Progressive Proposal In U.S. House of Representatives

December 21 2018 - 1:46PM

InvestorsHub NewsWire

Bitcoin Global News (BGN)

December 21, 2018 -- ADVFN Crypto NewsWire -- Since Bitcoin’s

creation the U.S. has been the stage for the majority of headlines

relating to cryptocurrencies. As the global center for finance, the

state of New York has been at the forefront of much of the

government regulation relating to cryptocurrencies. However, much

of the language is related only to cryptocurrencies as financial

instruments. This narrow view of the technology has allowed many

other countries around the world to take the lead in regulation for

the more broad industry of blockchain technology.

In contrast to countries like

Malta, Switzerland or Sweden, the government regulations in the

U.S. have made it difficult for blockchain technology related

businesses to flourish. But the potential benefits from these

businesses and the technology they are developing is becoming more

apparent. In September a bill was proposed to the U.S. House of

Representatives to cover the spread in a more positive way. It

incorporated three major components for the U.S. to transition to

representing:

-

Acceptance - "expresses support for

the industry and its development… a light touch, consistent and

simple legal environment"

-

Security for cryptocurrency miners

- "never take control of consumer funds"

-

Tax clarity - A "safe harbor" for

taxpayers relating to network hardforks.

"The United States should

prioritize accelerating the development of blockchain technology

and create an environment that enables the American private sector

to lead on innovation and further growth." - Tom Emmer

The bill has not since been

adopted, however a new proposal is showing more signs of reception.

The bill has a more focused intention, and presents a more

digestible possibility for change.

Token Taxonomy

Act

Warren Davidson and Darren Soto

make a proposal where “digital tokens” would be excluded from

financial definitions as securities. The bill overall is a perfect

representation of the clash that is happening with cryptocurrencies

in relation to the traditional fiat currency system. Both bills

that would require amending through their proposal were put in

place over 80 years ago:

Digital tokens would be defined as:

“digital units created… in response to the verification or

collection of proposed transactions” (mining, basically) or “as an

initial allocation of digital units that will otherwise be created”

(as in a pre-mine). These tokens must be governed by “rules for the

digital unit’s creation and supply that cannot be altered by a

single person or group of persons under common control.” So,

although this proposal is closer to something that could be adopted

in the U.S., it will likely take more time for laws like this to be

amended.

By: BGN Editorial Staff

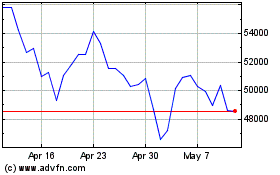

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Jun 2024 to Jul 2024

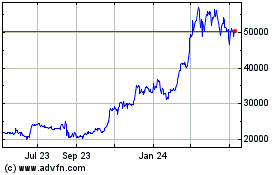

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Bitcoin (Cryptocurrency): 0 recent articles

More Bitcoin News Articles