bitcoin dips below $80K as Trump Canada tariffs halt

BTC price comeback appeared first on

CoinTelegraph.

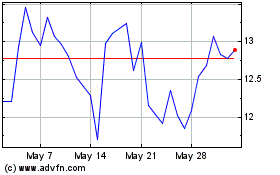

Dexe (COIN:DEXEUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Dexe (COIN:DEXEUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025